Last week, the World Bank released the latest issue of Africa’s Pulse, a biannual publication highlighting key macroeconomic trends in sub-Saharan Africa. The report updates the region’s growth forecast for 2019, revising its projection down to 2.6 percent, 0.2 percentage points lower than its April forecast and only slightly higher than the 2.5 percent growth in 2018. Like recent issues of Africa’s Pulse, this report highlights ongoing debt vulnerabilities on the continent with the region’s current account deficit widening in 2019—and notes that more countries are in debt distress or at high risk of debt distress than in previous years.

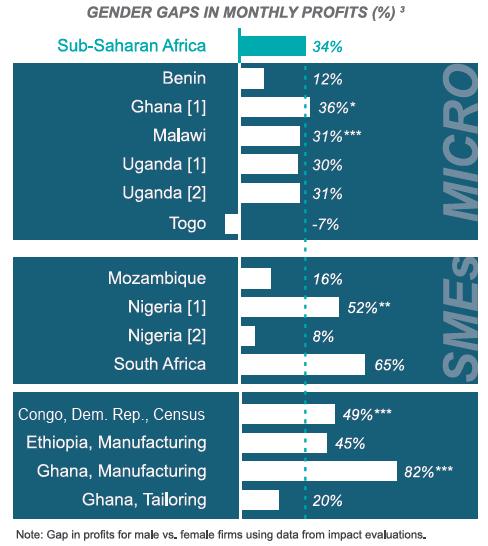

One of the special chapters in this report focuses on gender gaps in sub-Saharan Africa and policies to address them. As Figure 1 shows, women-led micro-, small-, and medium-sized firms earn 34 percent less in profits on average compared to male-led firms. A large share of the difference in profits is explained by the sectors where women operate (hair salons, retail, textile manufacturing, etc.) as they have lower profit margins.

Figure 1: Gender gaps in profits for entrepreneurs

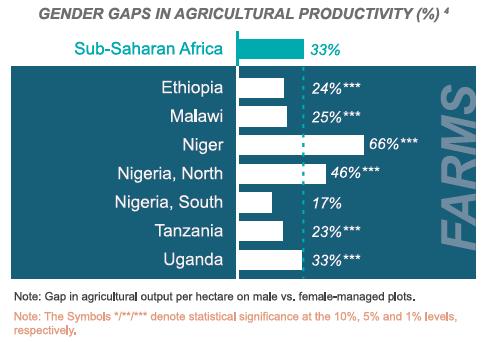

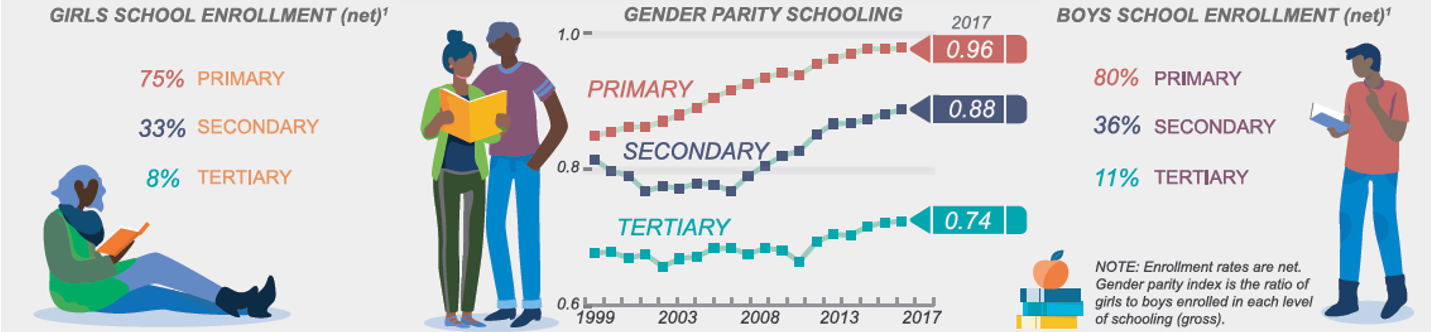

Gender gaps also exist in other sectors of the economy. As Figure 2 shows, female-managed agricultural plots in sub-Saharan Africa are, on average, one-third less productive than plots managed by men, for various reasons. Women are also less likely to have bank accounts or use mobile money. There is good news as the region is making progress in narrowing many gender gaps. For example, in education, sub-Saharan Africa is close to achieving gender parity in primary enrollment and has made progress on secondary and tertiary education, although more work remains.

Figure 2: Gender gaps in agricultural productivity

The report specifically identifies improving credit access as one of the six pathways for lowering gender-based constraints. Credit access is often a key constraint for female-owned businesses, leading to lower levels of investment and profits for their firms. Lack of collateral is a major impediment to credit access as women are much less likely to own assets and wealth compared to men (13 percent for women vs 39 percent for men). Other policy recommendations include building skills beyond traditional training, improving women’s land rights, increasing women’s use of hired and household labor, addressing social norms, and helping the next generation of girls.

A successful innovation tested in Ethiopia used psychometric tests—according to the report, “an innovative credit technology that helps predict the likelihood that a borrower will repay a loan”—as an alternative to traditional collateral and found that it performed well in predicting loan repayment, which led to a 99 percent loan repayment rate. Other tools recommended in the report include increasing adoption of digital technologies to support saving and more targeted loan products for existing entrepreneurs.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Figures of the week: Gender gaps in sub-Saharan Africa

October 17, 2019