Editor’s Note: In testimony to the U.S.-China Economic and Security Review Commission, Eswar Prasad discusses China’s twelfth five-year plan to reorient growth and implement short and long-term efforts toward balance and sustainability.

Chairmen Slane and Mulloy, and honorable members of the Commission, thank you for the opportunity to share with you my views on China’s twelfth five-year plan and the implications for China’s growth and reform strategy.

The plan lays out the momentous challenges that China faces in short-term macroeconomic management and longer-term structural transformation of the economy. This plan could herald a turning point in China’s economic development as it represents a marked shift in emphasis from high growth to the quality, balance and sustainability of that growth.

Premier Wen Jiabao’s report to the National People’s Congress, which should be read in conjunction with the other plan documents, strikes an interesting balance between self-congratulation for China’s economic performance over the last five years, including the economy’s resilience during the global financial crisis, and a sober evaluation of the immense development challenges that lie ahead.

The plan document is comprehensive and lists a large number of reform priorities. The emphasis on controlling prices through various policies clearly indicates that the major short-term priority for the government is to manage inflationary pressures.

The plan contains a set of medium-term objectives but has limited detail on specific courses of action for achieving those objectives. There is much more specificity about the actions being undertaken or under contemplation for attaining short-term objectives such as controlling inflation.

The longer-term objective of the plan is to reorient growth to make it more balanced and sustainable from different perspectives–economic, social and environmental. It will be a major challenge to put in place the reforms needed to rebalance the growth model and shift away from capital-intensive production, reduce the reliance on exports, generate more employment and allow more of the benefits of growth to filter down to the average household.

The plan documents send a direct and unambiguous message to provincial governments that they should shift from a focus purely on growth to broader economic and social considerations. But it is not clear that incentives facing provincial governments can be shifted easily.

The plan reveals some tensions between addressing short-term concerns and pushing forward with longer-term structural reforms. For instance, raising wages for workers is at odds with the goal of containing inflation. The plan indicates that further steps will be taken to liberalize controls on capital flows even as it recognizes that hot money inflows have added to domestic liquidity and helped fuel inflationary pressures.

The plan highlights the objectives of further financial system reform and progress towards capital account convertibility. However, few details are offered about such objectives. The plan has more details concerning policies that have direct implications for the average Chinese household–controlling inflation, increasing wages and employment, and strengthening the social safety net.

The reform agenda is clear but what is less certain is whether the government has the political will to take on such an ambitious reform agenda, battling against the vested interests that want to maintain the status quo and coping with social pressures from the short-term dislocations that the reforms might create. But China’s leaders may have little choice if they want to maintain their legitimacy and social stability.

Short-term Challenges

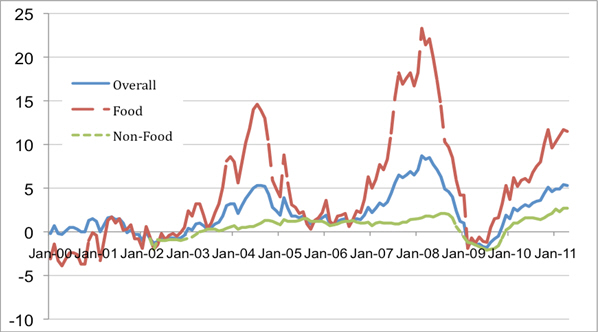

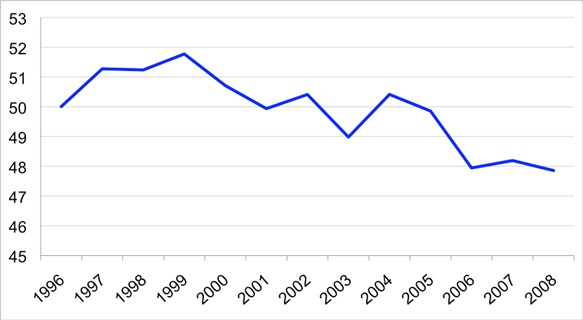

The major short-term policy challenge is to bring inflation under control. Chinese policymakers are understandably nervous about CPI inflation at a level above 5 percent. As in many other emerging markets, overall price dynamics are being driven by food prices. Food expenditures on average constitute about one-third of total consumption expenditures for Chinese households, so this is a major component of the CPI basket and food price inflation feeds into higher overall inflation by influencing wage demands. So far, nonfood inflation remains modest at about 3 percent (Figure 1).

Figure 1. Inflation (12-month inflation rates based on CPI indexes)

Sources: National Bureau Statistics; Haver; CEIC

But modest nonfood inflation is scant comfort for China’s government. Food price increases hit the poor a lot harder as food expenditures account for a larger share of their total expenditures compared to middle class households. The urban poor face a double whammy as they do not benefit from food price increases and measures to tighten policies to control inflation could affect their employment prospects.

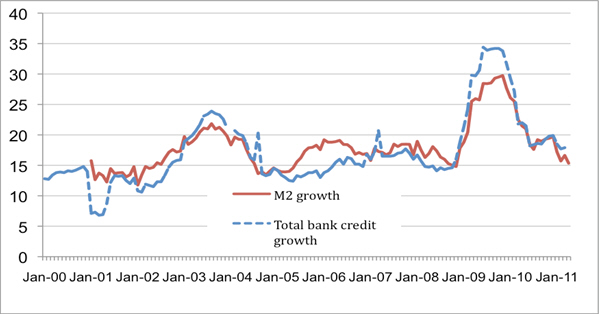

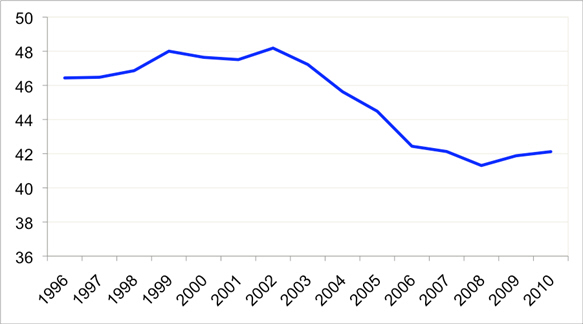

The government has responded aggressively to contain inflation by clamping down on growth in monetary aggregates and bank credit (Figure 2). The policy complication is that tightening credit could hurt employment growth by reducing credit flows to small and medium sized enterprises, especially those in the private sector. Moreover, standard monetary policy tools are typically not very effective at dealing with food price increases. Consequently, the government has taken a number of administrative measures, including price controls on some products.

Figure 2. Money and Credit Growth (12-month growth rates)

Sources: National Bureau Statistics; Haver; CEIC

Note: Bank credit growth through March 2011.

The key question is whether macroeconomic policies can be calibrated in a manner that brings inflation under control without knock-on effects on growth. This is not an easy task as the government is simultaneously aiming for a major transformation of the economy’s structure.

The risk of a hard landing has increased but still remains modest. Even if this risk did come to pass, the effects may not show up directly as a collapse in output growth but could take the form of a sharp fall in employment growth and a setback to other aspects of the growth rebalancing agenda.

Structural Transformation

Shifting the growth model

A major priority laid out in the plan is to rebalance growth to reduce the reliance on investment and exports and instead increase the share of private consumption to GDP. This is seen as necessary to ensure greater social stability by increasing the benefits that accrue to the average household from China’s red-hot GDP growth. In addition, shifting away from a capital-intensive production structure is important for ameliorating the destructive environmental consequences of rapid growth.

Factors such as rising wages could help boost consumption demand. Other fundamental reforms, including a stronger social safety net and a better government-funded health care system, are also necessary to shift consumption patterns of Chinese households. [1] The plan recognizes these issues and contains a number of proposed measures that would increase the coverage and extent of government financing of health care, pensions and the broader social safety net.

Growth also needs to become more balanced in terms of reducing regional disparities in economic development, especially when one compares the coastal versus the interior provinces. In addition, rising income inequality coupled with rising inflation that hits the poor especially hard can have serious implications for social stability, especially in urban areas where the urban poor are being hammered by high food price inflation.

Hasn’t the Chinese economy’s dramatic growth performance during the crisis shown that it has become less dependent on advanced economy export markets especially as GDP growth remained strong despite a decline in the trade surplus during 2009?

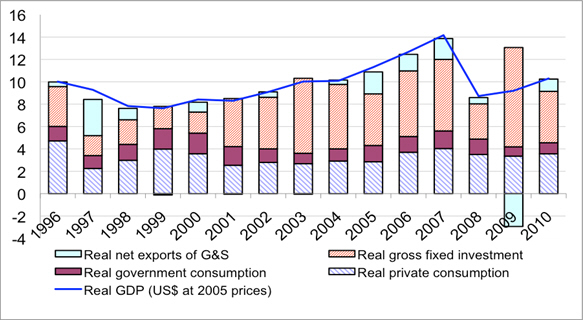

Answering this question requires a retrospective look at the Chinese growth model. There are two distinct features of the Chinese growth process in the decade before the crisis, when GDP growth averaged about 10 percent per annum. [2] First, investment accounted for more than half of overall GDP growth during the 2000s, with net exports playing an important role as well from 2005 to 2007 (see Figure 3). Private consumption, by contrast, has not been a key driver of growth. Second, even high GDP growth has not translated into much employment growth, with overall net employment growth averaging only about 1 percent over the last decade. [3]

Figure 3. Composition of GDP growth (in percent)

Source: EIU CountryData.

Note: Shaded regions in each bar show the contributions (in percentage points) of each component to total GDP growth. 2010 data are EIU estimates.

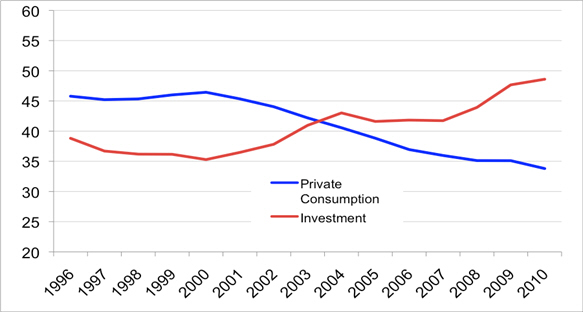

The growth model fostered by government policies has resulted in a rising share of investment and a declining share of private consumption in GDP (Figure 4). Moreover, weak employment growth and high investment growth have resulted in labor income falling as a share of national income and personal disposable income falling as a share of GDP (Figures 5-6). Thus, the Chinese government has had to cope with the twin challenges of boosting domestic consumption in order to make growth more welfare enhancing for its citizens and of generating higher employment growth in order to maintain social stability.

Figure 4. Shares of Private Consumption and Investment in GDP (in percent)

Source: EIU CountryData. 2010 data are EIU estimates.

Figure 5. Labor Income as Share of National Income (in percent)

Sources: Flow of Funds data, CEIC.

Figure 6. Personal Disposable Income as Share of GDP (in percent)

Source: EIU CountryData. 2009 and 2010 data are EIU estimates.

To counter the aftershocks of the crisis, the Chinese government embarked on a massive fiscal and monetary stimulus program in the latter half of 2008. In addition to an increase in government spending, state-owned banks were directed to make credit freely available. The banks went on an unprecedented lending spree, amounting to nearly $1.5 trillion (or about one-third of China’s GDP) in 2009. With cheap and plentiful money, along with subsidized inputs such as energy and land, conditions were ripe for a massive investment boom, which amounted to nearly 90 percent of GDP growth in 2009. [4]

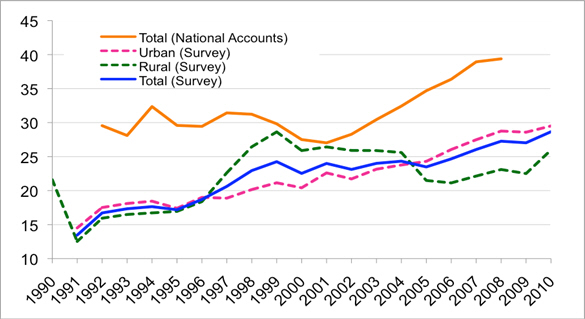

This investment boom is to some extent feeding on itself—so long as financing is available for construction and infrastructure projects, investment in ancillary industries pays off. But a slowdown in the investment machine as the government tightens credit supply could result in excess capacity in industries such as steel, aluminum and hard glass. Down the road, this could dampen employment and household income growth. Banks fear a resurgence of bad loans on their books if consumption demand doesn’t grow fast enough to soak up output from the new factories. Moreover, the Chinese household saving rate has trended upward in recent years; the economic uncertainty associated with the crisis and the weak global economic recovery are likely to increase savings for precautionary purposes (Figure 7).

Figure 7. Household Saving Rate (as percent of household disposable income)

Source: CEIC and author’s calculations.

Notes: Household savings survey data are based on per capita income and consumption, and population available through CEIC. Saving rates from the Urban and Rural Household Surveys are expressed as a share of disposable income and net income respectively. Saving rates from National Accounts (Flow of Funds) are expressed as a share of disposable income.

External Balance, Dependence on Exports

In short, the stimulus kept the Chinese economy humming along but in some ways actually worsened the balance of growth by tilting it even more towards growth led by investment rather than private consumption. The concern is that any dampening of domestic consumption growth could eventually increase the dependence on export-led growth, exactly the reverse of the balanced private consumption-led economy that Chinese leaders want. The reliance on exports, as noted earlier, is also because it is a key source of net job growth.

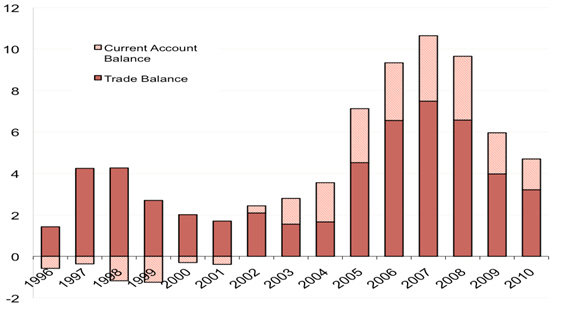

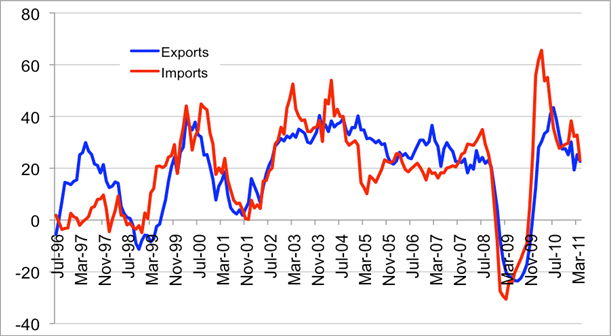

One dimension of growth rebalancing on which there has in fact been progress is related to China’s external balances. The trade surplus fell from its peak level of over 7 percent of GDP in 2007 to 3 percent in 2010 (Figure 8). Export and import growth took a tumble during the financial crisis but have since recovered sharply (Figure 9). The investment boom has driven import growth sharply higher while export growth has been strong but lower than import growth due to weaknesses in advanced country markets that absorb a large fraction of China’s imports.

Figure 8. External Balances (in percent of GDP)

Source: CEIC.

Figure 9. Export and Import Growth (12-month growth rates)

Source: CEIC.

In recent months, the trade surplus has again begun to widen and it is likely that the current account surplus will also rise. There is a sharp divergence of views among analysts about the direction in which these surpluses are headed. One view is that China has made durable progress in rebalancing its economy and reducing its dependence on exports. An alternative view is that China’s shrinking trade surplus is largely a cyclical phenomenon. China has grown strongly, sucking in huge quantities of imports, while its major export markets in the euro zone and the U.S. are just getting back on their feet after the global financial crisis.

This spills over into a wider debate about whether China has actually made significant progress on rebalancing its economy and contributing less to global imbalances. This is summarized by the stark difference between two key institutions in their forecasts for China’s current account to GDP ratio—the IMF pegs it at over 6 percent in 2012 while the World Bank puts it a shade under 4 percent (Table 1). My view is that both China’s trade and current account surpluses will rebound as cyclical factors unwind, especially if China manages to clamp down on credit growth and cools its economy while the U.S. and Europe solidify their recoveries (all of which remain slightly dubious propositions at this stage).

Table 1. Official Forecasts of China’s Current Account Balance (in percent of GDP)

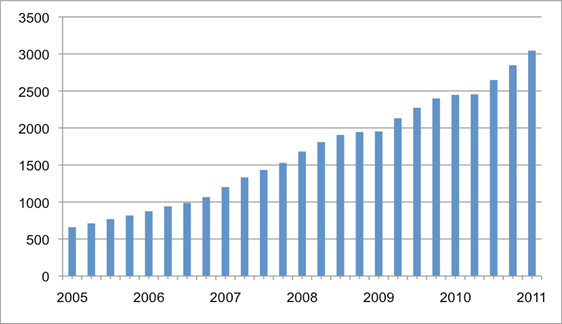

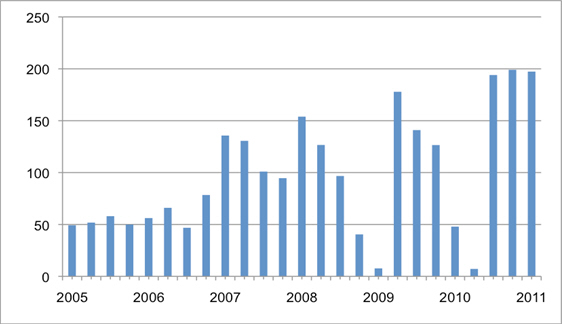

The Currency Regime and Capital Account Convertibility

China continues to intervene massively in foreign exchange markets to counter pressures for renminbi appreciation. China accumulated $448 billion of foreign exchange reserves in 2010, matching the pace in 2009 (Figure 10). The merchandise (goods) trade surplus of $185 billion accounts for less than half of this reserve accumulation in 2010 (the overall trade surplus on goods and services was lower at about $165 billion). It is also unlikely that valuation effects can account for the rapid pace of accumulation in 2010. [5]

Figure 10. Foreign Exchange Reserves (USD billions)

Foreign Exchange Reserve Stocks: 2005Q1 – 2011Q1

Accumulation of Foreign Exchange Reserves: 2005Q1 – 2011Q1

Sources: People’s Bank of China; Haver

Note: End of quarter figures.

China’s torrid pace of reserve accumulation continued in the first quarter of 2011, when it accumulated another $196 billion of foreign exchange reserves (Figure 10). [6] Reserve accumulation at the rate of nearly $200 billion in each of the three previous quarters highlights the Chinese central bank’s continued heavy intervention in the foreign exchange market. Even assuming significant returns on its existing stock of reserves (that could be showing up as new reserve accumulation), the implication of such rapid accumulation is that capital continues to seep into China through a variety of channels despite all the controls on inflows. Managing capital flows and their impact on domestic liquidity and inflation will be a major challenge for the Chinese government during 2011, especially if it continues to strongly resist currency appreciation.

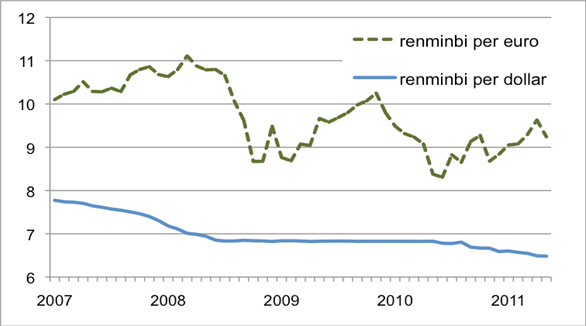

In fact, the renminbi’s appreciation relative to the dollar has been quite significant, especially in inflation-adjusted terms. Following its re-depegging from the dollar in June 2010, the renminbi has appreciated by about 5 percent in nominal terms against the dollar. On an inflation-adjusted basis, this implies that the renminbi is appreciating at a rate of about 7-8 percent a year in real terms relative to the dollar. [7]

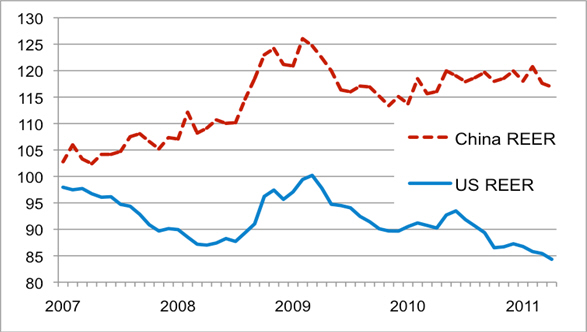

While China’s currency has been appreciating against the dollar, the dollar has been in broad retreat against other major currencies. Consequently, despite its nominal appreciation against the dollar and the high inflation rate in China, the renminbi’s real effective exchange rate has remained relatively flat over the past year (Figure 11). Signs such as rapid reserve accumulation suggest the currency is still significantly undervalued on a multilateral basis.

Figure 11. Exchange Rates

Nominal Exchange Rates: Jan. 2007 – May 2011

Real Effective Exchange Rates: Jan. 2007 – Apr. 2011

Source: Bank of International Settlements

Note: Real effective exchange rates are based on broad currency baskets. Index 2005 = 100.

China’s currency policy threatens to upset the delicate balance between keeping growth strong and inflation at moderate levels. China’s strong growth prospects and resurgent trade surplus will pull in large amounts of capital inflows from abroad, adding to the liquidity in the financial system and increasing the risks of higher inflation and asset market bubbles.

A currency appreciation would serve the dual objectives of tamping down inflationary pressures and helping to shift the balance of growth towards private consumption. Indeed, a more flexible currency would eventually allow the central bank a much freer hand in changing interest rates to meet the twin objectives of high growth and low inflation. A currency appreciation would help rebalance growth by increasing the purchasing power of domestic households. This would happen directly through the fall in the price of imported goods and also by giving the central bank room to raise deposit rates, giving households a better rate of return on their savings.

All of this makes it surprising that China has not used currency appreciation more aggressively as a tool in the fight against inflation and as one way of promoting more balanced growth. It seems that a huge political bar has to be crossed before the Chinese leadership accepts the use of currency policy as a tool against inflation. The twelfth five-year plan has little to say on this subject other than the ritual affirmation of steps to improve the exchange rate formation mechanism.

China is eager to make the renminbi an international currency and has already taken a number of small steps in that direction. However, contrary to expectations in some quarters, the plan did not lay out a timeline for opening up the capital account and making the currency fully convertible. There are other indications that this is seen as a policy objective over the next 5-10 years as it would set the stage for China’s ascendancy in global financial markets and make the renminbi an international currency. Indeed, the Chinese government has recently taken a number of relatively modest but symbolically significant steps to increase the use of the renminbi in international transactions, including trade settlement. The government is appropriately reticent about dismantling capital controls and allowing freer cross-border movement of capital without having a robust and well-functioning financial system in place.

Financial Sector Development and Reform

Financial sector reform remains a key priority that is highlighted in the twelfth five-year plan. The Chinese government recognizes that a more efficient financial system can play an important role in increasing productivity by reducing inefficiencies in the allocation of capital. A reformed banking system may also respond to incentives to lend more to small- and medium-sized enterprises, especially in the services sector, that tend to be better than large enterprises at generating employment.

China’s banking system appears well capitalized and the ratio of nonperforming loans relative to assets for the overall banking system is quite low. These figures mask a number of well-known problems, including persistent incentives to lend to state-owned enterprises rather than private sector enterprises, weak risk management capacity that results in credit to small and medium sized enterprises being rationed, and asset portfolios that include a significant amount of subpar assets that may turn into nonperforming loans if economic growth slows down.

Interest rate liberalization is an important element of banking reforms. At present, there is a ceiling on deposit rates and a floor on lending rates, resulting in a comfortable and noncompetitive spread that helps the profitability of banks. One effect, as noted earlier, is that households earn low or negative inflation-adjusted rates of return on their copious deposits in the banking system. Another is that the absence of price competition makes the banking system less efficient. Belying expectations–as many Chinese officials have mentioned this as a reform priority–the plan did not contain any specific language about interest rate liberalization, suggesting that the prospects for any significant steps in this area are remote for the time being.

China’s financial system remains bank-dominated, with limited corporate bond market development and limited scope of securities markets. The plan recognizes the need to broaden and deepen financial markets in order to improve their overall functioning and enhance their contribution to balanced growth. But this remains an aspiration rather than an objective backed up by a well-defined strategy.

Industrial Policy

The plan lays out two sets of objectives in this area. The first is to upgrade and restructure a group of traditional industries. The second is to foster and develop seven strategic emerging industries.

The traditional industries highlighted in the plan include (i) equipment manufacturing, (ii) shipbuilding, (iii) automobiles, (iv) iron and steel, (v) nonferrous metals, (vi) building materials, (vii) petrochemicals, (viii) light industry, and (ix) textiles. These industries are identified as needing technical upgrading as well as consolidation to benefit from scale efficiencies.

The industries that the government wants to develop into future pillars of the economy have a hi-tech or environmental focus. They include (i) energy conservation and environmental protection, (ii) new-generation IT, (iii) bio-tech, (iv) high-end manufacturing equipment, (v) new energy (including nuclear and renewable energy), (vi) new materials, and (vii) new-energy automobiles. The government intends to set up special funds to develop these new strategic industries. These funds will encourage start-ups and also complement private investment in these industries.

There are two important issues that will need to be tracked carefully as these objectives are transformed into concrete policy measures. The first is whether these measures will shift industry dynamics in a way that favors state-owned firms, thereby rolling back some of the gradual shift in the last two decades towards a more private sector-led industrial structure. The second issue, which has an international dimension, is whether some measures could take the form of explicit or implicit subsidies that are in violation of WTO guidelines.

In any event, China is clearly taking some important steps towards upgrading its industries and moving towards more hi-tech and high value added production. With various incentives and explicit government support, China is likely to make quick progress in clean energy and information technologies. The U.S. and other advanced economies could start losing ground in new technologies if China successfully implements its strategy of technology leap-frogging.

Conclusion

China’s twelfth five-year plan could represent a watershed in the country’s pattern of economic development. The broad objective of the plan is to reorient growth to make it more balanced and sustainable from different perspectives–economic, social and environmental. The challenge for the government is to break down the opposition of interest groups that prefer the status quo and to implement reforms needed to attain the plan’s objectives. With a leadership transition looming in 2012-13, it is possible that the window for reforms will shut for the time being and the medium-term elements of the plan will not be acted upon forcefully until the new leaders have found their footing and consolidated their power bases.

Footnotes

[1] For an analysis of the factors driving the trend increase in saving rates of urban households, see Marcos Chamon and Eswar Prasad, 2010, “Why Are Saving Rates of Urban Households in China Rising?” American Economic Journal: Macroeconomics, Vol. 2, No. 1, pp 93–130; and Marcos Chamon, Kai Liu and Eswar Prasad, 2010, “Income Uncertainty and Household Savings in China,” NBER Working Paper No. 16565.

[2] For more details, see Eswar Prasad, 2009, “Is China’s Growth Miracle Built to Last?” China Economic Review, Vol. 20, pp. 103–123. Also see Eswar Prasad and Grace Gu, 2009, “An Awkward Dance: China and the United States,” Brookings Institution Policy Note.

[3] The annual growth rate of non-agricultural employment averaged around 2.5 percent during this period, although this in turn has to be set against the growth rate of non-agricultural output, which has been 2-3 percentage points higher than that of overall GDP.

[4] Increases in private and government consumption demand amounted to about 45 percent of GDP growth, but this was offset by a large negative contribution of net exports to growth as the trade balance fell sharply in 2009 relative to 2008.

[5] Indeed, the dollar appreciated slightly relative to the euro during the year. The dollar-euro rate was 1.43 on Dec. 31, 2009 and 1.34 on Dec. 31, 2010. Assuming that most of China’s foreign exchange reserves are held in instruments denominated in dollars or euros, this means that the valuation effects in fact held down the pace of reserve accumulation in dollar terms.

[6] Valuation effects could account for about $50-60 billion of this increase (on the other hand, China recorded a marginal deficit on its trade account in this quarter). The euro appreciated relative to the dollar by about 6 percent during the first quarter. Assuming that about one-third of China’s reserves are held in euro-denominated investments, the valuation effects in dollar terms could account for about $55 billion (2.84 trillion * 1/3 * 0.06). The Japanese yen, by contrast, depreciated slightly relative to the dollar during the quarter.

[7] The renminbi’s value was held fixed relative to the dollar from July 2008 to June 2010. As of April 2011, twelve-month CPI inflation was 3.2 percent in the U.S. and 5.3 percent in China.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

TestimonyChina’s Approach to Economic Development and Industrial Policy

June 15, 2011