The New Global Economic Geography: The World Economy in the Aftermath of the Global Financial Crisis

Nothing could be more appropriate than the epigram by the formidable Irish playwright Oscar Wilde to describe the state of world affairs in the aftermath of the global financial crisis: “Truth is rarely pure and never simple.” In fact, it is fair to assert that the global financial crisis has created a “new global economic geography,” a new reality that responds to the remarkable fact that the crisis that crippled the advanced economies has nevertheless also left winners around the globe.

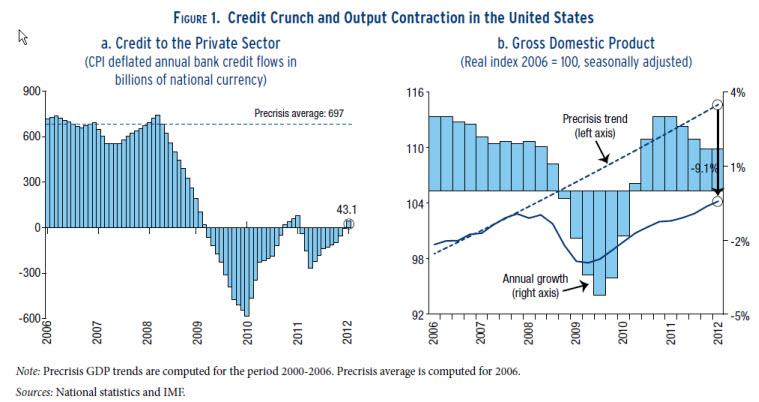

Let us illustrate this intriguing phenomenon of the post-financial crisis world, starting where it all began: the U.S. economy. The picture that emerges from figure 1 illustrates the devastating effects of the financial crisis: a severe credit crunch that came hand-in-hand with an equally severe contraction in output that still remains significantly below precrisis trends and persistently high levels of unemployment.

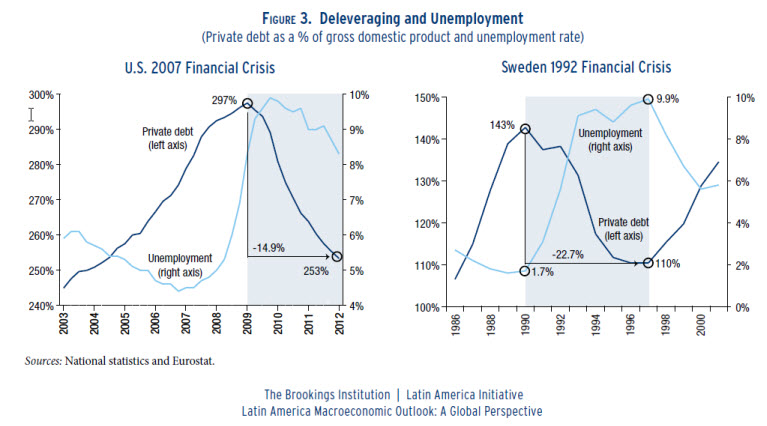

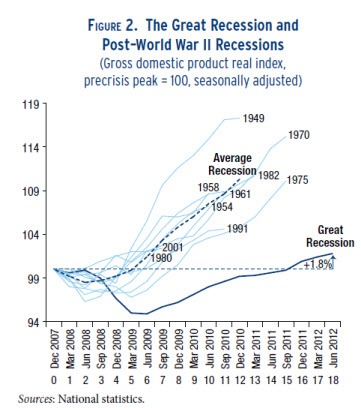

The dynamics of the Great Recession differ markedly from post-World War II recessions in many dimensions. First, the Great Recession was deeper and longer than any other post-World War II recession; that is, output declined by 5 percent peak to trough for six quarters compared to an average contraction of 2 percent for three quarters for the average post-World War II recession (see figure 2 and table 1).

Second, it took the economy longer to recover to precrisis levels of output relative to the duration of the contraction. Whereas for the average post-World War II recession it took 2.2 quarters for output to recover to its precrisis levels, it took nine quarters for output to recover to precrisis levels in the Great Recession. In other words, while the duration of the recovery phase was shorter than the duration of the contraction phase for the average post- World War II recession, during the Great Recession the recovery phase took significantly longer than the duration of the contraction phase (see table 1).

Third, since the Great Recession, output has not yet recovered to precrisis trend levels. In fact, it lies significantly below them. For the average post-World War II recession, recovery to precrisis trend levels took about twice the duration of the contraction. So, according to post-World War II historical patterns, the U.S. economy should have had already recovered to precrisis trend levels. The fact that it did not, together with persistently high levels of unemployment, is precisely what defines an anemic recovery.