Fiscal forward guidance may have a role to play in stimulating the economy

In a European Central Bank working paper, Giovanni Ricco of the London Business School finds that expected fiscal shocks are much more effective in stimulating the economy than are “misexpected” shocks—those that are unexpected and are not detected by the public at the time of their implementation— or unexpected shocks. This suggests that stronger forward guidance can increase the effectiveness of expansionary fiscal policy.

Uninsured individuals a large drag on hospitals

Using 28 years of confidential data, Craig Garthwaite and Matthew J. Notowidigdo of Northwestern University and Tal Gross of Columbia University find that, because hospitals are required to provide emergency care to those without insurance, each uninsured person costs local hospitals roughly $900 each year in uncompensated care. The authors also find that as the number of uninsured rises, hospital profit margins fall, suggesting that hospitals cannot pass all uncompensated care costs through to insured patients.

Fiscal consolidations based on higher taxes are more damaging to growth

Analyzing episodes of fiscal consolidation in 27 countries between 2009 and 2014, Iván Kataryniuk and Javier Vallés of the Banco de España find that debt reduction during this period was associated with much sharper reductions in output than in “normal times.” The effects of revenue increases were significantly higher than spending cuts, suggesting that consolidations based on higher taxes are particularly painful.

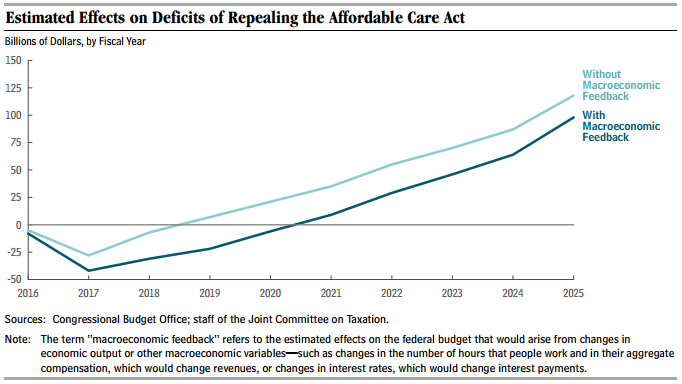

Chart of the week: Repealing the Affordable Care Act would increase deficits

Quote of the week: Economic and Monetary Union requires a “quantum leap” forward before reaching completion

The situation in Greece reminds us again that the Economic and Monetary Union is an unfinished construction as long as we do not have all tools in place to ensure that all euro area members are economically, fiscally and financially sufficiently resilient. To complete the Economic and Monetary Union, we need a quantum leap towards a stronger, more efficient institutional architecture.

—Mario Draghi, President of the European Central Bank

Commentary

Hutchins Roundup: Fiscal consolidations, impacts of uninsurance, and more

June 25, 2015