Mr. Chairman and Mr. Ranking Member:

Thank you very much for inviting me to testify today. These bills deal in complex ways with the rules that will govern how Congress handles budgetary matters in the near and distant future. In my testimony, I shall focus primarily on HR 3576 and 3580. I shall emphasize the following points.

- These bills would establish stringent spending limits. Those limits would force spending to be cut far below levels set in laws that Congress has duly enacted and the President has signed. These cuts would span the federal budget, cutting spending in myriad programs without debate or vote by members of Congress on the specific cuts involved.

- The limits on the size of government in HR 3576 and HR 3580 are lower than actual expenditures during the administrations of the last five presidents, Republican and Democratic. A variety of forces will tend to increase government spending in the future.

- The bills would set limits on deficits without regard to economic conditions. If adopted, they would likely deepen and lengthen recessions. They would increase unemployment and lower earnings and profits at times when the economy was already in distress.

- Although ostensibly aimed a limiting the scope of government, these bills would do nothing to curb tax provisions that are the functional equivalent of expenditures and that, like direct spending, alter the private allocation of resources.

- Although ostensibly aimed at limiting deficits, these bills would do nothing to inhibit deficitincreasing cuts in tax rates or the creation of new deductions, credits, or exclusions.

- These bills would end the established and benign principle, present in budget deals and negotiations for more than two decades and most recently embraced by the Bowles- Simpson commission, that programs protecting low income Americans should be exempt from sequestration.

- The bills would limit the size of government and fiscal policy not just for the next several years, but into a future no one can foresee. To do so, they must depend on projections of economic and political circumstances that are subject to vast uncertainty and enormous discretion by those preparing projections. They thereby cede to unelected technicians, who must use opaque assumptions and procedures, power over policies that under the Constitution are the responsibilities of members of Congress.

I

Government spending, revenues, and the deficit change because of new legislation and evolving economic circumstances. Congress enacts legislation. It does not control the economy.

Spending and revenues change automatically with economic activity. Most taxes increase when the economy expands and shrink when the economy contracts. Many expenditures vary with economic activity, as well.

- Spending under Old-Age, Survivors, and Disability Insurance, Medicare, and Unemployment Insurance increases when the economy slows. So does spending under income- or means-tested programs, such as Medicaid, Temporary Assistance to Needy Families, Supplemental Nutrition Assistance.

- Personal and corporation income taxes, payroll taxes, and many excise taxes rise and fall with economic activity.

These automatic variations in taxes and spending help keep the economy on an even keel. When the economy is booming, rising revenues and falling spending tend to prevent the economy from overheating. When the economy is declining, falling revenues and rising government spending directly support private demand or offset its fall. Without automatic stabilizers, the economy would more easily ‘overheat’ during economic booms. Without automatic stabilizers, the drop in income and increase in unemployment during recession would be more severe than is with them.

The faster such offsetting effects occur, the better. These stabilizing effects would be delayed if anti-recession legislation were enacted only after official statistics signaled economic shifts and only after Congress reacted to such news and resolved the inevitable political squabbling about just what to do. The fiscal relief measures enacted in 2008 under President George W. Bush and 2009 under President Barack Obama, for example, would have done even more good than they did if political disagreements not delayed them.

The bills that the Budget Committee is considering today would weaken or reverse half of the benign fiscal effect. They would not prevent tax collections from falling during recession. But both the spending and deficit caps would prevent spending from increasing. In fact, they would force cuts spending cuts. Those cuts would be mis-timed, wrongly calibrated, and perversely targeted.

- The spending cuts would be mis-timed because the caps would cut spending just when it should be increased—during economic slowdowns. That is when spending targeted on the unemployed and the needy automatically increases. That spending has two beneficial effects. It helps to maintain demand. And it relieves hardships associated with unemployment and falling income. Together with recession-induced drops in revenues, rising spending generates budget deficits and boosts the ratio of spending to GDP. To cut spending when the economy is weak would be no less wrong-headed than it would be to raise tax rates to offset the automatic drop in revenues. To do either because of an arbitrary formula would be mindless folly.

- The cuts would be wrongly calibrated because they would be largest during the deepest recessions when spending is most needed. It is during deep recessions when spending unemployment compensation, pensions, and health and food benefits increases most. It is during deep recessions when such assistance is needed most.

- The cuts would be perversely targeted because they would fall most heavily on the jobless and the sick. Meanwhile, of course, the automatic stabilizer that would be left in place—tax cuts—would go disproportionately to those who had the highest incomes and therefore faced the highest tax rates—those with high wealth or income. Please understand, the automatic reduction in tax collections that occurs when economic activity slows is a good thing. It also attenuates economic losses. But so, too, do automatic increases in government spending. To enact rules that reverse either of these automatic responses to declining economic activity would be senseless. Yet, that is just what these bills would do.

Please understand as well that this indictment of spending and deficit triggers in these bills does not depend on the wisdom or lack thereof of the particular stimulus legislation enacted at the end of President George W. Bush’s administration or the separate law enacted early in President Obama’s administration. I believe that this legislation was beneficial, as does the report issued this week by the Congressional Budget Office. I also think that the stimulus packages were generally well, although not ideally, designed and were too small. Some members of this Committee probably agree with those judgments. Some probably do not. But whatever one may think about the 2008 and 2009 stimulus packages should have nothing to do with one’s view of the legislation on which you are holding hearings today. I speculate that few members of this Committee personally believe that it would have been a good idea to cut unemployment insurance, Medicaid, defense procurement, agricultural supports, and highway construction just when timed to take effect when the financial collapse of 2008 occurred and massive unemployment ensued. I also speculate that fewer still would have voted for such cuts. Yet, such cuts that would have been forced had legislation such as proposed in these bills been enacted by those who a decade or two ago sat where you sit now.

To make matters even worse, the sequestration rule in this bill reserves the largest cuts for those programs that increase when economic activity falls or that were considered sufficiently important for Congress to expand faster than inflation. Outlays that are not expanding faster than the consumer price index would be exempt from sequesters. Programs that rise when unemployment goes up or incomes fall will surely rise faster than consumer prices. They will be cut. Spending on programs that Congress has deemed important enough to expand will increase faster than the consumer price index. They will be cut.

What is left? Programs that don’t directly help the unemployed or those with falling incomes. Programs that Congress does not think worth increasing. They will not be cut. It is hard to imagine a provision more perversely designed to slow economic recovery, to harm those most in need of help, and to shift resources from activities from high to low priority uses.

II

Disagreement about the proper role and size of the federal government is as old as our republic and was never deeper than it is today. These bills attempt to settle that disagreement through budgetary procedures. They create major, even insuperable, hurdles to raising spending. Simultaneously, they lower current barriers to cutting taxes.

Trying to settle the long-standing and deeply felt disagreements about the proper role and size of government in this way is a bit like trying to settle the outcome of a football game by telling one team that it has to go twenty yards for a first down and the other team that it has to go only ten. Such rules would be laughably unfair and one-sided. The same may be said of the cut-go rules.

This harsh comment in no way contradicts the importance, once the recovery is well established and well under way, of bringing the deficit under control. It also does not deny that elected officials may be tempted spend the taxpayer’s money irresponsibly if they are not forced to take account of the full costs of that spending. But there is a parallel and equally serious danger that elected officials, unless forced to take account of the deficitincreasing effects of their actions, use tax cuts to pander to their constituents. You ignore either risk at the nation’s peril.

It is fair and sensible to require sponsors of new spending to show how they will pay for what they want to spend. It is equally fair and sensible to require sponsors of tax cuts to show how they intend to offset the revenues they will surrender. It is neither fair nor sensible to require one, but not the other.

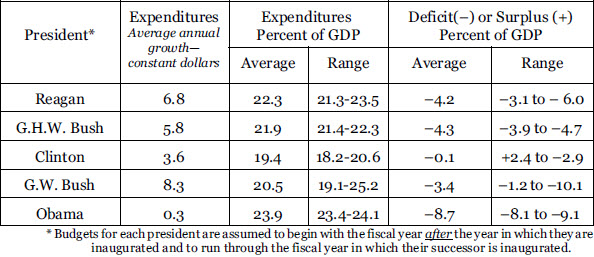

Nor would it be fair nor sensible for current members of Congress to presume that they are sufficiently informed or far-sighted to know what the size or scope of government should be decades hence. The fiscal records of the last five presidents have varied widely. In every year Ronald Reagan and George Herbert Walker Bush were in office, as well as three of the presidential years of Bill Clinton and of George W. Bush, budget outcomes would have failed the spending tests set in HR 3576. In every budget year of the presidencies of Ronald Reagan and George Herbert Walker Bush, in four of the budget years of Bill Clinton, and in six of the budget years of George W. Bush, the deficit tests set in that bill would have triggered sequesters.

Hard, objective forces drove government spending and deficits during those presidencies. Similar forces will drive spending in the future. Future presidents and Congresses may find it necessary to deploy American military power abroad. They will encounter added pension costs for the tens of millions of baby-boomers yet to retire. If we are lucky, they will have to cope with added medical spending for a growing menu of beneficial diagnostic and therapeutic interventions. Unless we are both luckier and wiser than we have an reason to expect, they will have to grapple with recessions, financial panics, and natural disasters. No Congress can repeal such events. No Congress can foresee when they will happen or how severe they will be. It would therefore be profoundly unwise to legislate caps that hamstring what can then be done.

III

For at least two decades, deficit reduction efforts have been guided by the principle that the burden of closing the deficit should be shouldered by those with adequate incomes—the middle class and the well-to-do—not by the poor, people with disabilities, or the elderly, and certainly not primarily by these vulnerable groups. This view has been shared by Republicans and Democrats alike. Erskine Bowles and Alan Simpson endorsed this principle in the introduction to their draft plan for deficit reduction. While the overall plan did not secure the requisite super majority laid out in its charter, there has been no indication that committee members rejected this underlying principle.

Yet these bills would do just that. They would subject to sequester programs that serve the poor, such as Medicaid and Supplementary Nutrition Assistance. They would, in fact, target these programs for the largest cuts. They would permit long-term pension commitments to be rewritten without explicit debate, based on projections of spending or deficits stretching decades into the future that historically have been laughably inaccurate and are, inevitably, subject to manipulation through the artful selection of assumptions.

It is just over a decade since budget analysts, a Federal Reserve chairman, and at least a few economists worried—I am not making this up!—that then-anticipated budget surpluses would sop up all outstanding government debt and make impossible the management of monetary policy. Those worries now seem risible, but serious people believed them, just as many people now believe that projected deficits will materialize. We now see that projections thirteen years ago were unduly rosy. We should understand that it is just as easy for current projections, which depend on assumptions about events we cannot possibly anticipate, may be unduly bleak.

The Congressional Budget Office now issues long-term budget projections under alternative assumptions. Informed observers understand that these projections are highly sensitive to underlying but seldom examined assumptions. For example, if health care spending slowed to the rate of growth of income, most of currently projected long-term budget deficits would largely vanish. Let me be clear…I think such a slowdown in growth of health care spending is unlikely and we shouldn’t count on it. But how fast health care spending rises depends sensitively on the fruits of future medical research. We can guess, but we cannot know, what will be, but has not yet been, discovered. Projections are also sensitive to assumed interest rates, labor force participation, and productivity growth. CBO is crystal clear that its long-term budget projections are not forecasts, but extrapolations of certain trends about variables that no one can forecast accurately. CBO’s projections shape public debate, as they should. But they do not, and should not, trigger specific legislative action. HR 3580 would convert these guesses about the future course of spending and revenues into action forcing events and goad Congress and the President to act now on projections of spending and deficits as much as forty years in the future.

IV

During the 1980s, the nation faced large and troubling deficits. Members of Congress repeatedly enacted rigid targets for deficit reduction. None worked. Then, presidents of both parties and Congress under both Republican and Democratic leadership dealt with the substantive cause of deficits. They identified spending that Congressional majorities agreed could be cut and taxes that could be increased.

After those agreements had been struck, but only then, the pay-go procedural rules helped members stick by the deal. But those rules applied to both taxes and spending. They did not presume to know how much government should spend or tax decades into the future. They did not foster budget policy that would deepen recessions. They protected vulnerable populations and did not force them to shoulder the burden of deficit reduction. And, until they were repealed, they worked.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

TestimonyThe Broken Budget Process: Legislative Proposals

May 31, 2012