In a lengthy front page story the Washington Post recently warned readers that the Social Security program has gone “cash negative.” [“The debt fallout: How Social Security went ‘cash negative’ earlier than expected,” October 30, 2011] The program swung from a large cash surplus to a cash deficit. Instead of reducing the federal government’s budget imbalance, Social Security now adds $46 billion a year to an already large federal deficit.

As the Post noted in passing, the swing from cash surpluses to cash deficits was not exactly news. More than a quarter century ago the Social Security Actuary predicted that tax revenues flowing into Social Security would fall short of expected benefit payments in the middle of this decade. An unexpected and protracted slump has hurt jobs and wages, cutting payroll tax revenues below levels predicted as recently as four years ago. The slump also spurred some workers to file claims for early pensions, boosting annual outlays. The inevitable result: Social Security went from cash surpluses to cash deficits five years earlier than expected.

Nonspecialist readers and even budget mavens may have drawn a frightening, but incorrect, conclusion from the Post story. Even if the Social Security program is “cash negative,” it does not face an imminent funding problem. In fact, the total revenue flowing into the Trust Fund, including investment income on its reserves, is still comfortably larger than annual outlays on benefits and administration. The Trust Fund is currently growing, and it is expected to keep growing through 2022. In that year the combined Social Security Trust Funds will hold almost $3.7 trillion in reserves, enough to fund operations for about 2½ more years, even if tax payments and investment income should completely cease. (Of course, they won’t.)

“Cash negative” does not mean “insolvent” or “depleted of funds.” It means that one source of annual Social Security income – tax contributions – is lower than total program spending (benefit payments plus administrative costs). Social Security, like other pension funds, has another source of income, however. That income source is investment earnings, the money the Trust Fund earns on its reserves. When investment income is added to new contributions, the total revenues of Social Security are greater than its annual outlays, and this will continue to be true for more than a decade.

The “cash balance” of Social Security is simply the difference between annual tax contributions and annual outlays. It is relevant for thinking about the impact of Social Security on the unified federal budget – that is, the overall budget when Social Security is included. However, it is not directly relevant for thinking about the capacity of Social Security to make current or future benefit payments. The Social Security Administration can send out benefit payments as long as the Trust Fund has a large enough reserve to pay for monthly pensions. If the Trust Fund contains too little money to pay a month’s pensions, the Social Security Administration loses its authority to send out benefit checks. Last spring the Social Security Administration predicted the Trust Fund will be depleted of cash in 2036, or in about 25 years. Our parents and grandparents are not about to lose their Social Security checks.

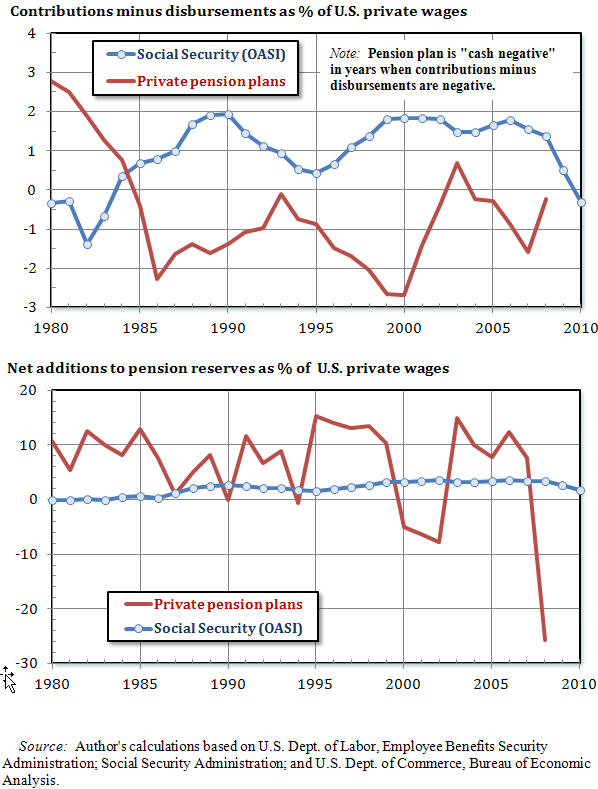

Readers of the Post story who worry about Social Security’s “cash negative” position may not realize that “cash negative” is the normal situation of the nation’s private pension system. According to statistics published by the Labor Department’s Employment Benefits Security Administration, the private pension system has been “cash negative” in 23 out of the last 24 years (see Chart 1). That is, in 23 recent years the annual disbursements of private pension plans were greater than the combined contributions the plans received from employers and employees. The shortfall of contributions compared to disbursements occurred every year between 1985 and 2008 except in 2003, when there was a small cash surplus. (The Labor Department’s statistics are based on tax reports, which take several years to process. The most recent information covers 2008.)

Between 1985 and 2008 contributions to the private pension system fell short of benefit payments and administrative costs by $0.85 trillion. In those same years, the largest Social Security Trust Fund, the one for Old-Age and Survivors Insurance (OASI), was never “cash negative.” It collected $1.13 trillion more in contributions than it spent on benefit payments and administration. If being “cash negative” is a symptom of impending collapse, it is the private pension system, not Social Security, which should be the topic of urgent national debate.

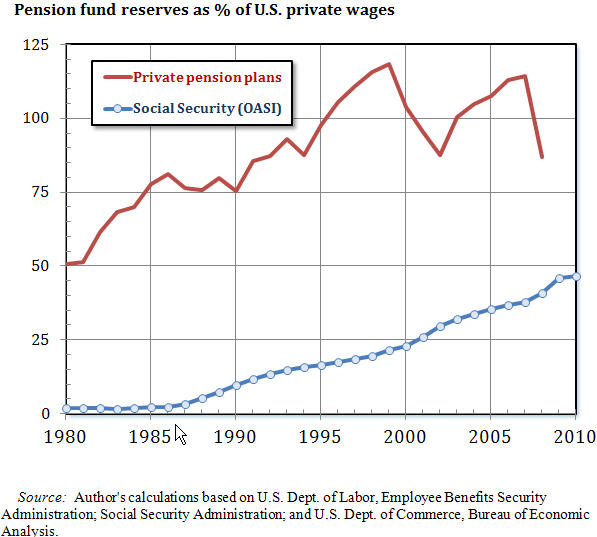

The private pension system is nowhere near collapse, though many old-fashioned, defined-benefit plans are clearly struggling. In fact, between 1985 and 2008 the private pension system added $3.66 trillion to its reserves, even though it was “cash negative” in all but one of those years (see Chart 2). How was this possible? Over that same span of years private pension plans earned a total of $4.5 trillion in investment income. Part of the investment income was used to finance benefit payments plus the cost of administering the plans, and the remainder was added to pension reserves.

The investment income of a private pension plan is regarded as a legitimate and uncontroversial way to pay for pension benefits. Curiously, however, the investment income of Social Security is widely believed to be a dubious, almost fictional source of funds. This is mainly because all the investment income of Social Security is earned on U.S. Treasury bonds, which is the only asset held in the Trust Funds. Interest on Treasury bonds is also a source of income for private pension plans, of course. In fact, Treasury securities are generally considered the safest assets in a pension fund’s portfolio. Why, then, are Treasury bonds thought to be such an unreliable source of revenue for Social Security?

The simple explanation is the treatment of Social Security interest earnings in the federal budget accounts. The interest earned on Social Security reserves is an income entry in the Social Security accounts, but it is a spending item in the U.S. Treasury accounts. The positive entry for Social Security is exactly offset by a negative entry in the Treasury accounts. When the two items are summed to calculate the unified federal budget balance (including both Social Security and the Treasury), the interest income essentially disappears. The only Social Security items that remain are the program’s tax collections and its benefit and administration outlays – in other words, the program’s “cash balance.”

The plain fact, however, is that the investment income of Social Security adds to the program’s spending power just as it does in the case of a private pension plan. If the Social Security Trust Funds earn $117 billion in interest income, as they did last year, the Social Security Administration has the authority to spend an additional $117 billion on benefit payments, either this year, next year, or in any future year when the Trust Funds still hold positive reserves.

Our Social Security pensions, and those of our parents and children, depend on the money in the Trust Fund when we retire, not on whether Social Security is “cash positive” or “cash negative” in a particular year. In the 47 years between 1937 and 1983, the OASI Trust Fund was “cash negative” in 21 years, or 45% of the time. The only years in which benefits were seriously threatened were 1980-1983, when the OASI Trust Fund was perilously low. Social Security was “cash negative” in those years, but if larger reserves had been accumulated before 1980 there would have been no worry about the ability of the program to make benefit payments.

Social Security certainly faces a funding problem. It is not, however, an immediate problem nor is it an issue Congress must deal with in the next 5 or 10 years. There is an important advantage to addressing the long-term problem sooner rather than later, however. The longer we wait to decide how to deal with the funding shortfall, the more dramatic the short-term adjustments needed to eliminate the shortfall. For example, if Congress takes no steps to adjust Social Security taxes, eligibility, or pension formulas between now and 2036, benefits will have to fall 23% in 2037. When the Trust Fund is depleted, benefit payments must be financed with current tax revenues, and those will be enough to cover only 77% of the benefits promised by today’s pension formula. Of course, voters and policymakers may eventually decide that the best solution to the funding problem is to trim pensions across the board by 23%. But in the very unlikely event this turns out to be true, it would be far better to give workers and pensioners several years and preferably several decades to prepare for such a big benefit cut.

We should deal with Social Security’s funding problem, and the sooner we do so the better for public confidence in the system. The desirability of reform does not excuse sloppy analysis, however. Contrary to a widespread view, the interest income on Social Security reserves provides a tangible source of funding for current and future benefits, exactly as is the case in a private pension plan. The “cash balance” of Social Security may be helpful for thinking about overall federal budget balance, but it does not offer a reliable gauge of the current or future sustainability of Social Security pensions. Social Security has been “cash negative” in many past years when benefits were secure and public confidence in them was high. When the reserves of the system are large, as they are today, benefits can be paid many years into the future, even if the program is “cash negative” during most of those years. If that seems hard to believe, remember the nation’s private pension plans. They have been “cash negative” for 23 of the past 24 years, and their reserves have continued to grow. I am still waiting to read the front-page story warning me private pensions are careening toward the abyss.

Chart 1. Pension Contributions, Pension Fund Disbursements, and Net Additions to Pension Fund Reserves, 1980-2010

Chart 2. Pension Fund Reserves at End of Year, 1980-2010

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Op-edSocial Security Went “Cash Negative” Last Year, but Private Pensions Went “Cash Negative” 25 Years Ago

November 17, 2011