The following memo was originally included in the publication Priorities for a new political economy: Memos to the left, a series of essays and memos published by the Policy Network that can be found at their website.

Centre-left governments face a number of critical domestic challenges. This memo is written primarily from a US perspective and with a recognition that the problems differ from country to country. Indeed, in some areas the United States has a lot to learn from our friends in other advanced countries. In other areas, the problems are not necessarily so dissimilar, but the US political system seems almost uniquely hampered in its ability to deal with them effectively. A number of policy priorities are outlined in this memo, which are aimed at advancing the following three goals: first, job creation and economic growth; second, long-term fiscal stability; and third, creating an opportunity society in which more people have a chance to join the middle class. These issues overlap. Growth promotes opportunity (although not necessarily broadly shared opportunity); too much fiscal constraint destroys jobs (but not if we get the timing right); some policies serve multiple objectives (for example, education aids both growth and opportunity).

1. We face high levels of joblessness as a result of the recent economic crisis. Equally important is the sense that those jobs are not going to come back due to global competition and the pace of automation. What will take their place and sustain a middle class lifestyle remains highly uncertain. At the current time there is a need for fiscal stimulus or other measures to deal with current unemployment.

2. Even among those who are employed, families are struggling to get ahead in the face of stagnant wages. Even before the recession, young men in their thirties were earning no more than their fathers’ generation did at the same age in the United States. Women’s wages are still lower than those of comparably situated men, but they have made impressive earnings gains as their education and experience have expanded. Their widespread entry into the labour market has been the primary reason that middle-class incomes have not fallen over the last few decades. This trend has placed great pressures on family life, especially in the United States, where there is little social support for working mothers. Single parents and families dependent on two earners cannot survive without adequate substitute care for their children and time off when needed. We need more subsidised childcare, more paid leave and other policies that can help families to balance work and family life.

3. Education and healthcare systems need to be modernised. Both are high-cost, low-productivity enterprises that have not kept pace with other sectors in terms of innovation and change (for example, the use of technology, performance-based compensation, heavier reliance on evidence about what works). We should catalyse innovation in the delivery of both healthcare and education to reduce costs and improve quality. In both sectors it will take experimentation and efforts to make government funding conditional on innovation and performance. For example, teacher tenure and compensation should be based on classroom performance, and compensation for healthcare providers should be based on the effectiveness of the treatments and drugs prescribed.

4. Infrastructure, whether in the form of highways, broadband or high-speed rail, needs to be improved and new investments need to be made in science. In the United States, there is interest in turning over decision-making for such investments to an independent body or bodies to lessen political pressures on the process. There is also interest in involving the private sector through loans and loan guarantees. With these reforms in place, giving priority to investments in education, infrastructure, science and access to healthcare make tremendous sense. The size of government is less important than its effectiveness and especially its ability to spur growth. Leaders need to argue for “smart” or “pro-growth” government, not more government. Greater decentralisation of government functions may be part of producing greater efficiency and effectiveness, especially in large, diverse nations such as the United States.

5. Over time, greater productivity from these investments in education, health, infrastructure and innovation will allow wages to rise and the prices of everyday products to fall. Global competition, despite its obvious downsides, will help to spur innovation. Better systems for training and retraining workers (while giving them some support in the interim) are badly needed. Trade is beneficial to a society, on balance, but policies to help those who are the victims of economic change have not worked well thus far.

6. Ageing populations, combined with major medical advances, have improved the quality and length of life, but have also led to excessive government spending on healthcare and retirement. Current government obligations for these items are not sustainable or affordable without ever-increasing tax rates. In the United States, federal healthcare and retirement expenses currently absorb over 70 per cent of all revenues. While revenues can and should be increased, this cannot be the entire solution. We need to reallocate resources from the more affluent elderly to the less affluent young. This can be done gradually and in a way that preserves current benefits for those who are retired or about to retire but slows the growth of benefits for future generations while investing more in them when they are young. Any society that invests in its old at the expense of its young does not have much of a future. By reforming these programmes now we can ensure that they will be there for future generations.

7. We must radically simplify the tax system to make it fairer, more efficient and less tilted towards special interests and the more affluent. We can reap additional revenues in the process. Eliminating just half of all tax expenditures in the United States would produce about $5 trillion over a decade and, along with the expiration of the so-called Bush tax cuts which would yield another $4 trillion, could plug most of the deficit hole for the coming decade (but not beyond this point when the costs of paying for the baby boomers’ retirement loom large). To increase mobility and opportunity, and thus social justice, we should also increase taxes on large inheritances and on accumulated wealth, not earned income (except at the highest levels). We should dedicate any new taxes to high-priority public investments in education and healthcare so that the public know what they are getting for their money. Although disliked by economic purists, earmarked taxes have far more staying power than general revenues.

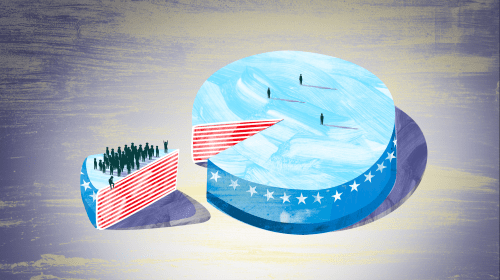

8. Inequality has increased to levels not seen in almost a century, with both income and wealth heavily concentrated at the very top. This is raising concerns that not just economic but also political power is increasingly skewed to favour the very rich and to favour the sources of their wealth, such as finance and energy. Below the top income ranks the kind of broad-based prosperity that was the hallmark of mid-twentieth century America has disappeared. These growing income gaps have many causes but the most important are the failure of the supply of educated workers to keep pace with demand, changes in family structure and changes in pay practices and norms.

9. Polls in the United States show unequivocally that the theme of opportunity resonates more with the public than the problem of poverty or inequality. Yet, as a result of inequality and demographic trends, we are headed towards divided societies in which on the one hand there is an elite that is well educated and well paid and forms intact families in which children are provided good opportunities from an early age, and on the other a rapidly growing group of less-educated young adults who are adrift. The latter group is not just floundering in the labour market; they are also not forming strong families. In the United States, half of all children born to women under the age of 30 spend their early years either in single-parent homes or in very unstable family environments. Meanwhile, Brookings Institution research shows that those who graduate from high school (or better), who work full time and who delay having children until they are married are almost guaranteed to escape poverty. A college education is the ticket to success in the United States but it should not be the only option. More emphasis on technical education at the secondary and post-secondary level, as well as more opportunities for young people to get on-the-job training and experience in new or under-resourced fields, could enhance job prospects, productivity and earnings for the many youth who either do not go to college or drop out before they graduate.

10. An opportunity exists to use the fiscal crisis to restructure social assistance. It should be tied to personal responsibility (for example through welfare for work) and provide more flexibility to local governments (for example through block grants). Government should only assist those who are helping themselves or those who are truly incapacitated. It should provide jobs and wage supplements to the poor, not unconditional assistance. At the same time, it is important to recognise that many of those who are disabled or long-term unemployed want to work and should be given an opportunity to do so, through subsidised private or public sector jobs if necessary, but on a temporary basis. That said, there is only so much restructuring and reform that can be done and there are political and economic limits to raising revenues. As argued above, gradually reallocating resources from more affluent seniors to less affluent working-age families and their children has to be part of the solution as well. The emerging consensus in the United States is that investments in high-quality early education and parenting programmes are the most cost-effective way to provide greater opportunity for the less advantaged.

Commentary

How to Fulfill the Promise of Opportunity for All

June 9, 2011