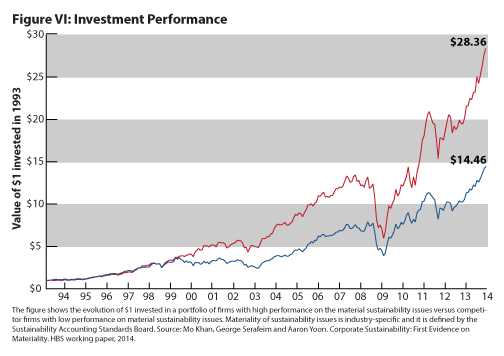

When a company focuses on improving its environmental or social good performance, what happens to that company’s financial performance and shareholder returns? Harvard Business School professor George Serafeim answers this question with new research that reveals that companies that undertake true sustainable efforts outperform competitors who don’t. Investing $1 in 1993 grows to $28 in 2013 by investing in a portfolio of firms with good performance on material sustainability issues, Serafeim finds. In contrast, investing in a portfolio of firms with poor performance on material sustainability issues would return just over $14 during the same time period.

Serafeim arrives at these conclusions by undertaking a more nuanced and detailed analysis of corporate sustainability. Adopting a long-term horizon, understanding materiality by industry, and incorporating regulations, societal expectations, innovations, and governance models into the research efforts yield a far more precise understanding of how well sustainable corporations are performing, he argues.

Unlike all previous research in this area, Serafeim’s model breaks out future financial performance into four key sectors: health care, financial, technology and communication, and nonrenewable resources. Understanding the materiality of the different sustainability issues for different companies (and their respective sectors) seems to be an important factor for understanding the financial impact of these issues, he writes.

This means that companies can create economic value or just waste shareholders’ money by trying to “do good.” Which one of the two happens depends on whether the company is trying to improve performance on an underlying topic that is important for the industry that is in, Serafeim argues. Identifying what is material for a company, and how to improve performance on that issue in a way that is synergistic to financial performance requires hard work from the part of the company, he writes.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).