Editor’s Note: In the coming decade, China’s economic growth is projected to slow from its long-run average annual rate of 10 percent, sustained over the past three decades. The imminent slowdown also reflects a variety of specific structural challenges. Arthur Kroeber argues that responding effectively to these challenges requires a broad set of reforms in the financial sector, fiscal policy, pricing of key factors such as land and energy which are now subject to extensive government manipulation, and the structure of markets.

In the coming decade, China’s economic growth will certainly slow from the long-run average annual rate of 10% sustained over the past three decades. In part this is a natural slowdown in an economy that is now quite large (around US$7 trillion at market exchange rates) and solidly middle-income (per capita GDP of about US$7,500, at purchasing power parity). Despite the certainty of this slowdown, China’s potential growth rate remains high: per-capita income is still far below the level at which incomes in the other major northeast Asian economies (Japan, South Korea and Taiwan) stopped converging with the US level; the per-capita capital stock remains low, suggesting the need for substantial more investment; and the supply of low-cost labor from the traditional agricultural sector has not yet been exhausted. All these factors suggest it should be quite possible for China to achieve average annual real GDP growth of at least 7% a year through 2020.[1]

But the imminent slowdown also reflects a variety of specific structural challenges which require active policy response. Inadequate policies could result in a failure of China to achieve its potential growth rate. Three of the most prominent structural challenges are a reversal of demographic trends from positive to negative; a substantial secular decline in the contribution of exports to growth; and the very rapid increase in credit created by the 2009-10 stimulus program, which almost certainly led to a substantial reduction of the return on capital. Responding effectively to these challenges requires a broad set of reforms in the financial sector, fiscal policy, pricing of key factors such as land and energy which are now subject to extensive government manipulation, and the structure of markets. This paper will argue that financial sector reform is the best and most direct way to overcome these three major structural challenges.

1. China’s growth potential

There are several strong reasons to believe that China has the potential to sustain a fairly rapid rate of GDP growth for at least another decade. We define “fairly rapid” as real growth of 7% a year, which is a very high rate for an economy of China’s size (US$7 trillion), but substantially below the average growth rate since 1980, which has been approximately 10%.

The most general reason for this belief is that China’s economic growth model most closely approximates the successful “catch-up” growth model employed by its northeast Asian neighbors Japan, South Korea and Taiwan in the decades after World War II. The theory behind “catch-up” growth is simply that poor countries whose technological level is far from the global technological frontier can achieve substantial convergence with rich-country income levels by copying and diffusing imported technology. Achieving this catch-up growth requires extensive investments in enabling infrastructure and basic industry, and an industrial policy that focuses on promoting exports. The latter condition is important because a disciplined focus on exports forces companies to keep up with improvements in global technology; in effect, a vibrant export sector is one (and probably the most efficient) mechanism for importing technology.

A survey of 96 major economies from 1970 to 2008 shows that 14 achieved significant convergence growth, defined as an increase of at least 10 percentage points in per capita GDP relative to the United States (at purchasing power parity). Eight of these countries were on the periphery of Europe and so presumably benefited from the spillover effects of western Europe’s rapid growth after World War II, and from the integration of eastern and western Europe after 1990. The other six were Asian export-oriented economies: Japan, South Korea, Taiwan, Malaysia, Thailand and China. Most of these countries experienced a period of very rapid convergence with US income levels and then a sharp slowdown or leveling off. On average, rapid convergence growth ended when the country’s per capita GDP reached 55% of the US level. The northeast Asian economies that China most closely resembles were among the most successful: convergence growth in Japan, Taiwan and South Korea slowed at 90%, 60% and 50% of US per capita income respectively. In 2010 China’s per capita income was only 20% of the US level. Based on this comparative historical experience, it seems plausible that China could enjoy at least one more decade of relatively rapid growth, until its per capita income reaches 40% or more of the US level.[2]

So China’s growth potential is fairly clear. But realizing this potential is not automatic: it requires a constant process of structural reform to unlock labor productivity gains and improve the return on capital. The urgency of structural reform is particularly acute now. To understand why, we now examine three structural factors that are likely to exert a substantially negative effect on economic growth in coming years.

2. Challenges to growth

When considering China’s structural growth prospects, it is necessary to take account of at least three major challenges to growth. Over the past three decades, rapid economic growth has been supported by favorable demographics, a very strong contribution from exports, and a large increase in the stock of credit. The demographic trend is now starting to go into reverse, the export contribution to growth has slowed dramatically in the last few years, and the expansion of credit cannot be safely sustained for more than another year or two at most.

Demographics. From 1975 to 2010, China’s “dependency ratio”—the ratio of the presumably non-working (young people under the age of 15 and old people above the age of 64) to the presumably working (those aged 15-64) fell from approximately 0.8 to 0.4. Over the same period the “prime worker ratio”—the ratio of people aged 20-59 to those 60 and above—stayed roughly stable at above 5. Both of these ratios indicate that China’s economy enjoyed a very high ratio of workers to non-workers. This situation is favorable for economic growth, because it implies that with a relatively small number of dependent mouths to feed, workers can save a higher proportion of their incomes, and the resulting increase in aggregate national saving becomes available for investment in infrastructure and basic industry.

Over the next two decades, however, these demographic trends will reverse. The dependency ratio will rise, albeit slowly at first, and the prime worker ratio will decline sharply from 5 today to 2 in the early 2030s. These demographic shifts are likely to exert a drag on economic growth, for two reasons.

The first impact, which is already being felt, is a reduction in the supply of new entrants into the labor force—those aged 15-24. This cohort has fluctuated between 200m and 230m since the early 1990s, and in 2010 it stood at the upper end of that range. By 2023 it will have fallen by one-third, to 150m, a far lower figure than at any point since China began economic reforms in 1978. Because the supply of new workers is falling relative to demand for labor, wage growth is likely to accelerate above the rate of labor productivity growth, which appears to be in decline from the very high levels achieved in 2000-2010. As a result, unit labor costs will start to rise (a trend already in evidence in the manufacturing sector since 2004) and inflationary pressures will build. In order to keep inflation at a socially acceptable level, the government will be forced to tighten monetary policy and reduce the trend rate of economic growth.

The second impact will be the large increase in the population of retirees relative to the number of workers available to support them. This is the effect described by the prime worker ratio, which currently shows that there are five people of prime working age for every person of likely retirement age. As this ratio declines, the overall productivity of the economy slows, and the health and pension costs of supporting an aging population rise. The combination of these two effects can contribute to a dramatic slowdown in economic growth: during the period when Japan’s prime worker ratio fell from 5 to 2 (1970-2005), the trend GDP growth rate fell from 8% to under 2% (though demographics, of course, does not explain all of this decline). Over the next 20 years China’s prime worker ratio will decline by exactly the same amount as Japan’s did from 1970-2005.

Export challenge. Another element of China’s extraordinary growth was its rapidly growing export sector. Exports are a crucial component of catch-up growth in poor economies because, as explained above, they act as a vector of technology transfer: in order to remain globally competitive, exporters must continually upgrade their technology (including their processes and management systems) to keep up with the continuous advance of the global technological frontier.

Precisely measuring the impact of exports on economic growth is tricky, because what matters is not headline export value (which contains contributions from imported components and materials), but the domestic value added content of exports. In addition, a dynamic export sector is likely to have indirect impacts on the domestic economy through the wages paid to workers, the long-run effect of technological upgrading and so on. If we ignore these second-round impacts and focus simply on the direct contribution to GDP growth of domestic value added in exports, we find that exports contributed 4.6 percentage points to GDP growth on average in 2003-07. In other words, exports accounted for about 40% of economic growth during that period.[3]

Such a high export contribution to growth is on its face unsustainable for a large continental economy like China’s, and in fact the export contribution has slowed substantially since the 2008 global financial crisis. In 2008-11 the average contribution of export value added to GDP growth was just 1.5 percentage points – about one-third the 2003-07 average. It is likely that the export contribution to growth will fall even further in coming years.

Credit challenge. China responded to the global financial crisis with a very large economic stimulus program which was financed by a large increase in the credit stock. The ratio of non-financial credit (borrowing by government, households and non-financial corporations) rose from 160% in 2008 to over 200% in 2011. While the overall credit/GDP ratio remains lower than the 250% that is typical for OECD nations, a rapid increase in the credit stock in a short period of time, regardless of the level, is frequently associated with financial crisis. In China’s case, it is evident that the majority of the increase in the credit stock reflects borrowing by local governments to finance infrastructure projects which are likely to produce economic benefit in the long run but which in many cases will result in immediate financial losses.[4] To avert a potential banking sector crisis, therefore, it would be prudent for government policy to target first a stabilization and then a decline in the credit/GDP ratio.

The good news is that China has recent experience of deflating a credit bubble. In the five years after the Asian financial crisis (1998-2003), the credit/GDP ratio rose by 40 percentage points (the same amount as in 2008-11) as the government financed infrastructure spending to offset the impact of the crisis. Over the next five years (2003-08), the credit/GDP ratio fell by 20 points, as nominal GDP growth (17% a year on average) outstripped the annual growth in credit (15%). This experience suggests that, in principle, it should be possible to reduce the annual growth in credit significantly without torpedoing economic growth.

The bad news is that the 2003-08 deleveraging occurred within the context of the extremely favorable demographics, and unusually robust export growth that we have just described. Not only are these conditions unlikely to be repeated in the coming decade, both these factors are likely to exert a drag on GDP growth. Given this backdrop, any reduction in the rate of credit growth must be accompanied by extensive measures to ensure that the productivity of each yuan of credit issued is far higher than in the past.

3. The role of financial sector reform

The three growth challenges described above are diverse, but they are reflections of a single broader issue which is that China’s ability to maintain rapid growth mainly through the mobilization of factors (labor and capital) is decreasing. Much of the high-speed growth of the last decade derived from a rapid increase in labor productivity which was in turn a function of an extremely high investment rate: as the amount of capital per worker grew, the potential output of each worker grew correspondingly (“capital deepening”). But the investment rate, at nearly 49% of GDP in 2011, must surely be close to its peak, since it is already 10 percentage points higher than the maximum rates ever reached by Japan or South Korea. So the amount of labor productivity gain that can be achieved in future by simply adding volume to the capital stock must be far less than during the last decade, when the investment/GDP ratio rose by 10 percentage points.

The obvious corollary is that if China’s ability to achieve rapid gains in labor productivity and economic growth through mobilization of capital is declining, these gains must increasingly be achieved by improved capital efficiency. More specifically, the tightening of the labor supply implied by the demographic transition means that unit labor cost growth will accelerate; all things being equal this means that consumer price inflation will be structurally higher in the next decade than it was for most of the last. This in turn means that nominal interest rates will need to be higher. As the cost of capital rises, the average rate of return on capital must also increase; otherwise a larger share of projects will be loss-making and the drag on economic growth will become pronounced.

On the export side, the dramatic slowdown in the contribution to economic growth from exports means the loss of a certain amount of “easy” productivity gains. Greater productivity of domestic capital could help offset the deceleration in productivity growth from the external sector. Finally, as just noted, the need to arrest or reverse the rapid rise in the credit/GDP ratio means that over the next several years, a given amount of economic growth must be achieved with a smaller amount of credit than in the past—in other words, the average return on capital (for which credit here serves as a proxy) must rise.

Conceptually this is all fairly straightforward. The problem for policy makers is that measuring the “productivity of capital” on an economy-wide basis is not at all straightforward. In principle, one could measure the amount of new GDP created for each incremental increase in the capital stock (the incremental capital output ratio or ICOR). But in practice calculating ICOR is cumbersome, and depends heavily on various assumptions, such as the proper depreciation rate. Moreover, in an industrializing economy like China’s, the ratio of capital stock to GDP tends to rise over time and therefore the ICOR falls; this does not mean that the economy misallocates capital but simply that it experiences capital deepening. Sorting out efficiency effects from capital deepening effects is a vexing task.[5]

A more practical approach is simply to examine the ratio of credit to GDP. There is no one “right” level of credit to GDP, since different economies use different proportions of debt and equity finance. But the trends in the credit to GDP ratio in a single country (assuming there is no major shift in the relative importance of debt and equity finance), which are easily measured, can serve as a useful proxy for trends in the productivity of capital, and provide some broad guidelines for policy.

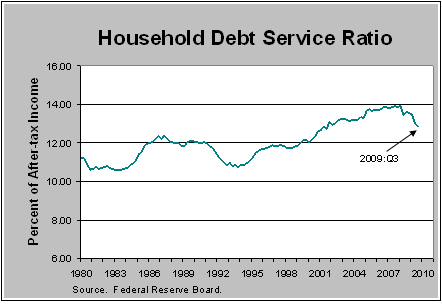

Figure 1 shows the ratio of total non-financial credit to GDP in China since 1998 (all figures are nominal). Total non-financial credit comprises bank loans, bonds, external foreign currency borrowing, and so-called “shadow financing” extended to the government, households and non-financial corporations; it excludes fund-raising by banks and other financial institutions. This measure is similar to the measure of “total social financing” recently introduced by the People’s Bank of China.

Figure 1

This shows, as noted previously, that the credit to GDP ratio rose sharply from 160% of GDP in 2008 to 200% in 2010. The current ratio is not abnormally high: many OECD countries have credit/GDP ratios of 250% or so, and Japan’s is around 350%. But it is obvious that the trend increase is worrying: if credit/GDP continues to rise at 20 percentage points a year then by 2015 it would hit 300%, a level much higher than is normal in healthy economies. It seems intuitively clear that to ensure financial stability, policy should target a stabilization or decline in the credit/GDP ratio. Success in this policy would imply that the productivity of credit, and capital more generally, improves.

The large increase in the credit/GDP ratio in 2008-10 is not unprecedented. Following the Asian financial crisis of 1997-98, the total credit stock rose from 143% of GDP in 1998 to 186% in 2003, an increase of 43 percentage points in five years, as a result of government spending on infrastructure and the creation of new consumer lending markets (notably home mortgages). During this period the credit stock grew at an average annual rate of 15.9%, but nominal GDP grew at just 10% a year.

Over the next five years, 2004-08, the average annual growth in total credit decelerated only slightly, to 14.8%. But thanks to a gigantic surge in productivity growth—caused by a combination of the delayed effect of infrastructure spending, deep market reforms (such as the restructuring of the state owned enterprise sector), and a boom in exports—nominal GDP growth surged to an average rate of 18.3%. As a consequence, the credit/GDP ratio declined to 160% in 2008, a decline of 26 percentage points from the peak five years earlier.

This experience shows that, in a developing country like China, it is quite possible to deflate a credit bubble relatively quickly and painlessly. To do so, however, two conditions must be met: the projects financed during the credit bubble must, in the main, be economically productive in the long run even if they cause financial losses in the short run; and structural reforms must accompany or quickly follow the credit expansion, in order to unlock the productivity growth that will enable deleveraging through rapid economic growth rather than through a painful recession. These conditions were clearly met during the 1998-2008 period: the expanded credit of the first five years mainly went to economically useful infrastructure such as highways, telecoms networks and port facilities; and deep structural reforms improved the efficiency of the state sector, expanded opportunities for the private sector, and created a new private housing market. This combination of infrastructure and reforms helped lay the groundwork for the turbo-charged growth of 2004-08.

The credit expansion of 2008-10, following the global financial crisis, was about the same magnitude as the credit expansion of a decade earlier: the credit/GDP ratio rose 40 percentage points, from 160% to 200%. But the expansion was much more rapid (occurring over two years instead of five), and while the bulk of credit probably did finance economically productive infrastructure, there is evidence that the sheer speed of the credit expansion led to far greater financial losses. A large proportion of the new borrowing was done by local government window corporations, often with little or no collateral and in many cases with no likelihood of project cash flows ever being large enough to service the loans. A plausible estimate of eventual losses on these loans to local governments is Rmb2-3 trn, or 4-7% of 2011 GDP.

Furthermore, whereas in the late 1990s restructuring of the state enterprise sector and creation of the private housing market took off at the same time the government began to expand credit, the 2008-10 credit expansion occurred without any significant accompanying structural reforms. In sum we have significantly less reason to be confident about the foundations for economic growth over the next five years than would have been the case in 2003.

On the assumption that the trend rate of nominal GDP growth over the next five years is likely be quite a bit less than in 2003-08, just how difficult will it be for China to stabilize or better yet reduce the credit to GDP ratio? For the purposes of analysis, Figure 1 proposes two scenarios. Both assume that nominal GDP will grow at an average rate of 13% in 2012-2015 (combining real growth of 7.5% a year with economy-wide inflation of 5.5%). The “stabilization” scenario assumes that total credit grows at the same 13% rate, stabilizing the credit/GDP ratio at around 200%. The “deleveraging” scenario assumes that credit growth falls to 9.5% a year, enabling a reduction in the credit/GDP ratio of 25 percentage points to 175%–about the same magnitude as the reduction of 2003-08.

A quick glance suggests that achieving either of these two outcomes will be far more difficult than in the previous deleveraging episode. In 2003-08, the average annual rate of credit growth was just one percentage point lower than during the credit bubble of 1998-2003. In other words, the work of deleveraging was accomplished almost entirely through economic growth, rather than through any material constraint on credit.

In the three years following the global financial crisis, by contrast, total credit expanded by 22.7% a year, generating nominal GDP growth of 14.1% on average. The required drop in average annual credit growth is 10 percentage points under the stabilization scenario and 13 points under the deleveraging scenario, while nominal GDP growth declines by only a point. In other words, this episode is likely to be the reverse of the 2003-08 episode: deleveraging will need to come almost entirely from a constraint on credit, rather than from economic growth.

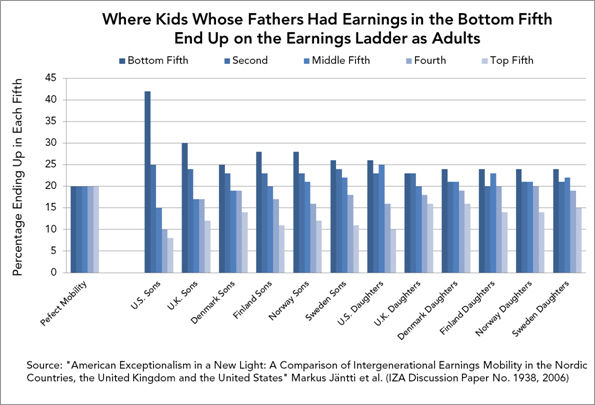

Figure 2

Another way of looking at this is to examine the relationship between incremental credit and incremental GDP—that is, how many yuan of new GDP arise with each new yuan of credit. This calculation is presented in Figure 2. This shows that in 1998-2003 each Rmb1 of new credit generated Rmb0.39 of new GDP; this figure rose to 0.72 in 2003-08, an 84% increase in the productivity of credit. The GDP payoff from new credit in 2008-10 was far worse than in 1998-2003. Simply to stabilize the credit/GDP ratio at its current level will require a 73% increase in credit productivity. To achieve the deleveraging scenario, a 150% improvement will be required.

The good news is that under the deleveraging scenario, the average productivity of credit in 2011-2015 only needs to be the same as it was in 2003-08. In principle, this should be achievable. But as previously noted, the mechanism of improvement needs to be quite different this time round. In 2003-08, the productivity of credit rose because credit growth remained roughly constant while GDP growth surged, thanks to structural reforms that accelerated returns to both capital and labor. Over the next several years, by contrast, the best that can be hoped for is that GDP growth will remain roughly constant. Consequently any improvement in credit productivity must come from constraining the issuance of new credit, while substantially raising the efficiency of credit allocation and hence the returns to credit.

What are the main mechanisms for improving the efficiency of credit, and of financial capital more generally? Broadly speaking, there are two: diversification of credit channels, and more market-based pricing of credit. Historically most credit has been issued by large state-owned banks, which are subject to political pressure in their lending decisions, and the majority of credit has gone to state-owned enterprises. Diversifying the channels of credit to include a broader range of financial institutions, a more vigorous bond market, and even by encouraging the creation of dedicated small- and medium-size enterprise lending units within the big banks, should improve credit allocation by giving greater credit access to borrowers who were previously shut out simply by virtue of a lack of political connections. Over the past decade government policy has been broadly supportive of the diversification of credit channels: specialized consumer credit, leasing and trust companies have been allowed to flourish, and there is some anecdotal evidence that SME lending at the state owned banks has begun to pick up steam.

The government has been far more reluctant, however, to embrace systematic measures for improving the pricing of credit. Bank interest rates remain captive to the policy of regulated deposit rates. Guaranteed low deposit rates means that banks have little incentive to seek out and properly price riskier assets, and are content to earn a fat spread on relatively conservative loan books. Bond markets, which in more developed economies form the basis for pricing of financial risk, are in China large in primary issuance, but small in trading volumes. The majority of bonds are purchased by banks and other financial institutions and held to maturity, make them indistinguishable from bank loans. Active secondary market trading by a wide range of participants is the essential mechanism by which bond prices become the basis for financial risk pricing.

4. Conclusions and recommendations

China still has potential for another decade of relatively high speed growth, but a combination of structural factors means that “high speed” in future likely means a trend GDP growth rate of around 7%, well below the historic average of 10%. Moreover, a combination of negative trends in demographics and the external sector, and the need to constrain credit growth after the enormous credit expansion of 2008-2010, mean the obstacles to realizing this potential growth rate are quite large. In order to overcome these obstacles, the efficiency of credit, and of capital more generally, must be improved. A large increase in credit efficiency was achieved in the previous economic deleveraging episode of 2003-08, but that increase in efficiency resulted mainly from an acceleration in GDP growth due to capital deepening, rather than from a constraint on credit. Over the next several years, the best that can plausibly be achieved is a stabilization of nominal GDP growth at approximately the current level. Any increase in credit efficiency must therefore come from a constraint on credit growth and direct improvements in credit allocation, rather than from capital-intensive economic growth.

In order to achieve this improvement in credit efficiency, three improvements to China’s financial architecture are urgently needed. First, the diversification of financial channels should continue to be expanded, notably through the acceptance and proper regulation of so-called “shadow financing” activities, which reflect market pressure for higher returns to depositors and greater credit availability (at appropriate prices) for riskier borrowers. Second, the ceiling on bank deposit rates should gradually be lifted and ultimately abolished, in order to give banks incentives for increased lending at appropriate prices to riskier borrowers who (it is to be hoped) will deliver a higher risk-adjusted rate of return than current borrowers. Third, steps should be taken to increase secondary trading on bond markets, in order to enable these markets to assume their appropriate role as the basis of financial risk pricing. Particular stress should be laid on diversifying the universe of financial institutions permitted to trade on bond markets, to include pension funds, specialized fixed-income mutual funds and other institutional investors with a vested interest in active trading to maximize both short- and long-term returns.

[1] This paper draws heavily on detailed work on China’s long-term growth prospects, capital stock and debt by my colleagues at GK Dragonomics, Andrew Batson and Janet Zhang.

[2] Andrew Batson, “Is China heading for the middle-income trap?” GK Dragonomics research note, September 6, 2011.

[3] Janet Zhang, “How important are exports to China’s economy?” GK Dragonomics research note, forthcoming, March 2012

[4] Andrew Batson and Janet Zhang, “What is to be done? China’s debt challenge,” GK Dragonomics research note, December 8, 2011

[5] Andrew Batson and Janet Zhang, “The great rebalancing (I) – does China invest too much?” GK Dragonomics research note, September 14, 2011.