The Federal Reserve has come in for considerable criticism, much of it deserved, for being slow to understand and react to high and persistent inflation pressures. I have been one of those critics (“Assessing the Federal Reserve’s new monetary policy framework” and “The Federal Reserve’s Everything Bubble”). For too long the Fed saw inflation as primarily “transitory,” a product of COVID-related shifts in demand and disruptions to the supply of goods and labor that would abate either as vaccinations conquered COVID or as economies adapted to living with the virus. It appeared to discount the ongoing effects on aggregate demand and inflation of the hugely expansionary fiscal policies of late 2020 and early 2021, and of holding on to its own very accommodative monetary policies. And it was slow to recognize that the record level of vacancies and churn in labor markets was a better measure of tightness and pressure on wages and prices than some traditional measures of participation or unemployment rates.

The lag in recognition and response to some extent grew out of the experience of 2010-2019, when the Fed struggled to bring inflation up to its 2 percent target. It adapted to that environment by adopting a new framework for policy in August 2020 called flexible average inflation targeting (FAIT), which embodied a number of asymmetries appropriate to the earlier period, but which raised inflation risks under alternative circumstances. For example, the Fed said policy would react to employment undershooting estimates of maximum employment but not to overshooting, unless inflation were already high. With respect to price stability, it said it would make up for periods in which inflation fell short of 2 percent by overshooting the target for a time, but apparently would not make up for overshoots of the target. The new framework did not seem even to contemplate the possibility of persistent strong inflation pressures.

Moreover, the Fed in effect doubled down on FAIT’s focus on employment and assumption of a continuing disinflationary environment in its forward guidance on tapering asset purchases and raising rates above zero. The Federal Open Market Committee said in December 2020 that tapering would wait for “substantial further progress” towards maximum employment and stable prices and that its policy rate would remain at zero until labor markets reached levels consistent with maximum employment and inflation was on track to exceed 2 percent. In its communications the Fed emphasized that both labor market and inflation criteria had to be met to trigger action. As a consequence, while waiting for labor markets to improve further, the Fed kept purchasing assets as inflation gathered momentum, and it kept real interest rates negative even when the economy hit full employment, guaranteeing a substantial overshoot of the inflation target.

A soft landing for the economy now—bringing inflation down to the neighborhood of 2 percent without a recession—will, in the words of Janet Yellen, require skill and good luck. In my view, we’ve seen evidence in the behavior of the Federal Reserve that raises my hopes for the “skill” piece of that equation—hence my two cheers, despite my past disagreements.

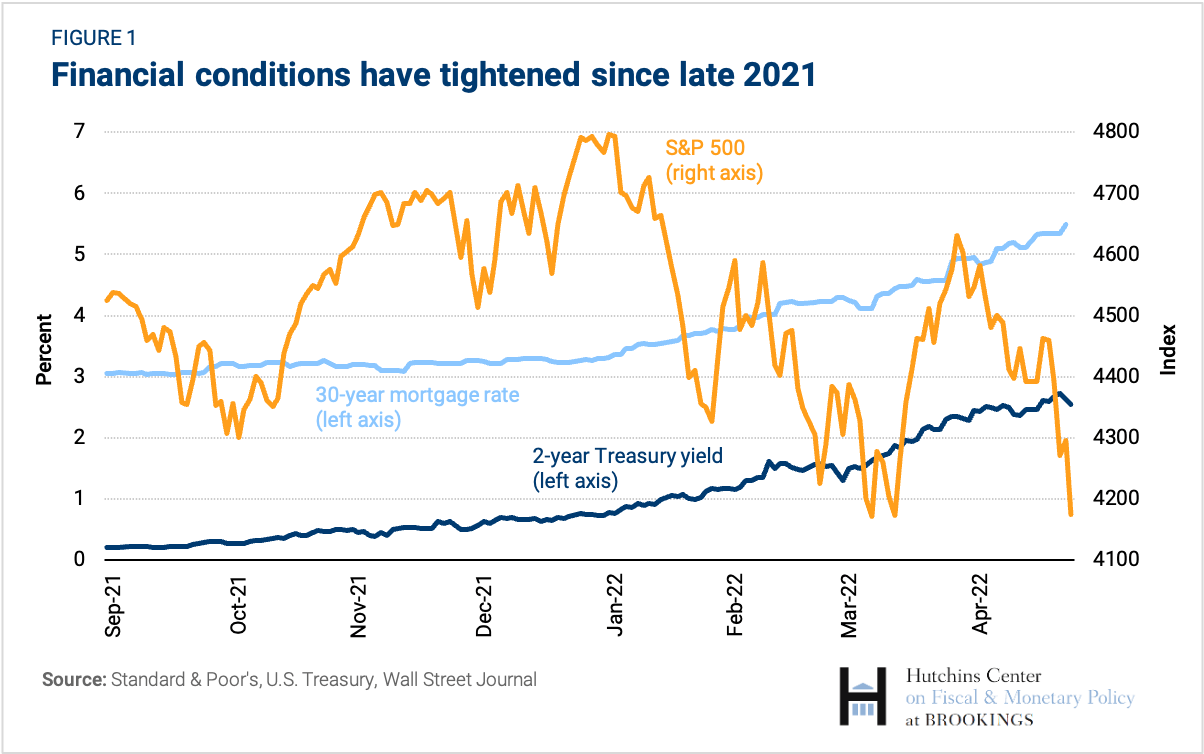

Cheer one: The Fed has evaluated the evidence, admitted mistakes, and taken rapid action to correct them—not a pattern of behavior often observed in government. It began to taper its purchases sooner than it had anticipated and then, as evidence of high inflation accumulated, accelerated the pace at which it stopped buying securities and raised rates earlier than it had planned. More importantly, it has been open in its expectations about the pace and extent of rate increases and portfolio runoff, adjusting these plans as incoming data suggest the persistence of extraordinarily tight labor markets and continued rapid increases in wages and prices. Financial markets have brought the effects of anticipated policy actions forward, resulting in a considerable tightening of financial conditions—increases in interest rates, declines in equity prices, and a rise in the foreign exchange value of the dollar.

Tighter financial conditions will damp demand sooner, shortening those famous “long and variable lags” between the implementation of monetary policy and its effects on the economy, decreasing pressure on prices.

Cheer two: Critically, the so-called pivot in policy grew out of the culture of the Fed as an intellectually rigorous, non-partisan government agency taking its monetary policy cues only from its legislative mandate to achieve maximum employment and stable prices. That mindset provided the armor against the relentless attacks of President Trump, and it will help the Fed to adapt to the surprises it inevitably will face as it follows through on its pledge to restore price stability. The Fed encourages a diversity of views among its policymakers and transparency in airing those differences. Seeing those diverse views, we can be confident that alternative perspectives are getting a hearing inside policy councils. It allows its staff to publish studies challenging some of the basic tenets of its policy framework, indicating a degree of intellectual ferment that can only help improve policymaking over time: “Why Do We Think That Inflation Expectations Matter for Inflation? And Should We?,” “The Natural Rate of Interest Through a Hall of Mirrors,” and

“Anchored or Not: How Much Information Does 21st Century Data Contain on Inflation Dynamics?”.

There has been a great deal of speculation lately that we are in for a repeat of the virulent inflation of the 1970s and the insufficient pushback from the Fed. On the inflation front, there are troubling resemblances—supply shocks arriving amid already rapid price increases. But I am confident that the policy response will be very different this time. There’s the learning experience of the 1970s, of course, and the explicit 2 percent inflation target now in place. But perhaps an even more important difference from the 1970s is the culture of the Fed. I can assure you from personal experience that, from the perspective of being open to new ideas and diversity of thought among policymakers and staff, this is not your grandfather’s Fed. Diversity and openness are essential ingredients for good policy that will evolve as the data and its analysis respond to the changing circumstances. The evidence of the last six months indicates that, in contrast to the 1970s, today we have a Fed that will carefully weigh all the factors, conduct good dispassionate analysis of developments, and adapt to changing circumstances—even if, on occasion, it takes a little longer than some of us might have wished.

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Op-edTwo cheers for the Fed

April 27, 2022