This explainer was originally published in June 2025 and has been updated to reflect more recent developments like passage of the GENIUS Act.

What are stablecoins?

Stablecoins are digital, cryptographic tokens whose values are pegged to those of other assets, like the U.S. dollar. This feature differentiates stablecoins from bitcoin and other crypto assets whose values fluctuate with supply and demand and makes them a more popular alternative as a medium of exchange and a store of value.

Stablecoins currently in circulation have a collective market capitalization of over $250 billion. Almost all of these—approximately 99%—are pegged to the U.S. dollar, while the rest are pegged to other fiat currencies or commodities like gold. Issuers of most tokens hold assets in reserve and allow holders to redeem their tokens for the reference asset at any time. Some stablecoins, such as Dai, are pegged to real-world assets but backed by crypto assets held in reserves of varying degrees of overcapitalization to account for their relative volatilities. A few others have a peg maintained by algorithmic manipulations of the token supply in response to demand and are not backed by redeemable reserves. Fiat-backed stablecoins currently comprise about 87% of the total circulating supply and algorithmic stablecoins less than 0.2%.

|

Asset |

Reserve asset |

Price |

Market capitalization |

24-hour trading volume |

|---|---|---|---|---|

| Tether (USDT) | USD equivalents and others* | 0.9999 | 142.50 | 65.73 |

|

USD Coin (USDC) |

USD equivalents |

1.0000 |

53.98 | 9.37 |

| Multi-Collateral Dai (DAI/USDS) |

various crypto-assets |

0.9999 | 7.04 |

0.18 |

|

Largest crypto assets, for comparison |

||||

|

Bitcoin (BTC) |

94,535.95 | 1,874.53 | 48.20 | |

| Ether (ETH) | 2,641.54 | 318.43 | 25.32 | |

Source: Brookings calculations using data from CoinGecko (as of May 26, 2025)

* 81% of Tether’s reserves are held in cash equivalents, while the rest are held in secured loans, bitcoin, precious metals, and other investments.

How do stablecoins work?

Stablecoins are stored and exchanged on decentralized networks (known as blockchains) that serve as ledgers of all transactions. No single intermediary is required for two parties to transact in crypto assets. Instead, participants in a network receive small transaction fees for the computation expended to verify the validity of transactions, and the consensus of these observers allows transactions to proceed. Mutual trust in the execution of transactions is assured by the structure of blockchains themselves, which are publicly accessible for viewing and participation.

Unlike many other crypto assets, the largest reserve-backed stablecoins are issued by entities that retain the sole prerogative to mint and destroy tokens. The ability of holders to redeem tokens for reference assets relies on the trustworthiness of issuers and takes place on their terms. For instance, Tether, the largest stablecoin, charges up to a 1% fee and requires a minimum of $100,000 in tokens to redeem them for dollars. The largest exception is Dai, issued by a decentralized autonomous organization (or DAO) whose protocol is governed by the vote of its token-holding members.

How are stablecoins used?

Stablecoins are primarily used for trading crypto assets, transacting in goods and services, insulating against local currency instability, and sending payments across borders. (Many of the facts in this post on stablecoin use around the world are drawn from a 2024 report by Chainalysis, a data platform that provides blockchain intelligence by connecting crypto asset transactions with real-world entities.)

Investors increasingly use stablecoins rather than cash to buy into and out of crypto asset investment positions, since many exchanges make it quicker and easier to trade with crypto assets than with real-world assets. Some stablecoins are investment vehicles in their own right, as a small but growing number of stablecoins pay interest. Some issuers, such as MakerDAO (behind Dai) and Ethena (USDe), offer both standard and yield-bearing versions of the same stablecoin.

Stablecoin payments for goods and services in the real-world economy have taken off faster in other countries than in the U.S., but there is potential for growth here. Stripe, the second largest online payments processor, now enables users to pay U.S. merchants with stablecoins. Stripe then pays these merchants in U.S. dollars and charges only half the fee it applies to card transactions. Other payments firms have also entered the fray, with PayPal announcing in April 2025 that it will begin granting 3.7% interest to users who hold its stablecoin, PayPal USD, in PayPal/Venmo wallets. Visa is launching a platform for banks to issue tokens, and banks have been in talks about issuing tokens on their own.

By easing access to foreign currencies, especially the dollar, stablecoins have grown sharply in countries with volatile fiat currencies. Argentina, Nigeria, and Turkey, plagued recently by extreme inflation and falling exchange rates, all show high stablecoin usage relative to other countries in the same regions. In a 2024 survey sponsored by Visa of crypto-technology users in Brazil, Turkey, Nigeria, India, and Indonesia, 47% of respondents reported that saving money in U.S. dollars was a primary reason for using stablecoins.

Crypto assets are also becoming more popular for cross-border payments and the sending of international remittances because they are cheaper and quicker than traditional alternatives, such as Western Union or Walmart. The World Bank estimates an average cost of $9.61 to send a $200 remittance from the U.S. to Mexico (the largest remittance corridor in the world); by contrast, the average bitcoin transaction fee has hovered around $1 to $2 this year, irrespective of transaction size and dependent only on network congestion. According to an executive at a global stablecoin payments platform interviewed by Chainalysis, some NGOs and nonprofits have also turned from cash to stablecoins to send aid to crisis zones more quickly.

Although crypto assets are less anonymous than cash—since transactions are preserved in a public ledger—identifying a real-world entity with the public key attached to its transactions can be difficult. This can help to protect individuals, especially those living under oppressive regimes, from expropriation and political persecution. But greater privacy also creates opportunities for facilitating crime: Chainalysis estimates that $25 billion to $32 billion in stablecoins were received by illicit actors in 2024, representing about 12% to 16% of total year-end market capitalization.

What risks and benefits do stablecoins pose?

The major risk to holders of stablecoins is that the issuer may not be willing or able to fulfill redemption requests for their tokens at face value. In May 2022, an escalating sell-off of the algorithmic stablecoin TerraUSD caused it to break its peg and plummet in price, eliminating over $45 billion in value within a week. During this turmoil, Tether saw its stablecoin trading on the secondary market at values as low as 94 cents on the dollar despite continuing to honor requests redeeming tokens for dollars in full. Some issuers of asset-backed tokens have begun to publicize the composition of their reserves to boost confidence in their solvency, but implementation has been uneven in the absence of regulatory standards.

Stablecoins present macro considerations as well. For one, their increased use in money laundering and terrorist financing poses risks to national security. In addition, increased holdings of stablecoins by the public could potentially draw down bank deposits and thereby limit the efficacy of monetary policy. On the other hand, if issuers hold cash reserves as deposits and steer new cash into banks, such as from unbanked or foreign populations, stablecoin uptake may increase deposits and enhance the transmission of monetary policy. The composition of reserves also has implications for public finance—U.S. Treasury securities, not cash, are currently the favored reserve asset of the largest stablecoin issuers, who are already as significant holders of Treasury bills as the largest U.S. money market funds. Continued stablecoin growth could therefore bolster demand for government debt, not to mention the global dominance of the dollar, which is overwhelmingly the peg of choice among tokens currently in circulation.

How are stablecoins regulated in the US?

In July 2025, Congress passed the GENIUS Act, which establishes a federal regulatory framework for stablecoins. Similar to the U.S.’s dual banking system, stablecoin issuers may apply for approval from either federal or (if total issuance is below $10 billion) state regulators in states where such regulation exists. Issuers must back their stablecoins one-to-one with reserves of cash or other permitted assets—such as Treasury securities, repurchase and reverse repurchase agreements, government money market funds, bank deposits, or tokenized versions of the same—and must report monthly on the composition of their reserves. Issuers will also be subject to federal anti-money laundering regulations. Their stablecoins, which cannot pay interest, must be redeemable for a fixed monetary value. The law designates the Treasury’s Comptroller of the Currency as the federal regulator for nonbank issuers, whereas bank subsidiaries that wish to issue stablecoins will be regulated by the applicable state or federal bank regulators. State and federal regulators have until July 2026 to finalize implementation rules, including stablecoins’ tax characterization, standards for foreign stablecoins sold in the U.S., and policies regarding conflicts of interest for stablecoin issuers, an issue of public debate given the Trump family’s growing business in crypto assets. The law does not cover what it terms “non-payment stablecoins,” which include algorithmic stablecoins, and remain in the purview of state regulators.

Previously, all stablecoins were regulated and supervised as money transmitters, primarily at the state level. Many state governments have applied existing rules, and some have passed new laws, to subject issuers and exchangers of crypto assets to regulations for consumer protection and financial soundness. Money transmitters are required to register with the Treasury’s Financial Crimes Enforcement Network, which in 2013 clarified that reporting requirements for anti-money laundering and countering the financing of terrorism (AML/CFT) apply equally to the transmission of crypto assets. Banks, for their part, needed special permission under Biden administration policies to custody crypto assets, hold reserves for stablecoin issuers as deposits, and participate in blockchains, but the Comptroller of the Currency reversed this policy in March 2025.

In 2015, the New York Division of Financial Services—an early mover on crypto regulation—began requiring businesses engaged in any of several activities involving crypto assets to obtain a dedicated BitLicense and comply with standards including capital requirements, AML programs, and consumer protection. New York first approved the issuance of stablecoins by licensees in 2018, and in 2022 clarified that licensees issuing U.S. dollar-backed stablecoins must hold full reserves of highly safe and liquid assets, publish monthly attestations of reserve adequacy by independent accountants, and redeem stablecoins for reserves in a timely fashion under clearly disclosed policies.

Other states, including Florida, Nevada, Utah, West Virginia, and Wyoming, have created regulatory sandboxes in which novel financial technologies can access markets through exceptions to standard procedures, usually for limited periods of time. Uniquely, the Wyoming legislature in 2023 authorized a new state commission to issue redeemable Wyoming Stable Tokens (WYST) against reserves consisting exclusively of U.S. Treasury bills in the amount of 100% to 102% of outstanding tokens. Any interest earned on reserves above the 102% mark will be used to pay first for the commission’s operating costs and then for schools. WYST are expected to enter circulation later in 2025, and North Dakota has announced its intention to follow suit.

How are stablecoins regulated abroad?

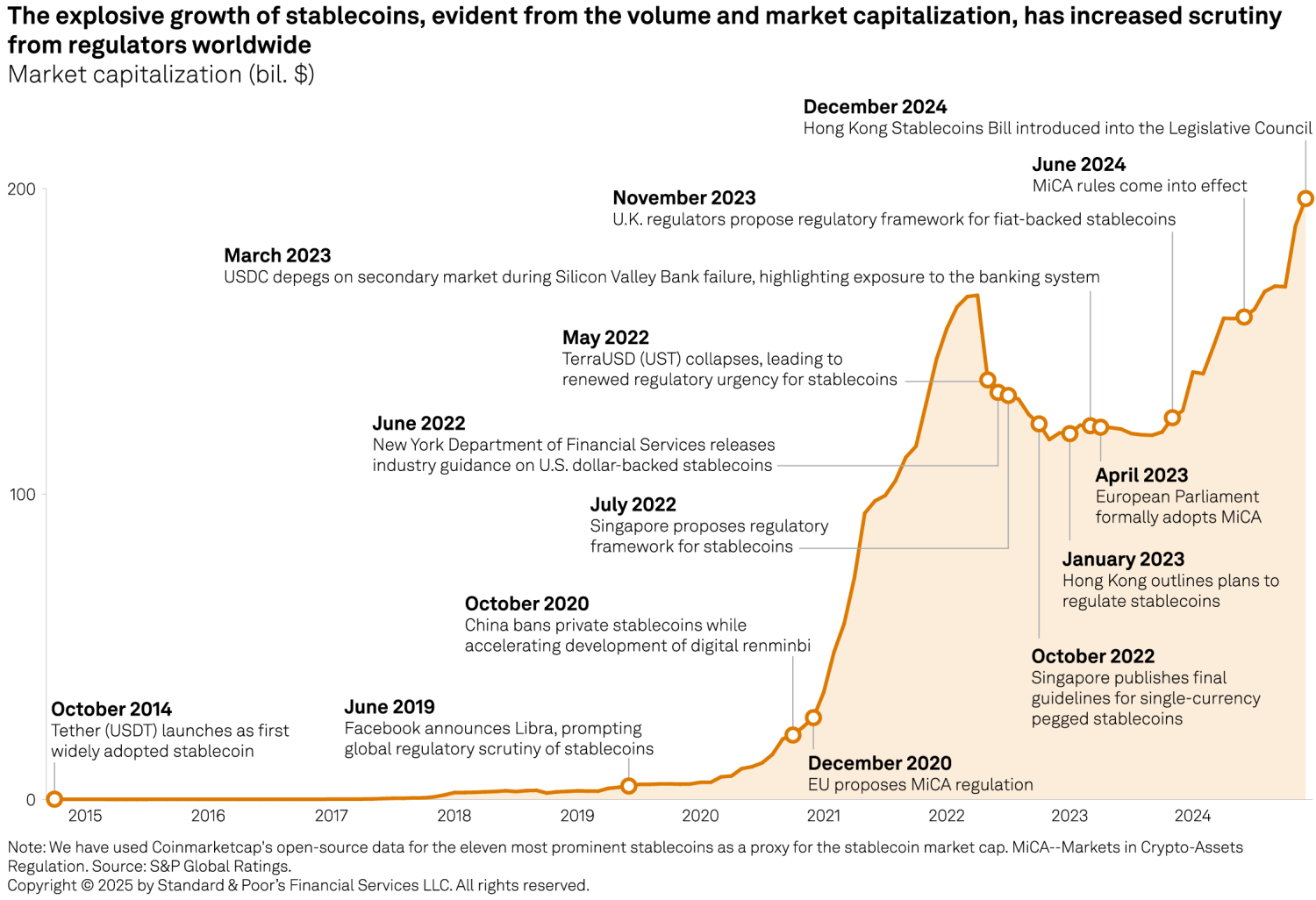

Many foreign governments have enacted stablecoin regulations, including Switzerland in 2019, Japan in 2022, Singapore in 2023, the United Arab Emirates in 2024, and Hong Kong in 2025. Several others, from the U.K. to Brazil, have proposed frameworks for further development and implementation. These approaches have variously emphasized rules for capitalization, liquidity, custody, redemption, disclosure, consumer protection, and AML/CFT.

The European Union in 2023 adopted the Markets in Crypto-Assets Regulation, which sets requirements for the composition of reserves, prohibits charging fees for token redemption, and prohibits stablecoins from paying interest. In addition, it limits the daily non-investment transaction volume of any stablecoin not backed by a single European currency, citing risks “to financial stability, the smooth operation of payment systems, monetary policy transmission or monetary sovereignty.”

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

What are stablecoins, and how are they regulated?

October 24, 2025