I. Introduction

Over the last decade and a half, countries in Latin America (henceforth LA or the region) have, by-and-large, crafted societal consensuses in favor of macroeconomic stability, and have invested heavily in policies and institutions necessary for that stability. Seen from the lens of previous decades, this is a major achievement.

Over roughly the same period, these countries also developed new programs to combat poverty. Beginning in 1995, a simple idea began to take hold in Mexico and later in Brazil: that rather than transferring income to the poor through price subsidies, food stamps, or direct distribution of foodstuffs (milk, tortillas, bread, etc.), it is better to transfer income directly in monetary form. However, to ensure that such transfers are not permanently needed, they should be conditioned directly on those households’ investments in their human capital, in particular, their health, nutrition, and children’s education. The bet is that healthier and more educated youngsters will enter the labor market under better conditions than their elders did, allowing them to earn more income through their own efforts, breaking the intergenerational transmission of poverty. In short, rather than the older thought, “transfers of income today and transfer of income tomorrow,” the new paradigm emphasizes “transfers of income today to facilitate greater owned earn income tomorrow.”

Greater macroeconomic stability and these new poverty programs, more commonly known as Conditional Cash Transfer programs (CCTs), have contributed to the region’s reduction in the proportion of households living in extreme poverty and lowering of income inequality. Other forces have also contributed, like the expansion in coverage of primary education, potable water, and electricity. But it is the combination of faster growth and lower inflation associated with macroeconomic stability, on one hand, and more effective transfers of income to the poor through CCTs, on the other, that has meant that for the majority of the poor in LA the present is better than the past and, equally important, the promise that the future can be better than the present is more credible than in the past.

I argue here that CCTs, despite their notable contributions to the reduction of poverty in the region, are insufficient in bringing about further and lasting gains in social welfare, and that some trends in social policy are worrisome and may actually be acting against the long term interests of the poor. There is a deep flaw in the overall architecture of the region’s social policy, understanding by social policy a broader set of programs than those transferring income to the poor through CCTs. This flaw is a major obstacle to reducing inequality further and to construct a more effective social safety net that goes beyond the elementary goals of providing poor households with minimum levels of consumption and facilitating their investments in nutrition and education. In fact, under the current architecture the region’s governments are caught in a dilemma between increased productivity and faster growth, on one hand, and increased social spending, on the other. In the context of more democratic contests for political power, governments will lean in the direction of higher social spending at the cost of faster growth and, eventually, long-term fiscal sustainability. My main point is that if this flaw is corrected—no minor matter—countries in the region can make a qualitative jump in the direction of reduced inequality, greater social inclusion, and faster growth.

II. Dimensions of Social Policy

Two dimensions of social policy need to be separated. The first dimension concerns a policy’s objectives. For our purposes here I distinguish between programs that provide social insurance and programs that redistribute income. Social insurance helps households manage events like losing one’s job (unemployment insurance), getting sick (health insurance), suffering an accident (disability insurance), or facing old-age poverty (retirement pensions). Social insurance programs target all households, regardless of their income level, and their objective is to protect those households against risks. In most OECD member countries, these programs have broad coverage, are a core component of social policy, and absorb a significant percentage of public spending. Programs to redistribute income, on the other hand, focus on a subset of households, usually the poor, and their objective is to increase those households’ consumption. In OECD countries these programs take various forms (food stamps, negative income taxes), but their coverage is narrower than social insurance programs, and their costs are substantially less onerous to the public purse.

The second dimension is access. Since the origins of social insurance in LA in the middle of the past century, access has been limited to workers with a salaried job (an inheritance, as it happens, from Bismarck’s first social insurance programs in Germany at the end of the 19th century!). The reason is that these programs are paid by firms with contributions based on workers’ wages. But many workers do not have a salaried job because they work on their own; others are employed by firms that evade these contributions. As a result, many workers (referred to as informal workers in the region’s lingo) are left without access. Anchoring social insurance on salaried labor has resulted in Latin America’s “truncated welfare State”: Formal workers are covered; informal ones are not. This is a key flaw: Clearly, informal workers can also get sick, lose their job, suffer an accident, or face old-age poverty.

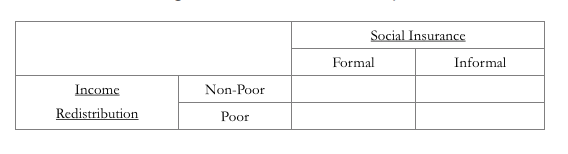

Figure 1 depicts the two dimensions of social policy. Objectives are separated into social insurance (columns) and income redistribution (rows). In turn, access to social insurance programs is depicted separating workers by labor status, formal and informal; and access to income redistribution programs dividing workers by income level, poor and non-poor. Note that formal and informal is not equivalent to non-poor and poor. A large informal sector is a distinguishing feature of LA economies vis-à-vis those belonging to the OECD. Its social implications have already been noted, but there is also a key economic implication: On average, workers are more productive when they are formally employed than when they are informally employed.

Figure 1: Dimensions of Social Policy

III. Conditional Cash Transfers

Perhaps the most important innovation in social policy in the region over the last 15 years concerns the bottom row of Figure 1. The myriad of programs to transfer income to poor households through programs like price subsidies for food, electricity, fuel and transportation, or through direct distribution of bread, tortillas, milk and the like, has been gradually replaced by programs that give monetary transfers while imposing conditions associated with attendance to school and health clinics. These new programs are LA’s flagship CCTs. Evaluations of Mexico’s Progresa-Oportunidades, of Brazil’s Bolsa Familia, of Colombia’s Familias en Acción, and of similar undertakings in Honduras, Nicaragua, the Dominican Republic, and Ecuador, among others, show that these programs have been more effective in reaching the poor than previous ones, and have had a positive effect on critical indicators like school attendance, grade progression, nutrition, and health. They have also helped, indirectly, reduce inequalities in the distribution of income.

Three things need to be noted about CCTs. First, all poor households benefit from them, regardless of whether their workers hold formal or informal jobs. Second, the size of the income transfer is not meant to, by itself, raise households from poverty. The transfer complements the income that they earn with their own efforts, and aims to provide some minimum consumption and compensate parents for the lost income of having their children in school rather than helping on the family farm or begging in the streets. Larger transfers can undermine households’ incentives to work creating a “poverty trap.” Third, these programs do not create jobs, although by giving youngsters more education they should help them find jobs with higher productivity when they enter the labor market. The program’s exit door is a more productive job. Put differently, CCTs are not meant to be permanent welfare, but temporary investments in the human capital of the poor.

IV. Social Insurance

Most workers in Latin America are informally employed and therefore are excluded from social insurance. This exclusion creates a major problem because governments should not leave those workers unprotected against risks. As a result, and in addition to the CCT programs described above, governments in the region have been creating new programs to provide social insurance to informal workers. These programs have been less noted and are usually confused with CCTs, as they are all are lumped together under the label of social safety nets (and, because they increase social spending, applauded by all, comme il faut). However, social insurance programs for informal workers and CCTs are quite distinct: Their objectives are different (protection against risks vs. redistribution), their time horizon is different (permanent vs. temporary); their target population is different (informal vs. poor) and, as noted below, so are their economic implications.

Social insurance programs for informal workers have been increasing in the region. In the early 2000s a program to provide free health insurance to informal workers was created in Mexico (although similar efforts started decades before). In Colombia there is a legal mandate to provide informal workers with the same health benefits as formal ones (paid partly with taxes on formal workers). Programs to provide income to retired workers without a pension have been created in Uruguay, Panama, Brazil, and Mexico. Argentina recently extended family allowances previously reserved for formal workers to informal ones.

More programs like these will emerge, or existing ones will be strengthened, for three reasons. First, increased life expectancy, aging populations, and previous histories of informality imply that many workers are reaching retirement age with no pension. Second, the transition from preventable to chronic-degenerative diseases generates more expensive health challenges. The third, a bit different in nature but equally relevant, is that in the region’s more democratic environments, governments rightly feel the need to overcome the limitations of their “truncated welfare State” and extend social insurance to informal workers (and why not enjoy the political advantages of doing so). So, willy-nilly, in a somewhat disorderly way, and to various degrees across countries, a system of social insurance for informal workers parallel to the existing one for formal workers is being created; a different phenomenon than CCTs which, it is useful to reiterate, are transitory programs that enhance the human capital of the poor.

Having two parallel systems of social insurance, one for formal workers and one for informal ones, is not a good idea. As noted, programs for formal workers are paid with wage-based contributions. But for a variety of reasons workers and firms believe that these programs’ costs exceed their benefits and therefore perceive them partly as a tax. The same happens with employment protection rules (regulations that make it very difficult or costly to fire workers), an important component of social insurance in a region where unemployment insurance is the exception rather than the rule: These regulations create barriers to formal jobs that are also equivalent to a tax on formality. On the other hand, even if informal workers do not fully value the benefits of the social insurance programs at their disposal, from their point of view they are free, as they are paid from general government revenues and not by any direct contribution from them. Moreover, in some cases informal workers can lose access to these free benefits if they get a formal job. Thus, this set-up results in a tax on formal employment and a subsidy to informal employment, a combination that goes a long way in explaining the very large informal sectors observed in LA.

The critical questions are how workers and firms react to these taxes and subsidies. Consider the message to a firm: If it hires a salaried worker legally it must pay for his health insurance, but if it does so illegally, the worker will get it free (or highly subsidized). If the firm is small and unlikely to be detected by the authorities—the situation of the vast majority of firms in LA—the temptation to evade is large indeed. Or consider the message to the worker: If she is formally employed she is obliged to save for her pension, but if she is informally employed, she will receive a free pension from the government. In the end, the most important social institution in these countries, the labor market, is strongly distorted.

None of this is good for productivity. Informal firms tend to be small under-exploiting economies of scale, and engage little in labor training, technology adoption, or innovation. Informal workers peddle wares in the streets instead of learning new skills in firms. The large presence of informal firms in the region is also not good for fiscal sustainability: A small formal sector narrows the tax base while social insurance programs for informal workers increase spending and erode the tax base. And it is clearly not good for the rule of law.

The economic shortcomings of social insurance start with its original design. It is limited only to formal workers, funded through a tax on salaried labor that creates costly distortions, and characterized by counterproductive employment regulations. But these shortcomings are compounded by adding a parallel system of social insurance for informal workers. The social raison d’être for this addition is unquestionable: Doing nothing to protect large segments of the labor force from various risks is unacceptable. But that social fact should not ignore the economic fact that these programs are aggravating, not mitigating, the long-standing problems in the labor market that social insurance programs and employment regulations for formal workers have already created.

V. The Formal-Informal Dichotomy

Let’s return to Figure 1. The labor force in LA is divided between the four quadrants. As a general proposition, the upper left and lower right quadrants are more populated than the other two. This situation is exactly the opposite of what one would expect, particularly in a region where more than two-thirds of the total population is urban. Poor workers have low education and few financial resources; the expectation is that they would be salaried, and therefore formal. However, if formal jobs are taxed and informal ones subsidized, this is not the case. Moreover, if as it also happens in the region, many social insurance programs for informal workers are targeted on poor workers, the trend is even stronger. The point here is that the distribution of the labor force among the four quadrants of Figure 1 is not independent of the incentives to firms and workers implicit in the formal-informal combination of social insurance programs. Indeed, this combination may be contributing to trap poor workers in low-productivity informal jobs.

More generally, the formal-informal dichotomy is a major stumbling block in breaking the intergenerational transmission of poverty. As a result of the region’s CCTs, in the years ahead poor youngsters will enter the labor market with more human capital than earlier entrants. However, as things stand, it is unlikely that they will find more productive jobs. Put differently, the exit doors from CCTs are being obstructed by the flaws in the region’s social insurance architecture.

Critically, note that the problem is in the columns of Figure 1, not in the rows. Thus, the problem cannot be solved by creating new CCTs; or increasing transfers in the existing ones. Moreover, attempts to reconvert or extend existing CCTs to also provide social insurance for the poor may deepen the problem. A targeted program to invest in the human capital of the poor cannot simultaneously provide them with social insurance conditioned upon their holding informal jobs, and at the same time expect the poor to transit out of poverty by finding higher-productivity formal jobs. And if the poor’s earnings lag behind those of the rest of the population as a result of their lagging productivity, inequality will increase and, with it, the temptation to reduce it by increasing transfers to the poor—focusing on the rows again, not on the columns.

LA has reasons to feel proud of the CCTs that it pioneered almost two decades ago. With some variations, they are being replicated in other regions of the world, including the United States. In some countries, like Colombia, Mexico, and Brazil, these programs provide benefits to around a quarter of the total population, exceeding sometimes the population estimated to be in poverty; they need to grow no longer. In others, like Peru, Guatemala, and Paraguay, there is a need to expand their coverage. In all, there is room to improve their operations by focusing more, in particular, on early child development. These programs have already made a large contribution to poverty alleviation. To continue to do so effectively, they need to focus sharply on their objectives to invest in the human capital of the poor, and resist the temptation to use them to respond to any circumstance, be the only instrument to reduce poverty through ever increasing transfers, or transform them into hybrids with many goals, in the end reaching none, like the eagle that pursues two rabbits at the same time.

After reaching full coverage of those in need, the greatest triumph of LA’s CCTs would be to gradually shrink and over the long run become unneeded, as extreme poverty is progressively eradicated from a region benefiting from macroeconomic stability and a healthier and more educated labor force. To reach that point, the region needs to eliminate the tax on formality and the subsidy to informality and provide all workers with the same social insurance programs. Poor workers need, most of all, a more productive job; but they also need to benefit from unemployment, health, life, and disability insurance, retirement pensions, and related protection mechanisms enjoyed by other workers, not much different from what currently occurs in OECD countries. Reaching this goal is essential for genuine social inclusion. Therefore, after ensuring that CCTs reach all of their target population and operate effectively, the weight of the additional efforts to help the poor need to focus in raising their productivity; this requires facilitating their getting a higher productivity formal job. It is time for LA to move on and tackle new social challenges beyond those that can be solved through CCTs.

VI. Political Opportunity and Challenges for Reforming Social Policy

Looking forward, a large challenge for reforming social policy in LA is focusing on the root causes of the formal-informal dichotomy. Tackling this challenge requires revising regulations in the region’s labor markets, and the methods of financing its social insurance programs—put more bluntly, tax and labor market reform. These issues, long unaddressed, are as difficult as they are urgent. In fact, one can see the gradual emergence of social insurance programs for informal workers as a way of by-passing reforming the design flaws in tax, labor and social insurance programs for foramal workers that are behind the formal-informal dichotomy; a by-passing facilitated perhaps in some cases by a favorable international environment characterized by high commodity prices and associated revenue windfalls. This is understandable, but maintaining this dichotomy is unlikely to be a fiscally sustainable solution over the long run; and even if it were, it is a costly solution from the point of view of productivity and growth. It is also questionable whether this solution strengthens social inclusion as workers are permanently segmented into formal and informal categories, on one hand; and whether a social contract based on asymmetries in rights and obligations across labor categories is politically desirable, on the other.The technical difficulties in an integrated reform of tax, labor and social insurance regulations are large, and reasonable people can have different views as to how best to address them. However, at this point how governments design and implement this integrated reform is not immediately crucial. What is crucial is to recognize that, given where we are today, further lasting advances in social policy in the region can hardly be obtained by continuing along the route of ever higher transfers for the poor that distort the original intent of CCTs, on one hand; and more taxes to formality and subsidies to informality, on the other.

Tax, labor, and social insurance reforms will only occur if there is a societal consensus for them, much the same as what happened with macroeconomic stability. However, in constructing this consensus there is a political opportunity, when noting that these reforms rather than being ends in themselves acquire meaning as building blocks for an ambitious social reform. In particular, a social reform that resolves the design flaws at the root of the region’s truncated welfare State, extends the same social insurance to all and in particular the poor, and amplifies opportunities for productive jobs. This social reform will provide a sound basis to effect a clearly desirable increase in social spending without augmenting costly economic distortions; and it will enhance the foundations of a lasting prosperity based on higher productivity. A reform of this nature will need technical expertise and ideological agility but, most of all, bold political leadership. The region faces a great opportunity.

Commentary

Op-edIs social policy in Latin America heading in the right direction? Beyond conditional cash transfer programs

May 21, 2015