HARP saved participating households $3,500 per year

Sumit Agarwal et al. find that households who refinanced through the Home Affordable Refinancing Program (HARP) were able to lower the interest rates on their mortgages by an average of 1.4 percentage points, producing an average savings of $3,500 per borrower. The authors add that the program had a substantial impact on consumer spending, with over 20 percent of interest rate savings being spent on automobiles.

Fed’s Operation Twist aided leveraged firms, stimulated economy

Nathan Foley-Fisher of the Federal Reserve Board, Rodney Ramcharan of the University of Southern California, and Edison Yu of the Philadelphia Fed find evidence that the Fed’s maturity extension program, also known as Operation Twist, designed to reduce long-term interest rates, helped relax financing constraints and lower borrowing costs for firms most reliant on long-term debt, thereby increasing employment and investment.

Hospital ownership of physician’s practices significantly influences patient choice

Laurence C. Baker, M. Kate Bundorf, and Daniel P. Kessler of Stanford University find that patients seeking care from a physician whose practice is owned by a hospital are significantly more likely to choose the hospital owning the physician’s practice. Furthermore, patients are more likely to choose a high-cost, low-quality hospital when the admitting physician’s practice is owned by that hospital.

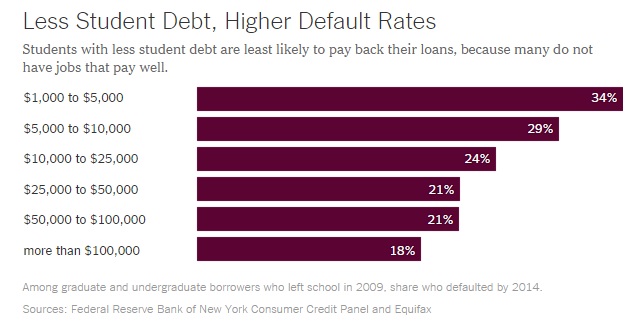

Chart of the week: Student debt

Quote of the week: Fed should not wait for inflation to reach 2 percent to begin tightening

…For the purpose of meeting our goals, the entire path of interest rates matters more than the particular timing of the first increase. With inflation low, we can probably remove accommodation at a gradual pace. Yet, because monetary policy influences real activity with a substantial lag, we should not wait until inflation is back to 2 percent to begin tightening. Should we judge at some point in time that the economy is threatening to overheat, we will have to move appropriately rapidly to deal with that threat. The same is true should the economy unexpectedly weaken.

– Stanley Fischer, Vice Chairman of the Federal Reserve Board

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: HARP, Fed’s maturity extension program, and more

September 3, 2015