The financial reserves of Social Security are currently invested solely in U.S. Treasury bonds. Expected investment returns on these reserves could be increased if the portfolio were diversified to include riskier assets, such as publicly traded equities. By increasing the expected return on asset holdings, investing part of Social Security reserves in stocks can strengthen the long-term financial outlook of the program. Some advocates of this policy also believe it would improve the distribution of risks between America’s young and old. By increasing the annual fluctuation of returns on the Trust Fund, however, the shift in policy also exposes Social Security to greater financial risk and potentially to greater political risk.

Our paper evaluates the implications of investing part of the Trust Fund in U.S. equities. The evaluation is performed using two simulation approaches. First, we use actual historical returns on publicly traded stocks to investigate whether, with the benefit of hindsight, it would have been advantageous to invest part of the Trust Fund in equities starting in two past years, 1984 and in 1997. We picked 1984 because it was the first year after enactment of the 1983 Social Security amendments, which put Social Security on a path to accumulating large Trust Fund reserves. In 1997, there was intense public debate over the wisdom of investing some reserves in equities. Our second evaluation strategy analyzes the current Social Security outlook under the assumption that lawmakers act immediately to restore long-run solvency by increasing the payroll tax. This policy dramatically increases future Trust Fund reserves compared with those expected under current law. We use Monte Carlo simulation methods to investigate whether investing in equities would strengthen the long-term outlook compared with the current policy of investing all reserves in Treasury securities.

Equities have historically offered investors a better expected rate of return relative to that on safer assets, such as Treasury bills or bonds. The geometric mean return on the S&P 500 stock index between 1928 and 2015 was 9.5 percent. In comparison, the mean return on 3-month Treasury bills was just 3.5 percent, and that on 10-year U.S. Treasury bonds was 5.0 percent. However, in exchange for higher expected returns, stock market investment also carries greater risk. The standard deviation of S&P 500 annual returns was 19.8 percent, versus just 3.1 percent for Treasury bills and 7.8 percent for 10-year Treasury bonds. For many long-term investors, including nearly all pension funds, the sizeable historical premium on equity investment makes the extra risk of stock holdings appear worthwhile.

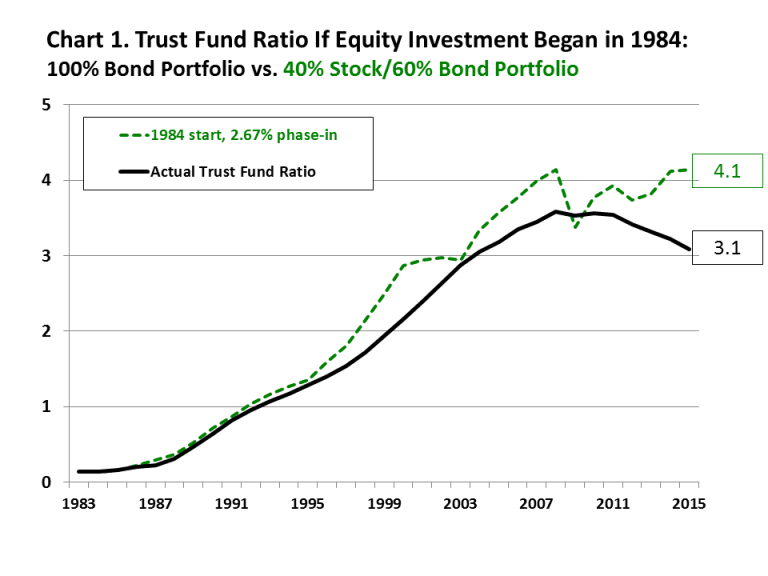

Our simulations suggest that equity investments would have been helpful historically and can be helpful prospectively. Investing part of Social Security reserves in equities can reduce the need for future payroll tax hikes and benefit cuts. If equity investment had begun in 1984, for example, and if equity holdings had ramped up to 40 percent of the Trust Fund portfolio, reserves at the end of 2015 would have been $3.8 trillion compared with actual holdings of just $2.8 trillion. A more helpful measure of the size of the reserve is the “Trust Fund ratio”—the amount of assets in the Trust Fund at the beginning of the year divided by expected Social Security payouts during the year. If equity investment had been phased in beginning in 1984, the Trust Fund ratio at year-end 2015 would have been 4.1 compared to the actual ratio of 3.1 (see Chart 1). If equity investment had been phased in beginning in 1997, the ratio would have been 3.7.

To evaluate the potential impact of future investment in U.S. equities, we first eliminate the funding imbalance that will deplete the Social Security Trust Fund in 2034. In order to accomplish this, we assume that Congress increases the combined payroll tax rate by 2.62 percentage points in 2016, a step that eliminates the 75-year funding imbalance under the Social Security Trustees’ intermediate assumptions in 2015. We then assume equities are phased into the Trust Fund and reach 40 percent of reserve holdings over a 15-year period starting in 2016. The bond portion of the portfolio consists of special issue Treasury securities identical to the ones currently held in the Trust Fund. Like many analysts, we expect future real equity returns to be somewhat lower than they have been in the past. We perform a statistical analysis based on repeated random sampling to project a range of future outcomes for equity and bond returns. This kind of analysis is commonly known as Monte Carlo simulation. Equity returns are assumed to follow a lognormal distribution based on the distribution of historical Wilshire 5000 index returns, while Treasury bond interest rates are constructed from interest rates on new special issues, which follow an autoregressive model. (The Wilshire 5000 index reflects the market-capitalization-weighted performance of essentially all publicly traded U.S. stocks.) The covariance between interest rates on new special issues and equity returns is assumed to be zero. For simplicity, equity mean-reversion is not incorporated in the model.

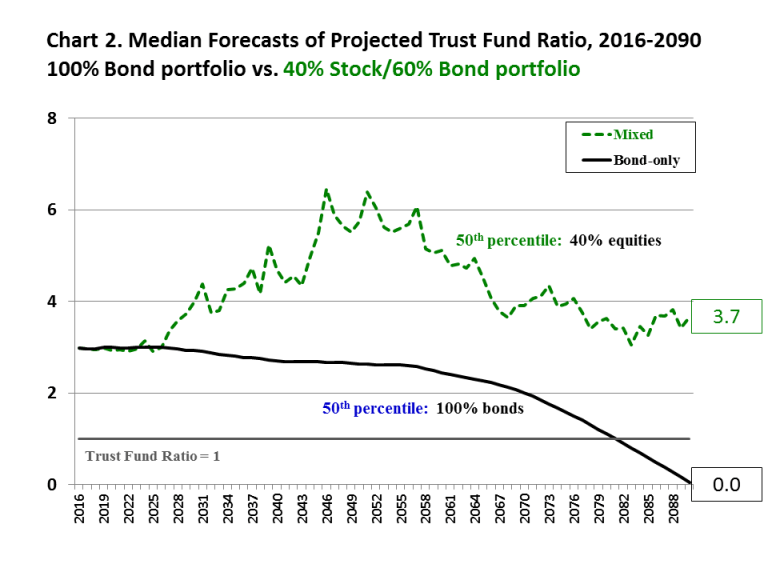

Our key result is that the 50th percentile of outcomes for the 40% stock/60% bond portfolio generates a Trust Fund ratio close to 4.0 at the end of the 75-year period. This is far above the 50th percentile Trust Fund ratio if all reserves are held as special issue Treasuries, which is 0.0 (see Chart 2). Even the 25th percentile of the mixed portfolio remains above 1.0 during the projection period and yields a better outcome than an overwhelming majority of the bond-only simulations. The mixed portfolio also does a much better job of avoiding bad outcomes over the 75-year horizon. Only 23 percent of all simulations for the mixed stock-bond portfolio fall below a Trust Fund ratio of 1.0; only 11 percent of all simulations end with Trust Fund exhaustion. In comparison, in 84 percent of cases the 100-percent-bond portfolio produces a Trust Fund ratio that is less than 1.0. In 47 percent of cases, the Trust Fund is exhausted before the end of the 75-year planning horizon.

The economic and political issues surrounding equity investment transcend the expected return on the Trust Fund’s investment portfolio, of course. Opponents of equity investment fear government interference in the allocation of capital in the broader economy. Many are also concerned that public ownership of equity shares will lead to government interference in corporate decision-making. It is also uncertain how the higher expected returns and greater risk of a mixed equity-bond portfolio should be taken into account when assessing the long-run financial outlook of the Social Security program. Our paper considers these issues in turn.

People in favor of investing part of the Trust Fund in stocks typically assume the government will take a passive role in selecting and voting the company shares held in the Trust Fund. They believe—and we assume in our paper—that Trust Fund investments will track a broad market index, such as the Wilshire 5000. Legislation to permit equity investment could legally require investment neutrality to ensure there is no government interference in corporate decision-making. In fact, government neutrality isn’t just possible – it’s already happening. We point to actual experience of U.S. government investment in equities to show that government neutrality is both feasible and practically attainable. For example, the experience of the federal employees’ Thrift Savings Plan offers a road map for insulating stock selection and votes of corporate shares from government interference.

A crucial issue in the debate over including risky assets in the Trust Fund portfolio is the treatment of the additional risk of the portfolio in evaluating the funding status of Social Security. Some government agencies, including the Congressional Budget Office (CBO) and the Office of Management and Budget (OMB), have ignored the higher expected return. They credit equities held in the Trust Fund as yielding the long-term return on Treasury securities. In effect, these agencies view the cost of the additional risk in stocks as precisely offsetting their higher expected return. Under this view, adopting a policy of equity investment would produce no immediate improvement in Social Security’s 75-year funding status. However, if equities continue to produce superior returns in the future, the investment gains would eventually be reflected in higher Trust Fund ratios. This in turn would imply a smaller need for future payroll tax increases or benefit cuts to keep Social Security solvent.

Editor’s Note: This is a summary of a paper that appeared in the Center for Retirement Research at Boston College.