Editor’s Note: This blog is part of the larger

Foresight Africa 2015

project that aims to help policymakers and Africa watchers stay ahead of the trends and developments impacting the continent. You can read the full report

here

.

Infrastructure investment, a key focus for sub-Saharan Africa (SSA) in 2015, has been rising rapidly since 2006. Access to energy, transport, water and sanitation and telecommunications is essential to economic growth and poverty alleviation. In 2010, the World Bank attributed more than half of the recent improved growth performance in the region to infrastructure.

This trend of investments is great news, but the emphasis should now shift to ensuring that this funding is strategically and effectively applied across the continent. As the world considers new and better ways of financing for development, infrastructure investments should be a vital part of that discussion. Based on an analysis conducted for a forthcoming Brookings paper

[1]

, the following are six priorities for the region in 2015 as the region moves to fill the gap in access to infrastructure:

-

- Adapting Regional and Global Coordination Mechanisms. While external financing to African infrastructure has more than tripled since 2006, what is striking is the changing composition of the sources of that financing.

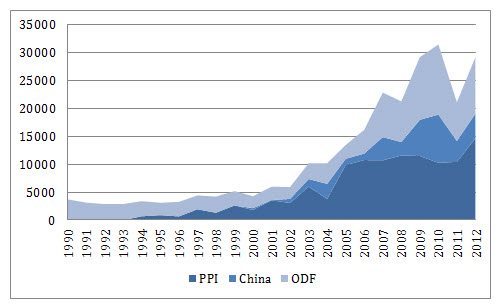

Figure 1: External Infrastructure Investment in SSA: By Sources, All Sectors, 1990-2012, in $ Millions (Current)

Source: Gutman, Sy, and Chattopadhyay.

As seen in Figure 1, today, traditional sources comprising of OECD developed countries and the multilaterals, the World Bank and African Development Bank (AfDB)—altogether classified as “official development finance” (ODF)—represent a still-significant but shrinking share of this funding. Meanwhile, private capital (PPI) and non-traditional bilateral sources, such as China, have grown in importance.

While there is coordination among the traditional members of ODF, this collaboration has tended to exclude the growing non-traditional sources. In light of the changing environment, then, the concern is whether traditional multilateral institutions can still provide the effective coordination and collaboration necessary in infrastructure development, Can the objectives of collaboration among traditional donors set forth in the Paris Declaration in 2005 be effectively applied across a broader range of financing sources? With the BRICS Development Bank and a China Infrastructure Bank on the horizon, plus other bilateral, regional and global agencies and initiatives emerging, there is little need to create additional or new institutions but rather to adapt the existing ones to be more inclusive and collaborative with these non-traditional sources.

-

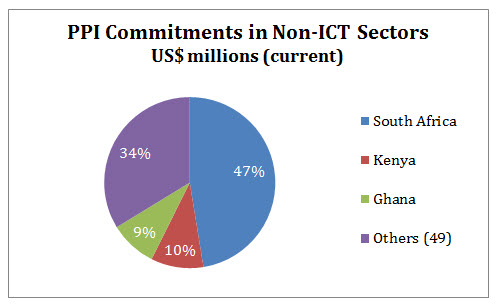

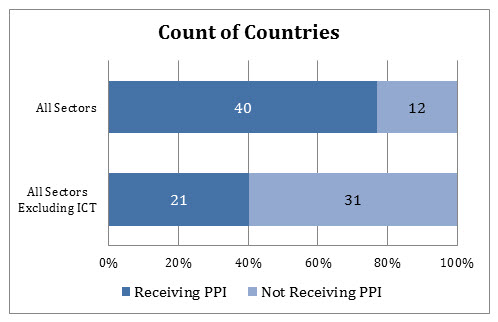

- Targeting and Extending Private Provision of Infrastructure. Substantial efforts by OECD countries and the multilaterals have been made to mobilize private capital and to develop instruments and guarantees that leverage private funding. Despite the rhetoric, however, PPI has been highly concentrated in information and communications technology (ICT) investments. As Figure 2 highlights, in fact, the number of sub-Saharan African countries receiving PPI drops from 40 to 21 when ICT commitments are excluded. The positive news is that PPI for other sectors, especially energy, has recently grown, but it has been greatly concentrated in a few countries. Agencies offering guarantees and other risk mitigation measures should ensure that these initiatives are targeted to help broaden access to private finance across sectors and countries that have not benefitted from such financing in the past.

Figure 2: PPI Commitment Concentration in SSA: 2009-2012

Source: Gutman, Sy, and Chattopadhyay using World Bank PPIAF database.

- Addressing Urban Infrastructure. Urban infrastructure needs and related sub-national fiscal policies are clearly neglected by policymakers and development practitioners in the region. While Africa may still be a predominantly rural continent, it will continue to urbanize rapidly. Lagos and Kinshasa already have more than 12 million residents and are among the 35 most populous cities in the world. The U.N. estimates half of African population will be urban by 2035. Despite these trends, efforts directed at urban infrastructure, even by the multilaterals, as compared to the attention to regional cross-border infrastructure, are sporadic. They also involve little discussion on the decentralization of service provision and devolution of local revenue-raising. For example, indicators of transport access being monitored by the AfDB’s Infrastructure Consortium for Africa (ICA) rely on total length of paved roads per capita—which have no relevance for the serious transport issues faced by African cities. Moreover, as countries look to mobilize more domestic funding for infrastructure, the opportunities of local taxation and related service charges have not been touched. A major initiative directed at sub-national fiscal policy and urban infrastructure planning and development is needed now before urbanization overtakes countries’ ability to manage growth.

- Refocusing Attention on Project Implementation. As policymakers and finance sources have focused their attention to getting upstream funding for project preparation, pressing for reaching financial closure, and the bidding and awarding of contracts, there has been very little attention paid to actual project implementation and contract management. Poor project implementation poses one of the greatest risks to infrastructure investment outcomes. Examples abound where inattention to what happens during infrastructure construction has resulted in poor results at high cost. Whether it is due to the risks of corruption or uncertainties during construction, contract management has been the “orphan” of the procurement cycle—including for those projects financed by the multilateral institutions. Africa needs to ensure that the money being raised is spent well and that it takes measures to address this now.

- Looking Beyond Transactions. The 2010 World Bank’s comprehensive assessment of African infrastructure, Africa’s Infrastructure: A Time for Transformation, offered 10 recommendations of which only one dealt with financing needs. The other nine rightly emphasized a range of government and sectoral policy and operational efficiency measures. Of the projected $93 billion required annually to address sub-Saharan Africa’s infrastructure gap, the report estimated that $17 billion could be saved through efficiency gains from measures such as better maintenance, pricing reforms, better expenditure management and appropriate regulatory policy. Although there are reform efforts being undertaken across each of the infrastructure sectors, the bulk of the reporting and monitoring has been directed at project financing, at the specific transactions. Clearly the quality of the overall outcomes of the infrastructure efforts and their economic, social and environmental sustainability depends on paying attention to these other recommendations. To bring greater attention to these issues, ICA should monitor indices of sectoral efficiency and reform in addition to tracking finance mobilization.

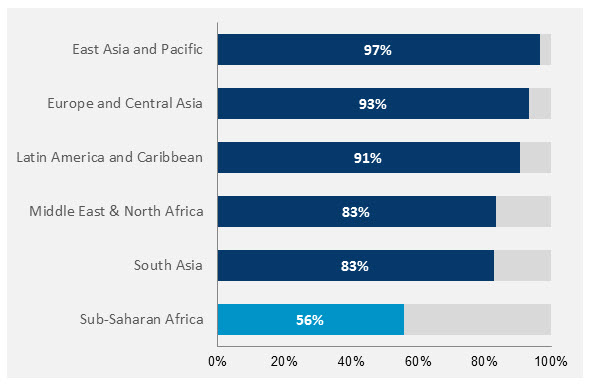

- Developing Local Industry for Infrastructure. Infrastructure is a key sector for developing local skills and businesses. Civil engineering and the construction industry are among the basic features of local commercial enterprises that are established with the growth of infrastructure financing. For example, in road building, local firms begin by winning small contracts or local sub-contracts within larger international contracts. Subsequently, many of these firms progress to win larger internationally bid contracts in their own country, some internationally within their region, and some ultimately in other regions. This pattern is evident in World Bank procurement statistics for civil works. In regions such as Latin America, East Asia, and Europe and Central Asia, over 90 percent of internationally bid World Bank contracts in each region are won by local or regional firms. Africa is a major exception, winning less than 60 percent. As funding grows, it is important to understand what is holding back local firms and to address these issues.

Figure 3: Construction Industry in Africa Lags Behind

Proportion of Internationally Bid World Bank Civil Works Contracts Won by Local and Regional Firms (FY 2013)

Source: Gutman and Zhang.

[2]

Clearly this emphasis on strategic and effective use of infrastructure investments is an agenda that goes well beyond 2015. But this is the time and opportunity to ensure that increased funding will actually result in greater access to energy, transport, water and sanitation, and telecommunications across Africa.

[1] Gutman, Jeffrey, Amadou Sy and Soumya Chattopadhyay. “Financing African Infrastructure: Can the World Deliver?” (Forthcoming) Washington, DC: Brookings.

[2]

Gutman, Jeffrey and Christine Zhang. “The Emergence of Markets: Procurement and the World Economy.” (Forthcoming) Washington, DC: Brookings.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Foresight Africa 2015: Infrastructure Requires More Than Raising Money

January 22, 2015