Introduction

Unemployment insurance (UI) in low-income countries faces unique challenges, particularly in regions with high informality, weak enforcement of UI claims, and significant job search frictions. Despite these hurdles, UI can significantly improve the well-being of workers and their dependents. This policy brief illuminates the findings of a study conducted in Senegal, evaluating the impact of three distinct UI schemes, each with different enforcement levels and funding sources. Among these, broad-based taxation has emerged as a viable solution to counter potentially high levels of fraudulent UI claims. These insights contribute to the design of practical UI schemes and provide actionable recommendations for effective labor market policies in low-income countries.

Unemployment insurance is difficult to implement in low-income countries

Unemployment insurance serves as a major social safety net for workers in developed countries, where labor markets are marked by high formality and the traceability of employment spells and wages through comprehensive labor force surveys and employer-employee matched data. This structure explains why UI operates effectively and covers a broad spectrum of workers in these regions.

However, the prevalence of UI diminishes in low-income countries, a trend attributable to challenges in monitoring work statuses, financing the UI budget, and verifying the legitimacy of UI claims.1 Specifically, labor markets in developing nations are often mired in complexities such as high levels of informality and self-employment; frequent transitions between formal and informal sectors; and shifts among agricultural, manufacturing, and service sectors. These intricacies are further compounded by labor market frictions related to skill mismatches, job searches, productivity variations, and migration barriers between economic sectors.23456 The combined effect of these factors makes implementing UI in low-income countries a daunting task for both workers and policymakers.78

Despite the aforementioned challenges, there is growing recognition among policymakers, development practitioners, and donors of the need to introduce, fortify, and expand worker protection in low-income countries.9 The frictions associated with job searches and job security in these regions expose workers to unemployment risks, hindering their ability to seek better opportunities or transition smoothly between jobs. These wage earners often serve as the financial backbone for a vast network of economic agents, playing a central role in the social insurance network and providing numerous transfers to kin.1011 Consequently, a country’s workers are pivotal for macroeconomic stimulus and relief. In such environments, UI can bolster workers’ welfare and mitigate their vulnerability to labor market fluctuations.

However, this increasing appreciation for the potential advantages of UI in low-income countries is often tempered by two critical questions concerning its implementation:

- Funding: How can UI be financed in a context where taxpayers represent only a small portion of the workforce and governments are financially constrained?

- Inclusion of informal workers: How can UI be tailored to include informal workers, who constitute the majority of the labor force in these regions?

- Structuring criteria: How should the eligibility requirements, duration of coverage, and exemptions be designed?

The scarcity of empirical evidence—stemming from the limited instances of UI adoption in low-income countries and the absence of high-frequency labor force surveys—complicates the task of answering the aforementioned questions and identifying the appropriate tools to address concerns about the feasibility of UI schemes in developing regions.

Our study, using a combination of a custom survey and a national labor force survey, provides answers to these critical questions. It stands as one of the first investigations to quantify the overall economic benefits of UI for low-income African economies, taking into account the unique labor market characteristics that present substantial challenges to UI implementation. In our analysis, we highlight the relative merits and efficiency of various scheme designs and provide significant insights into a field where empirical evidence on optimal strategies for UI implementation in friction-laden labor markets is sparse. The conclusions drawn from this study are representative of labor markets in low-income economies, marking a substantial contribution to the understanding of UI’s potential in these contexts.

Assessing different UI schemes in the Senegalese labor market

Our study explores the positive effects, known as “welfare gains,” that various UI plans can offer. These gains encompass several factors: the earnings from formal jobs minus taxes; the earnings from informal jobs, possibly including falsely claimed UI benefits; the UI benefits received during unemployment; the costs associated with job searching; and the worker’s assets. We translate these factors into changes in consumption.

We evaluate an extended Chetty (2006) model where workers may be formally employed, informally employed, or unemployed, focusing on two key challenges: moral hazard (the temptation to quit working to receive benefits) and liquidity constraints (using benefits to spend more).12 We examine three distinct economies that are defined essentially by the source of funding for UI and the degree of informality:

- Ideal economy: The government knows everyone’s job status, and there is no informal sector. Funding comes from a payroll/income tax on all workers, since every worker is a formal sector worker. This scenario serves as our best-case benchmark for UI gains.

- Standard economy: Following a typical developed-country model, only formal workers contribute to UI, but some informal workers falsely claim benefits due to imperfect government oversight. Only formal sector workers fund the UI program via an income tax.

- Value-added tax economy: UI is funded by a sales tax, with the presence of informal work and false claims.

To estimate the essential parameters for our study, we conducted a survey using a stratified random sampling approach. We focused on the population of active workers in Dakar, Senegal, randomly selecting 23 out of 129 enumeration areas (EAs) in the city. Within each chosen EA, we randomly sampled a fixed number of households, surveying all individuals aged 15 and over. In total, we gathered data from 1314 individuals across 345 households. The survey encompassed various aspects, such as demographic details, employment history, consumption expenditures, savings and borrowings, job exit rates, job search rates, attitudes towards a UI program, and peer influences.

We used the survey data to calculate key parameters needed to evaluate the welfare effects of different benefit levels and durations (e.g., two-month vs. six-month coverage) and coverage types (e.g., unemployed only vs. all non-formal workers). These parameters include the responsiveness of job search efforts to benefit levels (job search elasticities), the consumption values associated with each work state, and the workers’ risk aversion.

Broad-based taxation can achieve meaningful gains under high informality and weak enforcement

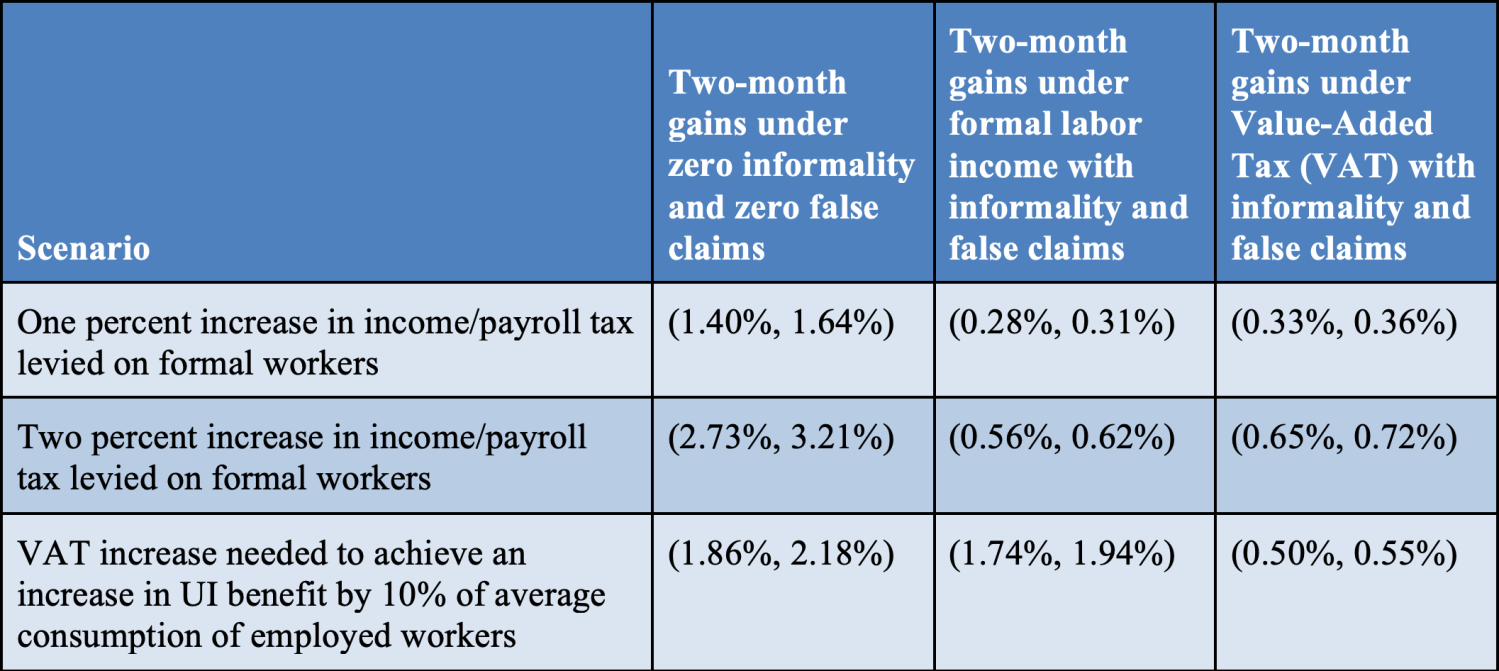

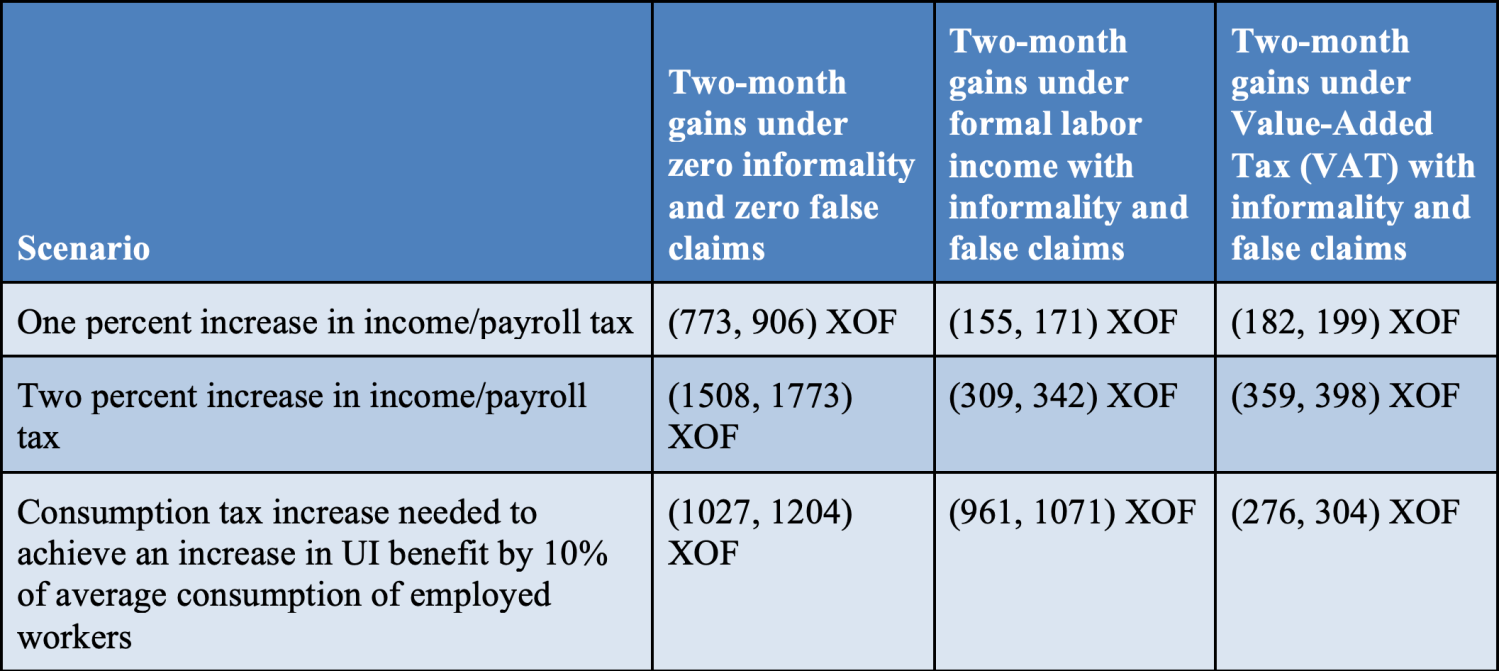

Table 1a illustrates the welfare gains associated with each of the three UI schemes previously described, considering various tax rates. The first column defines the tax rate or benefit level used to calculate the changes in benefits. The last row represents a scenario where the tax rate increase would boost the unemployment benefit to 10% of the average consumption level of employed people (equivalent to 6,090 XOF—the currency code for the West African CFA franc—in our data).

The remaining three columns detail the changes in consumption-equivalent welfare gains for each of the three UI schemes.

Table 1a. Estimated percentage changes in benefits under different UI schemes and for different scenarios

Table 1b. Estimated values of benefits changes under different UI schemes and for different scenarios

Tables 1a and 1b reveal three significant findings related to the welfare gains of different Unemployment Insurance (UI) schemes:

- Standard labor tax-funded UI with no informality or false claims: This ideal scenario yields substantial welfare gains. Specifically, a 1% labor tax levied from formal workers and directed toward UI results in a 1.4% consumption-equivalent welfare gain after two months. While informative as a benchmark, this scenario is not typical of most low-income African countries.

- Standard labor tax-funded UI with high informality and false claims: In a more realistic setting with high levels of informal work and false UI claims, the welfare gains are considerably lower. In the Senegalese context, a 1% labor tax levied from formal workers and directed towards UI leads to only a 0.28% consumption-equivalent welfare gain.

- VAT-funded UI with high informality and false claims: A UI program funded by a consumption tax or VAT performs notably better in environments with high informality and false claim rates. A 1% consumption tax allocated to UI produces consumption-equivalent welfare gains of 0.33%.

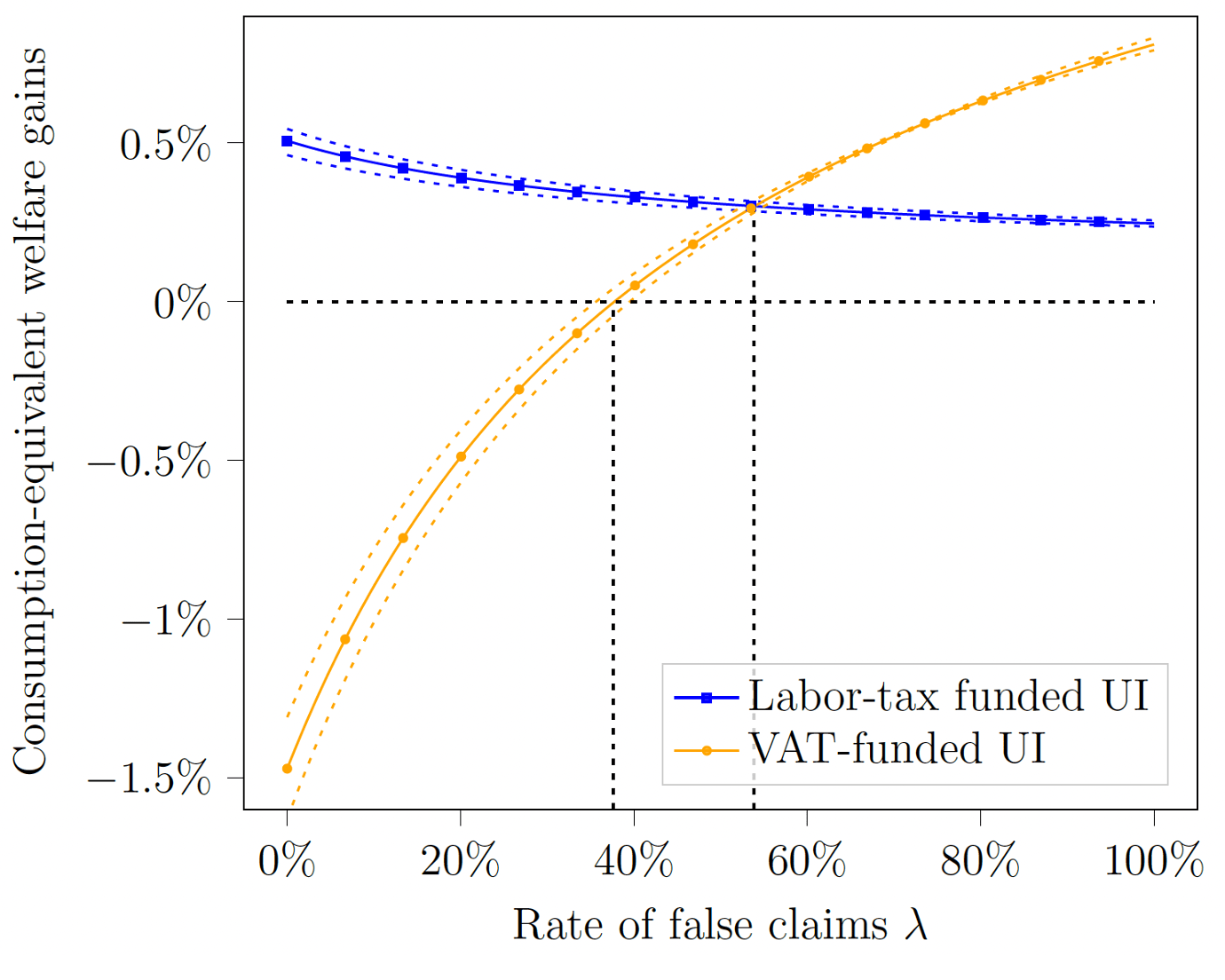

Figure 1 illustrates how welfare gains fluctuate with changes in the rate of false claims (or incidence of fraud) by comparing the effectiveness of labor-tax-funded UI and VAT-funded UI schemes.

Figure 1. Mean consumption-equivalent welfare gains as a function of the rate of false claims made by informal workers

The two policies have opposite trends when the rate of false claims increases. First, an increase in the rate of false claims under the labor-tax-funded UI system implies that the funds raised from taxing formal workers are shared with an increasing number of informal workers. The fact that informal workers have a lower marginal utility of consumption than the unemployed reduces the overall effectiveness of UI. Second, we estimate that the VAT policy is better than the labor-tax policy when the rate of false claims is above 53.5%. A low level of the rate of false claims in the VAT-funded UI leads to lower welfare gains relative to the labor-tax-funded UI system. When the rate of false claims is sufficiently low, such as in economies with highly formalized labor markets, we recover the standard result that a VAT is regressive and can even lead to welfare losses, so the labor-tax-funded policy would be preferable. In our work, we find that the threshold level below which the VAT policy has negative overall welfare effects is equal to 37.5%. However, given a fixed tax rate, VAT financing guarantees a broader tax base and higher revenue. When the rate of false claims is high, this fiscal effect is larger than the regressive effects of a consumption tax, leading to an improvement in welfare over that of the labor-tax-funded UI. When this rate of false claims reaches 100% (that is, all informal workers can claim UI), the VAT funding brings consumption-equivalent welfare gains to its maximum of 0.81%, while the labor-tax-funded policy reaches its minimum of 0.25%.

Our study includes a comprehensive robustness analysis that evaluates the validity of our findings across different enforcement levels, tax evasion rates, roles of informal transfers, sensitivity to varying risk aversion values, and the influence of the informal labor market’s size on UI system design.

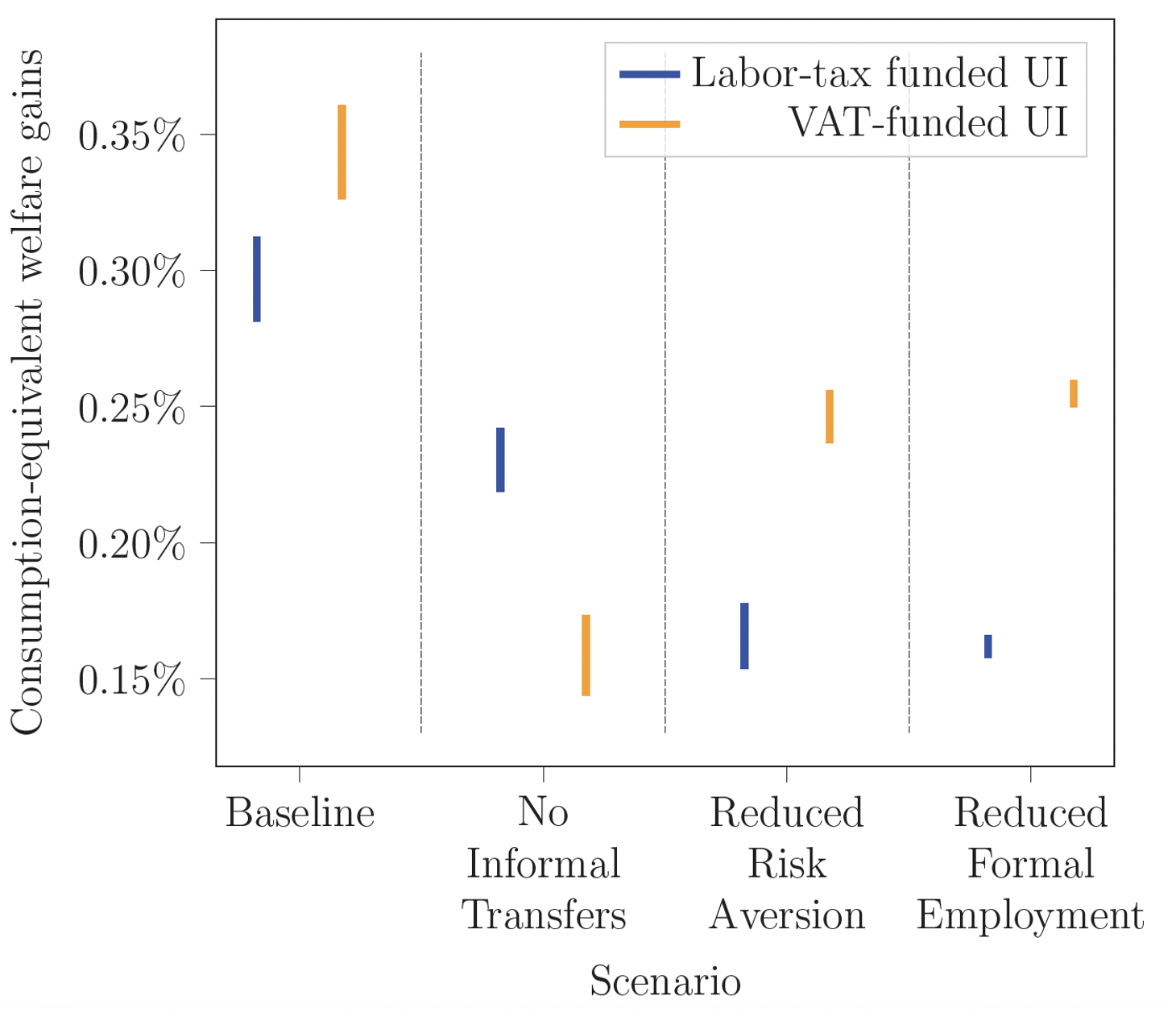

Figure 2 encapsulates the results of all robustness exercises, complete with confidence intervals. It illustrates the consumption-equivalent welfare under the diverse scenarios explored in our robustness analysis, reflecting the two-month welfare effect of a 1% increase in the tax levied from formal workers. In each scenario, the blue line on the left symbolizes the gains with a labor-tax-funded UI system (where the tax is paid solely by formally employed workers), and the orange line on the right signifies the gains with a VAT financing scheme. The length of the lines represents confidence intervals.

This robustness extends to scenarios involving consumption-tax evasion, no informal transfers, standard risk aversion levels, and increased informality. In the scenario with consumption-tax evasion, we assume that a portion of workers are able to purchase consumption through the informal market, thus evading consumption tax altogether. In this scenario, we assume that all informal workers, which represents 56.6% of workers in our data, are able to evade paying the consumption tax. In the scenario with no informal transfers, we shut down the possibility for workers to rely on informal borrowing options during periods of unemployment to allow for a complete crowding-out of informal transfers by the UI policy. In the scenario with modified risk aversion level, we consider a coefficient of relative risk aversion of 2, which is the level commonly used in standard macroeconomic models. In the scenario with increased informality, we aim to account for the fact that our survey primarily focuses on an urban population and may lead to an overrepresentation of formal workers compared to the true composition of the labor force in Senegal. In this scenario, we thus set the share of formal workers to a conservative estimate of 10% of the labor force.

Figure 2 confirms that the primary insight from Figure 1—that a broad-based VAT-funded UI system yields higher welfare than a labor-tax-funded UI system in a low-income economy with extensive informality and weak enforcement—holds across the various conditions that we consider. However, an interesting nuance emerges when considering informal transfers. Suppose unemployed individuals can access consumption from informal transfers at no cost. A complete (100%) crowd-out of these transfers can diminish the advantages of the VAT-funded UI system compared to the labor-tax-funded one.

Figure 2. Comparison of consumption-equivalent welfare gains under different robustness scenarios

Thus, broad-based taxation such as VAT emerges as a potential solution to compensate for weak enforcement, i.e., high false UI claim rates. This policy can lead to substantial and quantifiable welfare gains, demonstrating that the challenges of informality and weak enforcement challenges are not insurmountable.

Thus, broad-based taxation such as VAT emerges as a potential solution to compensate for weak enforcement, i.e., high false UI claim rates. This policy can lead to substantial and quantifiable welfare gains, demonstrating that the challenges of informality and weak enforcement challenges are not insurmountable.

Broad-based taxation as a solution and recommendations for policymakers in sub-Saharan Africa

Broad-based taxation, such as VAT, emerges as a viable solution to counteract weak enforcement and high false UI claim rates. This approach can lead to substantial and quantifiable welfare gains, proving that the challenges posed by informality and weak enforcement are not insurmountable obstacles.

The study’s findings provide actionable insights for policymakers in low-income countries, particularly in sub-Saharan Africa. To optimize welfare gains from UI schemes, we propose the following strategies:

- Design informative labor force surveys: Policymakers should create labor force surveys that yield meaningful insights into workers’ and non-workers’ potential responses under various benefit schemes. Unlike many labor market surveys that merely capture a snapshot of the labor market at a given time, there is a need for a more dynamic approach. National statistical agencies should be empowered to run comprehensive surveys that can measure labor market flows from formal work to informal work to unemployment, akin to the measurement of growth in national income.

- Tailor UI schemes to the local context: The design of UI schemes must take into account the prevalent levels of informality, enforcement capacity, moral hazard, and liquidity constraints faced by workers. A context-sensitive approach is essential.

- Use broad-based taxation as a funding source: Broad-based taxation, such as VAT, an inflation tax, or donor grants can serve as an effective funding sources for UI, offsetting the challenges posed by high false claim rates and weak enforcement.

- Invest in robust enforcement mechanisms: While broad-based taxation can alleviate some enforcement issues, further investment in strengthening enforcement mechanisms will enhance UI schemes’ effectiveness. Policymakers should strive for clarity and transparency in these schemes.

- Promote awareness of UI’s importance: Policymakers must actively work to expand UI’s prevalence in low-income countries. This can be achieved through awareness campaigns and by showcasing the tangible welfare improvements that effective UI schemes can deliver.

These recommendations form a comprehensive blueprint for designing and implementing UI schemes capable of delivering significant welfare enhancements, even in environments marked by high informality and weak enforcement. The success of UI schemes hinges on a meticulous evaluation of the behavioral responses of workers and non-workers within the specific local labor market context.

-

Footnotes

- Vodopivec, M., 2009. Introducing unemployment insurance to developing countries. Social Protection Discussion Papers and Notes 49170. The World Bank.

- Breza, E., Kaur, S. and Shamdasani, Y., 2021. Labor Rationing. American Economic Review, 111(10), 3184–3224.

- Donovan, K., Lu, W.J. and Schoellman, T., 2021. Labor Market Dynamics and Development. Working Paper.

- Alfonsi, L., Bandiera, O., Bassi, V., Burgess, R., Rasul, I., Sulaiman, M. and Vitali, A., 2020. Tackling Youth Unemployment: Evidence from a Labor Market Experiment in Uganda. Econometrica, 88(6), 2369–2414.

- Gharad, B., Chowdhury, S. and Mobarak, A.M. 2014. Underinvestment in a Profitable Technology: The Case of Seasonal Migration in Bangladesh. Econometrica, 82(5), 1671–1748.

- Hamory, J., Kleemans, M., Li, N.Y., and Miguel, E., 2020. Reevaluating Agricultural Productivity Gaps with Longitudinal Microdata. Journal of the European Economic Association, 19(3), 1522–1555.

- Benjamin, N., and Mbaye, A.A. 2012. The Informal Sector in Francophone Africa, The World Bank

- Cirelli, F., Espino, E., and Sanchez, J.M., 2021. Designing unemployment insurance for developing countries. Journal of Development Economics, 148, 102565.

- Duval, R.A., and Loungani, P., 2019. Designing labor market institutions in emerging and developing economies: Evidence and policy options.

- Cox, D., and Fafchamps, M., 2007. Extended family and kinship networks: economic insights and evolutionary directions. Handbook of development economics, 4, 3711–3784.

- Cox, D., Eser, Z., and Jimenez, E., 1998. Motives for private transfers over the life cycle: An analytical framework and evidence for Peru. Journal of Development Economics, 55(1), 57–80

- Chetty, R., 2006. A general formula for the optimal level of social insurance. Journal of Public Economics, 90(10), 1879–1901.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).