This paper is part of the fall 2020 edition of the Brookings Papers on Economic Activity, the leading conference series and journal in economics for timely, cutting-edge research about real-world policy issues. Research findings are presented in a clear and accessible style to maximize their impact on economic understanding and policymaking. The editors are Brookings Nonresident Senior Fellow and Northwestern University Professor of Economics Janice Eberly and Brookings Nonresident Senior Fellow and Harvard University Professor of Economics James Stock. Read summaries of all the papers from the journal here.

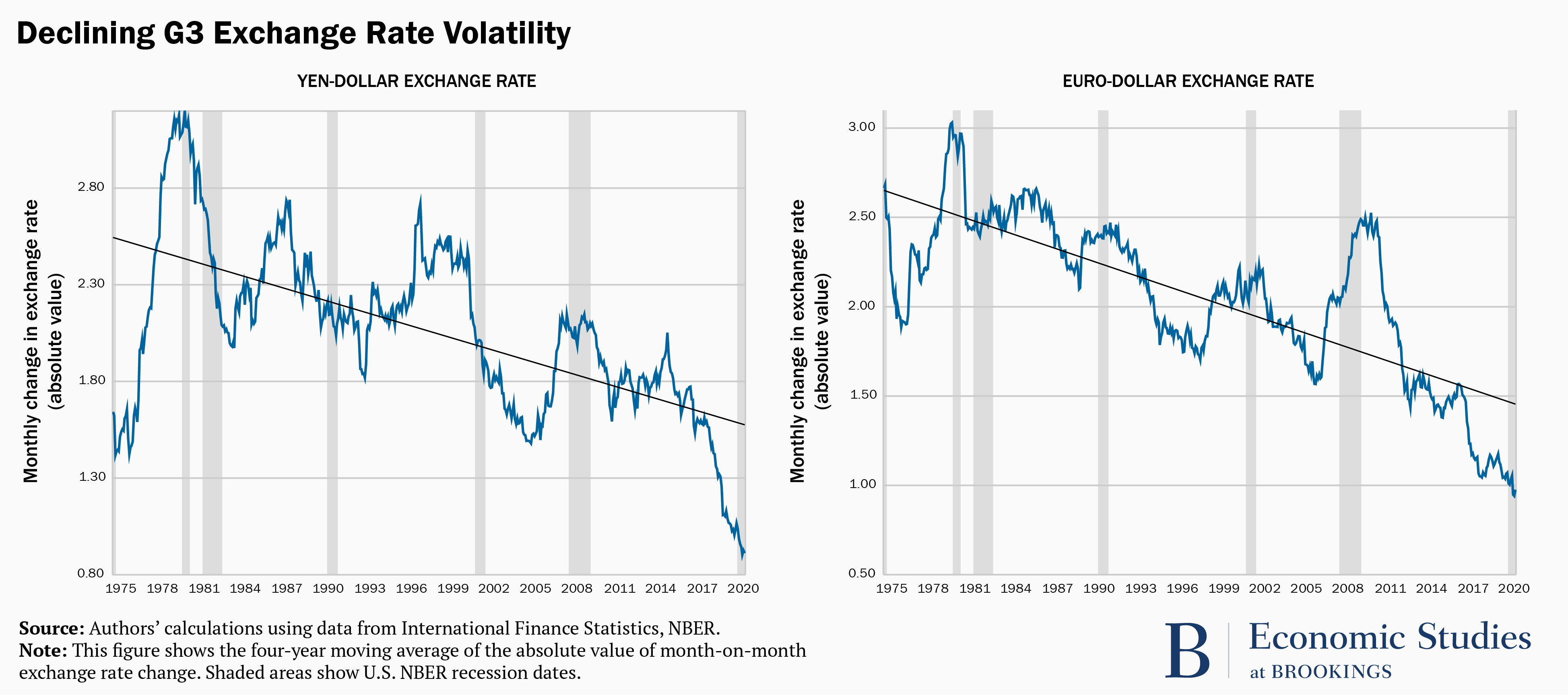

The volatility of currency exchange rates among advanced economies has been declining over the 21st century, especially since 2014, and so far the stability has continued through the COVID-19 recession, finds a paper discussed at the Brookings Papers on Economic Activity (BPEA) conference on September 24.

Stability among the world’s three core currencies—the U.S. dollar, Japanese yen, and euro—now rivals the stability experienced from the mid-1950s to the late 1960s when the Bretton Woods system tied major currencies to the value of gold, write the authors—Ethan Ilzetzki of the London School of Economics and Carmen M. Reinhart and Kenneth S. Rogoff of Harvard University.

In Will the secular decline in exchange rate and inflation volatility survive COVID‑19?, they conclude that the longer-term decline in exchange rate volatility likely reflects the success of independent central banks in stabilizing inflation, which in turn has narrowed differences in interest rates among the countries. (Typically, exchange rates move as central banks raise and lower interest rates in response to varying conditions in their economies.)

However, this year’s recent “stunning stability of exchange rates, despite an epic global recession”—and even as stock market volatility has surged—“more likely reflects the paralysis of monetary policy,” the authors write. The severity of the pandemic has forced major central banks to push short-term interest rates to near or below zero and markets expect rates to remain stuck at their lower bound for years to come.

The authors warn that “there are reasons to be concerned that today’s stability might mask fragilities, not strengths.” As the economic damage from the pandemic recession unfolds, “there is non-trivial risk that eventually the mix of highly expansive monetary and fiscal policy … could upend the inflation calm of recent decades,” they write. That, in turn, would end “the preternatural calm in exchange rate markets.”

The authors write that aggressive central bank intervention during the pandemic is creating a “liquidity glut.” That’s different than during the financial crisis of 2008-2009 when the Federal Reserve’s large-scale securities purchases, known as quantitative easing, had little effect on the broader money supply. This time, the authors write, the Federal Reserve’s M2 measure of the money supply has spiked by nearly 25 percent in just a few months.

“It is an open question whether, as the economy heals, this higher liquidity will eventually bleed over into inflation, particularly if central banks remain concerned with low growth and high public- and private-sector debts,” they write.

And they note that the huge expansion of U.S. public debt relative to the U.S. share of global gross domestic product could eventually leave the dollar vulnerable to a loss of confidence. The resulting demise of exchange rate stability would affect many economies, not just the U.S. economy. Many emerging market countries, for instance, trade and borrow mostly in dollars.

Rogoff, in an interview with Brookings, said the paper is not an argument against the massive fiscal and monetary stimulus that has been deployed to fight the COVID-19 recession, but rather a warning that policymakers should remain vigilant.

“We’ve had this wonderful confluence of low inflation and stable exchange rates. What could make the party end?” he asked. “If you are a policymaker, you shouldn’t take this for granted, and often these things end because policymakers take them for granted.”

David Skidmore authored the summary language for this paper. Becca Portman assisted with data visualization.

CITATION

Ilzetzki, Ethan, Carmen M. Reinhart, and Kenneth S. Rogoff. 2020. “Will the Secular Decline in Exchange Rate and Inflation Volatility Survive COVID-19? ” Brookings Papers on Economic Activity, Fall, 279-332.

CONFLICT OF INTEREST DISCLOSURE

The authors did not receive financial support from any firm or person for this article or from any firm or person with a financial or political interest in this paper. They are currently not officers, directors, or board members of any organization with an interest in this paper.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).