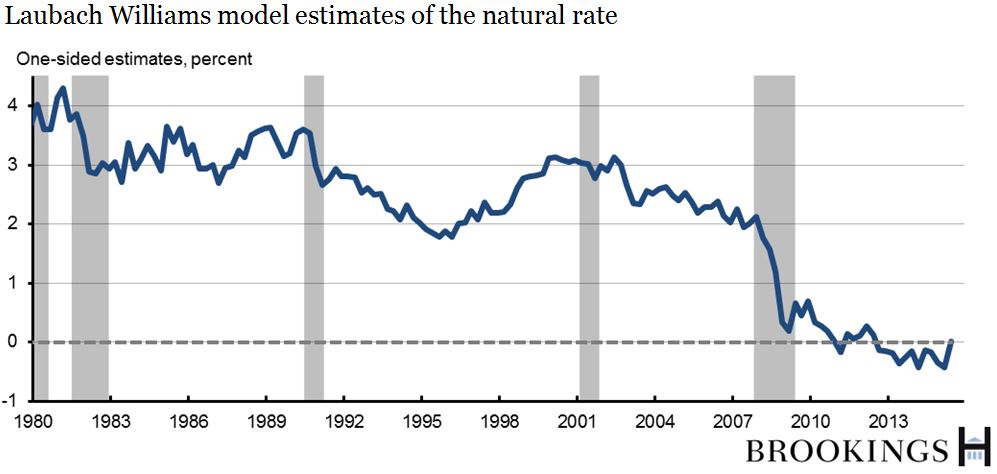

The equilibrium real interest rate—the rate consistent with stable inflation when the economy is at full employment—has trended downward over the past thirty years, according to Thomas Laubach, Director of Monetary Affairs at the Federal Reserve Board, and John C. Williams, President of the Federal Reserve Bank of San Francisco. And they anticipate it will remain low for “a long time.”

According to their model, the decline occurred in two parts: a gradual descent from 1980 to the Great Recession followed by a precipitous drop. They currently estimate the equilibrium rate has been at or below zero since the end of 2010. That contrasts with the 50-year average for the short-term rate controlled by the Fed, adjusted for inflation, of about 2 percent.

This isn’t how rates usually respond to financial crises. Using 140 years of data for 17 countries, they find little evidence “that crises are typically followed by lower than normal real interest rates,” and that, “if anything, real rates tend to be somewhat higher.” So what’s causing the change? The decline in the trend growth rate of the economy accounts for nearly one-half of the decrease. The rest they attribute to “unspecified factors.” Their model puts the current rate of growth of potential output of the economy at slightly over 2%, down from a bit under 3.5% as recently as the late 1990s.

To check the robustness of their finding that equilibrium rates have declined, they turn to alternative specifications such as delinking the natural rate from the trend growth for potential output, which produces results that are “broadly similar,” and changing the way they model inflation, which has only “relatively modest effects.”

While noting the difficulty in distinguishing between “highly persistent and truly permanent moves,” they argue that models with reversion to long-run averages have consistently (and erroneously) predicted a post-crisis rise in rates that has not yet materialized. It is their view that “a very low natural rate of interest may well be with us for a long time.

So what does this mean for policy? Given the uncertainty surrounding any estimate of the natural rate, they argue it might be prudent for the Fed to move away from relying on such estimates as a gauge for setting monetary policy. Second, if rates stay low for a prolonged period of time, Fed interest rates may be close to zero more often, suggesting a frequent need for unconventional monetary policy and the need to consider raising the Fed’s inflation target above its current 2% level.