In a new Urban-Brookings Tax Policy Center policy brief, “Residential Property Taxes in the United States,” Benjamin Harris and Brian David Moore provide an overview of residential property taxes in the United States and recent trends in aggregate property tax revenues at the county level. “Effective property tax rates vary substantially by state and region,” they find, “although the bulk of counties levy property taxes that are around $1,000 per homeowner and below 1 percent of house value.”

Explore how individual county-level jurisdictions stack up against each other across three criteria in this interactive map, highlights of which appear below.

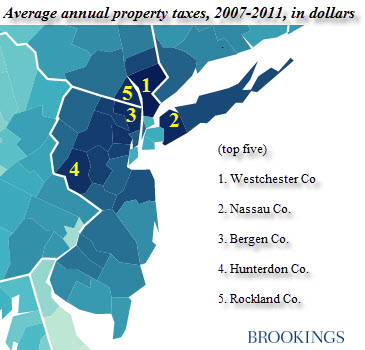

Top five average property taxes paid (2007-11)

1. Westchester Co., New York

1. Westchester Co., New York

2. Nassau Co., New York

3. Bergen Co., New Jersey

4. Hunterdon Co., New Jersey

5. Rockland Co., New York

See locations of these counties, clustered around or near New York City, to the right.

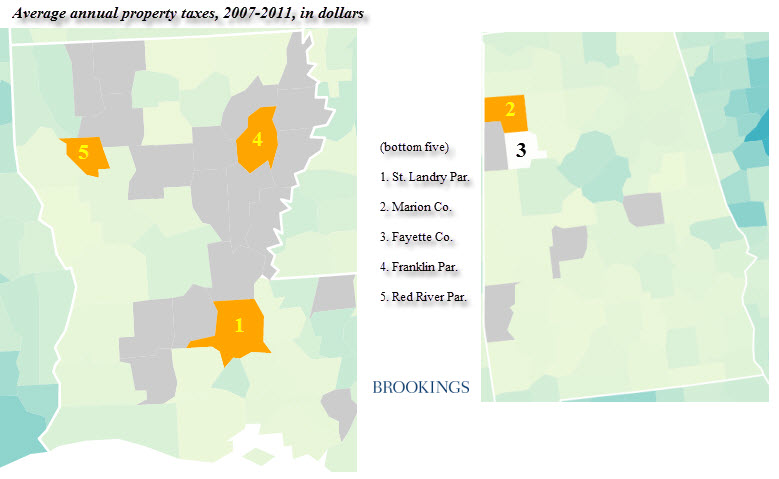

Bottom five average property taxes paid (2007-11)*

1. St. Landry Par., Louisiana

2. Marion Co., Alabama

3. Fayette Co., Alabama

4. Franklin Par., Louisiana

5. Red River Par., Louisiana

See the map below (not to scale) for locations of these counties:

* Some data are not available for 28 county-level jurisdictions in Alabama, Alaska, Hawaii, Louisiana and Mississippi.

Top five average property tax as share of home value, 2007-2011 (percent)

1. Shannon Co., South Dakota

2. Orleans Co., New York

3. Niagara Co., New York

4. Wayne Co., New York

5. Allegany Co., New York

Shannon County is home to the Pine Ridge Indian Reservation and its position on the list, an outlier, is explained by the authors as “the result of low property values combined with low population density.” The authors also explain in their report that these five counties are the only ones with property tax bills in excess of 3 percent of their home’s value (60 percent of counties’ property tax bills were less than 1 percent of their median home value; 37 percent were between 1 and 2 percent).

Bottom five average property tax as share of home value, 2007-2011 (percent)

1. Pointe Coupee Par., Louisiana

2. Hawaii Co., Hawaii

3. Catron Co., New Mexico

4. Kauai Co., Hawaii

5. Maui Co., Hawaii

See also the

interactive map of income taxes paid per county

.

Harris is a Brookings fellow in the Economic Studies Program. Moore is a research assistant with the Tax Policy Center.

Commentary

Top 5 and Bottom 5 Average Property Taxes Paid by County in the U.S.

December 26, 2013