What is Medicare?

Medicare is a federal health insurance program that covers nearly all Americans aged 65 and over and some younger Americans with disabilities. As of September 2023, 66 million individuals were enrolled in Medicare, with 11% receiving assistance due to disability and 89% due to age. Medicaid, a separate program, covers low-income individuals.

The federal government spent $832 billion on Medicare in fiscal year 2023, a sum equal to 3.1% of GDP. As the size of the population over age 65 grows and healthcare costs rise, Medicare spending will rise; the Congressional Budget Office projects that Medicare will be 4.2% of GDP in 2034. Today, 13.6% of total federal outlays go toward Medicare.

What is “traditional” Medicare, and what does it cover?

Traditional Medicare refers to Parts A and B, the programs that Congress created in 1965.

Beneficiaries choose between traditional Medicare and Medicare Advantage (defined below). Under traditional Medicare, beneficiaries are enrolled in Medicare Part A, which covers inpatient hospital care, some skilled nursing facility care, some home care, and hospice care; and Medicare Part B, which covers physician and other health provider services, outpatient care, preventive care, and some home health visits. Patients who choose traditional Medicare may separately enroll in Medicare Part D, which covers prescription drugs. Traditional Medicare does not cap yearly out-of-pocket payments, but many beneficiaries have supplemental coverage that reduces or eliminates deductibles, copays, and coinsurance and often caps total out-of-pocket expenses. Some beneficiaries purchase supplemental coverage from private insurers, while others receive it through their former or current employer or through Medicaid. Roughly one in ten traditional Medicare patients has no supplemental coverage at all.

What is Medicare Advantage, and what does it cover?

An alternative to traditional Medicare is to enroll in a private plan through Medicare Advantage, also known as Medicare Part C. Beneficiaries in Medicare Advantage pay premiums to private insurance plans. These premiums may be less than or greater than the Part B premium, depending on the plan. Many of these private options include drug coverage comparable to Medicare Part D, plus additional coverage—such as hearing, vision, and dental services—not offered by traditional Medicare. However, Medicare Advantage plans often have less extensive networks of doctors and hospitals than traditional Medicare. And cost-sharing terms dictating copays, coinsurance, premiums, and yearly limits vary between plans. A review of many studies found that Medicare Advantage and traditional Medicare rank similarly when it comes to beneficiary experience, affordability, service utilization, and quality. But Medicare Advantage has been criticized for being more expensive for the government. The Medicare Payment Advisory Commission estimates that the government spends 22% more for a patient enrolled in Medicare Advantage than it would if the same patient enrolled in traditional Medicare.

Medicare Advantage enrollment has surged in recent years. In 2007, one in five eligible Medicare beneficiaries were enrolled in Medicare Advantage. By 2023, half were.

Where does Medicare get its funding?

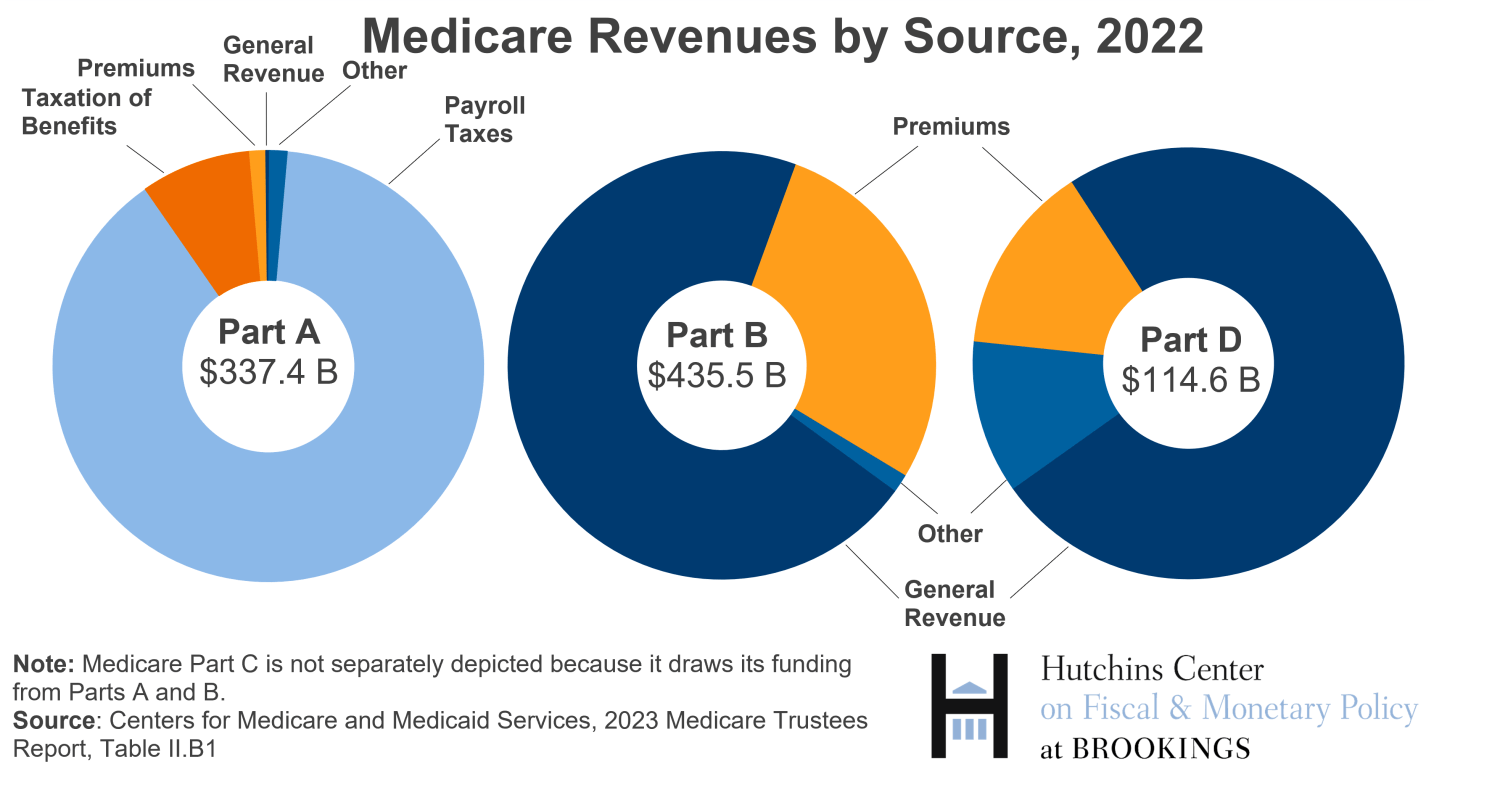

Each part of Medicare is funded differently. Medicare Part A is funded mainly through the Hospital Insurance (HI) payroll tax, which is levied on both employers and employees. Employees pay a 1.45% tax on wage earnings below a threshold of $200,000 ($250,000 for married couples) and a 2.35% tax on wages exceeding the threshold. Employers pay a tax equal to 1.45% of employees’ earnings. Payroll taxes accounted for 89% of Part A revenues in 2022. An additional 8% of revenues came from income taxes on Social Security benefits received by high-income beneficiaries.

There are no premiums for Part A coverage for most beneficiaries. In contrast, beneficiaries must pay premiums to enroll in Medicare Parts B and D, but premium revenues cover only about one quarter of expenses. Nearly all the remainder is covered by general revenues. Medicare Advantage is paid for by a combination of funds allocated to Medicare Parts A and B. In 2022, Medicare Advantage expenses accounted for 49% of Medicare Part A spending.

Why are Parts A and B of Medicare financed differently?

Medicare’s original financing structure is the result of a political compromise in the 1960s. The Kennedy administration, with the support of many Democrats in Congress, proposed hospital insurance for the elderly that would be covered by a mandatory payroll tax. Many Republicans opposed the idea, favoring instead a voluntary program funded by general revenues and premiums. Some southern Democrats also opposed the plan, fearing that mandatory tax-funded federal healthcare would force racial integration in the still-segregated South.

The compromise, which passed in the wake of Kennedy’s assassination, was a two-part system. Part A, which satisfied Kennedy’s original priorities, funded hospital insurance through a mandatory tax and desegregated hospitals by stipulating they would only receive funding if they admitted Black patients. Part B, which satisfied Republicans’ priorities, expanded insurance beyond hospital care and was funded by general revenues and premiums.

What is the Medicare Hospital Insurance trust fund?

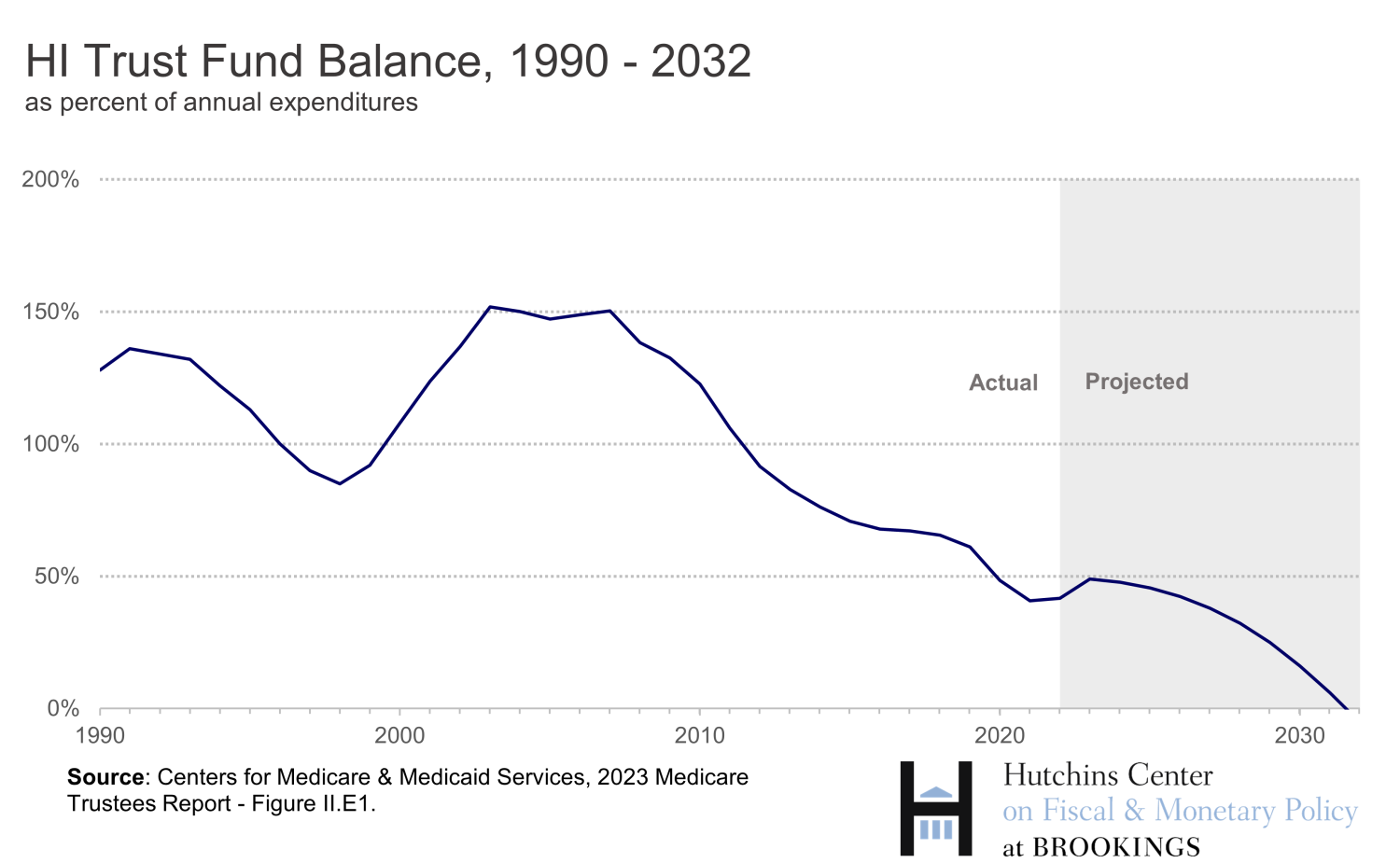

Payroll tax receipts and other Part A revenues are deposited into the Hospital Insurance (HI) trust fund; Part A and some Part C expenses come out of the HI trust fund. The surplus, if any, is invested in interest-earning U.S. Treasury securities.

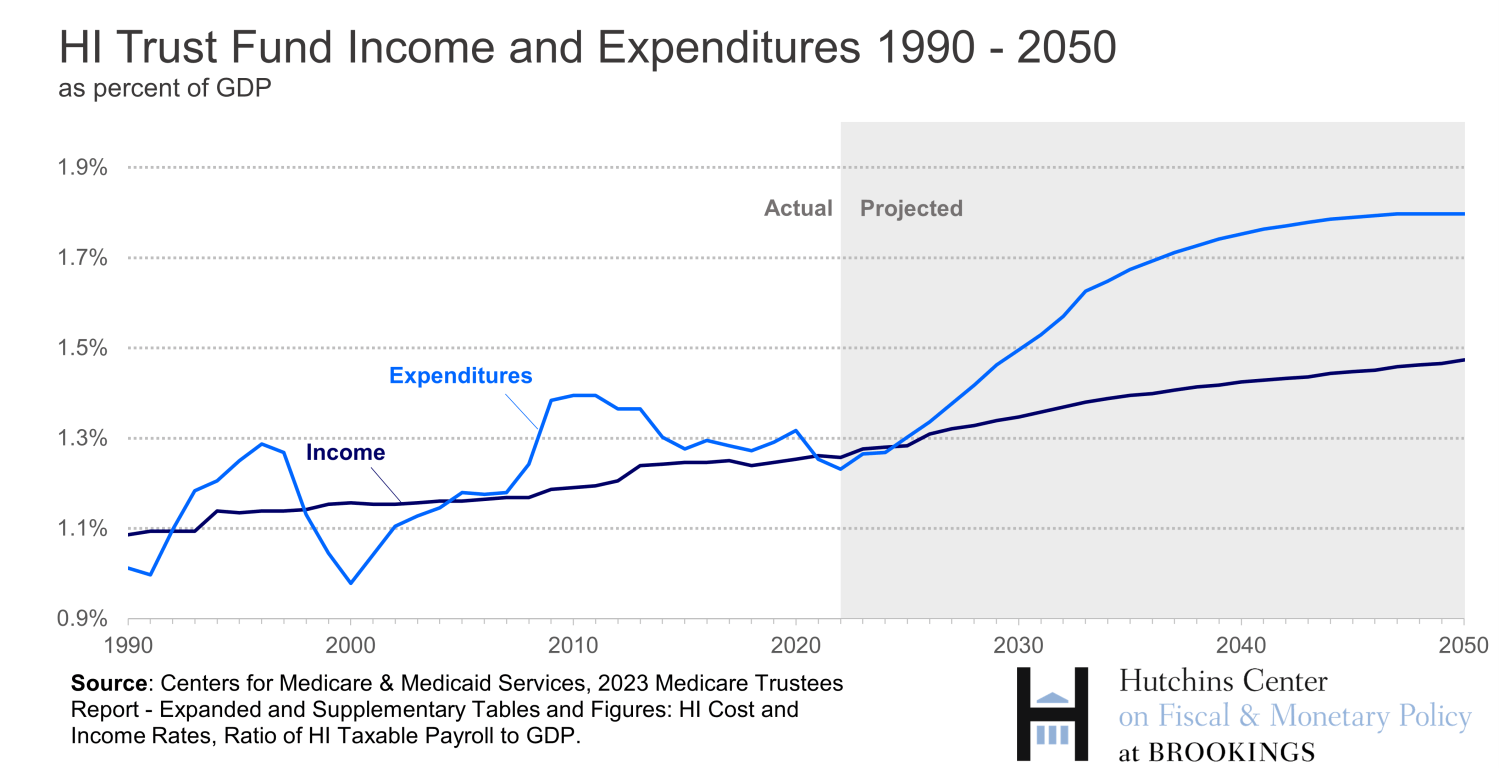

In recent years, spending has often exceeded revenues. Existing trust fund balances are drawn down to fill the gap. Fueled by increasing per capita healthcare costs and an aging population, Part A Medicare spending is expected to exceed revenues in the coming years, leading to a depletion of trust fund assets. The Centers for Medicare & Medicaid Services project that in 2031, the HI fund will run out of cash, and revenues will be sufficient to cover only 89% of Part A’s expenses.

Parts B and D of Medicare also have a trust fund. However, the gap between spending and premiums is always filled by the Treasury’s general revenues. As a result, this trust fund is never depleted, and it does not face issues of insolvency that the Part A trust fund does.

What happens if the HI trust fund is depleted?

It isn’t clear what will happen if Congress fails to act before the Hospital Insurance trust fund runs dry. On one hand, the law gives Medicare beneficiaries the right to receive services. On the other, the law says that Part A can only be financed by dedicated taxes and the HI trust fund.

In 1997, the HI fund was just four years away from running out of money. To reduce the federal deficit and prevent the HI fund’s impending insolvency, Congress passed the Balanced Budget Act of 1997. It reduced Medicare payments to health care providers and intensified efforts to ensure that payments weren’t fraudulent or inappropriate. It also moved some home health benefits from Part A to Part B (which raised Part B premiums but prevented Part A insolvency). These measures worked: By 2001, the HI fund was projected to stay solvent for 28 years.

Why is Medicare spending projected to grow faster than the economy?

Rising healthcare costs and the aging of the population exert continued pressure on Medicare.

Spending on healthcare has grown faster than the economy for decades. In 1965, when Medicare was inaugurated, national health expenditures (not just Medicare) accounted for 5.6% of GDP. By 2022, national health expenditures accounted for 17.3% of GDP. Many believe this rise reflects increased demand for health care as society gets richer and as new technologies become available. In addition to increased expenditures due to overall health spending growth, Medicare spending is also rising as a share of the economy because of the growing fraction of the population over age 65: In 1966, there were 16 older dependents for every 100 working-age Americans. By 2022, there were 26 older dependents for every 100 working-age Americans.

What options would prevent the Part A trust fund from being depleted?

Trust fund depletion could be prevented by raising revenues or cutting spending. Measures that reshuffle costs out of Medicare Part A and into other parts of Medicare, or that allocate existing government revenues into the HI trust fund, could also extend the fund’s longevity without directly changing overall government revenues or expenses.

What types of revenue increases have been discussed?

The Medicare payroll tax is the main revenue source for the HI trust fund. Raising the tax rate from 2.9% to 3.5% immediately would prevent insolvency of the HI fund for 75 years, according to the Centers for Medicare and Medicaid Services.

Alternatively, Congress could raise revenues from the Net Investment Income Tax (NIIT)—the extra tax that high-income taxpayers pay on their investment income. The Biden administration has proposed raising this tax from 3.8% to 5.0% for taxpayers making over $400,000 per year and expanding the base of the tax so that it includes income generated by certain limited partners and S corporation owners. These additional revenues would be allocated to the HI trust fund. Opponents of raising the NIIT worry that it will deter investment and impose an additional tax burden on successful small-business owners.

Of course, other types of taxes could also be increased, and the resulting revenues dedicated to the HI trust fund.

What about cutting spending?

A 13% immediate cut in Part A expenditures would prevent insolvency of the HI fund for 75 years. There is significant debate on what types of cuts are feasible.

Post-acute care, which helps patients recover from an illness, injury, or surgery, has been one target of possible Medicare spending cuts. Providers of post-acute care tend to have high profit margins. In 2021, for example, skilled nursing facilities had a 17.2% profit margin from Medicare services, home health facilities had a 24.9% profit margin, and inpatient rehabilitation facilities had a 17.0% profit margin. The Trump administration proposed cuts in Medicare payments to post-acute care providers in its fiscal year 2021 budget, claiming it would save $100 billion over a 10-year period. The Obama administration also supported cuts in payments to post-acute care providers.

Spending could also be reduced by increasing premiums that Part A beneficiaries pay for their health insurance, by equalizing payments for similar services performed across different sites, and by expanding competitive bidding for medical equipment.

Part A expenditures could also be indirectly cut through Medicare Part C. (Recall that Medicare Part C receives significant funding through the Part A trust fund.) Because sicker patients are more costly to treat, the government pays each Part C plan based, in part, on the health status of its enrollees. Some argue that this system incentivizes Part C plans to record an excessive number of patient diagnoses. Furthermore, research indicates that available data on Part C enrollees likely overstates their health risks, resulting in overspending on healthcare per patient. More accurate risk profiling could reduce the amount of money that the government pays Part C plans, and Medicare is already phasing in a new system that is expected to take full force in 2026. According to the Centers for Medicare and Medicaid Services, this phase-in will save Medicare (not just Part A) $11.0 billion in 2024 and $9.2 billion in 2025.

Another way to cut spending is to reduce “benchmarks,” which are the maximum yearly payments the federal government makes to Part C plans. According to the Congressional Budget Office, cutting these benchmarks by 10% beginning in 2025 would save Medicare (not just Part A) nearly $400 billion over the course of a decade. Available research suggests that a reduction in benchmarks would modestly reduce Part C generosity and increase premiums, with the largest impacts on dental, hearing, and vision services. But the Congressional Budget Office predicts that the effects of a 10% reduction in benchmarks would be small, with Part C insurers shielding their enrollees from high-value benefit cuts and only minimally exiting markets as a result of the policy.

What about using general revenues?

Another option is to devote general federal revenues to the HI trust fund. Proponents of the approach—which is already used to fund Medicare Part B and D—argue that it would reduce uncertainty surrounding Part A’s future and avoid the need for sudden tax increases or benefit cuts. Opponents of reallocating general revenues argue that, without this self-imposed limit on spending, Congress will be less likely to adopt reforms to the Medicare program that are needed to address our long-term fiscal imbalances.

There are various ways to use general revenues. One way to delay insolvency would be to move some Medicare Part A costs to other parts of Medicare that are funded by general revenues. For example, one-third of home health services spending is covered by Medicare Part A. Shifting these expenses to Medicare Part B would save the HI fund $6 billion per year. Some detractors of this policy worry that the additional costs placed into Medicare Part B would put upward pressure on the premiums that Part B beneficiaries pay.

The Trump administration’s fiscal year 2021 budget included a proposal to shift some Part A expenses out of the HI trust fund. Under the policy, federal spending on graduate medical education in teaching hospitals through Medicare, Medicaid, and other programs would be consolidated into a single new federal grant program. The expenses of this program would be paid using general revenues, thereby reducing the direct cost burden on the HI fund. Similarly, in 1997, Congress shifted some long-term care services from Medicare Part A to Medicare Part B.

-

Acknowledgements and disclosures

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).