The equilibrium interest rate—the inflation-adjusted rate consistent with full employment and stable inflation in the medium term—has far-reaching implications both for investors and for how the Federal Reserve sets interest rates. James Hamilton (University of California, San Diego), Ethan Harris (Bank of America Merrill Lynch), Jan Hatzius (Goldman Sachs) and Kenneth West (University of Wisconsin) see substantial uncertainty surrounding estimates of the rate and its trend, but doubt the equilibrium rate will remain depressed for the next several years.

Economists commonly assume a tight link between the equilibrium real federal funds rate (the Fed’s benchmark short-term rate) and the pace of economic growth. Hamilton, Harris, Hatzius, and West argue that this relationship is more tenuous than widely believed. Analyzing data back to the 19th century, they find some evidence that higher trend growth is associated with higher equilibrium rates, but note that this depends heavily on which years are included. Time preferences (the value that individuals put on money today vs. in the future), financial regulations, inflation trends, cyclical headwinds, and bubbles appear to play a significant role in shifting the equilibrium rate over time, and make any estimate inherently uncertain.

Nonetheless, the authors see little evidence for the “secular stagnation” view that the equilibrium rate is negative and will remain low for years to come as the economy struggles to grow. Instead, they argue that recent slow economic growth is better explained by temporary headwinds stemming from deleveraging in the household and banking sectors, fiscal consolidation, and housing supply overhang. As these headwinds have abated, U.S. economic growth has perked up, a trend they expect to continue. They estimate that the equilibrium rate is still positive and will rise in the future to somewhere between zero and two percent.

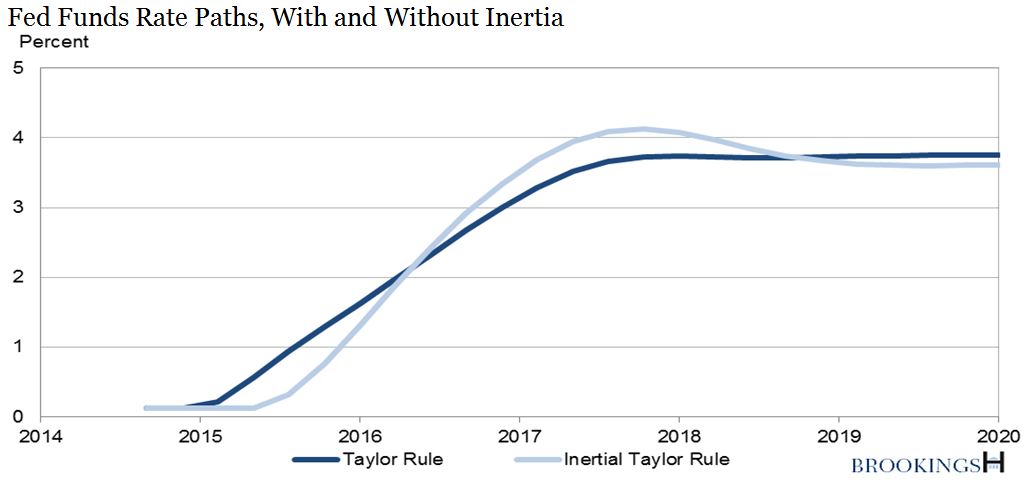

Given the uncertainty surrounding the equilibrium rate, the authors suggest that the Federal Reserve should build some inertia into their decision-making by placing less weight on the estimate of the equilibrium rate than on the widely cited Taylor Rule and more on the lagged federal funds rate. When there is more uncertainty over the equilibrium rate, raising rates later, but at a slightly faster rate, can keep output growth closer to potential than the “shallow glide path” often referred to by the Fed. Although this strategy would take the peak federal funds rate slightly above the estimated equilibrium, it would reduce the risk of raising rates prematurely due to incorrect estimates of the equilibrium rate.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).