Mobile money—the ability to store and transfer money using cell phones—is one of the most talked-about technologies in global development. Proponents believe it could redefine what it means to be poor by giving poor people access to basic financial services.

Read the related report from the Brookings Blum Roundtable »

In Kenya, where two-thirds of the population live on less than $2 a day, mobile money is now ubiquitous and has enjoyed outstanding adoption rates among low-income customers. Early evidence indicates it is already changing lives. For Safaricom, the leading provider of the service in Kenya, mobile money—or M-Pesa, as its product is called—has contributed directly to the company’s bottom line, while strengthening its market share.

Mobile phone operators are now tripping over each other to roll out similar services in other developing countries, from Afghanistan to Zambia. Intuitively, we would expect these to match, if not better, M-Pesa’s record of success by learning from M-Pesa’s experiences. So far that hasn’t happened. While a number of offerings in different countries are now taking root, none have so far matched the speed and scale of M-Pesa in Kenya. Others have failed miserably.

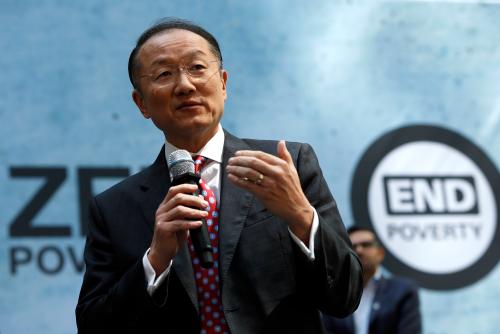

The video above chronicles M-Pesa’s pioneering story in Kenya and delves into the question of why its success has not been easily replicated elsewhere. We discussed this and other technological innovations for development last year at the Brookings Blum Roundtable—a high-level conference held each summer to discuss solutions to global poverty. To read more about the challenges of replicating M-Pesa, and the propagation of other innovations in the developing world, please read the 2012 conference report.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Mobile Money: A Technology Game Changer for Tackling Global Poverty?

March 12, 2013