MEDIA SUMMARY

Adjusting for bad weather would make monthly employment changes more accurate

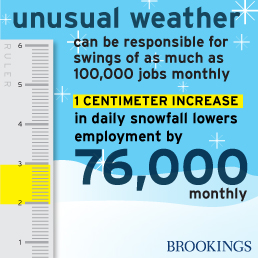

Winter weather can account for fluctuations of 100,000 jobs up or down in payroll data and big swings in GDP; Uncertainty impacts both Fed policymakers and Wall Street

Macroeconomic data can and should be purged of the effects of bad weather to help policymakers and markets have a more accurate sense of the health of the economy. Unusual weather is not accounted for by applying “seasonal adjustment,” and this new research shows that the effects of –unusual weather can be responsible for swings of as much as 100,000 jobs monthly.

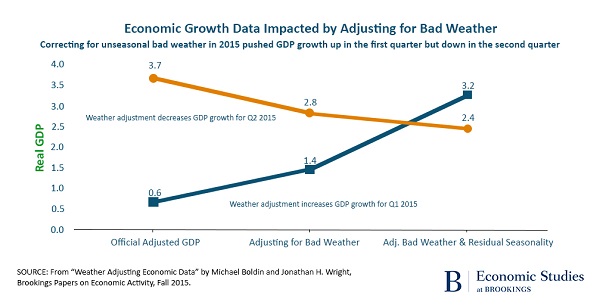

Adjusting for unseasonal weather also impacts GDP data, with growth in the first quarter of 2015 increasing from 0.6 percentage points at an annualized rate to 1.4 percentage points, while the estimate of growth in the second quarter drops from 3.7 to 2.8 percentage points.

Federal Reserve officials and other policymakers — as well as those on Wall Street and in the media — often look at monthly employment data as a signal of the overall health and momentum of the economy, and are hypersensitive to the data. It impacts whether the Fed moves interest rates or deploys other monetary policy tools; having certainty over whether the payroll numbers are changing due to bad weather or other factors would improve decision-making.

In “Weather Adjusting Economic Data,” Michael Boldin of the Federal Reserve Bank of Philadelphia and Jonathan H. Wright of Johns Hopkins University find that unusual weather effects are important and are not reflected in the conventional seasonal adjustment that the Bureau of Labor Statistics currently uses. The authors used data from the National Centers for Environmental Information (NCEI) on daily maximum temperatures and snowfalls in the 50 largest cities in the U.S. from 1960 to present as a way to measuring U.S.-wide temperature and snowfall in a way that makes a long time series easily available and that puts more weight on areas with higher economic activity.

They find that unusual weather has its most serious impacts on payrolls in the winter and early spring months (the first four months of the year), and hits the construction sector hardest, with cold winter weather lowering building activity while cooler summer weather could boost it.

Boldin and Wright estimate that a 1 degree Celsius decrease in average temperature in March lowers employment by 23,000 and that a 1 centimeter increase in daily snowfall lowers employment by 76,000.

Payroll changes are more predictable using the proposed seasonally-and-weather-adjusted data than using ordinary seasonally adjusted data, in every sector except government, they find. However, in the construction sector in particular, the difference between the 2 adjustments is significantly higher, with weather adjustment removing statistical “noise” that is unrelated to the trend, cyclical or seasonal components, thus giving a better measure of the underlying strength of the economy.

“Seasonal effects in macroeconomic data are enormous. These seasonal effects reflect, among other things, the consequences of regular variation in weather over the year. The seasonal adjustments that are applied to economic data are not however intended to address deviations of weather from seasonal norms. Yet, these deviations have material effects on macroeconomic data. Recognizing this fact, this paper has operationalized an approach for simultaneously controlling for both normal seasonal patterns and unusual weather effects… It is not that weather adjusted economic data should ever replace the underlying existing data, but weather adjustment can be a useful supplement to measure underlying economic momentum,” they conclude.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).