The advantages of a strong economy, such as accumulated household wealth, are reinvested into fostering future growth through investments in new assets, including small businesses. When a country prospers, it has more resources to innovate, produce goods and services, start businesses, and increase well-being. While an economy’s productivity—measured by metrics such as gross domestic product (GDP)—reflects our collective efforts, it does not automatically ensure that overall economic growth benefits everyone equally. History has shown that people, government, and corporate leaders are often willing to grow an economy based on the exclusion and exploitation of groups across racial and spatial lines (slavery, labor segregation, lending discrimination, land dispossession, etc.), highlighting the social construct of economic progress for some at the expense of others.

Understanding the distribution of economic resources in an economy is critical. Concepts such as “full employment” use population-wide data, masking substantive differences between racial groups, geographic areas, and other characteristics, which can paint an incomplete picture of the economy. When we are too focused on macro-level performance, we run the risk of optimizing economic growth at the expense of realizing the potential of members of society, including historically marginalized racial groups.

In many ways, we have yet to realize an economy grounded in inclusion. Statistics on Latino or Hispanic representation in business ownership reveal untapped potential for growth that could be activated with proper investment.

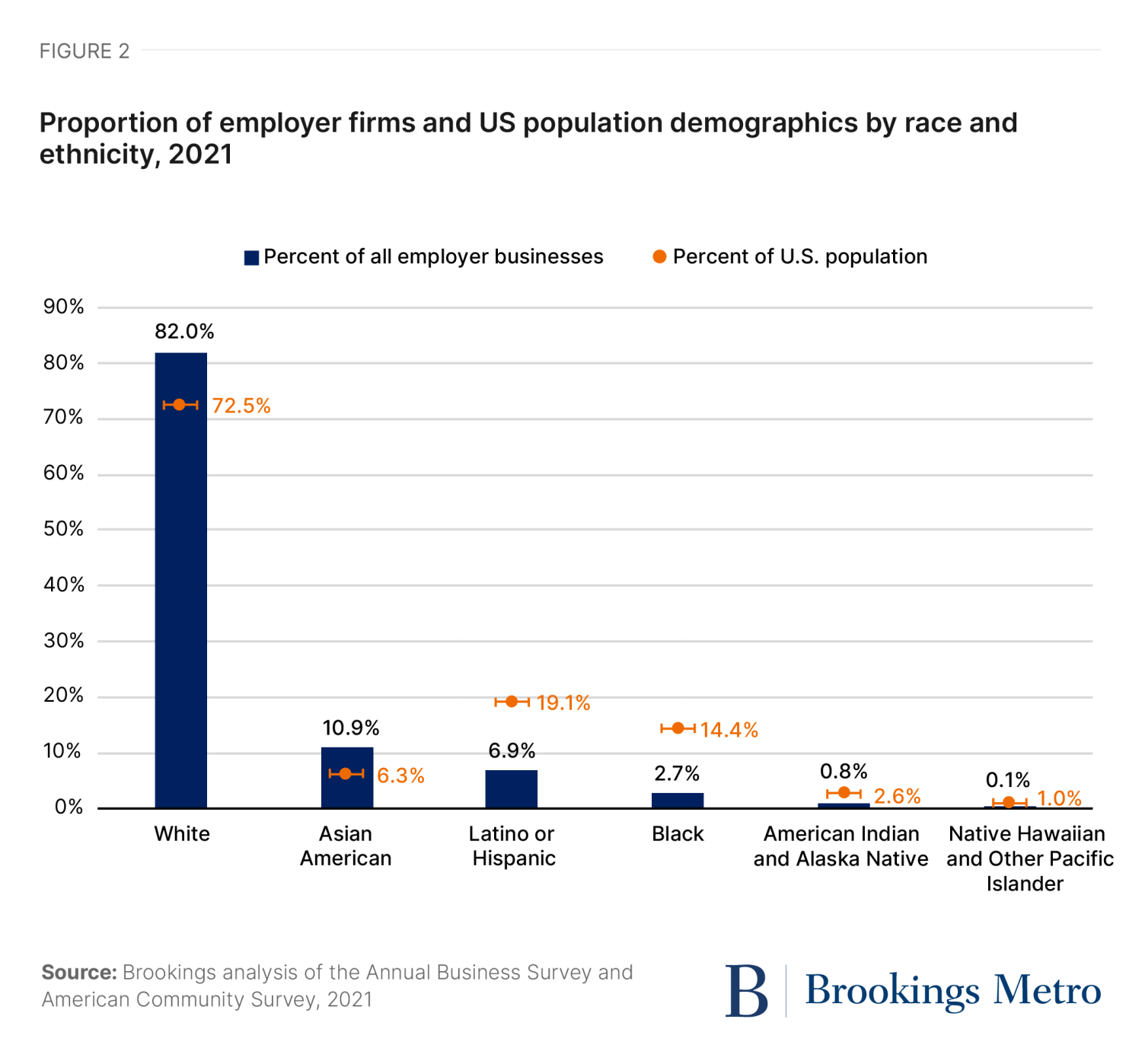

Employer firms (businesses with more than one employee) are a significant driver of wealth in the U.S. In 2021, Latino or Hispanic Americans accounted for 19.1% of the total U.S. population (the second-largest racial-ethnic group), yet owned only 6.9% of all employer firms—businesses that drive regional growth and create employment opportunities. In contrast, our latest research shows that Asian Americans (who represent 6.3% of the population) own 10.9% of employer firms, and white Americans (72.5% of the population) own 82%. Black Americans and American Indian and Alaska Natives are underrepresented as well, comprising 14.4% and 2.6% of the U.S. population, respectively, but only 2.7% and 0.8% of all employer firm owners.

Not surprisingly, from 2019 to 2022, Latino or Hispanic Americans have seen the lowest growth in business equity, which is among the largest drivers of household wealth. These disparities suggest the presence of structural barriers that not only hamper individual wealth accumulation among Latino or Hispanic Americans, but also threaten sustainable economic development as the nation diversifies. Maximizing the talents of all Americans toward broader economic growth and prosperity means that we should build upon the increasing share of Latino or Hispanic employer firm ownership.

To help do so, the Center for Community Uplift at Brookings is launching a new series that will evaluate the state of Latino or Hispanic-owned businesses, complementing our previous work on Black-owned business and entrepreneurship. The series will explore strategies to grow Latino or Hispanic business ownership as a pathway to shared prosperity, including in key emerging sectors such as artificial intelligence and green industries. This introductory report provides a high-level summary of trends in Latino or Hispanic-owned employer firms from 2017 to 2021 using the U.S. Census Bureau’s Annual Business Survey, and spotlights opportunities to grow the proverbial pie.

Latino or Hispanic-owned employer firms have experienced strong growth since at least 2018

Latino or Hispanic-owned businesses are on the rise. They have grown consistently since at least 2018, with an average growth rate of 5.6% between 2018 and 2021. Both Latino or Hispanic female- and male-owned businesses have grown over the period, with average growth rates of 7.4% and 5.4%, respectively.

Although they have increased their share of total U.S. employer firms by 1.36 percentage points from 2017 to 2021, Latino or Hispanic business owners remain underrepresented compared to their share of the U.S. population. Despite representing 19.1% of the population, Latino or Hispanic Americans own only 6.9% of all employer firms (or 7.9% when including firms that are owned by teams where at least 50% of the owners identify as Latino or Hispanic). In contrast, white Americans represent 72.5% of the population, but own 82% of all employer firms.

Moreover, while the share of Latino or Hispanic-owned employer firms has increased, the average number of employees per firm decreased slightly during the same period. Average revenue per firm has remained relatively stable, fluctuating between $1.3 million and $1.4 million. This suggests that while the number of Latino or Hispanic-owned businesses is growing, it isn’t leading to a corresponding increase in their size or output. This could reflect the fact that the majority of new Latino or Hispanic-owned employer firms are relatively small in terms of revenue. The Latino Entrepreneurship Initiative at the Stanford Graduate School of Business reported that in 2022, Latino or Hispanic-owned businesses secured corporate contracts that were on average 3.3 times smaller than their white-owned counterparts, and government contracts that were 30 times smaller.

Latino or Hispanic-owned employer firms are concentrated in construction as well as accommodation and food services

Latino or Hispanic-owned employer firms are primarily concentrated in construction (17.4%), accommodation and food services (11.5%), and professional, scientific, and technical services (11%). Unlike other demographic groups such as African Americans, Latino or Hispanic-owned businesses are distributed across a wider range of industries rather than being concentrated in a few sectors. For example, two sectors (health care and social assistance; professional, scientific, and technical services) comprise 42% of all Black-owned employer firms, while the top two sectors for Latino or Hispanic business owners (construction; accommodation and food services) comprise only 28.9% of all Latino or Hispanic-owned employer firms.

Understanding and building on the strengths of specific populations opens up opportunities for growth. For instance, the country can benefit from Latino or Hispanic employer concentration in construction, and these businesses can potentially benefit from climate policies in legislation such as the Inflation Reduction Act, which is fueling new infrastructure projects.

Metro areas in the Southwest are thriving places for Latino or Hispanic-owned employer firms

In metro areas across the Southwest U.S.—including Laredo, Eagle Pass, and El Paso, Texas—more than 50% of total employer firms are Latino or Hispanic-owned. Yet this figure still remains below parity, considering that Latino or Hispanic residents make up 95% of the population in Laredo and Eagle Pass, and 83% in El Paso.

Examining the concentration of firms in different markets helps us understand business environment dynamics that may or may not facilitate business ownership among all groups.

The largest numbers of Latino or Hispanic-owned employer firms are in major metropolitan areas that drive not only local but also national economic growth. These cities, known for their diverse populations, include Miami, Los Angeles, New York, Chicago, Houston, and Dallas. In these metro areas, Latino or Hispanic-owned businesses are thriving, with significant growth observed between 2017 and 2021, including a 47% increase in Dallas and a 24% increase in Los Angeles.

Latino or Hispanic-owned businesses can drive economic growth in a diversifying America

Latino or Hispanic growth in America can be seen in their rising share of the population and their increasing ownership of employer firms. Persistent representation gaps between these two statistics reveal an opportunity to grow these firms and the broader economy. However, in the background of these demographic realities is a coercive narrative around immigration that runs the risk of society missing opportunities for investment and growth among the overall Latino or Hispanic population, including U.S. citizens.

Immigrant communities have come under fire in this year’s presidential campaign, frequently depicted as a problem, and in the worst cases, as a danger to America. But in reality, the converse is true: Immigrants (and the descendants of immigrants) have historically been and continue to be central to regional and national economic growth. It is essential to disentangle the conflation of illegal immigration and Latino or Hispanic identity, particularly in discussions that deploy divisive or coercive language. Such narratives can obscure the significant investment opportunities within the Latino or Hispanic community.

What is clear is that Latino or Hispanic-owned businesses are pivotal drivers of economic growth in an increasingly diverse America. By removing the barriers they face, we can unlock substantial opportunities for economic expansion and employment, benefiting not only Latino or Hispanic communities but also the nation as a whole.

-

Acknowledgements and disclosures

This series was made possible through funding by the Ares Charitable Foundation. The findings, conclusions, and recommendations presented in this report are those of the authors alone, and do not necessarily reflect the opinions of the Ares Charitable Foundation. Brookings makes all final determinations regarding the research, content, and outcomes and will at no time promote the interests of any donor nor provide exclusive access to government officials.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).