The U.S. economy is now in its 93rd consecutive month of growth, the third longest expansion on record. It has added jobs for 76 straight months, at a robust pace of 200,000 jobs per month. The unemployment rate stands at 4.8 percent, near its pre-recession level.

Of course, this expansion has followed the worst downturn since the Great Depression. The Hamilton Project finds that the economy is still about 700,000 jobs short of its pre-recession employment level, adjusted for new people entering the labor force during that time. Partly as a result, only 60 percent of Americans 16 years and older are employed today, down from 63 percent before the recession. Wages are growing, but only after several years of relative stagnation. Frustration with the state of the economy was a major theme in the 2016 presidential campaign, and today animates Trump administration proposals around infrastructure, immigration, and the environment.

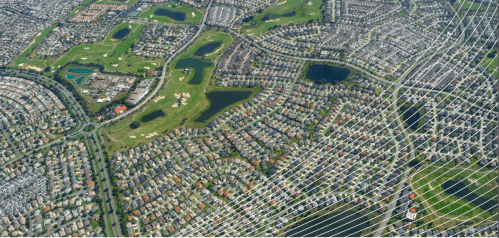

While useful, these top-line national numbers paint an incomplete portrait of the economy in a nation as large as the United States. Our new Metro Monitor offers a deeper look in two ways: it focuses on a wider set of indicators that chart comprehensive economic progress; and it examines these dynamics in metropolitan areas, the distinctive regional hubs of the American economy. Three maps from the Metro Monitor—illustrating changes from 2010 to 2015—help tell the story of an accelerating, but as-of-yet incomplete, economic recovery.

The first map highlights where regional economies’ growth and entrepreneurship has been strongest and weakest through most of the expansion. The fastest-expanding metro areas came in three categories: places in the Southeast and Southwest that suffered the most during the housing crash and are now “reverting to the mean;” highly educated places with significant technology and science industries that have expanded in the recovery (especially the Bay Area and Pacific Northwest); and the Energy Belt in Texas and Oklahoma that was still booming in 2015, but has lost much of its momentum since. Metro areas in the industrial Northeast, Midwest, and Deep South expanded much more slowly.

The second map focuses not on which economies are growing bigger and more dynamic, but instead on the quality of their growth, which is measured by indicators like productivity and average incomes. It highlights that the latter two categories of fast growers—the educated tech/science metro areas, and those in Texas/Oklahoma—performed well on what we call “prosperity.” However, it also points to lower-quality growth in the Sunbelt metro areas, where jobs have expanded faster in lower-paying sectors. The map also points to strong productivity growth throughout most of the Midwest, reflecting in part the resurgence of a manufacturing sector that is generating ever-more output without adding large numbers of jobs.

That leads to the third map, which arguably speaks most directly to the current economic debate—are people feeling the economic momentum in terms of employment and pay? In some respects, progress was widespread: From 2010 to 2015, the share of working-age adults in jobs rose in the vast majority of metro areas. Yet only a little more than half posted significant increases in median wages, and most of that progress occurred from 2014 to 2015. On these inclusion measures, regional patterns are less strong. Some fast-growing places like Houston succeeded in drawing more people into the labor market, but those new entrants earned lower wages, adding to the amount of working poverty in the metro area. Other slow-growing regions like Buffalo nevertheless managed to expand employment and wages at the same time.

These three maps help illustrate the mixed picture that captures the country’s economic mood today. Just 14 of the 100 largest metro areas managed above-average performance in all three areas. They included some of the highly-educated tech centers—Austin, Denver, Raleigh, San Jose, and Seattle—that shone blue across the maps, but also growing and diversified mid-sized markets like Charleston, Columbus, Nashville, and Omaha. Many more metro areas—23 in all, in nearly every corner of the country—failed to beat the average in any of the three categories. Residents of these lagging metro areas may indeed feel like the recovery has yet to hit home for them.

In the end, these maps of economic growth, prosperity, and inclusion pose almost as many questions as they answer. Users can begin to explore what’s behind the numbers with the Metro Monitor 2017 Dashboard. In the coming weeks, we will publish a series of analyses that probe more deeply into the factors—from industry to population to education—that are driving these metro trends. For now, these maps help make the case for why a broader, metro-focused view of success is crucial for both diagnosing and solving our nation’s economic challenges.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Three maps that show how US metro economies are doing

March 3, 2017