Executive summary

Medicare Advantage (MA) has attracted a steadily rising share of Medicare beneficiaries in recent years, a trend that is projected to continue in the years to come (Ochieng et al. 2025; CBO 2024; Trustees 2025). At present, beneficiaries who choose MA are “favorably selected,” meaning that they cost less to cover than those who choose traditional Medicare (TM), even after adjusting for the beneficiary characteristics accounted for in the MA risk adjustment system (e.g., Curto et al. 2019; MedPAC 2025). Because payments to MA plans are based on the average spending of TM enrollees, favorable selection increases the effective generosity of those payments—by an estimated 11% in 2025, according to the Medicare Payment Advisory Commission (MedPAC 2025). Observers have raised concerns that selection may intensify if MA penetration continues to rise, perhaps necessitating fundamental changes to how MA plans are paid (e.g., McWilliams 2022; Jacobson and Blumenthal 2022; MedPAC 2023; Lieberman et al. 2023).

This paper examines the effect of MA penetration on selection, with three main findings:

- It is unclear a priori whether higher MA penetration will strengthen or weaken favorable selection. Favorable selection arises because beneficiaries with a higher propensity to choose TM over MA tend to cost more to cover. A corollary of this fact is that the “marginal” beneficiaries who shift from TM to MA when MA penetration rises tend to cost more than those already in MA but less than those who remain in TM. Thus, rising MA penetration tends to raise the average cost of both MA and TM enrollees. The net effect on the difference in average cost between these two groups—or, equivalently, on the degree of favorable selection into MA—depends on which average rises faster.

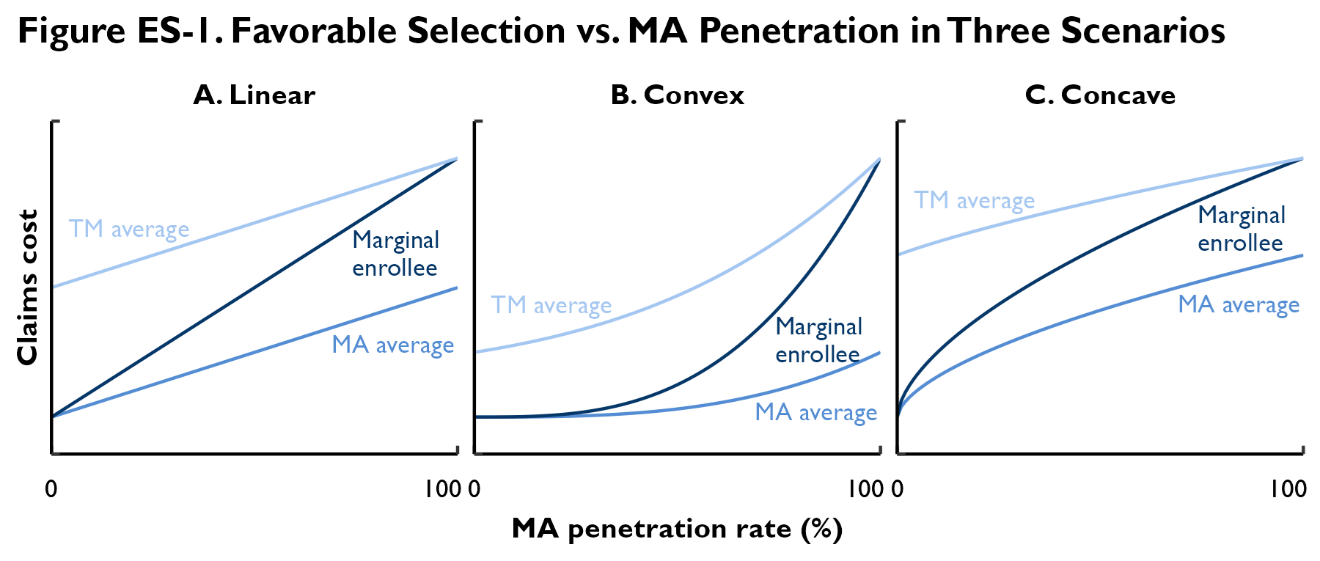

The model presented in this paper shows that this net effect depends on the curvature of the relationship between beneficiary costs and their propensity to enroll in MA, as depicted graphically in Figure ES-1. If this relationship is convex (e.g., because there is a small group of very-high-cost beneficiaries who almost always choose TM), then favorable selection tends to increase as MA penetration rises, as depicted in Panel B of the figure. By contrast, if this relationship is concave (e.g., because there is a small group of very-low-cost beneficiaries who almost always choose MA), then favorable selection tends to decline as MA penetration rises, as depicted in Panel C. If this relationship is linear, then favorable selection does not vary with MA penetration, as depicted in Panel A.

- Simple comparisons of selection patterns in counties with higher and lower MA penetration rates suggest that MA penetration has little effect on favorable selection, but these comparisons have limitations. One strategy for measuring the degree of favorable selection into MA is to compare the claims spending and risk scores of TM “stayers” (enrollees who remain in TM from one year to the next) to those of TM-to-MA “switchers” (enrollees who switch from TM in one year to MA in the next year). This method of measuring selection has been used extensively in prior work (e.g., Brown et al. 2014; Newhouse et al. 2015; Jacobson et al. 2019; Lieberman et al. 2023; MedPAC 2025).

- Our analysis addresses the limitations of prior analyses but reaches a similar conclusion: rising MA penetration is unlikely to have much effect on favorable selection into MA. We estimate a structural model of the relationship between MA penetration and selection using county-year panel data on stayer-switcher differences and MA penetration. The model structure allows us to explicitly account for the possibility that TM-to-MA switchers may not be representative of MA enrollees overall. Using data for multiple years also allows us to control for persistent differences across counties that may confound the cross-sectional relationship between MA penetration and stayer-switcher differences.

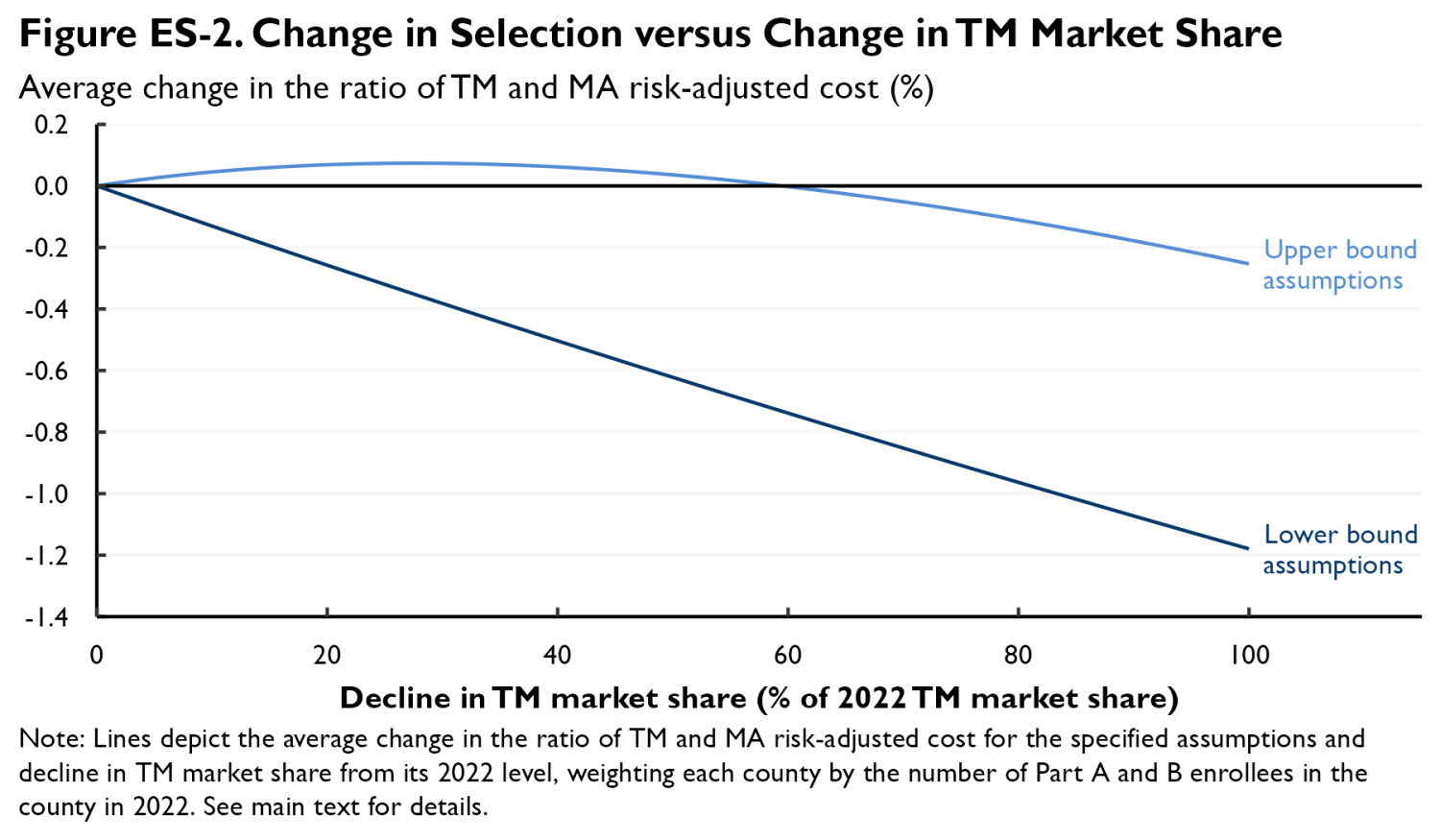

Our results imply that further increases in MA penetration would have little net effect on favorable selection, as illustrated in Figure ES-2. Concretely, we estimate that a decline in TM’s market share of 50% from its 2022 level would result in between a negligible increase and a 0.6% decrease in the risk-adjusted cost of the average TM enrollee relative to the average MA enrollee, depending on our assumptions. Our estimates are precise enough to rule out increases larger than 0.9% or declines larger than 1.3% with 95% confidence.

Our findings suggest that further increases in MA penetration would have only small effects on the degree of favorable selection into MA. This has at least two implications. First, it suggests that changes in selection (and their corresponding effects on the generosity of MA payments) are unlikely to meaningfully amplify or dampen underlying trends in MA penetration. In particular, it suggests that TM is currently at little risk of entering a selection-fueled “death spiral” in which increases in MA penetration exacerbate favorable selection, boost payments to MA plans, and thereby allow plans to lure still more beneficiaries away from TM.

Second—and related—it appears unlikely that rising MA penetration will change selection patterns in ways that substantially reduce the accuracy of MA payments. This joins earlier findings that rising MA penetration is unlikely, at least in the medium-run, to reduce TM enrollment to a level where the estimates of local TM costs used to set MA payment benchmarks become statistically unreliable (Crow et al. 2025). A corollary is that while the MA payment system’s current accuracy problems (e.g., MedPAC 2025) may offer a compelling rationale for MA payment reform, concerns that rising MA penetration will exacerbate these accuracy problems likely do not.

-

Acknowledgements and disclosures

We thank Richard Frank, Gopi Shah Goda, and seminar participants at Brown University for helpful comments and conversations and thank Chloe Zilkha, Rasa Siniakovas, and Christopher Miller for excellent research, editorial, and web posting assistance, respectively. This work was supported by a grant from Arnold Ventures. All errors are our own.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).