Shorter expected longevity likely plays a big role in the decision to claim Social Security benefits early

Gopi Shah Goda and John B. Shoven of Stanford University, Shanthi Ramnath of the U.S. Treasury, and Sita Nataraj Slavov of George Mason University find that roughly one-third of Social Security beneficiaries claiming benefits before the full retirement age have large enough IRAs to delay claiming benefits for at least two years. This suggests that liquidity constraints are not the primary reason that a large segment of the population claims benefits early. Those claiming early benefits tend to be in worse self-reported health condition, and have higher expected and actual mortality rates, suggesting that expected longevity may influence claiming decisions.

In emerging economies, macroprudential regulations and capital controls are most effective when used together

Anton Korinek of Johns Hopkins University and Damiano Sandri of the International Monetary Fund argue that, in order to mitigate financial instability caused by international capital flows, emerging economies should utilize both capital controls (to stimulate savings) and domestic macroprudential regulations (to reduce overborrowing). The authors add that economies with higher debt burdens or higher wealth inequality should set more stringent capital controls and macroprudential regulations.

Higher-quality hospitals experience greater growth in market share

Amitabh Chandra of Harvard University, Amy Finkelstein and Adam Sacarny of MIT, and Chad Syverson of the University of Chicago find that higher performing hospitals tend to have a larger market share and experience faster growth in market share than do lower-quality hospitals. The relationship between quality and market share is significantly stronger when a higher degree of choice is involved (transfers vs. emergency room visits), suggesting that consumer demand may play a larger role in the allocation of patients to hospitals than was previously thought.

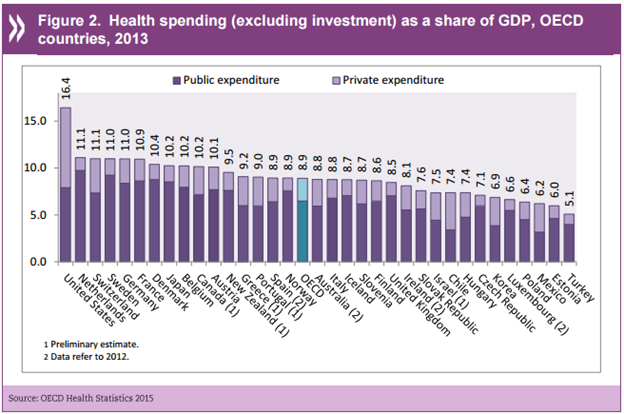

Chart of the week: US health spending far outpaces the rest of the OECD

Quote of the week: NY Fed’s Dudley: more research is needed before deciding to implement a system of macroprudential regulations

We have a very complex financial system in the United States. I think we need to do much more work in developing a coherent macroprudential framework before we start contemplating putting a number of countercyclical measures in place. Such a framework needs to take into consideration how it interacts with other policies, such as microprudential policies—to ensure the safety and soundness of individual institutions and monetary policy—designed to help ensure a stable macroeconomy. When are these policies substitutes? When are they complements? How will they interact? How will the governance work in coordinating across these three realms?

— William C. Dudley, President and CEO, Federal Reserve Bank of New York

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: Social Security benefits, hospital quality, and more

October 8, 2015