This viewpoint is part of Chapter 5 of Foresight Africa 2026, a report on how Africa can navigate the challenges of 2026 and chart a path toward inclusive, resilient, and self-determined growth. Read the full chapter on rebooting global partnerships.

While the zero-tariff policy appears in favor of increasing African exports to China, the story is not as straightforward.

In the summer of 2025, China announced the expansion of its preferential access for African nations, extending its zero-tariff policy for Least Developed Countries (LDCs) to encompass all African countries, except for Eswatini (which still maintains diplomatic relations with Taiwan).1 The policy eliminates all tariffs on Chinese imports originating from Africa, a measure that—in principle—could deepen economic ties between China and Africa by granting African exports greater access to the Chinese market. However, while the zero-tariff policy appears in favor of increasing African exports to China, the story is not as straightforward.

China’s persistent trade surplus: Africa’s exports dominated by minerals and raw materials

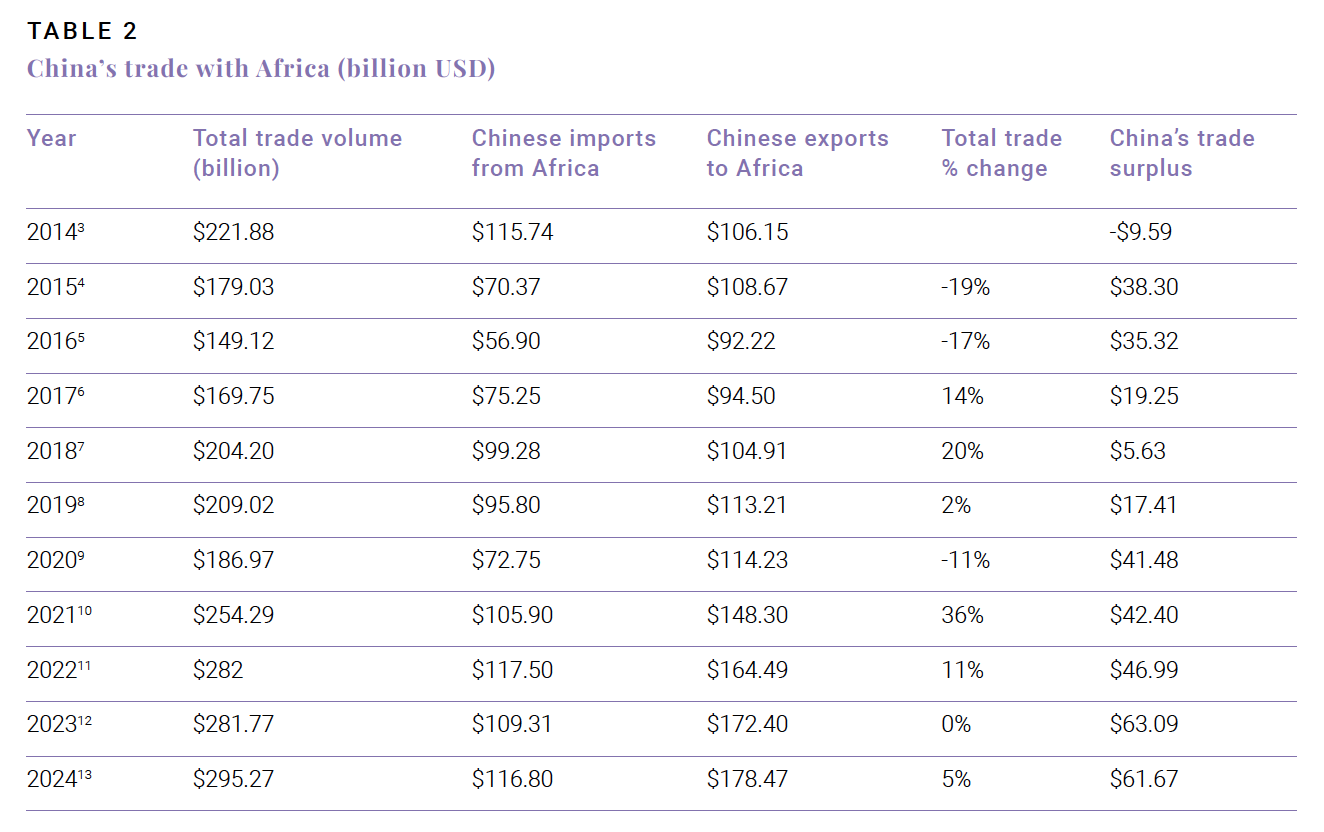

First, contrary to the conventional belief that China is a primary consumer of African natural resources and should therefore be running a large trade deficit vis-à-vis Africa, China has consistently run a trade surplus with the continent since 2015.

In terms of trade composition, it is indeed true that raw materials and natural resources remain the dominant export from Africa to China. By 2023, China’s leading imports from the least developed countries in Africa were mineral resources—about 40% of the total bilateral trade.2 These were closely followed by “non-edible materials” and “finished products categorized by raw materials,” which made up 29.2% and 29.7% of Chinese imports from Africa respectively. Despite China’s efforts to build Africa’s industrial capacity and to assist in the continent’s industrialization, Africa’s exports to the Chinese market remain concentrated in low-value, primary products.

On the continental front, Africa’s trade deficit with China is widening. While African exports to China have been increasing, its imports from China have grown even faster, to the extent that the continent collectively runs a $60 billion deficit vis-à-vis China.3

The role of agricultural exports

Trade of agricultural products deserves special attention because China has vowed to support African export of agricultural products. Indeed, to this end, Beijing established a “Green Channel” for African agricultural products to enter the Chinese market in its 2021 FOCAC commitment. The trade facilitation measures removed many of the tariffs as well as simplified customs procedures, including inspection. They have borne some fruit: By 2023, agricultural trade reached $9.35 billion, a 6.1% increase from the previous year, which is impressive.4 However, agricultural trade still constituted only 3.3% of total China-Africa trade that year. The focus on natural resources and minerals in China’s imports from Africa has not shifted at all.

Improving trade will take more than zero-tariffs alone

In the context of these realities, duty-free access alone does not necessarily change the unbalanced trade picture between China and Africa. On its own, expanding the zero-tariff policy to more African countries does not address the region’s need for economic restructuring, industrial upgrading, and supply chain transformation. Unless the policy facilitates capacity building and long-term economic growth based on industrialization and digitization, a zero-tariff policy may just deepen Africa’s status as the supplier of raw materials.

But the zero-tariff policy does offer a unique opportunity that could have an indirect but long-term impact on Africa’s growth, just not directly and not solely through boosting African exports of raw materials. With China’s zero-tariff policy, Africa could attract new foreign direct investment (FDI) from companies that wish to evade high tariffs elsewhere. For these companies, supply chain adjustment and setting up production or processing centers in Africa could offer another entry point into the Chinese market at a significantly lower tariff cost. That could translate into investment flows into Africa, as well as training and skilling programs for African labor to boost local capacity.

Africa has a long way to go to make use of the potential the zero-tariff policy offers. The policy is not just a way to boost exports, especially exports of raw materials. Instead, it should be treated as an opportunity to optimize resource allocation to improve Africa’s hardware and software infrastructure for structural transformation and long-term growth. A strategic channel could be through Africa’s advantageous position as a low-cost entry into the Chinese market. In the era of global trade war, that is gold.

-

Footnotes

- “China-Africa Changsha Declaration on Upholding Solidarity and Cooperation of the Global South,” Ministry of Foreign Affairs People’s Republic of China, June 11, 2025.

- China Institute of WTO Studies, Quantitative Analysis Report on International Economic and Trade Rules, Issue 8 (University of International Business and Economics, 2024).

- “In 2014, Trade Volume between China and Africa Exceeded US$220 Billion for the First Time,” Huanqiu. Com, January 25, 2015., “In 2015, the Trade Volume between China and Africa Was US$179 Billion, down 19.2% Year-on-Year.,” Huanqiu.Com, February 3, 2016., Xiaoyu Li, “2016 Trade Data and Related Rankings between China and African Countries,” Chinafrica, April 11, 2017., “China-Africa Trade Data | 2017 China-Africa Trade Data and Related Rankings,” China-Africa Friendly Economic and Trade Development Foundation, February 26, 2018., “The Resilience of China-Africa Economic and Trade Exchanges Highlights and Leads China-Africa Cooperation to Mutual Benefit and Win-Win Results,” Guangming Daily, May 19, 2022., “Statistics on China-Africa Economic and Trade Cooperation Data in 2019,” Ministry of Commerce of the People’s Republic of China, March 6, 2020., China-Africa Economic and Trade Expo Secretariat, Report on China-Africa Economic and Trade Relations (Institute of International Trade and Economic Cooperation of the Ministry of Commerce, 2021)., “The Research Institute of the Ministry of Commerce Released the ‘Report on Economic and Trade Relations between China and Africa (2023),’” Ministry of Commerce of the People’s Republic of China, July 10, 2023., “The Research Institute of the Ministry of Commerce Released the ‘Report on Economic and Trade Relations between China and Africa (2023).’”, “China-Africa Trade Data: 2024 China-Africa Trade Data and Related Rankings,” News.Afrindex.Com, January 20, 2025., “China-Africa Trade Data: 2024 China-Africa Trade Data and Related Rankings.”, “China-Africa Trade Data: 2024 China-Africa Trade Data and Related Rankings.”

- “Overview of Agricultural Product Trade between China and African Countries in 2023,” China Chamber of Commerce for Import and Export of Food, Native Produce and Livestock, n.d.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Can zero-tariff policy rebalance China-Africa trade?

January 27, 2026