This chapter is part of USMCA Forward 2024.

U.S.-China trade tensions, disruptions in supply chains, the Russian-Ukraine war, and the overall instability in the global order, have underscored the value of the predictability offered by the United States-Mexico-Canada Agreement (USMCA) framework at the regional level. What is to be done to harness this revival of the “North American idea”?

North America in a regionalized world

The regionalization trend that has emerged given the uncertain geopolitical environment is here to stay, at least in the foreseeable future. It is time to return to Robert Pastor’s North American idea,1 an understanding of the continent as a community of three countries whose prosperity depends on their capacity to cooperate and jointly produce goods and services and address security threats. There is a long road ahead. In her most recent book “The Globalization Myth,” Shannon O’Neil demonstrates that 40% of North American trade is intraregional. This figure is significantly lower than in the European Union (approximately two-thirds) or Asia (around 59%).2 The push for regionalization in North America has the potential to change that landscape. Developing a North American approach on energy cooperation is an indispensable condition to capitalize on this opportunity. The approach must be part of a broader agenda to build more resilient and secure supply chains, where access to clean, competitive, and reliable energy plays a pivotal role.

Former United States Trade Representative and World Bank President Robert Zoellick has underscored this: Unlike the process of European integration, the North American approach has not relied on sharing sovereignty or on supranational institutions. Zoellick comments that the North American Free Trade Agreement (NAFTA) “encouraged mutuality, frameworks for deeper cooperation and attention to shared interests.”3 This is especially true for the energy sector. North America’s most logical pathway to more integrated energy markets is to strengthen collaboration at the technical level (e.g., mutual recognition of technical standards), on regulatory harmonization, and on the development of transnational energy infrastructure.

The U.S.-Canada side letter on energy within the USMCA framework could be a stepping stone towards a more ambitious framework for regional cooperation. Mexico should adhere to the side letter that respects the spirit of North American integration as understood by Zoellick; It fosters regulatory cooperation and transparency specifically regarding access to transmission facilities and pipeline networks without sharing sovereignty on decision making processes.

North American energy security

In a world where energy security has regained a central position, North America’s reliable energy sources with low emissions at competitive prices represent a major economic advantage for investment in the industries of the future (e.g., semiconductors, data centers, artificial intelligence, and electromobility).

The International Energy Agency (IEA) defines energy security as “the uninterrupted availability of energy sources at an affordable price.”4 The IEA distinguishes between long- and short-term energy security. Long-term energy security requires sufficient investment in infrastructure to keep pace with economic growth and development, while short-term energy security refers to “the ability of the energy system to react promptly to sudden changes in the supply-demand balance.”5 Both short- and long-term energy security can be realized in North America. With respect to the supply of energy, the region benefits from geographic and climatic diversity that allows it to be competitive on multiple fronts, including solar, wind, nuclear generation, as well as natural gas. A balanced energy matrix composed of multiple technologies is a key requirement for energy security. However, despite this privileged energy “endowment,” North America needs to further invest in developing its energy resources as well as in energy infrastructure, including low-emission power generation, grid expansion and modernization, and natural gas infrastructure (e.g., storage and transportation). USMCA facilitates the goal of energy security by reducing barriers to trade in energy technologies which lowers costs and expands access to energy services. Many of the energy investments needed in North America are also large scale and long-term assets. The impact of USMCA on the business environment, reducing regulatory risk and increasing investment certainty, can reduce the cost of these investments.

One region, three visions

There is currently no vision for how to achieve energy security in North America. Each country is promoting eff orts to expand energy infrastructure with different visions and varying degrees of ambition. The U.S. leads the way with the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL), which are expected to trigger over $1 trillion in new investments in energy infrastructure by 2035. It is mostly related to the decarbonization of economic activities according to Princeton University’s Rapid Energy Policy Evaluation and Analysis Toolkit, although this estimate might be conservative. The U.S. industrial policy has also focused on energy storage technologies with over $70 billion in investment commitments for electric vehicles and battery development within the framework of the IRA.6 Simultaneously, though, new natural gas projects are facing increased scrutiny. Ultimately, North America needs an energy matrix that guarantees the reliability of the system while reducing the region’s carbon footprint, which will include an ongoing role for natural gas and the virtual elimination of coal and other highly polluting fuels.7

Canada has developed an energy roadmap and is currently discussing a bill in Parliament to enact investment tax credits for clean energies (expected to be as high as C$27 billion), including renewable power generation, hydrogen, as well as carbon capture and storage.8 Additionally, Canada is promoting expanding its pipeline infrastructure, despite heated debates given social and environmental concerns.

Mexico’s energy sector is in disarray and needs a significant new policy direction and greater coordination with its North American partners. The Mexican administration’s energy policy has been focused on supporting PEMEX and expanding investment in carbon intensive energy sources such as oil, discouraging investment in renewable energy. After five years of discouraging private investment in power generation, Mexico lags in terms of clean energy (in October 2023, only slightly over 20% of generation was clean) and the electric system overall is facing increasing pressures given the growth in demand driven by nearshoring and the electrification of the economy.9 Public investment—CFE’s new combined cycle plants and the landmark Plan Sonora—is proving to be insufficient in replacing private investment.10 Conversely, on the natural gas front, the Federal Government has opted to partner with the private sector to continue the expansion of the pipeline network, prominently in Mexico’s south/southeastern region. Mexico’s geographical location, its network of free trade agreements, and its technically skilled labor force should allow the country’s manufacturers to benefit from U.S. initiatives like the IRA and the CHIPS and Science Act. However, lack of access to clean, competitive, and reliable energy supply limits Mexican possibilities to make the most of nearshoring.

As outlined previously, energy policy remains domestically focused. There is no North American vision for the energy sector. The absence of such a vision means missed opportunities to increase energy security and build resilience into energy infrastructure and supply, such as expanding transnational transmission and generation. The construction of the high-voltage direct current transmission line from Quebec to New York City is an example of this.11 When it starts operating–expected in 2026—the project will transport clean energy (wind and hydro) across borders, reducing grid congestion as well as lowering electricity rates and emissions in New York City and Long Island. Moreover, the absence of a North American vision risks divergent approaches to clean energy across North America, which could become a trade issue as governments begin to prioritize clean energy products. For instance, the steps by the U.S. and the European Union (EU) towards a Global Arrangement on Sustainable Steel and Aluminum (GASSA) point to an emerging approach to trade in clean energy, steel, and aluminum with implications for North America.

Funding energy infrastructure in North America

On the financial side, the North American Development Bank (NADBank) could prove to be a suitable funding mechanism for the development of transnational energy infrastructure projects in the three countries. Expanding its mandate beyond the U.S.-Mexico border and increasing its capitalization would be the first steps towards this goal.12 NADBank should become a proper regional development bank specialized in energy and logistical infrastructure. The institution could prioritize investments in low-emission power generation capacity, transmission lines, and natural gas pipelines, accompanied by logistical infrastructure that enables the movement of goods between the countries.

Investments must go beyond strictly energy infrastructure. Logistical infrastructure should also be strengthened, with a special focus on the Gulf of Mexico to enhance connectivity among the energy clusters located both in the U.S. and Mexico, including modernizing ports, as well as roads and railroads in the surrounding states.

Developing competitive energy infrastructure should not be reduced to the USMCA partners. An indispensable condition for the sustained success of North America as a region is development in Central America. Hence, it is indispensable to promote investment south of the Suchiate River. There are difficulties on two main fronts: politics and finance. On the political front, a trilateral vision for the region that goes beyond energy would be needed. In addition, the economic and national security benefits of development in Central America (e.g., coproduction of goods, lower migration, new markets) would need to be stressed.

North America and the energy transition

The dilemma on energy security is not limited to availability, it also entails the environmental footprint of the energy matrix. Balancing the energy matrix to reduce North American emissions requires a gradual transition towards renewable energies and natural gas as a transition fuel. Natural gas emissions per million British Thermal Units are 53.1 Kg, while coal, fuel oil, and diesel emit 95.5, 75.1, 74.0 Kg of CO2 respectively.13

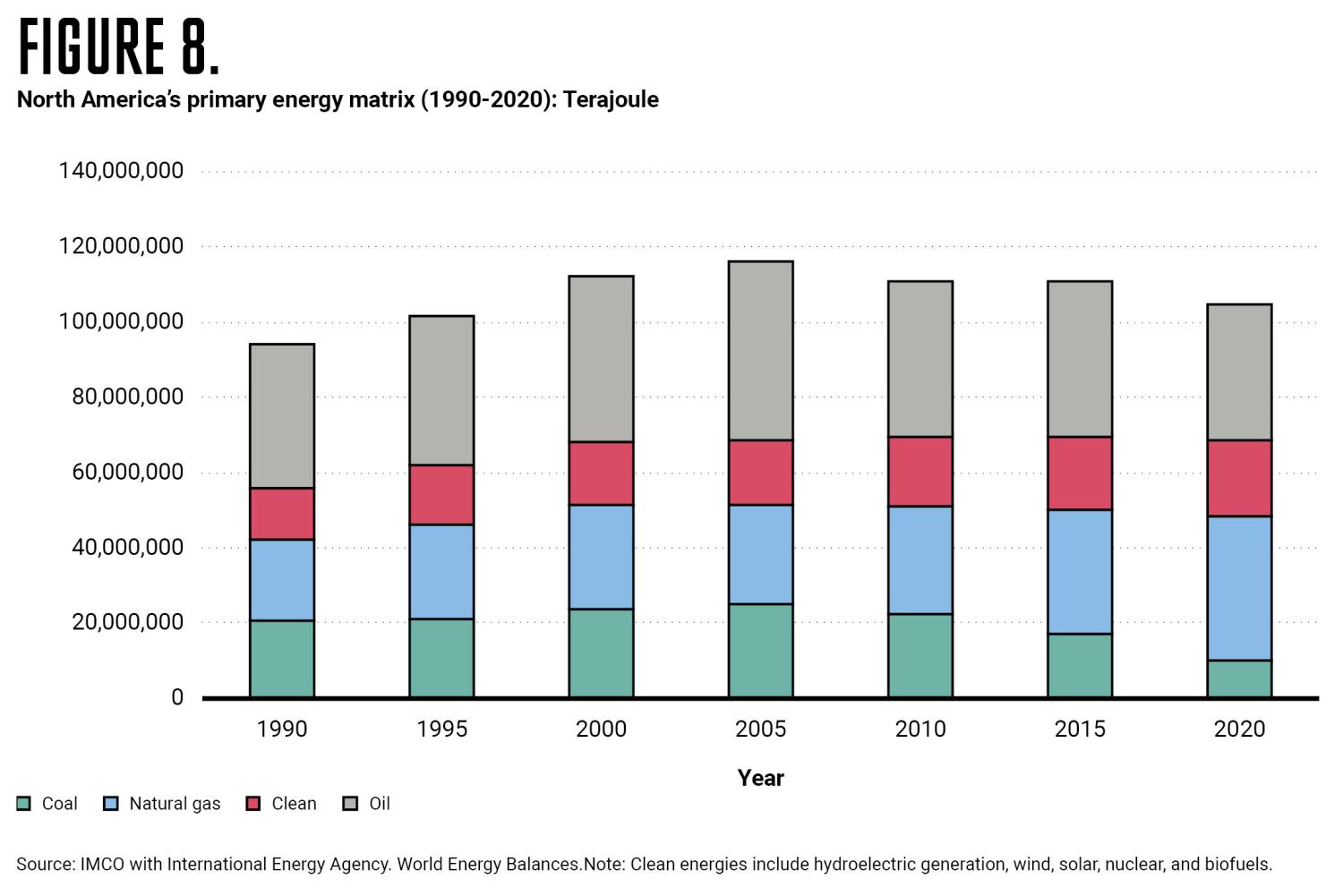

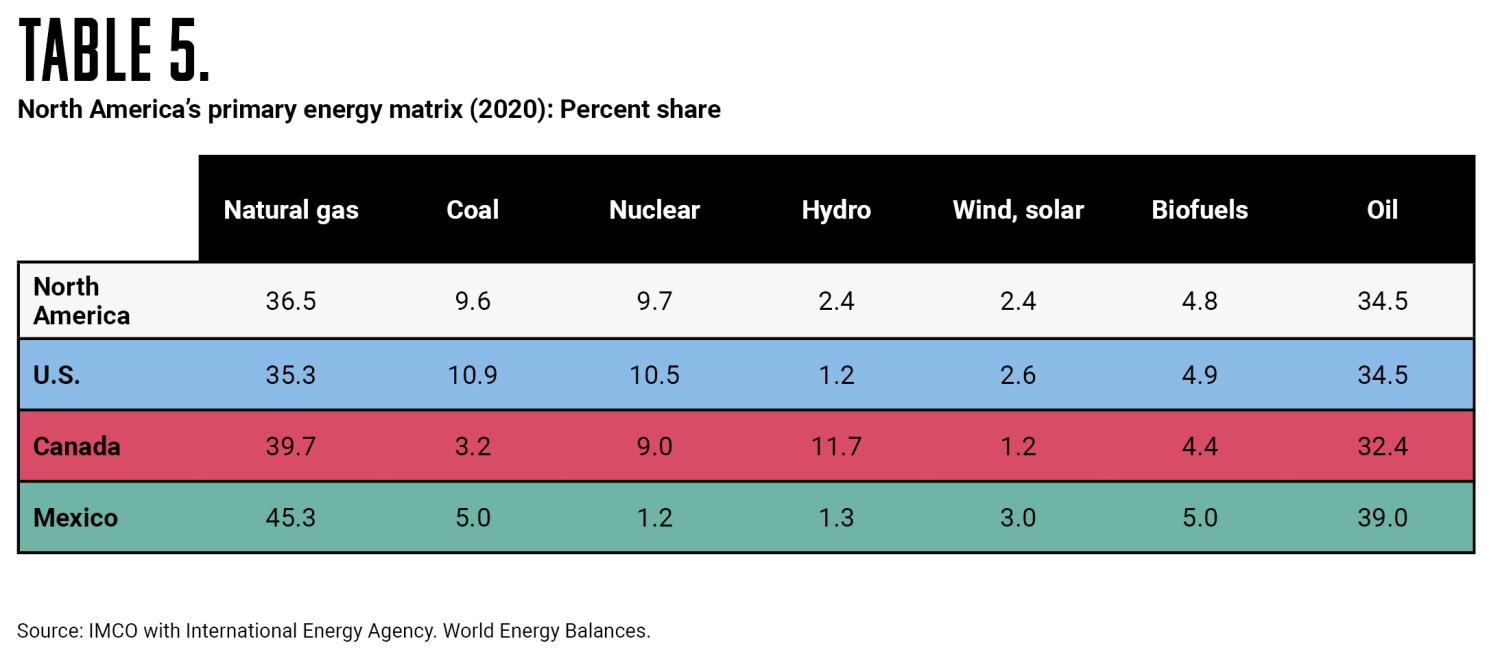

North America must decidedly decommission highly polluting facilities in favor of low-emission technologies. As shown in Table 5, in 2020, natural gas represented 36.5% of the region’s primary energy matrix while clean energies (e.g., nuclear, solar, wind, hydro, and biofuels) accounted for 19.3%. Nonetheless, coal still represented 9.6% and oil, 34.5%. The room for improvement cannot be overstated.

The ideas proposed in this chapter are consistent with the global imperative to reduce greenhouse gas (GHG) emissions to mitigate climate change and to develop a pathway to energy security across North America. The three countries have set ambitious greenhouse gas mitigation targets by 2030. The U.S. national determined contribution (NDC) is to reduce net GHG emissions by 50-52% to 2005 levels, Canada aims to reduce GHG emissions by 40-45% compared to 2005, and Mexico committed to reduce GHG emissions by 35% compared to the government’s baseline scenario (inertial emission growth scenario).

At the 2022 Conference of the Parties to the United Nations Framework Convention on Climate Change (COP27), all governments for the first time agreed to phase out of the use of fossil fuels while tripling global renewable power generation capacity by 2030—recognizing that “transitional fuels can play a role in facilitating the energy transition while ensuring energy security.”14 North America’s size and diversity eases the region’s path towards reducing its climate footprint. Yet again, political will at the tri-national level is an indispensable condition to achieve this objective. The clock is ticking for North America to meet its climate goals. Now more than ever investors’ certainty offered by the trade agreement should catalyze new investments in decarbonization efforts.

Final considerations

Federal and local governments, private companies, academia, as well as NGOs, all have a role to play in the development of a coherent North American vision for energy security and the energy transition anchored in transnational cooperation and transnational projects starting with natural gas pipelines and grid infrastructure. Failing to do so and remaining focused strictly on national endeavors on energy would imply missing the opportunity to consolidate North America as the most competitive region in the world ahead of the EU and Asia-Pacific. Mexico should be the champion of this idea since regionalization offers the country a once-in-a-lifetime opportunity to trigger higher growth levels and develop the country’s worse-off regions, especially south/southeastern states, which could for the first time integrate into North American supply chains.

There is no technical reason for energy to become a bottleneck for the region to make the most of the regionalization trend. Ultimately, the challenge is political, not economic. It is time to develop a North American strategy on energy.

Related viewpoints

More from USMCA Forward 2024

-

Footnotes

- Robert A. Pastor, The North American Idea: A Vision of a Continental Future (USA: Oxford University Press, 2011).

- UNCTAD, “Trade Structure by Partner,” Handbook of Statistics 2023, 2024, https://hbs.unctad.org/trade-structure-by-partner/.

- Virginia Watson, “Leaders Weigh in on North American Trade Policy During Global Leaders Forum – GPS News,” GPS News, November 12, 2021, https://gpsnews.ucsd.edu/leaders-weigh-in-on-north-american-trade-policy-during-global-leaders-forum/.

- https://www.iea.org/topics/energy-security

- Ibid.

- Ahmed Mehdi and Tom Morenhout, “The IRA and the US Battery Supply Chain: One Year On,” Center on Global Energy Policy at Columbia (blog), September 20, 2023, https://www.energypolicy.columbia.edu/publications/the-ira-and-the-us-battery-supplychain-one-year-on/. Princeton.Edu, “REPEAT | Rapid Energy Policy Evaluation & Analysis Toolkit,” n.d., https://repeatproject.org/results?comparison=benchmark&state=national&page=1&limit=25.

- International Energy Agency, “World Energy Outlook 2022” (International Energy Agency, November 2022), https://iea.blob.core.windows.net/assets/830fe099-5530-48f2-a7c1-11f35d510983/WorldEnergyOutlook2022.pdf.

- David Thurton, “Liberals ‘dawdle’ on Billions in Net-zero Investment Tax Credits: NDP Critic,” CBC News (blog) (CBC/Radio-Canada, October 27, 2023), https://www.cbc.ca/news/politics/net-zero-tax-credits-climate-1.7009126.

- “Energía – Monitor,” Energía, April 4, 2022, https://imco.org.mx/monitor/energia/.

- “Plan Sonora De Energías Sostenibles,” Gobierno De Sonora, n.d., https://plan.sonora.gob.mx/.

- “Home – TDI CHPExpress,” TDI CHPExpress, May 5, 2023, https://chpexpress.com/.

- “Opinion | Build Back Together as North America: A Blueprint for Regional Competitiveness,” Mexico Today Is Your Top Source for News About Mexico, December 2, 2021, https://mexicotoday.com/2021/12/02/opinion-build-back-together-as-north-america-a-blueprint-forregional-competitiveness/.

- Diego Díaz and Oscar Ocampo, “Gas Natural Para La Transición Energética Y Competitividad De México,” IMCO (Instituto Mexicano para la Competitividad, A.C., August 30, 2022), https://imco.org.mx/wp-content/uploads/2022/08/Gas-Natural-Competitivo-en-Mexico.pdf.

- https://unfccc.int/sites/default/files/resource/cma2023_L17_adv.pdf.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).