Content from the Brookings Institution India Center is now archived. After seven years of an impactful partnership, as of September 11, 2020, Brookings India is now the Centre for Social and Economic Progress, an independent public policy institution based in India.

This blog post and report were published with 2 sentences on page 6 that lacked proper citation of work originally printed in a report by the Government of India, as well as a sentence on page 7 that was not properly attributed to a publication from CGAP. As of June 9 2020, both have been updated to include these citations.

By making financial services accessible at affordable costs to all individuals and businesses, irrespective of net worth and size, financial inclusion strives to address and offer solutions to the constraints that exclude people from participating in the financial sector. Research shows thatcountries with deeper levels of financial inclusion— defined as access to affordable, appropriate financial services— have stronger GDP growth rates and lower income inequality. (Demirguc-Kunt et al. 2017; King and Levine 1993; Beck et al. 2000; Clark et al. 2006; Beck et al. 2007; Demirguc-Kunt and Levine, 2009).

In recent years, careful research on financial habits, needs and behaviours of poor households has yielded information on how they manage their complex financial lives. This has also facilitated product design and solutions of financial instruments that are more suitable to their needs (Morduch et al. 2010).

In this paper, we seek to investigate the extent of financial inclusion achieved in India based on the latest available data. We analyse latest empirical trends across all states (rural and urban) for various financial instruments, outreach of financial institutions and the changes in the enabling institutions which actively promote financial deepening in India. The financial instruments that we study include bank accounts, credit outreach, insurance products, pension and payments. The financial institutions that we study include banks (ATMs, branches), the postal system, microfinance institutions and Self Help Groups as well as new institutions such as small banks and payment banks. We also analyse the role of expanding enabling institutions, specifically Aadhaar and the telecommunication network across India, which has helped facilitate the growth of financial inclusion across the country.

In this paper, we seek to investigate the extent of financial inclusion achieved in India based on the latest available data.

In 2014, 62 percent of adults globally reported having a bank account as per the Global Findex. In India this was merely 53 percent, but the extraordinary push for bank accounts through the Pradhan Mantri Jan Dhan Yojana (PMJDY) since then has taken this number to 80 percent (Global Findex 2017 Report). As per the government’s own data, as of 13th February 2019, 34.43 crore accounts have been opened under the PMJDY. This implies in absolute terms, India still has a large unbanked population, which is likely to be targeted in the coming years.

The patterns and behaviours poor households’ exhibit around financial management, shed light on the complex financial lives they lead in order to survive on variable low incomes. While research and policy debates have focused on access to credit, poor and marginalised groups require access to a full range of financial services to effectively manage their economic lives. Financial inclusion in a diverse country like India must hence be studied as a spectrum of services, in order to encapsulate the different dimensions of the populations they aim to service.

Financial inclusion in a diverse country like India must hence be studied as a spectrum of services, in order to encapsulate the different dimensions of the populations they aim to service.

Certain sections of society (for example — the poor, rural populations, women) are typically-excluded from wage-earning employment opportunities, living and working in the informal economy. In economic terms, their consumption and production decisions become intertwined and there arises a greater need to smooth consumption, manage risks and sustain livelihoods. These sections of society have the lowest access to formal financial instruments, forcing them to rely on age-old informal mechanisms: relatives, friends, money-lenders, savings schemes or money under the mattress. These informal mechanisms are insufficient and unreliable as well as very expensive. Financial exclusion hence imposes large opportunity costs on those who suffer from it the most. When coupled with information asymmetries and high transaction costs, the poor who lack collateral or credit histories are stuck in a bad equilibrium with no escape.

Geographic exclusion is exposed through inaccessibility, distances and lack of proper infrastructure; social exclusion is exposed through illiteracy and class and caste barriers. Historically, the primary responsibility of financial inclusion in rural areas lay with the cooperative sector and commercial banks, but they were unable to bring rural populations into the fold. Informal employment, lack of collateral and the inability of rural populations to approach and negotiate with formal financial institutions, makes it easier for an entire subsection of our population to go unbanked. Institutional credit has long alienated small farmers from borrowing, linking lending to landholding status of borrowers. The Socio-economic Caste Census 2011 reveals that more than half of the rural households depend on manual casual labour and another 30 percent depend on cultivation for their livelihood. Reliance on non-institutional credit agencies by rural households was as high as 44 percent in 2012 as per the All-India Debt and Investment Survey (AIDIS). However, given the significant push for institutional access through various market reforms and government schemes, this number is likely to have risen. The relative position of various states and union territories in terms of bank branch coverage, normalised by population (demographic bank penetration), paints a dismal picture. Most notably, the rural versus urban divide as given in the data, stresses on the importance of serving unbanked, poor and rural populations of India.

Several policy and financial regulatory initiatives have aimed to make substantial progress in terms of financial inclusion indicators— branch penetration, account density or credit and deposit numbers. Landlines as a low-cost vehicle of communication and Aadhaar as unique biometric identifier have expanded rapidly. As one of the world’s most developed cell phone markets, both public and private cell phone operators have vastly expanded in recent years their reach and coverage in remote and previously inaccessible areas. The Self Help Group movement in India has helped bring about a profound transformation in rural areas. Microfinance Institutions (MFIs) have played a significant role in facilitating inclusion, as they are uniquely positioned in reaching out to the rural poor. Many of them operate in a limited geographical area, have a greater understanding of the issues specific to the rural poor, enjoy greater acceptability amongst the rural poor and have flexibility in operations providing a level of comfort to their clientele.

Social protection nets for vulnerable and poor households against medical shocks have been guaranteed under health insurance schemes such as the Pradhan Mantri Jan Arogya Yojana (Ayshman Bharat Yojna) that will help poor household smooth consumption and cope with risks better. Furthermore, an integral part of helping the poor build assets is protecting those assets. India is prone to natural disaster risk and lacks domestic safety nets, making insurance products a significant and growing area for financial providers. All these services have aided in the focused and targeted distribution of benefits to unbanked populations, in order to improve the efficacy of distribution and minimise leakages.

India is prone to natural disaster risk and lacks domestic safety nets, making insurance products a significant and growing area for financial providers.

Macroeconomic evidence shows that countries with deeper financial inclusion tend to grow faster and reduce income inequality (Beck et al. 2007). Developing inclusive financial systems hence is an important component for economic and social progress on the development agenda. Evidence also shows that financial access improves local economic activity. Several settings over the past decades have offered an opportunity to assess the impact of financial access compared to a baseline in quasi-experimental settings at the local economy level. A study by Burgess and Pande used state-level panel data in India to provide evidence that opening bank branches in rural unbanked locations was associated with significant reductions in rural poverty. Access to formal financial institutions aside, microfinance institutions and self-help groups remain a leading model for providing financial services to the poor, new models and technology developments have provided opportunities for scaling outreach, deepening penetration and moving beyond brick and mortar delivery channels.

Evidence from a variety of Randomised Controlled Trials (RCTs) suggests that growing access to financial instruments has a positive impact on self-employment, business activities and household consumption (Bauchet et al. 2011). Even though impact varies across individual product categories, most RCTs so far, however, show improvements in households’ abilities to make appropriate choices. For individuals that do not own businesses, microcredit helps them manage cash-flow spikes and smooth consumption. Access to microcredit also leads to a general increase in consumption levels as it lowers the need for precautionary savings. For business owners, microcredit helps them invest in assets that enable them to start or grow their businesses and increases their ability to cope with risk. (See Banerjee and Duflo 2011, Dupas and Robinson 2013). Overall evidence of savings and increased access to credit has shown positive impacts for small business owners and households. Furthermore, randomised evaluations of health and weather-based index insurance, show strong positive impacts on households and farmers helping them mitigate risk and manage shocks. (See, Cole, et al. 2013; Karlan, Osei-Akoto, Osei, and Udry 2014, Thornton et al 2010)

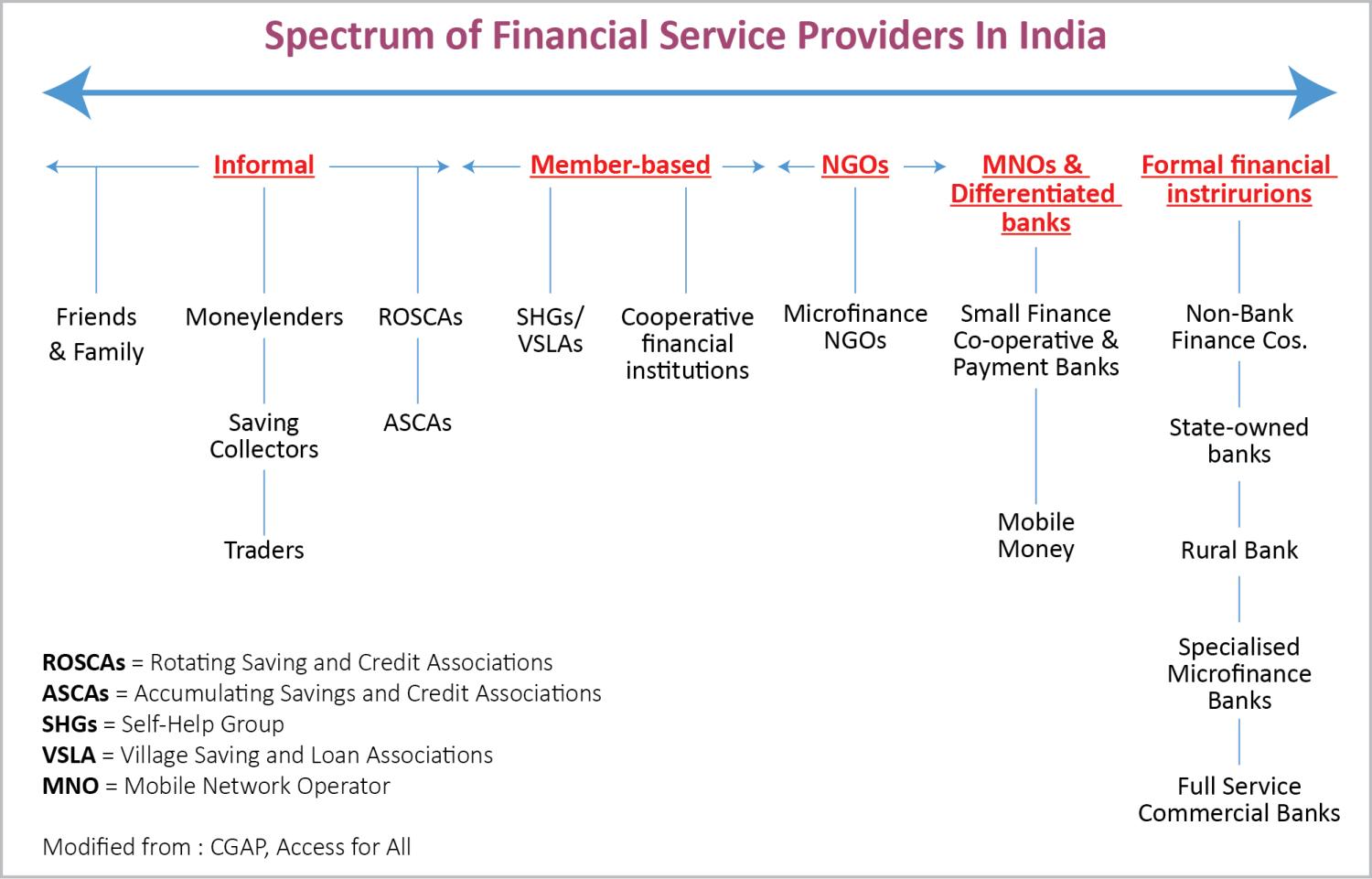

Given the participation barriers and capital market imperfections, policy interventions that foster financial inclusion are important to study. While strong institutions and policy efforts are effective in tackling financial exclusion, it is important to study a wider array of financial instruments to understand the multi-dimensional characteristics of poor populations. At any given time, a poor individual saves and borrows in informal ways and has multiple ongoing financial relationships. Vulnerability to risk and the lack of instruments to cope with external shocks adequately make it difficult for poor people to escape poverty. Lacking a formal bank account makes it difficult for the poor to save, which makes it less likely for them to cope with unexpected emergencies. As markets develop, the spectrum of financial service providers also develops, going from informal community-based models to more formal, regulated sources of financial services. (Refer to Figure 1 below).

As the Indian financial ecosystem evolves, any form of financial inclusion going forward must recognise broad needs and to study the impact of such inclusion, one must include not only policy mandates but also wider metrics. From a policy standpoint, studying such metrics will not only deepen our understanding of the impact of financial inclusion but also answer critical questions onhow to achieve it. Hence, it is important to identify a full range of financial services available to the poor — savings, credit and insurance.

In this paper, we seek to investigate the depth of financial inclusion, both rural and urban, in India. We study the issue from various standpoints, such as— products, institutions and enabling systems. In section 1, financial inclusion in India is analysed by studying products or schemes that promote savings, access to credit, payments, insurance (general, crop, life and health) and pension. The progress towards integrating the under-banked and unbanked into formal banking is gauged through new zero balance accounts under the “Banking for all” scheme (Pradhan Mantri Jan Dhan Yojana- PMJDY). Increase in access to loans by the unbanked and the under-banked is measured by the loans issued supported by MUDRA (Micro Units Development and Refinance Agency) bank. Launched by the Prime Minister in 2015, the MUDRA bank provides loans at low rates to micro-finance institutions and non-banking financial institutions, which then provide credit to Medium, Small & Micro Enterprises. Additionally, we study India’s achievements in the direction of becoming a pensioned society by analysing uptake of various State pension products.

In this paper, we seek to investigate the depth of financial inclusion, both rural and urban, in India. We study the issue from various standpoints, such as— products, institutions and enabling systems.

In section 2, we study penetration of banking as an institution across India. We analyse how banks — small, payments, commercial as well as public sector —have contributed towards the goal of financial inclusion. The Indian Post Bank has addressed the absence of brick and mortar infrastructure in villages, thereby revolutionising the banking landscape across rural India. Self Help Groups (SGH’s) and Micro Finance Institutions (MFI’s) continue to play a critical role in enabling access to credit for the poor.

Innovations and policy interventions in India have been aimed at reducing barriers to access existing financial institutions (for example, relaxing of minimum balance restrictions) and bringing banking options geographically closer to people, but as the data shows, far more needs to be done. Section 3 sheds light on enabling systems that help reach the unbanked and under-banked such as tele-density (cell phones and landlines) and broadband networks which allow for Aadhaar-enabled Payment Systems (AePS). We also look at the rate at which AePS have penetrated the Indian Payment systems.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).