This chapter is part of USMCA Forward 2025, which focuses on areas where deepening cooperation between the United States, Mexico, and Canada can help advance key economic and national security goals.

The U.S. CHIPS and Science Act, enacted in August 2022, primarily focuses on bolstering domestic semiconductor manufacturing and research within the United States. However, the legislation also allocates $500 million over five years to the International Technology Security and Innovation (ITSI) Fund, managed by the U.S. Department of State. This fund aims to facilitate collaboration with international partners to enhance global semiconductor supply chain security and diversification. This includes growing efforts to foster and develop a North American ecosystem that can support key elements of the semiconductor supply chain over the long term that can act as a supporting mechanism for the front-end manufacturing-focused CHIPS Act funded efforts to reshore advanced node capabilities within the United States. Here the U.S. is banking on the importance of both Mexico and Canada for help to meet U.S. goals around building semiconductor manufacturing capacity and supply chains in North America. This includes taking advantage of trade frameworks such as the U.S.-Mexico-Canada Agreement (USMCA) to support trade in the technologies and components key to semiconductor supply chains and to reduce investment risks.

U.S. funding efforts under the ITSI framework are beginning to ramp up, and 2025 will be a key year for the program in North America. While the funding aspects of the ITSI framework are focused on countries with less-developed capabilities to support semiconductor supply chains with a particular focus on expanding cooperation with Mexico, other important players such as Canada are also part of the mix. These players are participating in efforts to assess gaps in key areas that could be boosted via partnerships and contribute to the overall growth of a North American ecosystem that can support advanced node semiconductor manufacturing and packaging over the next decade.

Mexico is the focus so far of ITSI efforts in 2024, but aperture in 2025 will expand in the Americas

In March 2024, the U.S. Department of State announced a partnership with the government of Mexico to explore opportunities for expanding and diversifying the global semiconductor ecosystem. This collaboration, under the ITSI Fund, began with a comprehensive assessment of Mexico’s existing semiconductor industry, regulatory framework, workforce, and infrastructure needs. Key stakeholders, including state governments, educational institutions, research centers, and companies, participated in this analysis alongside Mexico’s Secretariat of Economy. The insights gained are intended to inform future joint initiatives aimed at strengthening and growing Mexico’s role in the semiconductor sector.

The focus of international collaborations under the CHIPS Act and ITSI framework has predominantly been on partnerships with countries like Mexico to enhance regional semiconductor supply chains. As noted, several key stakeholders have participated to enhance Mexico’s semiconductor ecosystem. These include:

- Educational institutions. Arizona State University (ASU) has been instrumental in workforce development initiatives and will remain one of the centerpieces of the entire ITSI-backed effort in North America and in other countries that ITSI is focusing on in Asia. ASU launched the “English for the Semiconductor Industry” course, benefiting over 10,000 participants across Mexico. Additionally, ASU conducted “train the trainer” workshops in Hermosillo and Tempe, focusing on semiconductor education.

- Research centers. This collaboration involves comprehensive assessments of Mexico’s semiconductor ecosystem, including research capabilities. This suggests the involvement of national research institutions in the evaluation process.

- Companies. The partnership includes engagement with private sector entities. For instance, over 350 professionals from Skyworks, an electronics manufacturer with facilities in Mexicali, have participated in the semiconductor English course.

As of late 2024, the general thrust of progress with Mexico under the ITSI partnership was becoming clearer. Based on current initiatives and strategic objectives, the following developments are anticipated:

- Workforce development initiatives. Building on existing collaborations, such as the partnership with ASU to provide semiconductor industry training, further programs are expected to enhance the skills of Mexican professionals in semiconductor assembly, testing, and packaging (ATP). These initiatives aim to align educational curricula with industry needs and promote greater participation of women in the semiconductor sector.

- Policy and regulatory reforms. Efforts are likely to continue in strengthening Mexico’s regulatory framework to attract semiconductor investments. This includes establishing coordination mechanisms across government institutions and stakeholders, developing a national semiconductor strategy, and facilitating trade of relevant inputs through streamlined customs processes.

- Supply chain development. Programs may focus on promoting the development of Mexican small and medium-sized enterprises (SMEs) within the North American semiconductor supply chain, fostering partnerships between U.S. and Mexican firms and facilitating the sourcing of inputs from within Mexico to support semiconductor manufacturing operations.

This collaboration underscores a multisectoral approach, involving educational institutions, research centers, and companies, to strengthen and diversify Mexico’s role in the global semiconductor supply chain. The ITSI approach in the Americas includes partnerships with Costa Rica and Panama, in addition to Mexico.

2025 will be key for launching new efforts and focusing investment in a North American ecosystem for semiconductor development

Early in 2025, several important initiatives will be coming together to drive further progress in the development of a broader North American ecosystem designed to support advanced semiconductor manufacturing centered in the United States and driven by CHIPS Act funding.

First, the CHIPS Act funding process saw significant progress in the last few months of 2024 as the Biden administration finalized agreements and began issuing awards to major front-end manufacturing firms including TSMC, Samsung, Intel, and Micro. The CHIPS Program Office in 2025 will be shifting from investment to portfolio management as it monitors progress across the CHIPS Act recipients and identifies gaps where further funding under a notional CHIPS 2.0 could assist in building out a sustainable ecosystem.

Under the ITSI effort, in February 2025, the collaborative efforts between Mexico and ASU will be formally launched. In addition, ecosystem reviews under an ITSI-funded program at the Organization for Economic Cooperation and Development (OECD) will be released through the first quarter of 2025. The OECD, through ITSI funding, is working through the Committee on Industry, Innovation and Entrepreneurship (CIIE) and the Committee on Digital Economy Policy (CDEP) and pursuing a number of efforts on semiconductor supply chains.1 These country reviews will include Mexico, Panama, and Costa Rica in the Americas, and Vietnam and the Philippines in Asia. The reviews will cover critical areas such as supporting infrastructure, energy-related capacity, and the skills gap.

In addition, in mid-January the Dominican Republic hosted a critical meeting of the Americas Partnership for Economic Prosperity (APEP) countries, including Mexico, Canada, and Costa Rica. The APEP effort is designed to reinforce economic cooperation in the hemisphere and to specifically support the development of more resilient and secure supply chains, meaning key technology-related inputs such as semiconductors. This meeting focused on the issue of financing, which is considered a major missing piece in the Americas for funding efforts to build out resilient and secure supply chains in complex technology sectors such as semiconductors. The focus of these efforts, in alignment with ITSI, is on workforce development and a supplier ecosystem. While the U.S. has a long and rich history of financing via venture capital and private equity, particularly the so-called “patient equity” required for sectors such as semiconductors, this approach to financing has lacked broader uptake in the rest of the Americas.

The APEP meeting will tackle issues around how to develop a financial framework for funding elements of a North and Central American semiconductor manufacturing ecosystem. In addition, via ITSI and APEP, the goal is to educate policymakers under the new Mexican administration—President Claudia Sheinbaum has indicated semiconductors are a top priority, and hence, Mexico’s partnership with ITSI is of major importance—and among the other APEP countries on efforts to galvanize resources to support building a semiconductor manufacturing ecosystem capable of supporting advanced front-end manufacturing in the United States. As part of this effort, the U.S. government will provide input about what countries need to gain access to funding via organizations such as the U.S. International Development Finance Corporation (DFC), the International Finance Corporation (IFC), and private venture capital. In addition, ITSI is also partnered with key industry associations such as SEMI and the Semiconductor Industry Association (SIA), which will also participate in the APEP conference.

In addition, in early 2025, there will be another iteration of the Government Leaders Forum (GLF) held in Tempe, Arizona, with ASU. The GLF in the context of ITSI is a platform where key decisionmakers and industry leaders come together to discuss and collaborate on issues related to global semiconductor supply chain security and workforce development, facilitated by the U.S. Department of State and ASU, leveraging funds from the ITSI fund established under the CHIPS Act. In November 2024, a GLF event—with partners including SIA—was held at ASU’s Tempe campus and included leaders from Costa Rica, the Philippines, and Vietnam to discuss workforce development and boosting collaboration in the ATP sector among key U.S. allies in Asia and the Americas. The early 2025 meeting will include leaders from Mexico, Panama, and Indonesia and focus on these same two issues.

This trifecta of events in early 2025—Americas Partnership for Economic Prosperity, Government Leaders Forum, and the Mexico/ASU launch—will go a long way to determine the future trajectory of all of these efforts overseen by the ITSI Fund and the U.S. State Department to drive progress on developing a viable semiconductor system in the Americas to support advanced semiconductor manufacturing. These efforts will pick up steam in 2025 at TSMC fabrication facilities in Arizona, and in 2026-2028 at facilities under construction by Intel in Arizona, Ohio, and Oregon, and Samsung in Texas.

One major ongoing challenge is accelerating the development of ATP capacity in the U.S.—the vast majority of ATP capacity currently resides in Asia with much advanced packaging being proprietary and includes separate complex supply chains. The CHIPS Program Office and ITSI are intent on avoiding a situation where leading front-end manufacturing firms are producing advanced semiconductors in the U.S. and then shipping them back to Asia for packaging and testing. TSMC facilities in Arizona, for example, will be doing pilot production in early 2025, including likely for graphics processing unit (GPU) leader Nvidia, but they will need to ship all production back to Taiwan for packaging as all of TSMC’s proprietary chip-on-wafer-on-substrate (CoWoS) packaging capacity is currently in Taiwan. As of early 2025, the Trump administration was reportedly in discussions with both TSMC and Intel about potential collaboration around bringing advanced packaging to U.S.-based locations as part of a broader reassessment of CHIPS Act funding and potential restructuring of Intel’s manufacturing and foundry operations.

In addition, the overall effort will benefit in early 2025 from the release of the OECD studies, which will show just how quickly particular countries are moving to address the challenges around issues such as workforce development. While there has been considerable progress over the past year to address all the challenges facing development of a robust supportive ecosystem for semiconductor manufacturing in the Americas, there are political realities that mean progress in 2025 will face challenges. For example, while the ASU engagement efforts are well organized and supportive, getting to government agreements that will ensure the programs can move forward will require some time and effort.

ITSI personnel have provided regular updates on progress to congressional staff, and they have stressed that the program is part of foreign assistance and should not be viewed as industrial policy. In addition, support in the new administration appears likely as ITSI does not have issues similar to the CHIPS Act around the many guardrails that the U.S. Department of Commerce included as part of the awards process, such as mandated child care, that some in Congress see as going beyond the intent of the CHIPS Act. It remains unclear how the new Trump administration will view the CHIPS Act overall and specific pieces such as ITSI, and there could be pressure to reduce or hold up funding until the new administration has assessed the program. The new Department of Government Efficiency (DOGE) under Tesla CEO Elon Musk could also become involved in this area.

Looking ahead, some uncertainty on the horizon

Finally, Canada’s efforts in this arena will evolve in 2025. Ottawa is a participant in APEP and also an important partner in the OECD’s work on semiconductor supply chains. But Canada has a well-developed education system and does not require the same type of attention and funding around issues such as workforce development as the primary ITSI partners. The U.S. Commerce Department’s Workforce Center of Excellence under the National Semiconductor Technology Center (NSTC) will be a deep well of semiconductor workforce and other information that Canada and all the ITSI partners can access. U.S. officials are putting a lot of effort into the Workforce Development Center of Excellence and because all countries in the Americas including Canada will need to upgrade their workforce—and Canada has major educational institutions that provide a major advantage—the country is likely to play a larger role overall in the coming years in the development of a long-term and sustainable semiconductor supply chain ecosystem in the Americas.

Support for the entire effort from the incoming Trump administration also remains a potential challenge, though given the bipartisan support for the CHIPS Act and the fact that CHIPS funding has gone to a number of “red states,” it is likely that the new administration will continue support for CHIPS programs, including ITSI. As noted above, there could be some pause in the program to review progress as the new administration takes a hard look at the overall CHIPS effort, and then this could be followed by a restructuring and rebranding of the program. In 2025, ITSI will also review new grant proposals from Costa Rica, the Philippines, Mexico, and Vietnam, determine where to build new programs, and assess what is missing in terms of policies and regulatory reforms. The funding for ITSI for 2025 has been appropriated and will likely move forward as part of the National Defense Authorization Act (NDAA), and the success of programs in 2025 will be a major factor in terms of getting renewed funding in 2026 for the overall effort.

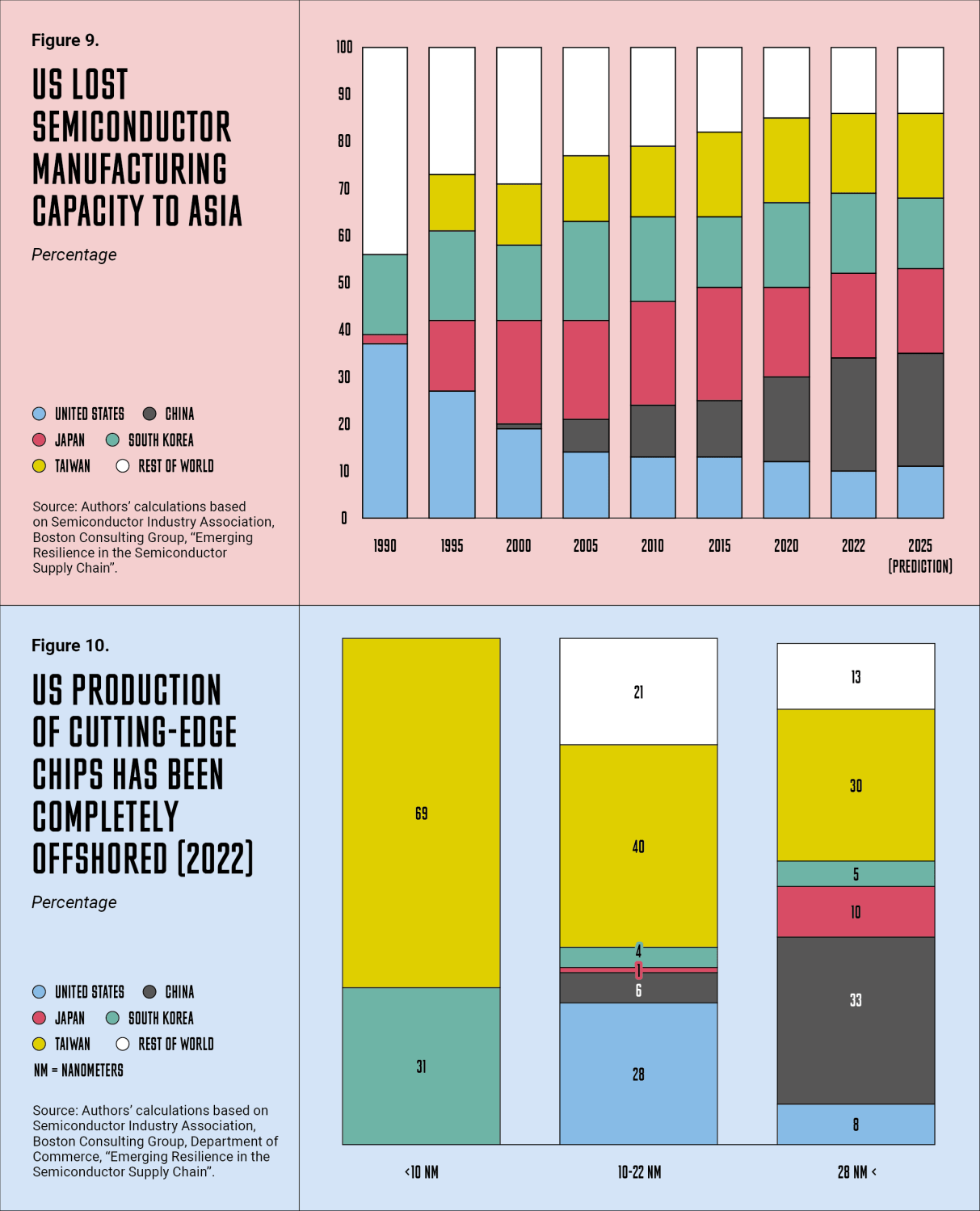

Sustained government support and political will, along with financial and industry support, will determine the degree to which Commerce Secretary Gina Raimondo’s vision of a U.S.-centered manufacturing capacity of around 20% of advanced node semiconductor manufacturing by 2030 can become a reality. This would require support from greater workforce development and packaging ecosystems in North America and throughout the Americas.

Finally, Trump’s proposed across the board 25% tariffs on imports from Mexico and Canada could upend these opportunities for regional cooperation around building semiconductor manufacturing capability. These tariffs would call into question the ongoing viability of USMCA and thereby raise investment risks. It would increase the cost of trade in components for building semiconductor supply chains. Perhaps most importantly, given anticipated retaliation from Canada and Mexico in terms of tariffs on U.S. imports, these tariffs would likely ignite a trade war that could spill over into other areas of North American cooperation, including around semiconductors. This would ultimately undermine the U.S. goal to reduce dependencies on Asia for semiconductor manufacturing.

Related viewpoint

-

Footnotes

- The relevant workstream here is the OECD effort to build a semiconductor exchange network of officials involved in semiconductor industry policymaking where participants exchange information on the current state of the semiconductor ecosystem and recent public and private initiatives in their respective countries.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).