Key takeaways:

- Since January 2025, the DMV region has shed federal jobs at a faster rate than the nation, while private sector job growth has plateaued.

- The DMV region’s unemployment rate has increased at a significantly higher pace than the nation’s, with the share of unemployed suburban workers growing the most.

- After a strong year of venture capital activity, venture capital flows into the DMV region have slowed dramatically since January 2025, while continuing to grow nationally.

- The number of homes for sale in the DMV region is up by 64% since last June, far surpassing the rate of change nationally and in other major metro areas.

- Data on the DMV region’s popularity with business and leisure visitors show mixed signs of resilience and potential softness.

- Both violent and property crime incidence are down year-over-year in the DMV region.

- More households in the DMV region are showing signs of financial distress.

The Trump administration is dramatically—and effectively—remaking the size, scope, and reach of the federal government. To maximize “government efficiency,” it has eliminated federal jobs, cut spending, and hollowed out agencies. Congress and the Supreme Court have upheld many of these executive actions, paving the way for more downsizing initiatives to come.

While these cuts will be felt across the country, the efforts to remake “federal Washington” are poised to fundamentally remake “metro area Washington.” That’s because this region, home to 6.4 million residents, provides a critical economic function for the U.S. and the world: hosting America’s national government. This includes the related public, private, and nonprofit activities that help the government carry out its mission on behalf of America’s interests at home and abroad. The federal presence also spawns adjacent industries and startups, fueling the growth of local private sector jobs. The result is a region that is a leading economic engine for the U.S. as well as the states of Maryland and Virginia. That’s why locals refer to the area as “the DMV”—to reflect the intertwined destinies of the District of Columbia and its two neighboring states.

The nature and magnitude of federal downsizing’s impact on the DMV economy are so far unclear. Do these changes represent a minor setback or an economic crisis with lasting, structural effects? Will certain populations, commercial corridors, and counties bear the brunt of federal retrenchment? And are there also opportunities that can arise from the federal transformation?

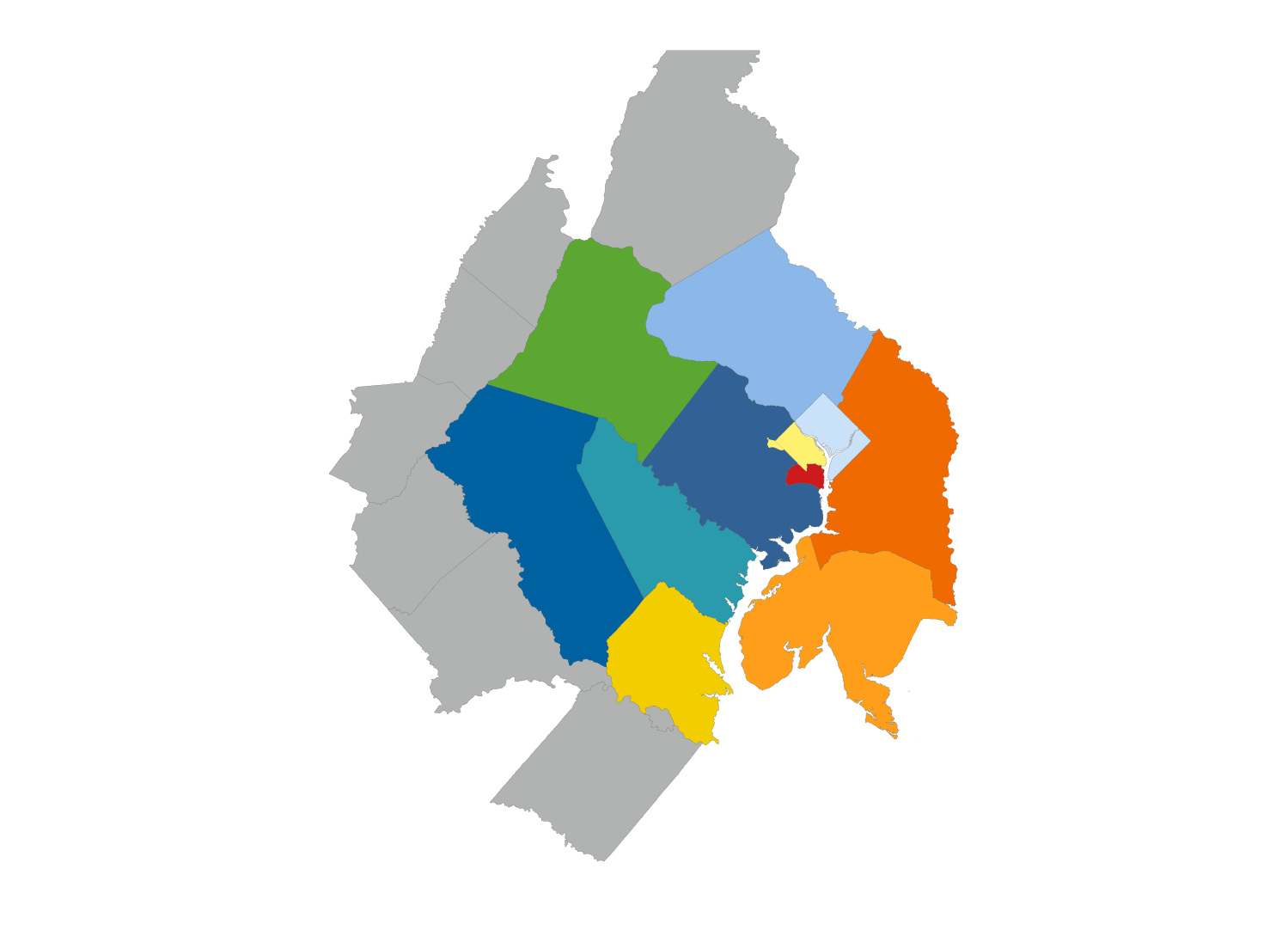

To shed light on these questions, Brookings, with the Metropolitan Washington Council of Governments (MWCOG), is launching the DMV Monitor. The DMV Monitor will track real-time changes in the regional economy since January 2025 to capture the effects of federal restructuring and other national policy shifts. The goal is to provide decisionmakers and the public with a data-driven picture of the economic, social, and fiscal health of the region, with an emphasis on understanding what has changed recently, grounded in the context of how these changes compare with national trends and how they are unfolding in each jurisdiction within the region. Brookings and MWCOG will update the DMV Monitor and its findings regularly, spotlighting key trends and focus areas.

About the DMV Monitor

The DMV Monitor is a data interactive and set of analyses that track the economic and social trends in the Greater Washington, D.C., Maryland, and Virginia metropolitan area to help leaders and the public understand the effects of federal restructuring and other policies on the region and its households.

To provide as holistic an assessment as possible, the DMV Monitor covers seven aspects of the region’s economy, summarized below. These indicators draw from both public and private data sources to examine effects across the 23-county metro area. To ensure timeliness, the DMV Monitor tracks data that can be updated on a monthly and quarterly basis. To provide proper context, the DMV Monitor compares the region’s trends with those of the nation and other major metropolitan areas (those with populations of 1 million-plus people). The DMV Monitor includes county-level trends to illuminate how impacts vary across the region.

Given the focus on timeliness and geographic detail, the DMV Monitor is not encyclopedic. That said, new data elements may be added over time. Finally, DMV Monitor analyses will summarize trends in ways that will reveal both challenges and emerging opportunities in the region. For more information, see the methodological appendix.

The DMV Monitor benchmarks the region’s performance across the following indicators:

|

Overall economy |

Labor market and workforce |

Innovation |

Real estate |

Destination and travel |

Municipal services |

Household well-being |

|---|---|---|---|---|---|---|

| Total jobs | Unemployment | Research grants | Office and retail vacancy | Hotel revenue | Transit ridership | Personal bankruptcy |

| Commercial bankruptcy | Job postings | Patent filings | Active homes for sale | Air travel | Medicaid enrollment | Credit-constrained population |

| Federal funding |

WARN notices |

Venture capital | Median home listing prices |

SNAP participation |

Cost of living | |

| Crime |

What follows is a summary of the current federal policy landscape, the DMV region’s unique position in this moment, and the initial findings of the DMV Monitor. More detailed trends can be found in the data interactive. We hope the DMV Monitor offers ongoing insights that the region’s leaders can use to adapt and work together in shaping the future of the Greater Washington economy.

Background and context

The Trump administration has made enormous headway in reducing the size of the federal bureaucracy, even as it has expanded federal reach in other ways. With the establishment of the Department of Government Efficiency (DOGE), the White House has accomplished the following:

- Laid off approximately 300,000 federal workers. The White House moved swiftly to terminate jobs, prompting media organizations, firms, and nonprofits to track employment losses, including by agency. In total, there will be 300,000 fewer federal workers on payroll nationwide by the end of calendar year 2025, according to a Trump administration official, with most of the reductions taking place by September 30 (the date by which most deferred resignations go into effect).

- Terminated over 13,000 federal contracts and over 15,000 federal grants. According to a White House tracker, these contract and grant cuts have yielded $59 billion and $44 billion in savings, respectively. While several investigative pieces have challenged these figures, it is nonetheless hard to ignore the impact of these cuts on public safety organizations, humanitarian relief groups, and health researchers, to name a few.

- Reduced office space. To enact further savings, federal agencies have assessed potential relocations out of Washington, D.C., and shedding unneeded office space. To that end, the Department of Agriculture announced plans to move most of its headquarters staff to other cities, while Department of Housing and Urban Development is relocating to the suburbs. The administration has also ended some federal leases and posted a starting list of federal assets to sell.

The White House’s drive to transform the federal government is likely to stick, and even expand over time. First, Congress has codified many of the president’s executive actions through the passage of the One Big Beautiful Bill Act and the Rescissions Act of 2025, which included $9 billion in spending cuts recommended by DOGE. Speaker Mike Johnson (R-La.) has also said that “multiple rescissions packages” may be coming. For its part, the Supreme Court issued a decision that allowed federal downsizing to continue, even as legal challenges and appeals continue. Emboldened, Trump administration officials tasked federal agencies over the summer to find further staffing cuts, additional contracts to terminate, and digital services to streamline.

Beyond federal downsizing, there are other federal actions that could also exact unique consequences on the DMV region. From the National Guard deployment and immigration enforcement actions to the federal takeover of key assets such as Union Station and the Kennedy Center, these actions could shape consumer spending and investment in the local economy.

The unique importance of the Greater Washington, D.C.-Maryland-Virginia area

The efforts underway to transform the federal government will have a disproportionate impact on the DMV region, which provides unique contributions to the nation.

First, the DMV region serves as the global headquarters of the U.S. government. As such, the federal government is a major employer. It clusters workers, firms, and other assets such as international embassies and global institutions, which make the region a hub for worldwide commerce and a place of stability and opportunity for families.

The federal government’s success comes from attracting and cultivating talent with specialized knowledge and a passion for service—a human capital pool that is often shared across industries. As one piece of evidence, the DMV region is home to the second highest share of college graduates of any major U.S. metro area. Further, while federal workers are located all over the United States, one-fifth are concentrated in the DMV region, making it the most exposed to federal employment among major metro areas. Federal jobs in the DMV region are good-paying jobs, fueling the growth of the region’s middle class, especially in counties with the highest number of federal civilian workers, such as Prince George’s County, Md., and Fairfax County, Va.

Through its procurement, the government catalyzes the growth of distinct suppliers in related sectors, especially in defense, IT, and professional and technical services. In fact, the share of all federal contracting in the United States is disproportionately concentrated in the DMV region, with two recent analyses showing that the federal government awarded approximately 25% of total FY 2023 national federal contracting dollars to entities located in the region.

Second, the DMV region is a major economic engine for the U.S. and the states of Maryland and Virginia. Thanks to these assets, the area is the sixth-largest economy in the U.S., and a driver of economic growth and revenue for Virginia and Maryland. In an update to Brookings analysis of metro area gross domestic product contributions to states, the DMV region is the largest economic engine in Virginia, generating 47.4% of the state’s economic output. For Maryland, that share is 40.1%.

In sum, the federal presence is intricately tied to the local economy. Any unraveling of federal jobs and contracts could unravel the many assets that have enabled the DMV region to thrive.

Findings

Given the disproportionate federal presence in the area, the DMV Monitor is tracking a holistic set of indicators to “monitor” both first- and second-order impacts of federal actions on the strength and stability of the region. We first examine the health of the overall economy and labor market, including what’s happening to employment and employer demand for workers. We then take a deeper look at specific aspects of the economy (innovation, tourism, and real estate) to provide insights into the level of dynamism and consumer and commercial demand. Finally, we examine the new federal environment’s impact on the provision of public services and, ultimately, the well-being of families. In all, the hope is to provide a picture of the cascading impacts that federal downsizing can have on the industries, workers, and communities that make up the DMV region’s economy.

In this first look, we find an abrupt negative shift in many economic and social trends in the DMV region since January 2025 or the same time last year. Across the range of seven indicators, there are early signals of serious distress, with some signs of resilience.

Overall economy: Since January 2025, the DMV region has shed federal jobs at a faster rate than the nation, while private sector job growth has plateaued

Federal employment nationwide declined 2.5% between January and June of 2025, and the aggregate change in federal jobs in very large metro areas mirrors that decline. In the DMV region, however, federal jobs are down nearly 4.5%—a loss of roughly 17,000 jobs in six months. While the region’s private sector had net positive growth of nearly 21,000 jobs over the same period (a growth rate above the national average), the trend has begun to plateau. These gains have been insufficient at keeping the region’s employment growth competitive with its peers. Of the 55 U.S. metro areas with populations greater than 1 million, the DMV region ranked 43rd on overall job growth between January and June of 2025.

Additionally, private sector job gains in the DMV region since January are concentrated in industries misaligned with the skills, fields of expertise, and professional backgrounds of most displaced federal workers. Of the net private sector jobs added in the DMV region so far this year, nearly 15,000 (45%) were in the construction sector alone, on top of 6,000 (18%) in hospitality and 4,500 (14%) in health care. While occupation-specific data for laid-off federal workers will likely not be available until early next year, these three industry sectors—which together added more jobs in the DMV region than the rest of the private sector combined—have historically had very low occupational overlap with the public sector, raising significant questions about the ability of private employers to absorb losses in the rest of the labor market.

Labor market and workforce: The DMV region’s unemployment rate has increased at a significantly higher pace than the nation’s, with the share of unemployed suburban workers growing the most

Nationally and among major metro areas, this summer’s unemployment rates are just slightly up compared to the same time last year. But the DMV region’s unemployment rate has jumped by 0.6 percentage points.1 While the District of Columbia is the jurisdiction with the highest unemployment rate in the region (5.8%), the biggest increases in unemployment took place in the Virginia suburbs, including Arlington County, the city of Alexandria, Fairfax County, and Loudoun County. This is likely because while higher shares of federal jobs are located in the District, the vast majority of the region’s federal workers live in Virginia and Maryland. While overall unemployment in the DMV region remains below the national average, this could change if rates continue to rise at such a rapid pace.

As an increasing number of unemployed workers seek jobs in the region, they will find a job market where job listings for full-time positions have grown by 4.7% since June 2024. However, the growth in demand for workers in the DMV region lags behind other major metropolitan areas and the country. Further, there is a very dramatic collapse in postings for job internships— more than double the decline seen nationwide, limiting the options for young people to gain valuable workplace skills in the region.

Innovation: After a strong year of venture capital activity, venture capital flows into the DMV region have slowed dramatically since January 2025, while continuing to grow nationally

For the DMV region to be economically resilient over the long run, it must be able to develop competitive advantages in new technologies and advanced industries that, even if still leveraging ties to the federal government, move beyond that in distinct and sizable ways. In this regard, the region has strengths to build upon. According to a recent study by our Brookings colleagues, the DMV region is an artificial intelligence “star hub,” with strengths in AI cloud-readiness, demand for AI workers, and robust federal R&D contracts. The region is also home to the nation’s first publicly traded quantum computing firm and tech and engineer giants such as Amazon, Northrop Grumman, and Bechtel.

While regularly available data on innovation capacity is thin, one proxy of a region’s innovation ecosystem strength is the ability for that region’s young enterprises to attract venture capital. In this regard, the DMV region is strong relative to other major metro areas domestically and globally in growth capital flow volume in the form of seed funding, angel investment, and crowdfunding. Historically, the DMV region’s growth capital flows are unsurprisingly more volatile than the pool of all major metro areas, but generally speaking, its flow volume moves up and down with the national trend.

Recently, however, the DMV region has bucked the national trend. In 2024, even as national growth capital flow slowed, a surge of transactions boosted the DMV region, including a $47 million seed round for Antithesis (a Vienna, Va.-based software startup); $63.9 million for YourPolicy (an Insurtech startup in Reston, Va.), $22.4 million for Medcura (a biotech firm in Riverdale Park, Md.), and $44 million to Defcon AI in McLean, Va.

In 2025, a new trend is emerging: While capital flows in major metro areas as a whole and the nation are seeing positive growth, the DMV region’s rolling 12-month dollar volume average has moved in the opposite direction, falling more than 30%. It will be worth monitoring this data to determine whether this slowdown is unique or tied to uncertainties the current federal environment presents.

Real estate: The number of homes for sale in the DMV region is up by 64% since last June, far surpassing the rate of change nationally and in other major metro areas

Homebuying trends help tell a story about household moves, either to a new community, to a bigger home, or from rental to homeownership (or the reverse). As some public and private sector workers in the DMV region face unemployment or employment uncertainties, it is worth examining the extent to which changing labor market dynamics are impacting household relocation decisions in the form of home moves.

In general, homebuying is a highly seasonal activity. Since the COVID-19 pandemic, the number of homes placed on the market in the DMV region has stayed relatively low, and has continued to stay that way as higher mortgage interest rates have kept homebuying relatively flat.

Against that backdrop, in June 2025, active home sale listings were up 29% nationwide and 32% in major metro areas compared to the same month a year prior. In the DMV region, however, the increase in active home sales was double (64%) that of peer metro areas. The number of homes listed for sale in the DMV region has risen to the highest level since the pandemic, even as interest rates have remained mostly unchanged.

This dramatic increase in home sale activity raises questions about where households are moving to, and if they are changing their tenure status (i.e., from owning to renting) due to increased instability. In a future expansion to the DMV Monitor, we will analyze U.S. Postal Service data on change-of-address requests to explore migration patterns. According to our Brookings colleague and leading demographer, William H. Frey, households moves in general remain historically low, with approximately 60% of moves taking place within the same county. However, long-distance moves are increasing. It will be worth examining the extent to which these for-sale homes reflect household decisions to leave the DMV region for another market.

Destination and travel: Data on the DMV region’s popularity with business and leisure visitors show mixed signs of resilience and potential softness

As home to the nation’s capital, the DMV region has always been a major destination for business, tourism, and international travel. Vacationers visit the region’s historic monuments and museums. World leaders and diplomats come to the city for critical meetings with federal officials or take part in major global policy summits, such as those hosted by the International Monetary Fund and the World Bank. Others come simply to conduct private business or participate in conferences hosted by nonprofits, think tanks, and other national institutions.

Despite starting the year with a major airport catastrophe, the DMV region has enjoyed rising combined year-to-date passenger volumes from 2024 at the region’s airports, in contrast to declining volumes nationally. In addition, winter is usually the worst season for the DMV region’s hotels, but this year the market received a substantial bump from the presidential inauguration.

However, heading into the region’s typical fall peak, the region’s spring and summer 2025 hotel revenue per available room underperformed the previous year. The next update of the DMV Monitor will capture the period in which various National Guard units and federal law enforcement personnel were deployed to Washington, D.C.—revealing whether these federal actions have affected hotel stays and revenues.

Municipal services: Both violent and property crime incidence are down year-over-year in the DMV region

One important aspect of a vibrant community is the capacity for local governments to provide critical public services that residents and businesses count on to improve quality of life and commerce. This ranges from good public schools to reliable public transit to safe streets.

When it comes to public safety, crime of all types is down year over year across the DMV region in absolute terms, as it is nationally and among major metro areas as a whole. Recent evidence shows that pandemic era spikes, then drops, in violent crime were attributable to employment levels and in-person classroom time. In brief, there is less crime when adults are working and young people are engaged in hands-on learning with peers and teachers.

Crime rates vary significantly from place to place, both nationally and within the DMV region. This is illustrated in Figure 9, which shows the rate of crime for select cities and counties in the DMV region, as well as for the region as a whole, other major metro areas in the U.S., and the nation. It shows that between 2024 and 2025, both property and violent crime rates went down for all jurisdictions shown. However, Figure 9 also shows that the rate of crime is much higher in some jurisdictions than others.

Examining crime rates in relative terms can help readers approaching the topic from different places understand why the same single “reality” may be perceived or experienced differently by others. To illustrate this, Figure 10 shows the relative difference in crime rates in 2024 and 2025 for different places in the DMV region compared to the crime rate for major metropolitan areas as a whole. The last column shows that the DMV regional crime rate is lower than major metro areas generally.

However, despite the decrease in crime levels nationally and within the DMV region, crime rates still remain relatively high in some communities. Within the DMV region, there were four jurisdictions with higher rates of crime in 2024 than major metropolitan areas in aggregate: the District of Columbia; Prince George’s County, Md.; Arlington County, Va.; and the city of Alexandria, Va. This is consistent with the evidence base that violent crime in particular is concentrated in specific neighborhoods and social networks.

Perceptions about crime in the District are likely shaped in part by the fact that crime there remains relatively much higher than U.S. metro areas as a whole, and because the reduction in the crime rate from 2024 to 2025 was not as large as the reduction among major metro areas in general; therefore, the gap between the District’s crime rate and that of major metro areas increased in 2025.

In general, evidence finds that the best way to break the cycle of violence and persistent crime in communities is to pair policing and criminal justice strategies with meaningful opportunities for youth, job training and employment opportunities for adults, and expanded investments and economic opportunities in distressed neighborhoods where crime is most concentrated. With rising unemployment and increased attention on public safety in the District, the DMV Monitor will continue to track crime trends in the region.

Household well-being: More households in the DMV region are showing signs of financial distress

The DMV region is home to some of the wealthiest counties in the United States, but also has a long-standing challenge with inequality and a high cost of living that makes economic security and upward mobility challenging for many households. For instance, according to Brookings’ Metro Monitor, the DMV region ranks 49th out of the 54 major metro areas in relative income poverty (26.7%), a measure of working poverty. Additionally, an Urban Institute dashboard chronicles how household financial wealth and savings also differ geographically, with households east of the Anacostia River especially vulnerable to employment and economic disruptions.

With new economic uncertainty in the DMV region, it is worth monitoring the health and well-being of households in the region. In an early indication of crisis, the Capital Area Food Bank 2025 Hunger Report finds that the severity of food insecurity in the region is worsening.

We looked at a dataset from the Federal Reserve estimating the share of people within a county who are severely credit-constrained (consumers with credit scores below 600) to assess the financial security of households in the DMV region. Since the beginning of this year, the share of the population that is severely credit-constrained has increased, as it has in major metro areas and nationally, likely due to a rising share of borrowers with severely delinquent credit card and student loan debt. These trends suggest that increased debt burdens and delinquency rates are occurring among both consumers who were already experiencing high financial stress and those previously less constrained.

Conclusion

Since January 2025, the U.S. economy has experienced uncertainty, with job growth slowing and unemployment and inflation ticking up. However, the DMV region’s economy has grown even weaker than the nation in many categories due to the Trump administration’s seismic actions to shrink the federal government.

According to the DMV Monitor, by June of this year, the DMV region experienced the first impacts of its major employer cutting jobs and relationships with local businesses. On jobs, the DMV region’s total employment trajectory took a nosedive, driven by the loss of federal government jobs, while total jobs grew faster nationally and among other major metro areas. Private sector job growth—a previous bright spot for the region—is stagnating, with many new jobs not aligned with the skills and experiences of most laid-off federal workers. As a result, job postings were not as robust as they were in peer regions, which is concerning when unemployment has soared, especially in the suburbs.

Perhaps in response to the loss of income and economic security, the number of homes for sale in the DMV region has skyrocketed, sparking concerns about a potential brain drain from the area. In the meantime, the share of households in the region that are severely credit-constrained, including those with large debt or missed payments, has also grown.

There are a few bright spots. Tourism remains relatively resilient, with the region’s air passenger volumes faring better than the nation and other major metro areas. Violent and property crime has declined across the region, even though rates remain relatively high in the District and some Virginia and Maryland suburbs.

In short, federal transformation is creating real turmoil in the DMV regional economy, at least in the near term. In the coming months, we will continue to monitor both the challenges and opportunities of this transformation. For instance, future DMV Monitor analyses will capture the implications of expanded National Guard and Immigration and Customs Enforcement (ICE) deployment in the District, as well as the September 30 deferred resignation deadline (the date at which most departing federal workers’ pay and benefits come to an end). At the same time, the Trump administration appears poised to enter into new federal contracts with local firms to advance nuclear energy, IT, and defense technologies, potentially fueling the region’s innovation ecosystem.

The future health and vitality of America’s capital region is uncertain. What is certain is that federal, state, and local leaders as well as the regional civic community have the chance to work together to shape its destiny, even as the federal government transforms itself. The region is too important—it is a major economic engine, a center of opportunity for families, and a welcome mat to the world.

In the coming months, we will continue to update the DMV Monitor to empower leaders in the region with information, context, and insight.

-

Footnotes

- Because there is a seasonal component to employment, we compare changes in employment to the same period of the previous year, as opposed to the beginning of the Trump administration (January 2025). We use the same approach for all indicators with seasonality.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).