There is surprisingly little direct investment between the United States and China—surprising given that these are the two largest economies in the world and the two largest worldwide recipients of foreign direct investment (FDI). Globally, about 20 percent of the stock of FDI is in the United States, and about 10 percent in China. The numbers are much smaller, however, when we look at direct investment between the two. U.S. statistics show about $50 billion of investment in China, or a little more than 1 percent of U.S. overseas investment. The world puts 10 percent of its direct investment in China, but the United States, only one-tenth that amount. In the other direction, analyzing China’s outward investment is complicated by the fact that more than half the reported outflow goes to Hong Kong, from which much of it probably flows on to other locations. Putting aside that flow through Hong Kong, about 8 percent of the stock of Chinese investment abroad is in the United States—again, a small share compared to global investors. In a new working paper, I analyze why there is so little direct investment between these two biggest economies.

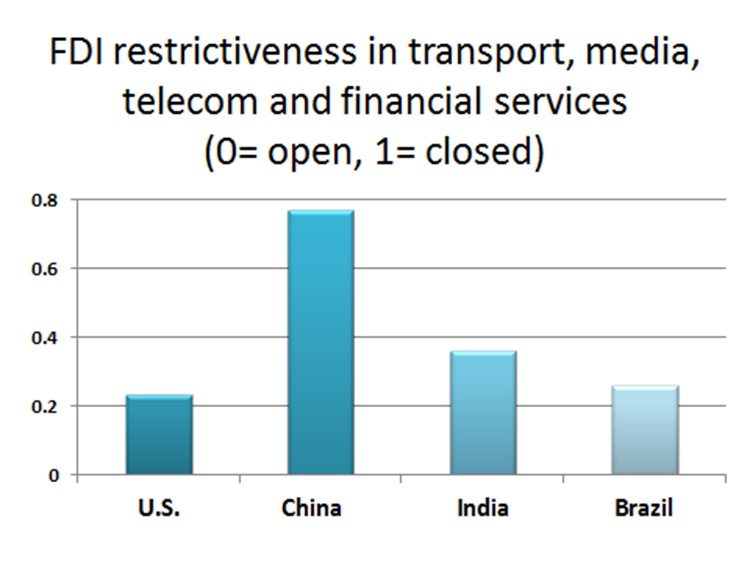

U.S. outward investment is particularly sensitive to property rights and the rule of law, including intellectual property rights protection. U.S. firms are often technology leaders so that protection of trademarks and patents is particularly important. According to the World Governance Indicators, China has poor property rights and rule of law, and the situation has gotten modestly worse over time. Also, China encourages FDI in some sectors (e.g., manufacturing), while prohibiting it in others (financial services, mining, telecom, and media, to name a few). According to an Organization for Economic Co-operation and Development ranking, China is more closed to FDI than other emerging markets such as India or Brazil, and much more closed than the United States (see figure below). China is particularly closed in sectors that are important parts of the U.S. economy.

Concerning the relatively small amount of Chinese direct investment in the United States: the initial impetus for China’s outward investment was to secure natural resources. There were more opportunities for this in developing countries of Asia, Latin America, and Africa, than in the United States. In recent years, however, Chinese outward investment has diversified and a larger share is coming to the United States in sectors such as real estate, food, and banking. While Chinese investment to the United States is increasing fairly rapidly, the national security reviews of the Committee on Foreign Investment in the United States (CFIUS) have soured many Chinese investors on the U.S. market. While CFIUS only reviews a small number of transactions each year, it has turned down a number of high-profile Chinese acquisitions on national security grounds.

Source: Blanka Kalinova, Angel Palerm, and Stephen Thomsen, 2010, “OECD’s FDI Restrictiveness Index: 2010 Update,” www.oecd.org/daf/investment/workingpapers.

The United States and China have agreed to negotiate a bilateral investment treaty (BIT). This could open the doors to large amounts of investment in both directions if it addresses key issues. For U.S. firms, access to more sectors and better protection of intellectual property rights are crucial. Chinese firms seek a less politicized environment in which to invest. In its Third Plenum resolution, the Communist Party leadership indicated its intention to open more sectors to foreign investment and competition. A BIT could help lock in these necessary reforms and lead to a deepening of economic ties.

Commentary

Why so little investment between the United States and China?

February 26, 2015