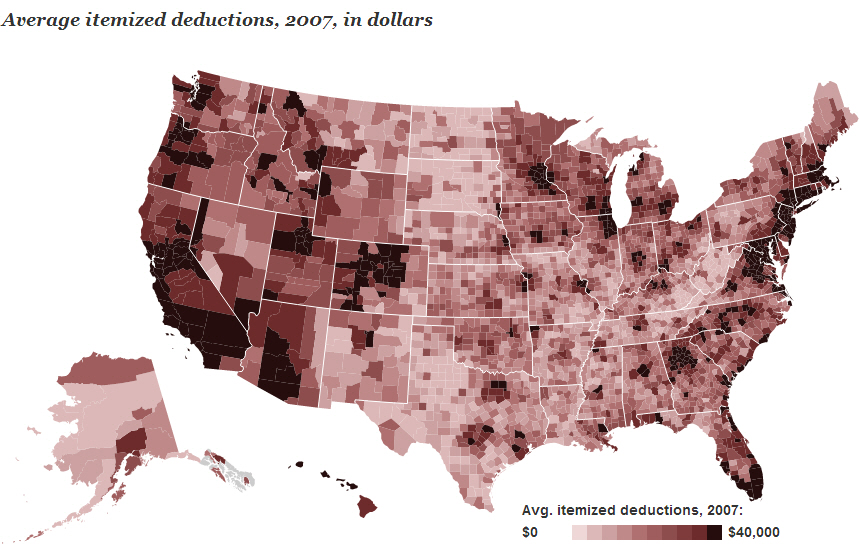

Taxpayer use of itemized deductions varies widely by location, according to a new analysis of 2007 IRS data. In about one in ten counties, 11 percent or fewer taxpayers itemize while in another 10 percent at least 38 percent of taxpayers claim deductions. In a handful of counties, more than half of taxpayers itemize. In general, taxpayers in high-cost, high-tax counties located along the coasts are far more likely to itemize than those in living in in the middle of the country (see map).

About one in three tax filers itemizes. The largest itemized deductions are for mortgage interest, state and local taxes, and gifts to charity. Others include certain medical expenses, job-related expenses, and casualty and theft losses. The Pease provision limits itemized deductions for upper-income taxpayers.

Interactive

Map: Itemized Tax Deductions in Your County

The variation in itemized deductions depends on many factors, but is driven by differences in income. For example, taxpayers with higher incomes own more expensive homes and carry larger mortgages and thus pay more in mortgage interest. Some live in states and counties with higher taxes. Taxpayers with higher incomes tend to give larger gifts to charity, and they tend to cluster along the east and west coasts.

Not only does the share of taxpayers who itemize vary greatly from county-to-county, so does the amount they claim. Among those taxpayers itemizing, the median county-level deduction was $18,590 in 2007. However, in 10 percent of counties, taxpayers itemized an average of $16,640 or less, while in another 10 percent they deducted an average of $22,990 or more. In about 1 percent, taxpayers deducted an average in excess of $35,020.

Where do the biggest itemizers live? Not surprisingly in high-cost, high-income urban counties located in southern California and the corridor between Washington, DC and Boston, and around major inland cities such as Chicago and Denver. Inland and rural counties tend to benefit less from itemization.

Commentary

Stark Variation in Taxpayer Use of Itemized Deductions, County by County

March 6, 2014