Tax cuts and transfers to individuals and firms are most effective forms of stimulus

Gerald Carlino of the Philadelphia Fed and Robert P. Inman of the University of Pennsylvania find that federal tax cuts, transfers to households and firms, and intergovernmental transfers to states for low income assistance are the most effective forms of fiscal stimulus. The authors conclude that if all ARRA funds had been allocated towards tax cuts and welfare aid—and not government purchases or project aid—economic growth would have 0.8 percentage points higher in the first year of stimulus, with an additional 500,000 jobs created.

Medicare Advantage advertising targets the healthiest individuals

Naoki Aizawa of the University of Minnesota and You Suk Kim of the Federal Reserve Board find that, through mass marketing and direct mail advertising, Medicare Advantage plan providers risk-select by targeting the healthiest individuals, reducing plan costs. The authors add that, if providers with large advertising expenditures were to stop advertising, premiums in those plans would rise by 40 percent as the risk pool deteriorated.

Monetary finance most effective option in some circumstances

In a paper presented at the 16th Jacques Polak Annual Research Conference at the IMF, Adair Turner of the Institute for New Economic Thinking argues that monetary finance—tax cuts or government purchases financed through central bank purchases of government debt—can be more effective than purely fiscal or monetary policies in some circumstances, and is not difficult to conduct from a technical standpoint. Turner acknowledges the political risk of excessive use, but suggests that maintaining central bank independence while providing greater scope for coordination with fiscal policy makers would overcome this risk.

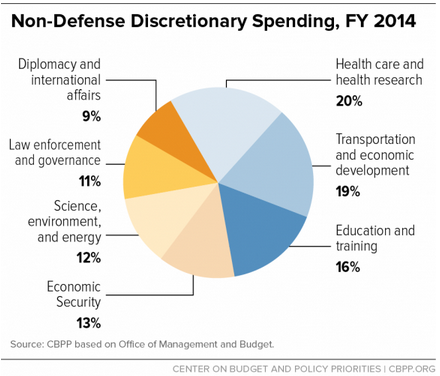

Chart of the week:

Quote of the week: With policy rates at the lower bound, signs of negative spillovers from abroad suggest that the Fed should proceed with “greater caution than normal”

The feedback loop between market expectations of divergence between the United States and our major trade partners and financial tightening in the United States means that material restraint to U.S. conditions is already in place. Looking ahead, a further weakening of foreign growth could pose downside risks to the U.S. outlook. Under normal circumstances, policy in the United States could adjust to signs that spillovers from developments abroad were affecting activity in the United States. But with policy rates in the United States at the lower bound, the ability to offset spillovers from adverse developments in foreign economies with conventional policy is constrained, suggesting greater caution than normal.

—Lael Brainard, Governor, Federal Reserve Board

Commentary

Hutchins Roundup: Stimulus spending, Medicare Advantage, and more

November 12, 2015