Income is the star of the inequality show, getting most of the headlines and attention. But wealth gaps are much greater than income gaps and may matter a great deal in terms of intergenerational mobility.

Wealth and Social Mobility

Most obviously, financial wealth is passed on and inherited. It is a direct means by which patterns of financial inequality in one generation can be replicated in the next. Wealth can also cushion a family against a negative shock such as a loss of income – and so reduce the impact on children’s education and stability. Wealth can also be used at strategic moments in the lifecycle. An injection of even small amounts of parental capital can help in terms of the cost of college or with housing.

It is hard to assess just how much these processes matter for mobility, in part because data on the timing of transfers is hard to come by. (The scholars to watch on this front are Joe Hotz and Judy Seltzer, who are crunching data from the PSID.) But wealth inequality rates in the United States are high enough that it is hard to imagine there are no knock-on effects for mobility:

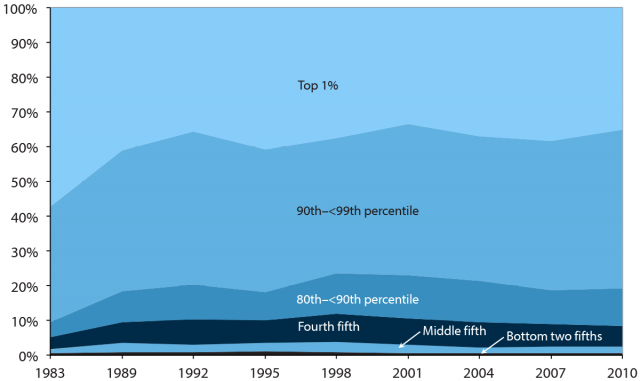

Wealth groups’ shares of total household stock wealth, 1983–2010

(Wolff, 2012)

Wealth gaps in the United States were exacerbated by the recession, in part because of the lopsided impact on property values. There is also a clear and present danger that wealth gaps are set to worsen: Thomas Piketty only has to be slightly right for us to be worried on this score.

Policies to Curb Wealth Gaps

The Urban Institute has just published a useful overview of wealth inequalities. The Urban authors set out three specific policy approaches for tackling the wealth gap:

- Universal Children’s Savings Accounts, with financial incentives for low-income families to build up funds

- A mortgage interest credit offering more help to homeowners on lower incomes

- Auto-enrollment in pension plans: a classic ‘nudge’ to retirement savings (already happening in many States – and also, by the way, in the UK)

Sensible stuff. But it is important to distinguish between policies aimed at simply reducing the wealth gap and policies seeking to reduce the impact of the wealth gap on intergenerational mobility. Auto-enrollment may help reduce inequality in the size of retirement accounts but it will not promote upward mobility between generations.

Asset-Based Mobility Policy: Narrowing the Focus

From a social mobility perspective, ideas like the one for incentivized savings accounts for children are the most attractive. Similar ideas are gaining a little traction in congress: Senator Ron Wyden, Chair of the Finance Committee, is pushing in this direction.

Most “asset-based welfare policies” limit the use of accumulated capital to funding education, buying a house, or investing in a pension. Perhaps they ought to be even more narrowly focused, as “asset based mobility policies,” with funds only able to be used for mobility-enhancing investments, such as in education or training, or to help start up a business.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Wealth Gaps: Time for Asset-Based Mobility Policies?

July 29, 2014