We begin a new year and a new Congress with a sense of déjà vu: as it was in the summer of 2011, our outstanding national debt is up against its legally specified limit. Speaker John Boehner has promised an encore in 2013, but Americans of all political persuasions should hope that this is a promise the Speaker decides to ignore.

In this research note, Governance Studies Fellow Philip Wallach explains our debt ceiling’s origins and development, showing that attempts to bring about effective policy change through threats not to raise the debt ceiling have a long historical record of failure dating back to the 1950s. This includes a little-remembered debt ceiling showdown in 1996 in parallel to the more famous budgetary standoff that led to government shutdowns. In that episode, Republicans demanded large spending cuts but eventually decided that creating a crisis would be politically disastrous, and settled for small concessions.

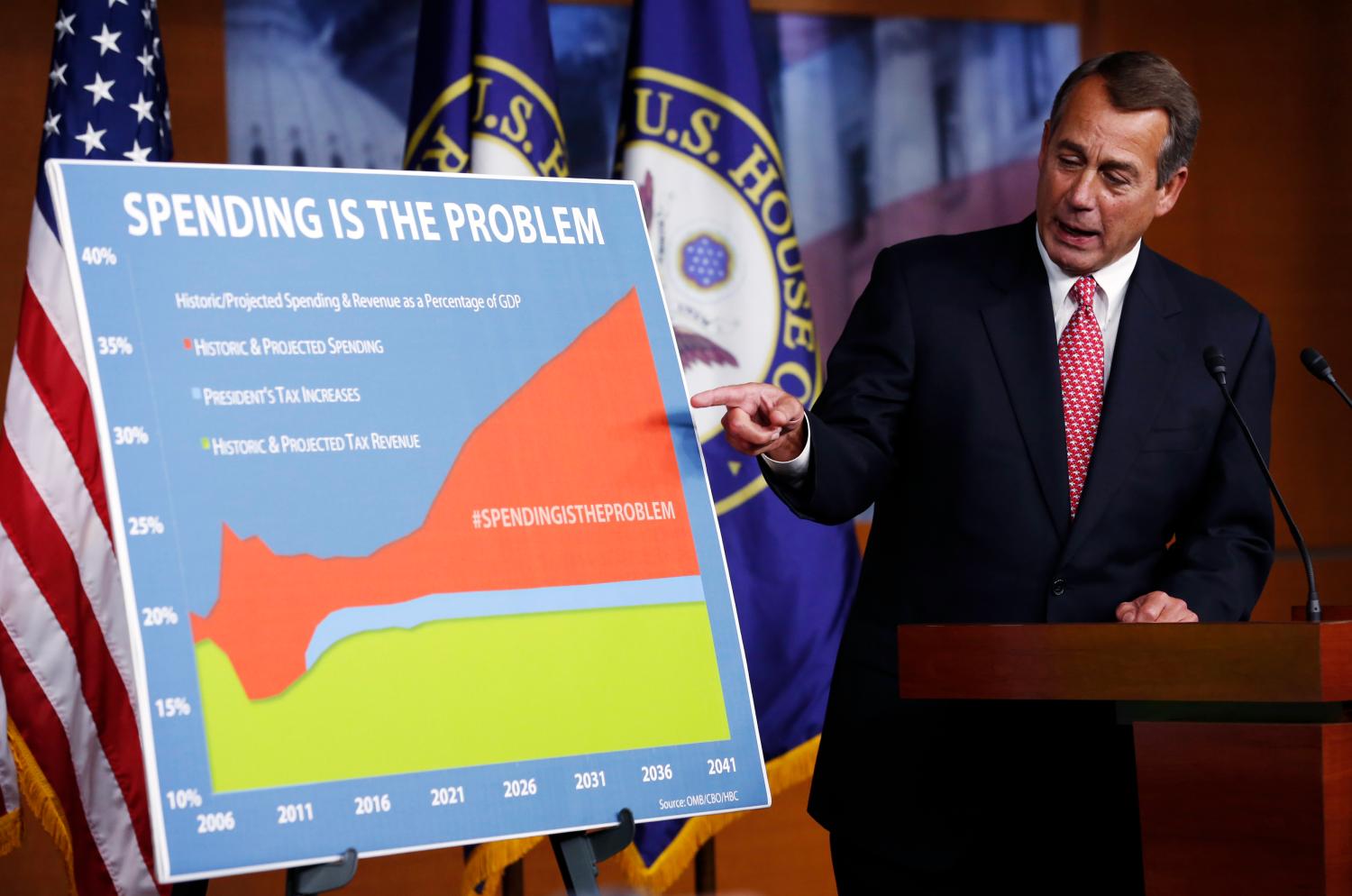

Wallach considers the strongest arguments for keeping the ceiling in place and shows why they fall short. He argues that debt ceiling brinksmanship represents an abdication of congressional authority over spending choices. Should Congress fail to increase the debt ceiling in a timely manner, the President would be forced to break laws, and would probably choose to fail to carry though many spending obligations. In doing so, he would have no legal guidance, forcing him to act in an autocratic manner fundamentally inconsistent with America’s rule of law tradition. Because Congress has nothing to gain in such a situation, their threats not to raise the debt ceiling ultimately ring hollow, rending debt ceiling brinksmanship an ineffective way to control spending, as the historical record confirms.

Wallach then offers superior alternatives to the debt ceiling that advocates of spending restraint should propose as replacements.

• To replicate the debt ceiling’s attention-grabbing quality, each party’s congressional leaders should be formally required to provide an explanation and plan whenever the country experiences distressingly large deficits.

• We should adopt a modest automatic-spending-control mechanism that would force spending reduction only if unemployment is low, thereby having a chance of passage and successful enforcement.

• We must reform our dysfunctional budgeting process. More government spending should be moved on-budget, forcing a hard look at the tradeoffs between entitlement expenditures and discretionary spending.

• Continuing resolutions should be forced to automatically push us toward balanced budgets, creating a default rule in which current unsustainable levels of spending are not retained simply through inertia.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).