Policy incentivizing part-time work kept males in the workforce longer

Peter Berg of Michigan State University, Mary K. Hamman of the University of Wisconsin La Crosse, Matthew Piszczek of the University of Wisconsin Oshkosh, and Christopher J. Ruhm of the University of Virginia find that the 1996 German Altersteilzeit policy, designed to encourage longer worklives by incentivizing part-time work, was initially successful in extending the worklives of males, but had little or no impact on women. The authors note that as the definition of part-time work became more expansive, the policy’s impact was mitigated.

Higher Social Security benefits increased cognitive function among beneficiaries

Using data from the Study of Assets and Health Dynamics and an exogenous change in Social Security benefits during the 1970s, Padmaja Ayyagari and David Frisvold of the University of Iowa find that higher Social Security benefit payments led to significantly higher cognitive function among beneficiaries. Specifically, the authors find that a $1,000 permanent increase in annual benefits was associated with a 1.4 percent improvement in overall cognition.

Capital controls in EMEs have not been effective in avoiding the monetary policy trilemma

Using data on 17 emerging market economies (EMEs) from 2001 to 2011, Gurnain Pasricha of the Bank of Canada, Matteo Falagiarda and Martin Bijsterbosch of the European Central Bank, and Joshua Aizenman of the University of Southern California find that the use of capital controls in EMEs have had little impact on net capital inflows, monetary policy autonomy, and exchange rates in those countries. The authors note, however, that the spillover effects of these policies to other EMEs are larger than previously thought, particularly in Latin American countries.

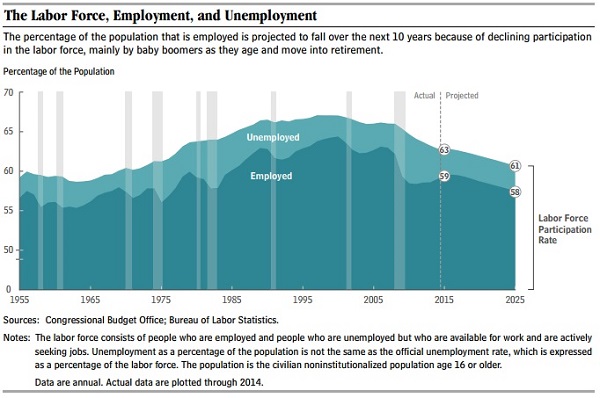

Chart of the week: CBO projects 2 percentage point drop in labor force participation rate over next ten years

Quote of the week: Higher-than-expected public debt can reduce likelihood of financial instability due to lower natural interest rate

…Over [the past decade], there has been a notable decline in the long-run neutral real interest rate…The decline in the long-run neutral real interest rate increases the likelihood of financial instability and the likelihood that the economy will run into the lower bound on nominal interest rates. Fiscal policymakers can mitigate these risks by choosing to maintain higher levels of public debt than markets currently anticipate.

— Narayana Kocherlakota, President of the Federal Reserve Bank of Minneapolis

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: Partial retirement, Social Security benefits, and more

August 27, 2015