Studies in this week’s Hutchins Roundup find that having more high-achieving male classmates hurts girls’ educational outcomes, washing machine tariffs raised consumer costs by $1.5 billion in 2018, and more.

Want to receive the Hutchins Roundup as an email? Sign up here to get it in your inbox every Thursday.

Having more high-achieving male classmates hurts girls’ educational outcomes

Angela Cools and Eleonora Patacchini of Cornell University and Raquel Fernández of New York University find that exposure during high school to “high achievers” affects girls’ educational outcomes, but not boys’. Using parent education as a proxy for being a high-achiever, they find that girls exposed to more high-achieving boys have lower math and science grades in high school, are less likely to complete 4-year college degrees, and have lower labor force participation and higher fertility as adults. The authors suggest that greater exposure to high-achieving boys is associated with lower self-confidence and more risky behavior in girls. On the other hand, greater exposure to high-achieving girls increases bachelor’s degree attainment for girls with lower test scores, without a college-educated parent, or attending higher performing schools. In contrast, boys are unaffected by high-achievers of either gender.

Washing machine tariffs raised consumer costs by $1.5 billion in 2018

Aaron Flaaen of the Federal Reserve Board and Ali Hortaçsu and Felix Tintelnot of the University of Chicago estimate the effect of U.S. tariffs by comparing changes in the prices of washing machines to changes in the prices of other appliances. They find that the 2018 tariffs—which were imposed on almost on all foreign producers –led to a nearly 12% increase in washer prices; the price of dryers—a complementary good not subject to tariffs— increased by an equivalent amount. Overall, the tariffs increased consumer costs by about $1.5 billion in 2018, whereas the total tariff revenue collected was only $82 million. In contrast, they find that country-specific tariffs, like the 2012 tariffs against Korea and the 2016 tariffs against China, led to a relocation of production to other countries, resulting in minimal price changes or even decreased prices.

US corporate loan supply falls when dollar appreciates

Institutional investors, who are more sensitive to global developments than traditional banks, have become the main suppliers of funding for U.S. corporate loans. Friederike Niepmann and Tim Schmidt-Eisenlohr of the Federal Reserve Board find that this shift has resulted in a new channel through which the value of the U.S. dollar affects the U.S. economy: When the dollar appreciates, institutional investors reduce demand for loans on the secondary market, leading U.S. banks to lend less to corporations. Using loan-level data and survey data on lending practices, the authors document that an increase in the broad dollar index of 2.5 points reduces U.S. banks’ corporate loan originations by 10%, with stronger effects for riskier loans. The authors conclude that more work is needed to fully understand the behavior of institutional investors, since these entities are largely unregulated and play such a large role in the supply of credit to U.S. firms.

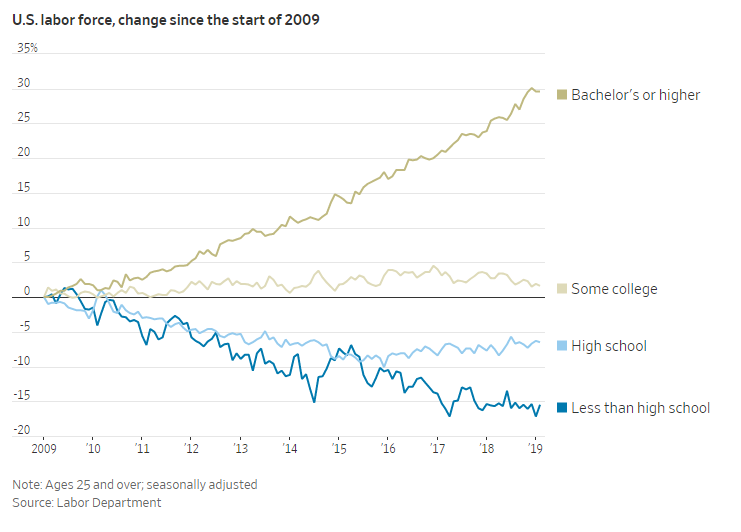

Chart of the week: The US labor force has added more people with four-year college degrees

Quote of the week:

“In the area of banking supervision, this year the ECB has formally identified climate-related risk as one of the key risks facing the banking sector…while many banks are already aware of the risks posed by climate change, much more needs to be done in this field. Banks seem to have approached this topic from a corporate social responsibility perspective rather than from a risk management perspective…I am in favor of establishing, at least at the European level – and preferably even at the global level – a common set of supervisory expectations about how banks should deal with climate change and environmental risks,” says Sabine Lautenschläger, member of the Executive Board of the European Central Bank.

“[B]anks need to make progress in methods and practices for assessing climate change-related risks. Yes, it is about governance in banks – whether these types of risk are fully embedded in the risk management framework. But it is about risk assessment techniques, too. We should foster a stronger risk management perspective and techniques with regard to climate-related risks; it is about having an adequate mapping and classification of “at-risk” assets and including them in banks’ forward-looking risk strategies with a longer time horizon than banks commonly use for assessing “traditional” risks.”

Commentary

Hutchins Roundup: High-achieving classmates, washing machine tariffs, and more

April 25, 2019