“Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community. Let us suppose further that everyone is convinced that this is a unique event which will never be repeated.” (Milton Friedman, “The Optimum Quantity of Money,” 1969)

“The deflation speech saddled me with the nickname ‘Helicopter Ben.’ In a discussion of hypothetical possibilities for combating deflation I mentioned an extreme tactic—a broad-based tax cut combined with money creation by the central bank to finance the cut. Milton Friedman had dubbed the approach a ‘helicopter drop’ of money. Dave Skidmore, the media relations officer…had advised me to delete the helicopter-drop metaphor…’It’s just not the sort of thing a central banker says,’ he told me. I replied, ‘Everybody knows Milton Friedman said it.’ As it turned out, many Wall Street bond traders had apparently not delved deeply into Milton’s oeuvre.” (Ben Bernanke, The Courage to Act, 2015, p. 64)

In previous posts, I discussed tools that the Fed might use in response to a future slowdown in the U.S. economy. I argued that, even if the scope for conventional interest-rate cuts is limited by already-low rates, the Fed has additional policy tools available, ranging from forward guidance about future rate policies to additional quantitative easing to targeting longer-term rates. Still, so long as people have the option of holding currency, there are limits to how far the Fed or any central bank can depress interest rates. [1] Moreover, the benefits of low rates may erode over time, while the costs are likely to increase. Consequently, at some point monetary policy faces diminishing returns.

When monetary policy alone is inadequate to support economic recovery or to avoid too-low inflation, fiscal policy provides a potentially powerful alternative—especially when interest rates are “stuck” near zero. [2] However, in recent years, legislatures in advanced industrial economies have for the most part been reluctant to use fiscal tools, in many cases because of concerns that government debt is already too high. In this context, Milton Friedman’s idea of money-financed (as opposed to debt-financed) tax cuts—“helicopter money”—has received a flurry of attention, with influential advocates including Adair Turner, Willem Buiter, and Jordi Gali.

In this post, I consider the merits of helicopter money as a (presumably last-resort) strategy for policymakers. I make two points. First, in theory at least, helicopter money could prove a valuable tool. In particular, it has the attractive feature that it should work even when more conventional monetary policies are ineffective and the initial level of government debt is high. However, second, as a practical matter, the use of helicopter money would involve some difficult issues of implementation. These include (1) the need to integrate the approach with standard monetary policy frameworks and (2) the challenge of achieving the necessary coordination between fiscal and monetary policymakers, without compromising central bank independence or long-run fiscal discipline. I propose some tentative solutions for these problems.

To be clear, the probability of so-called helicopter money being used in the United States in the foreseeable future seems extremely low. The U.S. economy has continued to strengthen and is not today suffering from the severe underutilization of resources and very low inflation (or even deflation) that would justify such an approach; and, as I’ve noted, the Fed has other tools still available. Nevertheless, it’s important that markets and the public appreciate that, should worst-case recession or deflation scenarios occur, governments do have tools to respond. Moreover, with central banks in Europe and Japan struggling to reach their inflation targets, money-financed fiscal actions may receive more attention outside this country.

What is helicopter money and how does it work?

As I learned when I spoke about it in 2002, the imagery of “helicopter money” is off-putting to many people. But using unrealistic examples is often a useful way at getting at the essence of an issue.

[3] The fact that no responsible government would ever literally drop money from the sky should not prevent us from exploring the logic of Friedman’s thought experiment, which was designed to show—in admittedly extreme terms—why governments should never have to give in to deflation.

In more prosaic and realistic terms, a “helicopter drop” of money is an expansionary fiscal policy—an increase in public spending or a tax cut—financed by a permanent increase in the money stock. [4] To get away from the fanciful imagery, for the rest of this post I will call such a policy a Money-Financed Fiscal Program, or MFFP.

To illustrate, imagine that the U.S. economy is operating well below potential and with below-target inflation, and monetary policy alone appears inadequate to address the problem. [5] Assume that, in response, Congress approves a $100 billion one-time fiscal program, which consists of a $50 billion increase in public works spending and a $50 billion one-time tax rebate. In the first instance, this program raises the federal budget deficit by $100 billion. However, unlike standard fiscal programs, the increase in the deficit is not paid for by issuance of new government debt to the public. Instead, the Fed credits the Treasury with $100 billion in the Treasury’s “checking account” at the central bank, and those funds are used to pay for the new spending and the tax rebate. Alternatively and equivalently, the Treasury could issue $100 billion in debt, which the Fed agrees to purchase and hold indefinitely, rebating any interest received to the Treasury. In either case, the Fed must pledge that it will not reverse the effects of the MMFP on the money supply (but see below).

From a theoretical perspective, the appealing aspect of an MFFP is that it should influence the economy through a number of channels, making it extremely likely to be effective—even if existing government debt is already high and/or interest rates are zero or negative. In our example the channels would include:

- the direct effects of the public works spending on GDP, jobs, and income;

- the increase in household income from the rebate, which should induce greater consumer spending;

- a temporary increase in expected inflation, the result of the increase in the money supply. Assuming that nominal interest rates are pinned near zero, higher expected inflation implies lower real interest rates, which in turn should incentivize capital investments and other spending; and

- the fact that, unlike debt-financed fiscal programs, a money-financed program does not increase future tax burdens. [6]

Standard (debt-financed) fiscal programs also work through channels #1 and #2 above. However, when a spending increase or tax cut is paid for by debt issuance, as in the standard case, future debt service costs and thus future tax burdens rise. To the extent that households today anticipate that increase in taxes—or if they simply become more cautious when they hear that the national debt has increased—they will spend less today, offsetting some of the program’s expansionary effect. [7]

In contrast, a fiscal expansion financed by money creation does not increase the government debt or households’ future tax payments and so should provide a greater impetus to household spending, all else equal (channel #4 above). Moreover, the increase in the money supply associated with the MFFP should lead to higher expected inflation (channel #3)—a desirable outcome, in this context—than would be the case with debt-financed fiscal policies.

Could the central bank implement an MFFP on its own? Some have suggested an alternative approach in which the central bank prints money and gives it away—so-called “people’s QE.” From a purely economic perspective, people’s QE would indeed be equivalent to a money-financed tax cut (Friedman’s original helicopter drop, although perhaps more targeted). The problem with this policy, which would certainly be illegal in most or all jurisdictions, is not its economic logic but its political legitimacy: The distribution of what are effectively tax rebates should be subject to legislative approval, not determined unilaterally by the central bank. I’ll return to the issue of MFFP governance in a moment.

Implementation issue #1: MFFPs, interest-rate targeting, and interest on reserves

As I’ve stressed, MFFPs differ from ordinary fiscal programs by being money-financed rather than debt-financed. In my illustrative fiscal program, government spending and tax cuts are paid for by the creation of $100 billion in new money. To have its full effect, the increase in the money supply must be perceived as permanent by the public.

In practice, however, most central banks do not make monetary policy by choosing a fixed amount of money in circulation. Instead they set a target for a short-term interest rate (in the U.S., the federal funds rate) and allow the money supply to adjust as necessary to be consistent with that target. The rationale for this approach is that the relationship between interest rates and the economy appears more stable and predictable than that between the money supply and the economy. If central banks target interest rates rather than the money supply itself, than it’s not immediately obvious how the idea of a “permanent increase in the money supply” can be made operational.

One possible solution for that problem is that the central bank, rather than making an explicit promise about the money supply, could temporarily raise its target for inflation—equivalently, it could increase its target for the price level at each future date. Since the price level and the money supply tend to be proportional in the longer run, aiming for a higher price level could approximate the effects of committing to a higher money supply. A shortcoming of this approach is that it obscures the fact that the fiscal package is being financed by money creation rather than by new debt—a distinction that, again, the public must appreciate if the MFFP is to be fully effective.

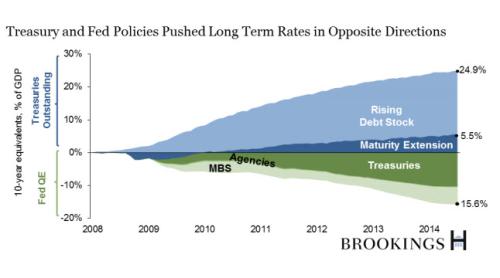

The methods that central banks use to meet their interest-rate targets pose further complications. Before the financial crisis, the Fed continuously varied the amount of money in the system (more precisely, the quantity of bank reserves) to keep the funds rate near the desired level. In the years since the crisis, however, several rounds of quantitative easing have resulted in very high levels of bank reserves, to the extent that the traditional method of making marginal changes to the supply of reserves is no longer effective in controlling the federal funds rate. Instead, following practices similar to those of other major central banks, the Fed currently influences the funds rate by varying the interest rate it pays on bank reserves and on other short-term investments at the Fed. [8]

As my former Fed colleague Narayana Kocherlakota has pointed out, the fact that the Fed (and other central banks) routinely pay interest on reserves has implications for the implementation and potential effectiveness of helicopter money. A key presumption of MFFPs is that the financing of fiscal programs through money creation implies lower future tax burdens than financing through debt issuance. In the longer run and in more-normal circumstances, this is certainly true: The cost to the Treasury of spending increases or tax cuts – and thus the future tax burden – will be lower if the Fed provides the financing. In particular, when the Fed’s balance sheet has shrunk and reserves are scarce again, the Fed will be able to manage short-term rates without paying interest on reserves (as it did traditionally), or in any event by paying a lower rate on reserves than the Treasury must pay on government debt. In the near term, however, money creation would not reduce the government’s financing costs appreciably, since the interest rate the Fed pays on bank reserves is close to the rate on Treasury bills.

Both interest-rate targeting and the payment of interest on reserves make it more difficult to achieve and communicate the cost savings associated with money financing. Here is a possible solution. Suppose, continuing our example, that the Fed creates $100 billion in new money to finance the Congress’s fiscal programs. As the Treasury spends the money, it flows into the banking system, resulting in $100 billion in new bank reserves. On current arrangements, the Fed would have to pay interest on those new reserves; the increase in the Fed’s payments would be $100 billion times the interest rate on bank reserves paid by the Fed (IOR). As Kocherlakota pointed out, if IOR is close to the rate on Treasury bills, there would be little or no immediate cost saving associated with money creation, relative to debt issuance.

However, let’s imagine that, when the MFFP is announced, the Fed also levies a new, permanent charge on banks—not based on reserves held, but on something else, like total liabilities—sufficient to reclaim the extra interest payments associated with the extra $100 billion in reserves. In other words, the increase in interest paid by the Fed, $100 billion * IOR, is just offset by the new levy, leaving net payments to banks unchanged. (The aggregate levy would remain at $100 billion * IOR in subsequent periods, adjusting with changes in IOR.) Although the net income of banks would be unchanged, this device would make explicit and immediate the cheaper financing of the fiscal program associated with money creation. [9]

Implementation issue #2: the governance of MFFPs

The most difficult practical issues surrounding MFFPs involve their governance—who decides, and how? Unlike orthodox fiscal and monetary policies, MFFPs would seem to require close coordination of the legislature and the central bank, which may be difficult to manage in practice. [10] To the extent that that coordination is successful, some worry, it might put at risk the longer-term independence of the central bank. Another concern is that the option of using money finance might be a “slippery slope” for legislators, who might be tempted to use it to facilitate spending or tax cuts when such actions no longer make macroeconomic sense.

The governance concerns, as proponents like Adair Turner have emphasized, are perhaps the most important reason that MFFPs should not be a first-resort, or even second-resort, policy. But no one is recommending the use of such policies in ordinary times; it’s precisely in the most difficult or extreme circumstances, in which other monetary and fiscal tools might be unavailable or ineffective, that MFFPs might be considered. On the principle that roofs should be patched before the rain comes, discussion of the governance of MFFPs seems well warranted.

So, how could the legislature and the central bank play their appropriate roles in managing a joint monetary-fiscal operation, without endangering central bank independence or falling down a slippery slope of unconstrained monetary finance of fiscal spending or tax cuts? A possible arrangement, set up in advance, might work as follows: Ask Congress to create, by statute, a special Treasury account at the Fed, and to give the Fed (specifically, the Federal Open Market Committee) the sole authority to “fill” the account, perhaps up to some prespecified limit. At almost all times, the account would be empty; the Fed would use its authority to add funds to the account only when the FOMC assessed that an MFFP of specified size was needed to achieve the Fed’s employment and inflation goals. [11]

Should the Fed act, under this proposal, the next step would be for the Congress and the Administration—through the usual, but possibly expedited, legislative process—to determine how to spend the funds (for example, on a tax rebate or on public works). Importantly, the Congress and Administration would have the option to leave the funds unspent. If the funds were not used within a specified time, the Fed would be empowered to withdraw them.

This arrangement would effectively leave to the Fed the responsibility of conducting the technical analysis of whether an MFFP is needed to achieve the Fed’s mandated goals, and of determining the corresponding amount of money to be created. Those conditions would help preserve the Fed’s policy independence and limit the ability of Congress to use monetary financing opportunistically. (Of course, the Congress could intervene in the Fed’s decision process in some way, but that is always a possibility.) For its part, under this arrangement the Congress and the Administration would retain their constitutional authority to determine whether public funds would be spent, and if so how, avoiding a principal drawback of “people’s QE.” Legislators might consider acting in these circumstances, even if ordinary fiscal actions seem unattractive, because (1) the spending or tax cuts would not have to be financed by increased debt and (2) legislators would have in hand the Fed’s assessment that a MFFP was justified by (rare) economic circumstances and the lack of viable alternative policies. If Congress chose not to act, that would of course be its right.

Conclusion

Money-financed fiscal programs (MFFPs), known colloquially as helicopter drops, are very unlikely to be needed in the United States in the foreseeable future. They also present a number of practical challenges of implementation, including integrating them into operational monetary frameworks and assuring appropriate governance and coordination between the legislature and the central bank. However, under certain extreme circumstances—sharply deficient aggregate demand, exhausted monetary policy, and unwillingness of the legislature to use debt-financed fiscal policies—such programs may be the best available alternative. It would be premature to rule them out.

[1] Ken Rogoff has discussed the costs and benefits of eliminating paper currency, at least bills of large denominations. I won’t discuss that or related options, like taxing currency, here.

[2] Under normal circumstances, expansionary fiscal action leads to higher interest rates, which tend to reduce private spending and investment. This “crowding out” effect diminishes the net impact of the policy on output and employment. However, if interest rates are “stuck” at or near zero, say because monetary policymakers are constrained by the lower bound on rates, then the crowding-out effect is avoided and fiscal action is more effective.

[3] In his development of the concepts underlying special relativity, Albert Einstein resorted to gedankenexperimenten—thought experiments—about hypothetical trains and elevators moving at high speeds in empty space. These examples helped Einstein build intuition, and their improbability did not detract from their usefulness in thinking about the actual physical world.

[4] Friedman’s example corresponded specifically to a money-financed tax cut. Like most contemporary proponents, I’ll include money-financed public spending under the heading of helicopter money.

[5] In other words, I am assuming here that the economy’s problem is a shortage of aggregate demand. An MFFP would not be helpful, and could well be counterproductive, if slow growth arises from other factors, like weak productivity performance.

[6] By “tax burdens” I mean actual tax payments to the government. It’s true that higher inflation acts as a de facto tax on money holdings, but that tax becomes relevant only if actual inflation rises, which would be a sign that the program is achieving its goal of stimulating spending.

[7] In a so-called Ricardian economy, in which households have perfect foresight and are able to borrow and lend freely, a temporary tax cut would be predicted to have zero effect on consumer spending. In this idealized economy, households recognize that the tax cut makes them no better off, since the extra funds received via the tax cut just equal the present value of the increase in their future tax obligations. Empirically, the offset of expected future taxes against current income appears to be much less than complete, that is, tax cuts affect household spending at least to some extent, even if debt-financed. In contrast, fiscal spending (as on public works) affects output and incomes even in a perfectly Ricardian economy.

[8] Specifically, the Fed now sets a target range for the federal funds rate, with the floor of the range corresponding to the so-called reverse repo rate paid to short-term investors with the Fed and the ceiling corresponding with the interest rate the Fed pays on bank reserves. Fed policymakers have indicated that they would like to return to the traditional method of managing the federal funds rate in the medium term.

[9] Presumably, in scoring an MFFP, the Congressional Budget Office would recognize that the $100 billion program involves no increase in debt or financing costs.

[10] This statement is not precisely true, in that one can imagine independent monetary and fiscal choices that, taken together, are equivalent to an MFFP. For example, ordinary fiscal policy actions together with a credible increase in the central bank’s inflation target could in principle provide similar stimulus to an MFFP. Part of the rationale for an MFFP, however, is that legislators may be reluctant to take independent fiscal action when the government debt is initially high; in that situation, explicit coordination between the fiscal and monetary authorities seems essential.

[11] The amount the FOMC allows in the Treasury account would also be the base for the bank levy described just above. So the two proposals of this post fit together nicely.

Comments are now closed for this post.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

What tools does the Fed have left? Part 3: Helicopter money

April 11, 2016