In principle, it should be easy for a country with fewer than 20 million people and abundant natural resources to get to high income and sustain this status. Kazakhstan has 22 million hectares of arable land—more than all but 14 countries in the world, the second-largest uranium reserves, the twelfth-largest oil wealth, and the fifteenth-largest natural gas reserves. This is a wealthy country with a great people.

So why hasn’t Kazakhstan become a high-income economy? More accurately, why didn’t it become one after rising very closely to what the World Bank considers high-income levels of more than $12,500 in 2014?

Observe first what sets Kazakhstan apart from the three dozen OECD countries that have reached high income. There are three main issues:

- Dependence on natural resources

- Distant location and

- Dispersed population.

Because of this unique combination, Kazakhstan will have to devise its own development strategy. It can’t just copy someone else’s like Singapore did with Hong Kong China or South Korea did with Japan. The need for this tailored strategy is urgent as Kazakhstan’s economy has grown at a slower pace after each slowdown. Its per capita income grew by nearly 10 percent between 2000 and 2007, by 4 percent between 2010 and 2014, and by 3.5 percent between 2016 and 2019. During 2020-2022, the economy grew by 2.3 percent and this year, 2023, we expect per-capita income to grow by about 3.5-4 percent. Further, once you take out the effect of investment and employment increases, growth is close to zero. That is to say, productivity growth has been negligible since 2008. This is a visible symptom that Kazakhstan’s structural transformation has stalled, so has its sectoral transformation, and so has its spatial transformation.

A recent report by the World Bank shows a tight three-way relationship between a country’s per-capita income, the sectoral composition of its output, and the share of its urban population. The report shows that per capita income has grown mostly when the prices of its commodity exports have happened to be high. This is not a bad thing—there are other resource-rich countries where even this hasn’t happened. But it does mean that Kazakhstan’s fortunes are mainly decided by the international commodity markets rather than its industries and people. This is not a good thing.

Further, Kazakhstan’s production structure has not changed much. The share of mining in GDP has remained broadly unchanged at 14 percent since 2000. Manufacturing’s contribution to GDP has been static since 2004 at 13 percent GDP. Commodity exports are broadly stable accounting for more than 80 percent of total shipments abroad.

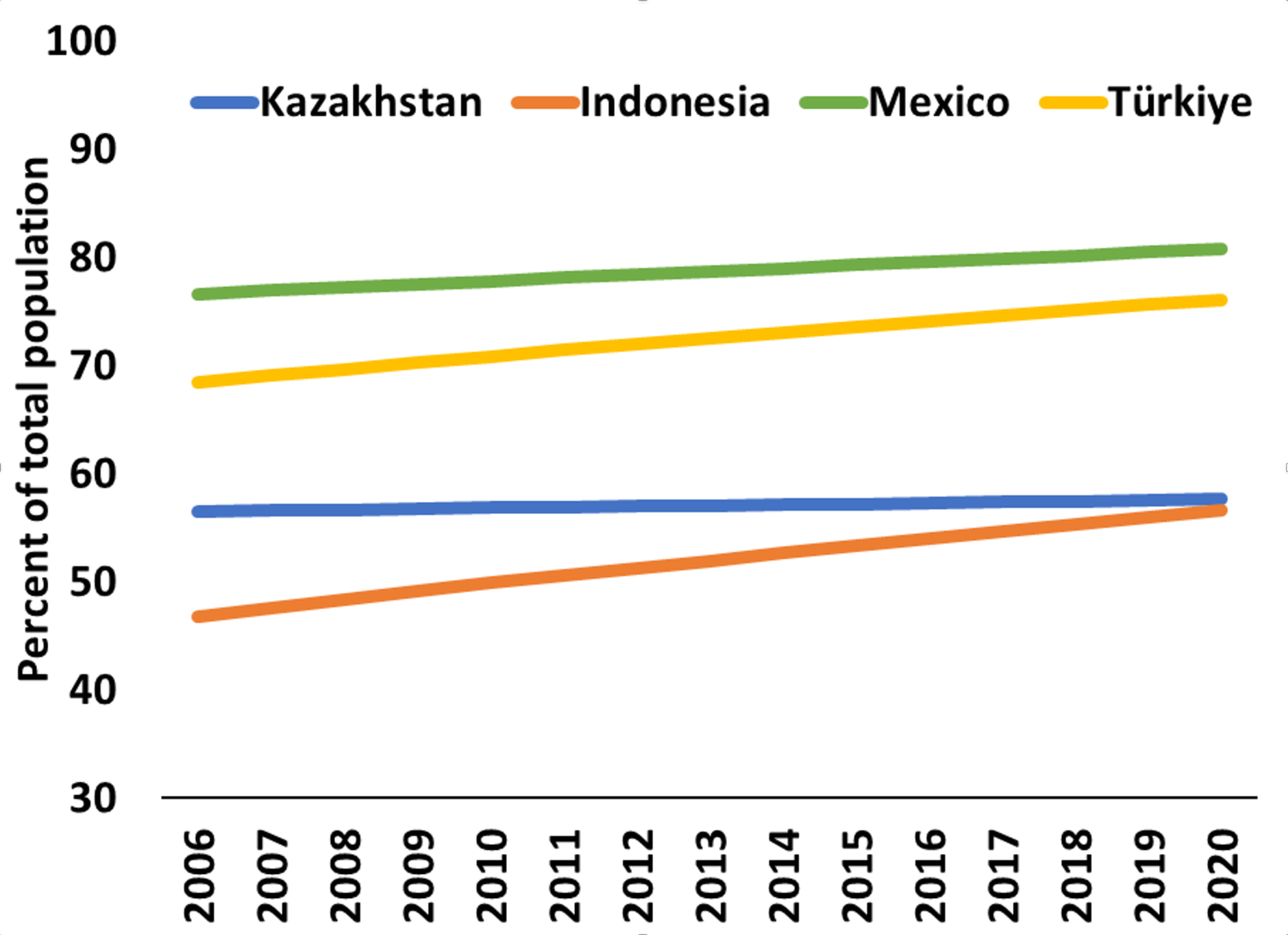

Finally, the share of the urban population has stayed at around 58 percent for the last twenty years. In 2008, it was a little less than 57 percent. In 2020, it was a little less than 58 percent.

Figure 1. Stagnant urbanization in Kazakhstan: urban share of the population, 2006–2020

Economic dynamism has been stymied in Kazakhstan. There are several reasons for this outcome:

- The dominance of state-owned and state-connected enterprises means that production is being carried out in places that are not the best for these activities; goods are produced in places far from markets or with methods that should have changed a long time ago.

- Another problem is low economic freedom for people and private firms. By definition, this has to be the decision of government. If a government trusts its citizens, it gives them freedom. Economic freedom may be the least controversial freedom to give.

- Kazakhstan has made it hard for firms to both start and to shut down if they are not viable. Just as education is the grease that keeps individuals moving to better-paying jobs and places, competition is the grease that pushes firms to be more productive and innovative. The competition regime in Kazakhstan has not been improving; if anything, it may have gone backward.

- The population density is 6 people per square kilometer. Mobility toward urban areas is dampened by high housing costs, a severely limited rental market, and the residency registration system. In the highest-demand urban areas, housing is extremely unaffordable when compared with local incomes. Housing subsidies and legacy policies contribute to one of the highest homeownership rates in the world. Finally, the residency registration system deters many people from relocating within the country, as benefits are tied to where a person is registered. For those who are unregistered, the system can lead to exclusion from many social services and benefits.

- Perhaps the greatest driver of mobility—spatial, sectoral, and social—is good-quality education. Education quality is poor for a country on the doorstep of high-income. About 60 percent of 14-year-olds are functionally illiterate, the third highest percentage in Europe and Central Asia (ECA).

While these are daunting challenges, there are signs of hope.

- The first is that a new e-governance system has simplified resident registration. But advanced economies do not have resident registration and Kazakhstan should consider discontinuing it.

- There are signs of growing spatial concentration of manufacturing, especially near the borders and near Almaty and Astana. It is heartening to note that regions with higher population densities respond to shocks better than remote sparse places.

- Kazakhstan’s territorial development strategy has some good features. Two of them are an emphasis on providing basic services everywhere and recognizing that big cities are the best way to improve both economic efficiency and living standards.

But Kazakhstan has a long way to go. Its three largest urban areas account for less than 25 percent of the GDP; in developed economies, this averages close to 50 percent.

- But urban productivity trends are going into reverse. To counter these reversals, Kazakhstan should contemplate empowering subnational governments more by investing in their capacity and giving them more autonomy in decisionmaking.

- One more change may be to stop subsidizing monotowns, an artifact of Soviet planning. Instead, the government should be thinking of creating regional and city development fund that finances local economic development programs that are implemented by subnational governments.

While there may be significant temptation to build infrastructure, economic zones, and urban structures to bolster the economy, policymakers should resist the temptation to first pour concrete. Advancing market reforms should be the first and foremost order of business.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Kazakhstan: Advance market reforms first, pour concrete later

June 30, 2023