Below is Chapter 5 of the 2026 Foresight Africa report, which brings together leading scholars and practitioners to illuminate how Africa can navigate the challenges of 2026 and chart a path toward inclusive, resilient, and self-determined growth.

Introduction: Key trends driving Africa’s global positioning

From pandemic aftershocks to rising debt distress and tightening global liquidity, African economies have undergone significant strain over the past few years. Yet even amidst these challenges, the continent is also outperforming the rest of the world in key areas and is facing promising future trends that will drive profound change.1 Africa was the fastest growing region in 2025 and home to 11 of the 15 fastest growing economies in the world.2 By 2050, one-quarter of the world will be African, and the number of Africans in urban areas will double from 700 million today to 1.4 billion.3 Consumer and business spending on the continent is also expected to reach $16.1 trillion.4

As featured in Figure 21, there are 13 key trends that are reshaping Africa’s opportunities to drive sustainable development. However, the continent’s ability to harness these transformative opportunities increasingly depends on how it navigates a complex web of shifting international dynamics: traditional development models are being fundamentally restructured, new partners are offering alternative cooperation models, and official development assistance (ODA) is on the retreat.

A dynamic landscape: Trends reshaping Africa’s agency on the global stage

Chief among these dynamics is the tightening of global aid amidst rising need. Eleven countries, accounting for 75% of global ODA in 2024, have announced cuts in the next two years. For the first time since 1995, four countries (France, Germany, the U.K., and the U.S.), who have accounted for almost two-thirds of global ODA over the past decade, have announced funding cuts.5

With traditional partners scaling back ODA, new partners are stepping up. Ireland, Korea, and Spain, for example have announced increases to ODA while Denmark, Norway, and Luxembourg have pledged to maintain their current commitments. The Gulf States have also accelerated their engagement with the continent. The UAE has led with security assistance in sub-Saharan Africa and Qatar has become an active mediator in conflicts including negotiations between Ethiopia and Sudan in 2010 and Rwanda and the DRC in 2025.

Rewriting the playbook: Setting a foundation for African leadership

The potential for African states—and the continent as a whole—to take a leading role in global affairs requires intentional and structural reforms. African governments need to plug persistent gaps in funding, leverage private capital, enhance security and resilience, and focus on implementation.

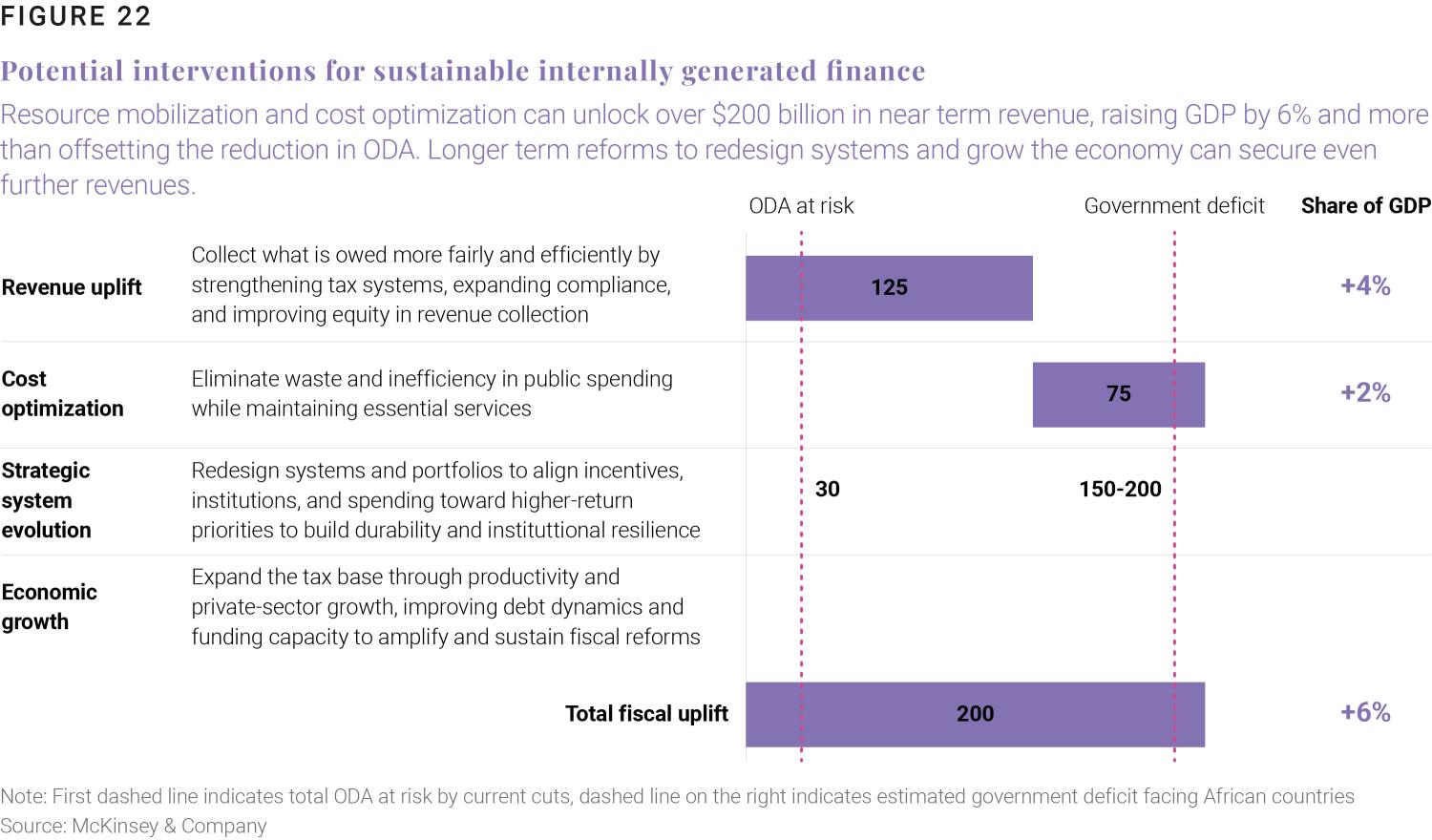

Mobilize domestic resources: Africa’s average tax-to- GDP ratio is 16% (well below the 34% average for OECD countries) but has significant variation. As of 2022, Somalia, Congo, Equatorial Guinea, and Niger have tax-to-GDP ratios below 10%, but Tunisia and Morocco have managed to reach over 30%.6 This gap could potentially be addressed domestically through key levers such as improving tax collection (without harming growth); expanding non-tax revenue; as well as government cost optimization (Figure 22). This is more than sufficient to cover the gap created by retreating ODA. (For a more detailed discussion on strategies to mobilize Africa’s own resources for development, see Chapter 1.)

Finance instruments that leverage private capital: A key insight from recent years is that the composition of financing matters more than the headline total. While Africa attracts sizable flows, the mix remains skewed toward grants and traditional loans, rather than mechanisms that mobilize domestic banks, pension funds, and institutional investors at scale. An opportunity exists to shift the mix toward instruments that attract and leverage private capital—such as blended finance facilities, risk-sharing guarantees, and local currency infrastructure funds—and to replicate models already proving effective both on the continent and in peer emerging markets. Local actors in government and civil society will be needed to fill financing gaps and might be better suited to guide such finance towards pressing local priorities.7

Some examples include:

- Blended finance platforms that pair ODA/other official flows with development bank guarantees to de-risk local currency lending and extend tenors.

- Pipeline accelerators and technical assistance/ Viability Gap Funding mechanisms that systematically take projects from concept to bankability.

- Regional revolving funds that recycle repayments into new infrastructure and SME financing, compounding the impact of limited concessional capital.

When executed effectively, these vehicles can transform grant dollars into risk capital that attracts domestic and global investors, a critical need in a region where private sector investment and equity remain underutilized.

Strengthen regional development and security: Rather than outsourcing security to overseas partners, African countries can benefit from taking a regional or continental approach to security. In the Sahel, a recent study estimates that a pan-African approach can outperform the EU’s security-development nexus by linking infrastructure and socioeconomic programs to security ones.8 Strong regional bodies and pan-African approaches can protect public goods, overcome conflicts, and consolidate peace and human rights.

Move from policy intention to policy implementation: The state of implementation of the 17 Sustainable Development Goals varies across Africa. South Sudan, the Central African Republic, Chad, Somalia, the DRC, and Sudan are at less than 50% implementation, while Mauritius, Morocco, and Algeria are above 70%. Going forward, political will and accountable leadership (across the personal, peer, vertical, horizontal and diagonal levels) will be key to drive implementation.9 As discussed in recent reports from the OECD,10 the Brookings Institution,11 and the Policy Center for the New South,12 policymakers can consider policy implementation models for accelerated performance. Matland’s ambiguity-conflict model is particularly useful in identifying critical factors for driving implementation in each context, from the community up to the global level.13

Opportunities for expanding African leadership

For the continent to take a leadership role in today’s global affairs, intentional and structural reforms are required. Below are three key opportunities that African countries should seize in order to make the most of the current moment.

1. Using new partners and new partnership dynamics to Africa’s advantage

The growth of South-South cooperation, coupled with renewed diplomatic engagements from both emerging and traditional partners, including from countries such as Australia, Brazil, China, India, Japan, and the U.S.14 (as evidenced by the increased number of Africa summits and visits in recent years) provides African countries with an opportunity to use this moment to assert their priorities.

For the continent to take a leadership role in today’s global affairs, intentional and structural reforms are required.

Strategize based on the partner: Speaking with a unified voice at the regional or continental level can be incredibly effective to take advantage of the growth in bargaining power that comes with more options in partners. At the same time, and given the current political environment, African nation states could also consider a strategic posture of a transactional approach to open new engagement opportunities. The DRC’s minerals for security deal with the U.S. and Somalia’s port access proposal with Ethiopia relied on partners’ preferences for bilateral, transactional proposals.15 Countries pursuing such approaches should ensure that their achievements converge with broader regional agendas, working hand in hand with national, regional, and continental officials, while leveraging strong bilateral relationships to also advance broader continental objectives.

Elevating the role of local actors: Local actors like civil society, local government, local authorities, and community groups will inevitably have to step in to fill financing gaps and might actually be better suited to guide financing to the most pressing local priorities, even in partnership with new emerging partners.16

Consider strategic advantages: The race for critical minerals that power the technologies of the future (including the battery value chain and clean energy technologies) is an example of how strategic advantages can open new avenues for African agency, as new partnerships grow from this demand. As discussed in a recent Brookings brief, African countries can grant themselves the upper hand in such partnerships, including through regulatory and policy reforms.17

2. A rising global presence for Africa

Africa’s growing representation and influence in global institutions create a unique opportunity for coordinated action, one that African countries should seize to shape outcomes for the continent and the world.

Growing influence in global fora: The continent has momentum built from South Africa’s leadership of the G20 and the African Union (AU) gaining a seat in this body. At this year’s G20 summit, African countries spoke on the need for more fair global finance, establishing an Africa expert panel that will recommend ways to lower borrowing costs and improve the continent’s agency in global financial governance.18 At the U.N. Security Council, the A3 (the three African members) have become a coordinated diplomatic coalition via joint statements, joint negotiating blocs, and alignment with the AU. Consequently, the Peace and Security Council has become a vehicle through which African priorities and voices are advanced.19

African countries should leverage this momentum to advance their objectives, including forging equitable partnerships that prioritize value addition, technology creation, and expanding Africa’s voice in global finance, amongst other issues. In the context of fractured commitments to (or mistrust in) multilateralism, continuing to strengthen the coordination of African leadership to reflect priorities of the continent will be critical to drive action on areas like climate change and global financial governance.

3. Leveraging technologies to create innovative partnership opportunities

Many African countries are already leading the way in digital and advanced technology adoption, offering promising pathways for new types of partnerships that can leverage Africa’s strengths in entrepreneurship and youth.

Seizing the digital revolution and AI momentum: Africa leads the world in mobile money growth,20 including in Kenya, which reached a 91% mobile money penetration rate in 2025.21 Success in mainstreaming mobile money through a strategic blend of regulation, infrastructure, and partnerships means that Africa now has an opportunity to build off this success, including AI-driven financial tools and advanced interoperability frameworks.22

The economic opportunity of the Fourth Industrial Revolution (4IR) in Africa is incredibly large.23 GenAI alone could unlock $100 billion in Africa, according to a McKinsey analysis,24 while AI overall could double Africa’s GDP rate.25

Bridging the AI and digital divide: To ensure that African countries are not left behind as AI and the 4IR advance, policymakers could implement strategies at the national, regional, and continental level, covering both the management of risks and the promotion of innovation, each with clear roles for stakeholders.26 University-private sector partnerships can help anchor AI research and development on the continent, train Africans, and invest in publicly available datasets so African entrepreneurs and innovators can benefit. African policymakers could also focus on investment in cybersecurity, anticipatory regulatory frameworks, and public-private partnerships that could unlock areas where African countries might lead, for example, AI use cases in energy.

Conclusion: Africa’s moment to lead

Moving forward, Africa’s success will depend on seizing the three opportunities listed above, but with three strategies in mind.

First, diversifying partnership portfolios to reduce overreliance on traditional donors and using the continent’s leverage to its advantage. Second, institutionalizing value-addition requirements and technology transfer clauses that ensure partnerships contribute to long-term capacity building. Third, strengthening regional coordination through bodies like the AU and emerging frameworks like the Africa AI Council. African countries must maintain an unwavering focus on sustainable development outcomes and transform this moment of dynamic global power relationships into an opportunity to lead the way.

Related viewpoints

-

Footnotes

- Landry Signé, Realizing Africa’s Potential: A Journey to Prosperity (Brookings Institution Press, 2025).

- British A. Robinson, “The $2.5 Trillion Opportunity US Investors Can’t Access,” Milken Institute, November 26, 2025.

- Andrew Stanley, “African Century,” Finance & Development, September 2023; “Africa’s Unprecedented Urbanization Is Shifting the Security Landscape,” Africa Center for Strategic Studies, May 12, 2025.

- Landry Signé, Unlocking Africa’s Business Potential: Trends, Opportunities, Risks, and Strategies (Brookings Institution Press, 2020); Signé, Realizing Africa’s Potential.

- OECD, Cuts in Official Development Assistance: OECD Projections for 2025 and the near Term, OECD Policy Briefs, 26th ed., OECD Policy Briefs (2025).

- Jakkie Cilliers, “The Rising Stakes of Foreign Investment in Africa,” ISS Today, September 2, 2025.

- Landry Signé, “Development Strategies in a Changing Global Political Economy,” in Development Co-Operation Report 2023: Debating the Aid System, Development Co-Operation Report (OECD Publishing, 2023).

- Yasmine Mahssoun, Beyond Military Responses: An African-Led Approach to Security and Development in the Sahel, No. 4, IRPIA Policy Brief (Institute for Research and Policy Integration in Africa, 2025

- Signé, “Development Strategies in a Changing Global Political Economy.”

- Signé, “Development Strategies in a Changing Global Political Economy.”

- Landry Signé, “Turning Policy into Action: Overcoming Policy Failures and Bridging Implementation Gaps,” Brookings Institution, January 13, 2025.

- Landry Signé, Policy Implementation – A Synthesis of the Study of Policy Implementation and the Causes of Policy Failure, PP-17/03 (OCP Policy Center, 2017.

- Signé, Policy Implementation, 14.

- Signé, “Development Strategies in a Changing Global Political Economy.”

- Signé, “A New US-Africa Blueprint.”

- Landry Signé, “Development Strategies in a Changing Global Political Economy,” in Development Co-Operation Report 2023: Debating the Aid System (OECD Publishing, 2023).

- Marit Kitaw and Landry Signé, “What Africa Can Learn from the US-Ukraine Critical Minerals Deal,” Brookings Institution, September 3, 2025

- African Union, “Africa Calls for Fairer Global Finance at G20–Africa High-Level Dialogue,” Citizens and Diaspora Directorate, November 10, 2025.

- Security Council Report, From the Margins to the Center: The Rise of the A3 in the UN Security Council, No. 4 (2025); Faith Mabera, “In a Changing Global Order, Africa Is Embracing Its Agency,” IPI Global Observatory, October 21, 2025.

- Rishi Raithatha, “Searching for Mobile Money’s Centre of Gravity – Is It Really Kenya?,” GSMA, November 24, 2025.

- Stella Nolan, “Kenya Leads the World in Mobile Money Penetration,” Telco Magazine, September 24, 2025.

- Nolan, “Kenya Leads the World in Mobile Money Penetration.”

- Landry Signé, Africa’s Fourth Industrial Revolution, 1st ed. (Cambridge University Press, 2023).

- Mayowa Kuyoro and Umar Bagus, “Leading, Not Lagging: Africa’s Gen AI Opportunity,” QuantumBlack AI by McKinsey, May 12, 2025.

- Tanvi Deshpande, “Understanding AI for Sustainable Development in Africa,” GSMA, February 12, 2024

- Landry Signé, “Leveraging AI and Emerging Technologies to Unlock Africa’s Potential,” Brookings Institution, January 13, 2025

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).