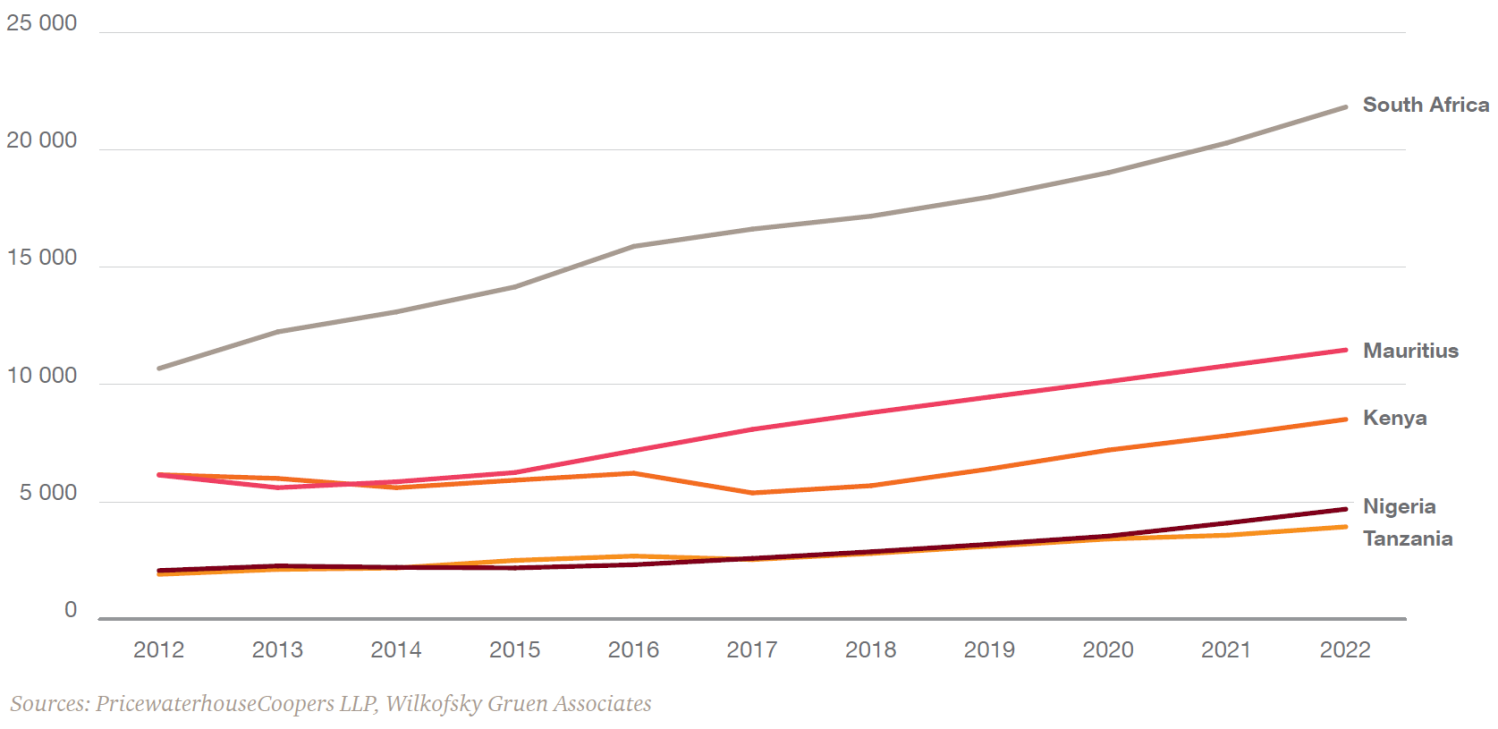

This month, PricewaterhouseCoopers (PwC), released a report titled “Hotels Outlook: 2018-2022: South Africa – Nigeria – Mauritius – Kenya – Tanzania,” outlining the key trends, challenges, and future prospects for the hotel industry in these countries. Overall, as Figure 1 shows, these countries have mostly seen increased revenue and are projected to see more in the future.

Table 1 shows the year-on-year change in the growth of hotel room revenues in the countries the study covers. Overall, hotel room revenue in the select countries increased by 2.7 percent in 2017, down from the 10.6 percent increase in 2016. According to the report, the absolute declines in Kenya’s and Tanzania’s revenues offset the major increases in Nigeria and Mauritius (Table 1).

In 2017, South Africa saw hotel room revenue rise by 4.6 percent since the previous year, which is a smaller increase than that of 2016 when the country recorded a 12.2 percent growth. The hotel markets in Nigeria and Mauritius continued to perform well in 2017, with both achieving double-digit growth. Nigeria experienced 11.7 percent growth, and hotel room revenue in Mauritius increased by 12.7 percent in 2017.

Last year, Kenya experienced a drop in visitors. The report cites a supreme court ruling on the invalidity of the result from the August presidential election and the election re-run in November, as the potential reason. After the instability, in December, the drop in visitors slightly recovered, but not enough to boost overall room revenue, which showed a 13.5 percent decline. Tanzania’s hotel room revenue amounted to $206 million in 2017, a decline of 5.5 percent over 2016 due to a drop in the number of nights guests stay at a hotel (“guest nights”). The report attributes the drop to certain government regulations such as the 2016 introduction of an 18 percent value-added tax on tourism and the increase in visa fees for business travel by up to 500 percent.

Table 1: Hotel room revenue in South Africa, Nigeria, Mauritius, Kenya, and Tanzania (millions of rand)

Overall, the report states that the hotel sector has the potential for further growth in the countries studied over the next five years because of an increase in the number of foreign and domestic travelers as well as an expansion in hotel chains. Over that period, hotel room revenue from the five markets as a group is projected to increase at a 7.4 percent compound annual rate.

This growth will not be equal though: Continued improvement in the domestic economy will lead to faster growth in guest nights in Nigeria, which will help make it the fastest-growing country in terms of hotel room revenue, with a projected 12.6 percent compound annual increase in revenues. Meanwhile, Kenya, Tanzania, and Mauritius are forecasted to have compound annual increases of 9.6 percent, 9.1 percent, and 7.2 percent, respectively.

South Africa is projected to be the slowest-growing market, with a 5.6 percent compound annual increase in room revenue, which will offset growth in overall tourism in South Africa. However, the moderate growth in hotel room revenue will remain steady due to a stronger global economy and an improving domestic economy, and the average daily room occupancy rate growth will be the principal driver with a projected 4.1 percent compound annual increase.

The report concludes that, while certain countries have experienced slight drops in hotel room revenue—e.g., Kenya last year—the trajectory is upward facing, and hotels in the countries studied will continue to accumulate surpluses over the coming years.

Kiara Rodriguez Gallego contributed to this post.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Figure of the week: Hotel revenues and growth in South Africa, Nigeria, Mauritius, Kenya, and Tanzania

July 13, 2018