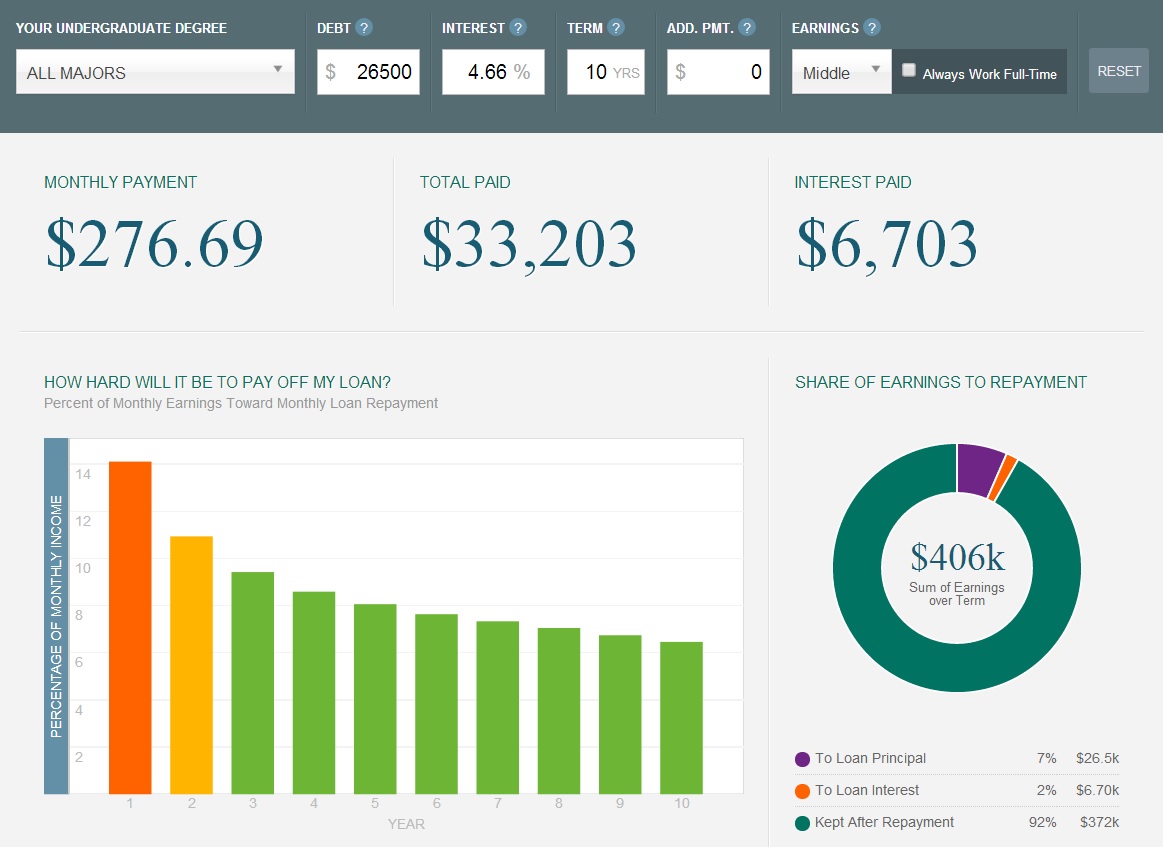

Today, roughly 70 percent of American bachelor’s graduates leave school with debt, and for those that do, the median balance is $26,500. While career earnings tend to grow rapidly, student loans are typically repaid in the first decade of the career when earnings are at their lowest. For the graduate with typical debt level and earnings, payments under the standard 10-year repayment plan take up 14.1% of earnings in the first year, but gradually fall to only 6.5% of earnings in the tenth and final year. This repayment strategy, however, can place a particularly heavy burden on graduates from majors whose earnings start low before rising later in the career. For these students, college may not provide the cash flow needed to easily pay off loans in years immediately following graduation.

Using major-specific earnings data from the U.S. Census Bureau’s American Community Survey, The Hamilton Project has created a student loan repayment calculator that shows the share of earnings necessary to service traditional loan repayment for 80 majors. You can choose or search from each of these majors, as well as change the size and features of the student loan using the selection boxes above. You can even compare repayment from one major with that of another. By default, loan features reflect the experience of a typical graduate borrower, and earnings include part-time workers and those who experience unemployment throughout the year (but exclude those with graduate degrees, as these individuals often accumulate additional debt).

See the accompanying interactive feature, Undergraduate Student Loan Calculator, to calculate the share of earnings necessary to service traditional loan repayment for 80 majors.

An accompanying economic analysis explores the challenges currently facing the student loan repayment system, which often creates a heavy burden on recent graduates by having them make payments in the beginning of their careers when their earnings are low. The analysis yields the following key conclusions:

First, earnings trajectories differ across majors but nearly all of them show rapid growth in the early-career years.

- Graduates see steep earnings growth in the first five years after earning a degree: the typical increase in median earnings over this period is 65 percent. This implies that a focus on earnings right out of school—either as an indicator of earnings potential or loan repayment ability—can be misleading.

- Graduates from majors with lower initial earnings are more likely to see faster earnings growth in early-career years. In the first five years after degree receipt, graduates in some of these majors show increases of over 100 percent while graduates from other majors see gains of no more than 30 percent.

Second, the burden of student loan repayment diminishes rapidly as earnings grow, but it can still be difficult for the graduates of some majors under typical repayment strategies and loan levels.

- For a bachelor’s graduate who borrowed, and who had typical earnings and student debt, payments under the standard 10-year repayment plan take up 14.1 percent of earnings in the first year, but only 6.5 percent of earnings in the tenth year.

- Among borrowing graduates with typical earnings and debt levels, eight in ten will pay more than 10 percent of their earnings in the first year of repayment. However, fewer than one in eight will pay such a share of earnings in the fifth year, and none will by the tenth year.

- However, the share of earnings necessary for loan repayment varies substantially across majors. With typical earnings and student debt, borrowing graduates in drama and theater face payments of 24 percent of their earnings during the first year of repayment, with this fraction gradually falling to 10 percent during the tenth year. Graduates from energy and extraction engineering, on the other hand, experience repayment shares of only 7 percent and 4 percent, respectively, over the same horizon.

- Because student loan debt is fairly similar across majors, the spread in earnings repayment shares over the majors is mostly driven by differences in earnings trajectories.

- This mismatch between the timing of repayment of student loans in early career and higher earnings in mid-career can be mitigated in part through income-based repayment plans. For borrowers with debt of $26,500—the typical or median amount—99 percent of graduates would qualify for the most generous income-based repayment plan in the first year of the career, 82 percent would in the fifth year, and 54 percent would in the tenth year.

Our goal in providing this analysis and interactive feature is to highlight earnings and student debt information that can help consumers—students and their families—make the best decisions regarding their higher-education investments. We hope the analysis and interactive feature will be a springboard for discussion regarding educational investments, financial aid and loans, and career choices.

- For the full economic analysis, click here.

- For the student loan repayment calculator, click here.

- To explore career earnings by college major, click here.

Commentary

Major Decisions: Graduates’ Earnings Growth and Debt Repayment

November 21, 2014