How do companies create new products and services?

Economic journals, think tank papers, and business school seminars describe a relatively formal process in which research institutions—universities, independent inventors, young technology firms, or federal laboratories—develop scientific breakthroughs that have commercial application. Because the research has monetary value, these institutions define and protect their intellectual property and rely on market mechanisms—such as licenses,mergers and acquisition, and contracts—to transfer technologies to companies. Effectively, the innovative process is interpreted to be relatively formal and based on clear market signals.

The reality is much more complicated. Firm inventions come from a range of sources, not just research institutions and are translated into products in a number of methods beyond patents, licenses, and technical service contracts. Moreover, the process is far more industry-specific than most economic studies suggest.[1]

The formal approach described above hasn’t just been observed but was intentionally created. Vannevar Bush, the science advisor to President Franklin Roosevelt, first outlined this form of innovation in his now famous 1945 report, Science, the Endless Frontier.[2] Bush thought the development of future technologies would require advances in both basic science and commercial application, the former being the province of the nation’s universities and federal laboratories and the latter of the private sector. He worried that companies would never invest in basic science and that government investment in applied research—such as the Manhattan Project—had little place in peace-time America. From this perspective came national research institutions like the National Science Foundation.[3]

Today, this classic model of innovation is at the heart of most of the country’s innovation policies. Research and development tax credits, patent and licensing laws, angel and venture capital incentives, and technology transfer programs all operate around the concept that there are innovation generators (universities, labs, independent inventors, and technical consultants), and they transfer knowledge to firms through formalized market mechanisms (patents, licensing, mergers and acquisitions, and contracts).

What types of innovation are included in this brief?

Innovation is a broad concept, generally encompassing everything from scientific breakthroughs to novel business models. This brief analyzes a particular cross-section of the innovation economy based on academic surveys that have distinguished different forms of technology creation. As with all research methods, there are limitations to this approach.

First, the majority of industries analyzed are within the manufacturing sector, with the important addition of the software industry (a service). While innovation is by no means limited to manufacturing and software, over two-thirds of the country’s R&D exists within these sectors. Of course, retail, wholesale, transportation, and health care have their own unique innovation pathways,[4] but these are outside the scope of this paper.

Second, the research presented here surveys existing firms and asks how they access external innovation. But a major mechanism for innovation is the creation of new companies. Universities, labs, and other institutions play a role in helping to establish new technology companies, and these efforts clearly support U.S. innovation. An important question is whether research institutions are helping to create new companies or are mostly creating new patent technology; the literature suggests the latter.

Unfortunately, this question is beyond the scope of this brief. New startups and entrepreneurs are considered sources of innovation (by being acquired by larger companies or through licensing agreements, contracts, or informal arrangements), but this paper does not offer insight on how entrepreneurs themselves derive their innovative inputs.

Nonetheless, the industries included here represent a large portion of the technology-based economy, and the tactics employed by different firms offer a strong cross-section of activity to suggest policy recommendations.

The problem with this approach is that firms often don’t use either research institutions or formal channels to bring new ideas to market. In many industries, patenting, licensing, and R&D contracting are exceptions rather than the rule. Instead, firms gain commercial insight informally from other firms, from customers, and from suppliers through partnerships, reverse engineering, unrelated contracts, or the hiring of workers with the specific knowledge the firm desires. For example, original equipment manufacturers (OEMs), like Boeing, Apple, and General Electric are more than just customers to their thousands of suppliers. They corral innovation throughout the supply chain by establishing platform systems (e.g., planes, computers, or MRI machines), and, as these products’ components become more complex and expensive, more of the research, design, and customization is pushed down the value chain, making suppliers a critical source of innovation.[5] Likewise, consumer-facing companies of all sizes also learn from their customers through product surveys, focus groups, and other activities.[6]

These informal channels are discussed in consulting reports and are well known to on-the-ground economic developers, but they haven’t influenced policy and practice in most cities, in part because little comprehensive evidence of their relevance exists.

One reason so little research has been done on informal innovation channels is because traditional metrics of innovation are well understood and easy to quantify (particularly patent data). Analyzing informal channels, by contrast, usually requires surveying firms, which is difficult and costly.

However, such surveys of firms do exist, and they help shine light on the actual methods of innovation firms employ. For example, Ashish Arora, Wesley M. Cohen, and John P. Walsh surveyed over 1,000 manufacturing companies in 17 different industries, ranging from wood manufacturing to pharmaceuticals, and asked both where the majority of the innovation for new or improved products came from and what was the method of acquiring that innovation.[7]

This brief uses this research, along with other surveys, to describe a more nuanced approach to urban innovation. The paper begins by reviewing the economic literature to examine how firms actually come across new ideas; it then develops a simple taxonomy of the innovation process and describes how each model differs from the classic view of innovation. Finally, it offers recommendations to public, private, and philanthropic stakeholders for how to develop more tailored strategies to their local industry structure. Specifically, the brief recommends that these stakeholders should:

RECOGNIZE that all industries can be innovative, not just software and medical technology startups, and identify the particular innovation pathways utilized by local firms.

ELIMINATE institution wide technology transfer practices at research universities that focus on licensing and adopt options that allow specific departments and centers to cater to different industries.

ESTABLISH partnerships with non-research colleges and universities to support firms seeking short-term process innovation.

MODIFY the traditional accelerator model to respond to the innovation needs of startups in nontraditional growth sectors

LINK designers, engineers, and software developers in urban centers to manufacturing supply chains in the surrounding regions.

ADVANCE the appropriate place-based strategies to increase the density of innovative firms and support organizations.

The overarching priority of this brief is to help policy makers, practitioners, philanthropies, and firms better understand how innovation occurs on an industry level and, through this knowledge, enable them to better facilitate economic growth in cities.

Leaving the classic model behind

In contrast to the traditionally accepted view of the invention process, the most prominent source of innovation for companies is not research institutions but rather customers and suppliers.

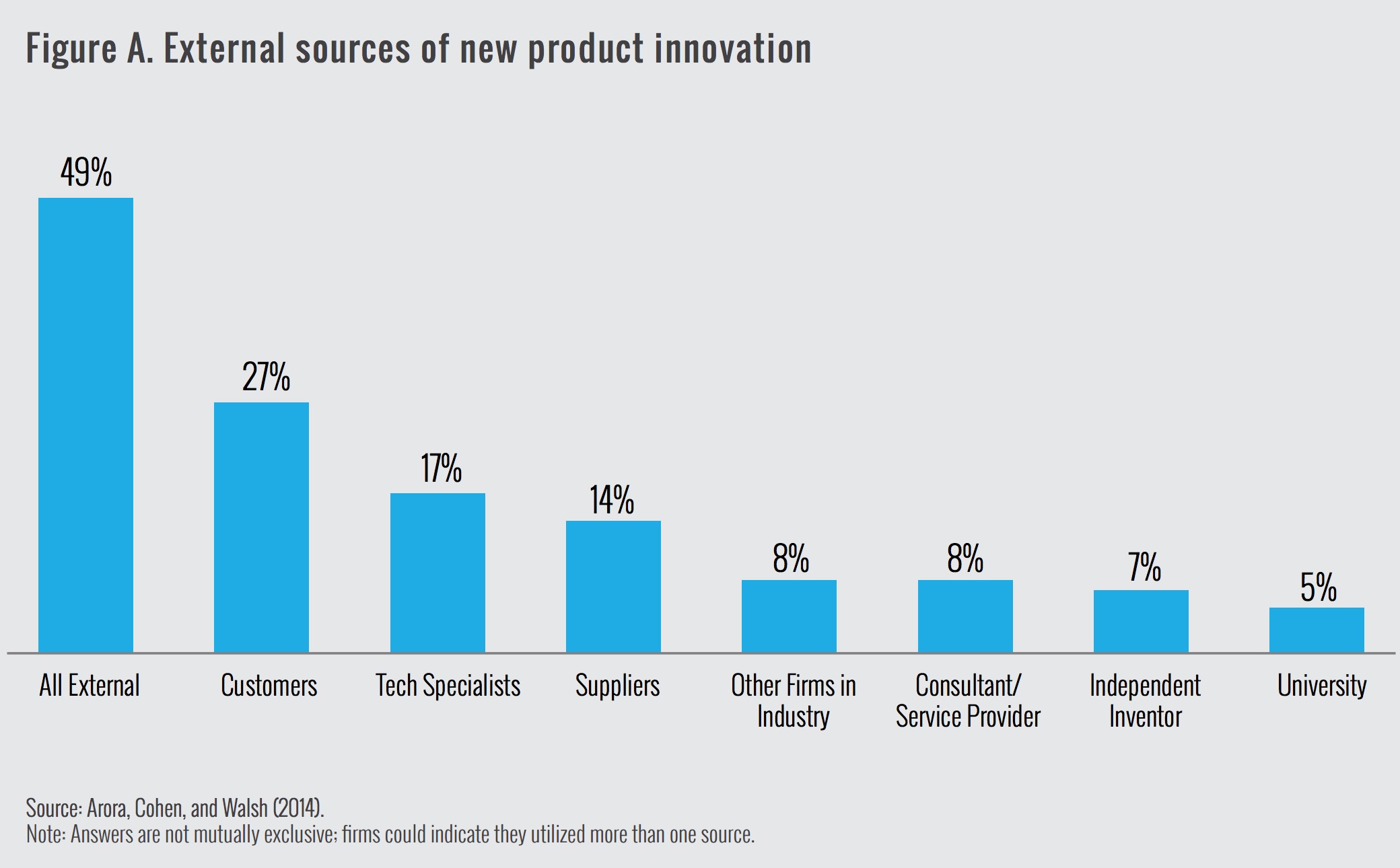

In the survey of manufacturing firms by Arora, Cohen, and Walsh, 50 percent of those responding said that external sources were responsible for new product innovation; 27 percent said the innovation was derived from customers and 14 percent from companies in their supply chain. As Figure A shows, “technology specialists”—or traditional sources of innovation, including research consultants, inventors, and universities—were the source of innovation for only 17 percent of firms. Perhaps most surprising is that only 5 percent of the manufacturers said they drew from universities as a source of new products. This figure is lower than what other research indicates, in part because this study had a stricter definition of innovation.[8] Regardless, this research suggests that when firms look outside their four walls for new ideas, other firms are much more likely to be a source of information than universities.

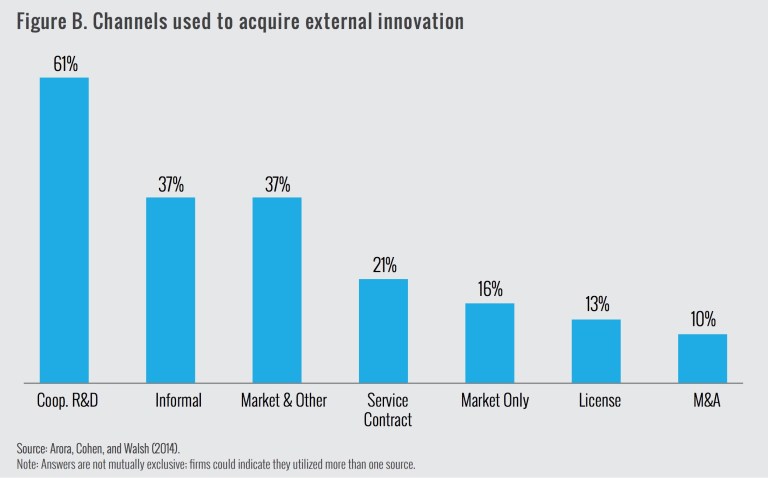

Not only is the source of innovation different than in the accepted innovation models, so too are the channels through which new ideas are transferred. Economic literature and common sense suggests that research that has market value is transferred to firms through market mechanisms such as licenses and royalty agreements. Yet here again, the evidence suggests otherwise. According to Arora, Cohen, and Walsh, the majority of firms employ nonmarket channels for their innovation. Sixty percent of manufacturers that rely on external sources for invention join into cooperative research ventures with other firms, labs, or universities. And over one-third depend on even more informal channels such as hiring of new workers, consortia membership, or any number of interactions with other companies that are not paid for.[9]

On the other hand, only 16 percent of companies that seek external sources for innovation do so solely through market mechanisms (most use a mix of market and nonmarket methods). The most important type of market engagement—employed by 21 percent of companies—is service contracts, usually with technical consultants or software developers.[10] By contrast, just 13 percent of firms sign licensing agreements with universities, labs, or inventors, and only 10 percent use mergers and acquisitions (M&As). These last two findings are remarkable given that revenue from licensing technologies constitutes the most popular benchmark of university commercialization, and that the value of new technology has been used to justify the astonishing price tags of recent M&As. [11]

These findings show that the classic model is not as common as generally assumed. However, that doesn’t mean universities, military research facilities, and national labs are irrelevant or that the classic model should be thrown out. It may be the case that, while informal methods are more frequent, they produce less value than formal channels. (Arora, Cohen, and Walsh inquired about the frequency of collaboration, not the economic value of those engagements.) Research from management studies indicates that innovation derived from suppliers and customers is often incremental in nature, improving existing products and processes but rarely spawning new industries.[12] This makes sense given that firms engage with their suppliers and customers around existing product lines. Customers rarely know what possibilities might lie beyond existing technology, and suppliers have contractual obligations to work within existing product systems. For example, a drivetrain supplier for Ford’s F-150 trucks has little reason to build a drivetrain compatible with an electric vehicle.

On the other hand, inventors and researchers in national laboratories, universities, and military research facilities have a mandate and ability to push the frontiers of science and are therefore better equipped to support firms seeking to change the market. Ford may not need the Massachusetts Institute of Technology or Oak Ridge National Laboratory to build a cheaper drivetrain, but when trying to create new materials to design cheaper, lighter cars it very well might. Economist Fred Block finds that since the 1990s over two-thirds of the most influential technologies (as defined by R&D Magazine) were supported by federal research funding at national laboratories or universities.[13]

If nontraditional sources are more often utilized but traditional institutions are less frequently used but are more beneficial, which should regional leaders promote in their economic strategies? With limited resources, should stakeholders focus on enhancing regional supply chains or university technology transfer?

The answer is that it depends on the industries within a city.

Industry-specific innovation

Industries employ varying tools to create new products and services, and this practice has important implications for policy making and practice designed to support innovation and economic development.

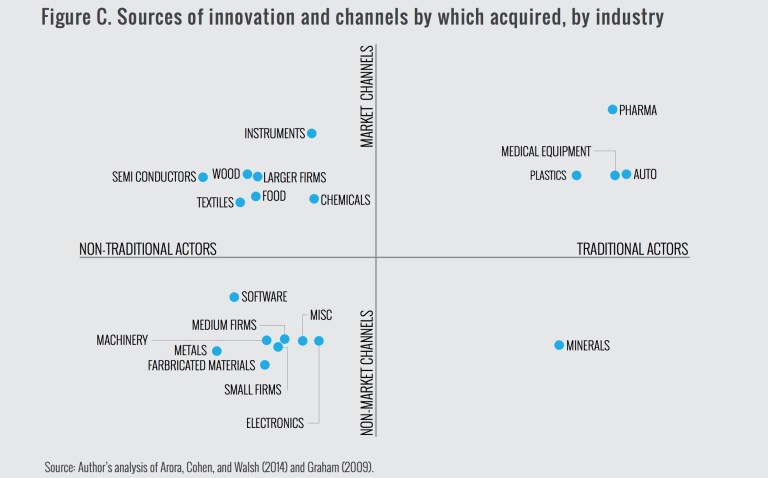

Drawing from the Arora, Cohen, and Walsh survey and other research, the figure below breaks industries into four quadrants based on whether they predominately use traditional or nontraditional technology generators and formal or informal channels to acquire their technology.[14] Traditional actors include universities, independent inventors, and scientific services consultants; nontraditional actors include customers and suppliers.[15] Market channels are defined as licensing agreements, mergers and acquisitions, and contracts, while nonmarket channels include informal partnerships and collaborative R&D ventures.[16]

Industries that work primarily with universities and other traditional actors and use market channels as sources of invention are in the top right-hand quadrant. These industries are referred to as classic industries. Industries that more often cite clients and suppliers as primary sources of innovation and leverage joint research agreements or other informal methods are in the bottom left quadrant and are referred to as unconventional industries. Industries that mix the use of actors and channels are called mixed industries and are in the top left and bottom right quadrants. Each industry’s particular placement is based on how much it uses each respective channel and actor, compared to the average manufacturer. For example, the most extreme classic industry is pharmaceuticals in the top right corner because it depends on traditional actors and formal channels far more than the average firm. By contrast, the chemical industry is near the middle of the graph because it uses nontraditional actors and formal channels at roughly the same rate as average.[17]

Classic industries

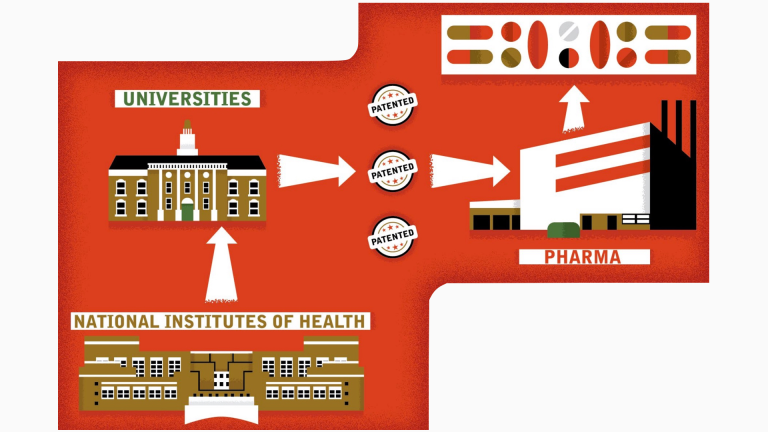

For firms that follow the classic model, basic and applied R&D is key. In these industries—which include pharmaceuticals, medical devices, plastics, and automotive companies—new products often depend on scientific breakthroughs, and innovation requires substantial scientific expertise, long timelines, and considerable investment in laboratory and other equipment. Most firms in these industries cannot afford these costs in-house and rely on R&D institutions like military facilities and national laboratories, universities, or private inventors to support their innovative efforts. Discoveries often take years to generate in the lab but, once made, are easy to replicate and open to imitation by competitors. Further, technologies are often distinct and easily codified into patents, service contracts, and licensing agreements. Therefore, industries that follow this model rely heavily on formal, market mechanisms to transfer knowledge.

The pharmaceutical industry is a good example of a classic industry.[18] Scientific breakthroughs in fields like organic chemistry are typically funded by federal agencies, usually the National Institutes of Health, and then patented by university technology transfer offices (TTOs). TTOs then try to license the technology to large pharmaceutical companies, which cover the substantial costs of clinical trials and manufacturing. If the science isn’t far enough along to license to a pharmaceutical firm, then the originating scientist will often establish a biotechnology startup around the invention and seek venture capital to cover the costs of clinical trials, with the end goal of being acquired by a larger company.

Unconventional industries

In many industries the classic model doesn’t fit the innovation process. Companies in these industries—including electronics, metals and fabricated metals, and software—use neither market channels nor traditional knowledge generators to create many of their new products and services. Unlike firms that follow the classic model, innovation in this unconventional category is far less linear and sequential. The average small and medium-sized firm fits into this category, which makes sense since small manufacturers often don’t have formal R&D departments (several high-tech industries are important exceptions) and, because they do not as often patent or formally protect their intellectual property, are involved less in market-based innovation.

An important feature of these industries is that there is less distinction between the actors generating technology and those consuming it. Instead of relying on universities, federal labs, or private inventors for knowledge, companies depend on suppliers, customers, and other firms. One reason for this is that innovation in these industries is less tethered to scientific breakthroughs and is more incremental and adaptive. For example, over 80 percent of innovation within unconventional firms comes in the form of processes or products that are new to the firm but not actually new to the market.[19] Of course, in every industry scientific frontiers are being tested but, for unconventional firms, many other avenues are employed.

A second feature of these industries is the prevalence of process innovation. Much of the industrial novelty lies not in new products but in better production methods. Research shows that process innovation is far harder to replicate because it depends on the unique production capacity of a firm—its business models, capital equipment, and skilled labor.[20] Therefore, process innovation is often better protected by trade secrets rather than patents and is transferred through the job-hopping of individual workers rather than market transactions.[21]

Metals are a good example of an unconventional industry. Large customers in this industry (such as Alcoa) often rely on small or medium-sized, highly specialized suppliers for inputs. These suppliers exist predominately in regional markets and lack clear interoperability between their products, with competition based on costs. Innovation is often within the metallurgy process—for example, to reduce heat or lag time. These process innovations rarely get transferred through market mechanisms and are usually seen as too incremental to justify the cost of trying to license their use.

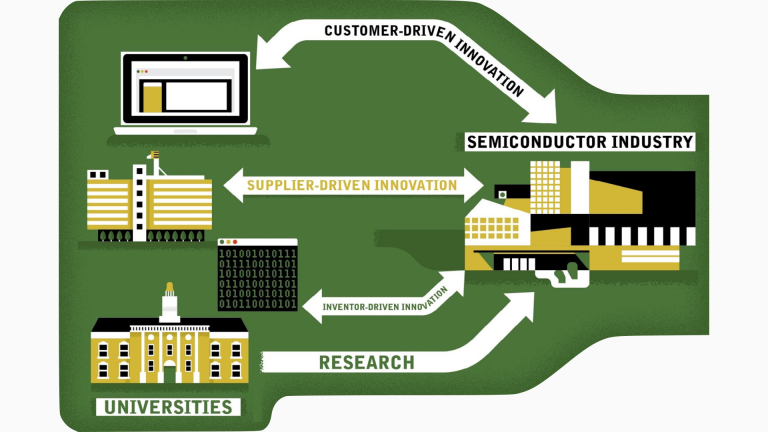

Mixed-industry innovation

Finally, many industries— including semiconductors, textiles, wood, food, chemicals, and instruments—fall somewhere in between the classic and unconventional approach. Firms in this category predominately rely on nontraditional actors but formal channels to acquire innovation. Like unconventional firms, basic science is not tied to most innovation for mixed industries. Instead, ideas are predominately derived from engagement with key suppliers and customers, who often maintain long-term partnerships tied to highly specific product platforms, such as a particular type of smartphone.

For mixed industries, value is often based on physical technologies that are easy to replicate, particularly when compared to the experience of unconventional firms that employ company-specific forms of process innovation. Bargaining power between firms in the value chain is then tied to ownership of these new technologies. Like firms in the classic model, mixed-industry firms do not just compete on the cheapest products but on the technical capacity baked into these products. As such, market-based transactions such as licensing, technical service contracts, and M&As are used to secure knowledge. Finally, while traditional institutions like universities, inventors, and technical consultants play less of a role than in the classic model, they are more important to mixed industries than they are to those in the unconventional categories. Leaps in scientific frontiers are desirable but less frequent than incremental innovation.

Semiconductors are a good example of a mixed industry. Technology development often follows from the chip’s end products, such as consumer electronics, automobiles, or communications equipment, and therefore technical requirements, design processes, and performance are the outcome of longstanding customer relationships. Moreover, the market is fairly concentrated, with five firms driving more than 60 percent of wafer demand.[22] That means that innovation is usually tied to a particular customer.[23] Further, the growth of “fabless” chipmakers (companies that design and sell but do not manufacture chips) has increased the reliance on external suppliers for critical knowledge inputs. In short, most innovation in the semiconductor industry is driven by suppliers and customers. However, new design features are easily reverse engineered and replicated, so the protection of intellectual property is an important consideration in the industry. And because many firms sell to the same customers and use the same suppliers for their manufacturing, design, and equipment needs, creating clear boundaries between which technologies can be licensed and to whom has become an industry norm.

Within the mixed industries, one of the most interesting findings is that none of them, besides minerals, predominately works with traditional research institutions and primarily uses nonmarket channels to transfer knowledge. While many firms use market channels and work with nontraditional actors, the opposite is rare. There could be many reasons for this, but one obvious explanation is that traditional scientific institutions simply do not transfer knowledge to the private sector outside of market methods. The implications of this will be discussed in the next section.

Every typology has exceptions. Dozens of variables beyond the four quadrants of Figure C could be used to segment innovation, ranging from source of capital to the skill level of the workforce. And in every industry there are firms that are at the cutting edge of science and working effectively with a variety of traditional and nontraditional institutions on new inventions. Nonetheless, who firms work with and the channels they use to create economic value is important, and from this perspective the innovation process is not monolithic. The next section discusses ways city and metro stakeholders can consider these different models when shaping their urban innovation strategies.

Innovation policy for cities

The most important implication of the traditional-nontraditional/market-nonmarket typology presented here is that nonmarket channels of innovation are far more important than have typically been acknowledged in policy and practice, and the lack of focus on them has likely limited the innovation potential of cities areas. Attention to the industry mix of a city is commonplace in many economic development strategies: zoning laws, training programs, taxation, and land-use rules all consider the composition of firms. Yet the way city stakeholders approach technology development is mostly homogeneous. In most places, incubators, accelerators, university technology transfer offices, and public-private research partnerships look more alike than different.

Instead, public, private, and institutional stakeholders should implement more tailored strategies based on whether local industries fall into the classic, unconventional, or mixed model of innovation. These strategies would:

Recognize that all industries, not just software and medical technology startups, can be innovative, and identify the particular innovation pathways utilized by local firms.

Policy makers and other leaders should cast a wider net when considering innovation policy. “Innovation” in too many cities is synonymous with software development and medical technology (both devices and new drugs). This is unfortunate for several reasons. First, these industries represent only a minority of jobs in most cities.[24] Second, as discussed in this brief, software and medical technology have highly specific innovation pathways that may not be relevant to the rest of the economy.

Software and pharmaceuticals increasingly exist at polar ends of the innovation spectrum. Because of cloud computing and other technologies, the upfront costs of a software company are declining while the potential size of the market is growing (with a greater consumer base and the onset of the “Internet of Things”). Moreover, consumer Internet applications have almost zero marginal cost—it costs pretty much the same to download an app once or a million times—so successful companies can scale with ease. By contrast, pharmaceutical and medical device companies require substantial basic science and are regulated, and these features dramatically increase the time and upfront costs of a startup reaching market. Also, for a drug or device, which must be manufactured, scale is an issue. The bottom line is these two industries are extremely different from one another and outliers compared to the rest of the economy.

The overemphasis on software and medical technology can be observed across the country in the creation of state and local organizations—often called technology development corporations—tasked with fostering regional innovation. These entities have a mandate to support commercial research and entrepreneurs across the economy, but in reality their efforts focus predominately on software and medical technology. This bias derives partly from the fact that for decades traditional economic development agencies ignored these industries and entrepreneurship in general by focusing exclusively on attracting large, traditional firms. Now, while many cities have numerous technology programs (accelerators, technology-based economic development organizations, industry associations, etc.) there is still a deficiency of support organizations for innovation in most sectors.

Some cities recognize that they will never have a competitive advantage in software or medical technologies and are beginning to develop organizational models that cater to their particular form of innovation. For example, in Milwaukee the Water Council is a coordinated effort by the city, local universities, and businesses to use the region’s deep expertise in brewing and water transport manufacturing and services to foster water technology. Programs include a Fresh Water Seed accelerator to support the pipeline of entrepreneurs in the sector, a Global Water Center that serves as a central node linking large and small water companies, and the School of Freshwater Sciences at the University of Wisconsin-Milwaukee, the country’s only freshwater graduate school. Together, these efforts support water technology at each stage of the innovation process, from research commercialization to startup support to scale or acquisition.

Eliminate institution-wide technology transfer practices at research universities that focus on licensing and adopt options that allow specific departments and centers to cater to different industries.

In most urban areas, universities and national laboratories are ill-equipped to work outside of the classic model. These institutions have technology-transfer offices and legal councils that focus on patenting and licensing but pursue few joint research or informal partnerships with the private sector. In the classic model, research anchors tend to expect businesses to work with them on terms that are convenient to the researchers instead of creating commercialization channels based on the unique attributes of the industries around them.

A common response by many anchor institutions to lackluster commercial activity is that the institution’s research isn’t a good fit for nearby firms. But often the problem is less about the type of technology as it is about the channel used to try and transfer knowledge to companies. Universities and national laboratories should eliminate institution-wide licensing practices and adopt options for commercialization that align with how innovation occurs in mixed and unconventional industries.[25] Doing so would widen the number of firms potentially interested in working with their local research organizations.[26]

For example, researchers in an organic chemistry department seeking a private-sector pharmaceutical partner probably do need to patent and license their technology, but engineers developing a new material would be better served through a joint research venture with a company that allows testing of the product at scale. At the same time, neither method would be appropriate for a media arts department trying to transfer design concepts to a local business. All of these activities are innovative and have the potential to impact the regional economy, but only if firms are able to access university knowledge through the channels with which they are most familiar.

Georgia Tech is a leading university not only for licensing technology but for creating startups from university research. To this end, the university has created a number of technology transfer programs that focus not on patents and licensing but on the nurturing of startups. For example, the Industry Connects program links university startups with Fortune 1000 companies with the goal of creating contracts, not venture funding. Venture funding may be critical for software and life science companies, but, for advanced manufacturing and other technologies, revenue-generating contracts are a much stronger indicator of success. According to its own reporting, over 90 percent of startups from Georgia Tech research are either revenue generating, have been acquired by another company, or have successfully completed an initial public offering.[27]

Foster partnerships with non-research colleges and universities to support firms seeking short-term process innovation.

Some research institutions will be able to break free of the classic model more easily than others.

In many cases, longstanding research capacity actually makes it harder for a university or national lab to support other types of innovation. Many of the nation’s finest research universities receive the majority of their funding from federal agencies or institutional endowments and have longstanding organizational rules and global alumni networks. These characteristics can make it difficult for the universities to support local firms outside of basic research. But most cities have numerous universities, colleges, and technical schools that are perhaps less prestigious but are willing to adopt policies that make them able to partner with firms seeking incremental and process innovation, as compared to basic research.

In the past, many of these schools have been brushed aside because they have limited ability to support firms with scientific breakthroughs (e.g., a new drug therapy). But because they have local alumni, business connections, and a willingness to deviate from the rules that govern most research universities—such as tying tenure to business contracts rather than publications—they may be ideally situated to assist companies in areas such as product proof-of-concepts or problem solving within the manufacturing process. As such, cities that have clusters of mixed and unconventional industries should help foster stronger partnerships between higher education and business leaders to better utilize these institutions.

For example, Lorain County Community College near Cleveland runs the SMART Commercialization Center for Microsystems that helps companies test new sensor technology. The center is a multiuser shared resource that supports commercialization of sensor products by helping companies inspect and reliability-test design concepts.[28] Ohio and the surrounding Midwestern states have a number of leading research universities in the area of instruments and controls; the SMART Center serves as a critical link between university science and industry innovation.

Modify the traditional accelerator model based on the innovation needs of startups in growth sectors, not simply the needs of software companies.

While leveraging research anchors is important, firms in the unconventional and mixed categories draw more from other firms for their innovation. Strategies to promote better firm interactions are therefore essential.

There is no shortage of examples of organizational models to support firm collaboration, ranging from industry associations to firm consortia, including hallmarks like Sematech in the semiconductor industry. Today, however, the fastest-growing and most popular institutional models that link a city’s firms, entrepreneurs, and investors are accelerators and incubators (or co-working spaces). It’s estimated that there are 3,000 active accelerators internationally and many times as many co-working spaces.[29] Unfortunately, because they are in vogue cities often support these spaces without considering their economic impact. As with most technology-based organizations, the economic value of the accelerator model depends on whether the program is tailored to the needs of local industries.

The empirical work on accelerators suggests that the traditional accelerator model works best for software startups in cities with an abundance of venture capital but, unless tailored, has limited effectiveness for other industries.[30] For example, MIT researchers Daniel Fedher and Yael Hochberg find that cities that have accelerators see higher investments in software startups than those that do not, but the presence of accelerators has no impact on funding of biotechnology startups.[31] These findings may come as a surprise given that software and biotechnology startups are both represented by most accelerator programs (unlike many other industries that are rarely represented at all, like energy or advanced manufacturing). But biotechnology and software get grouped together because they are considered “high tech” and seek venture capital; yet, as discussed above, they couldn’t be further apart. Software is an unconventional industry while pharmaceuticals follows the classic model, and therefore it is difficult for one accelerator to meet both these industries’ needs.

While it’s true that some highly publicized accelerators, like MassChallenge, have had success in both software and the life sciences, such success is rare and, in the case of MassChallenge, is in part a function not of the similarities between these industries but of the accelerator’s size, leadership, and access to a vast Boston network of mentors and investors.[32] But not all places are like Boston and not all industries are like software.

In order for accelerators to work in places outside of Boston and Silicon Valley, they should be tailored to connect entrepreneurs in a variety of industries with suppliers, customers, and investors. For example, AlphaLab Gear in Pittsburgh is one of the first and most successful accelerators in the country to focus on the needs of hardware companies. Leveraging the engineering strengths of Carnegie Mellon University and the medical device capacity at the University of Pittsburgh, AlphaLab Gear is translating research into successful companies through mentorship and financing models that are appropriate for hardware innovation.[33] Similarly, BetaSpring, a top-ranked accelerator in Providence, R.I., seeks “revenue-first” companies with the goal of acquiring customers and creating revenue (by contrast, software-oriented accelerators rarely seek revenue). BetaSpring’s goal is to attract firms more reflective of the Providence economy, like advanced manufacturing, rather than compete with nearby Boston for software entrepreneurs.[34] In both AlphaLab Gear and BetaSpring, the institutions have focused on the particular innovation constraints of firms in each city’s most prominent industries. With purposeful adjustments, accelerators can better fit the innovation pathways of a variety of industries.

Link designers, engineers, and software developers in urban centers to manufacturing supply chains in the surrounding regions.

In some industries, policies and practices should be designed to support firms by helping to connect them to manufacturing supply chains.

For example, 3D printing and the maker movement have created substantial buzz around urban manufacturing. Yet currently much of the activity, such as creating artisanal products for consumers, remains within the retail sector. While certainly not trivial, these activities represent only the tip of the iceberg of 3D printing and digital design. Today, designers and engineers in cities have the capacity to prototype parts for the world’s largest manufacturers. Yet creating connections between urban designers and suburban production factories is an organizational challenge unaddressed by most cities.

Mentors in co-working spaces and maker shops understand how to help entrepreneurs sell on Etsy, but most have no idea how get a contract with Toyota. Yet from a technology perspective, selling goods on Etsy and being able to digitally design or prototype a component for Toyota can be increasingly complementary. Because unconventional industries innovate through informal partnerships across supply chains, public- and private-sector leaders in cities with many unconventional industries need better strategies to link urban manufacturers, designers, and engineers with the larger manufacturing ecosystem. Because of real estate prices, large-scale manufacturing factories will rarely be located in cities, but many of their knowledge hubs may be.

In some cities corporate research centers serve as intermediaries between urban researchers, engineers, and designers on the one hand and suburban production facilities on the other. For example, Coca-Cola uses its research center in Midtown Atlanta (adjacent to Georgia Tech) to connect young firms to its production pipeline. General Electric has similar objectives in developing its new oil and gas research center in Oklahoma City.

Advance the appropriate place-based strategies to increase the density of innovative firms and support organizations.

Finally, a preponderance of research shows that proximity is a critical factor in informal knowledge exchange.[35] This is because much of the innovation process is not codified into patents, invention disclosures, or firm contracts but is tacit in nature and transferred through workers, entrepreneurs, funders, and institutional interactions that are in close proximity to one another. For example, Rosenthal and Strange find that, for knowledge transfer among firms within the same industry, companies located within one mile of each other see 10 times the effects of information exchange as those located between two and five miles apart.[36] Because proximity is so vital for nonmarket innovation channels, cities and states should identify their dense industry clusters based on city blocks, not metropolitan or county geographies.

In the past, labor markets—often defined by metropolitan areas—were considered the appropriate unit of analysis for urban innovation, but research on tacit knowledge transfer suggests that hubs of relevant firms, universities, and other actors increasingly co-exist in much smaller geographic areas.[37] Innovation districts—dense clusters of research and commercial activity in the core of cities—are increasingly relevant to firms that develop technologies through informal methods. Large companies are locating near universities that have both strong research competencies and programs to develop young companies.[38] These companies are also locating near small firms that increasingly serve as conduits of innovation through supply chains, acquisitions, or the attraction

of these firms’ knowledge workers. In short, the geography of innovation is shifting to help facilitate the informal and unconventional innovation processes that are essential for many industries.

For example, the Chicago Innovation Exchange (CIE) is the University of Chicago’s central location in the city to help students, researchers, and entrepreneurs connect. While many urban universities have constructed new buildings and public spaces for entrepreneur activity, CIE differs in its highly tailored mission—to help startups in the hard sciences during their first 12-18 months. To be successful, young hardware companies (for example) need access to a huge array of actors, including other academic fields, national laboratories, venture and private equity funding, software and analytic firms, mentors, and other similar firms. CIE has not only created vibrant “places” (e.g., incubators, public spaces, commercial corridors, etc.) where graduate students actually want to stay and create companies but also has brought dispersed regional assets into close proximity. Both Argonne National Laboratory and the University of Illinois have physical locations in CIE, and both have national expertise in engineering and serve as strategic assets to young hardware companies.

Neighborhood, city, and regional leaders need to think about their industry portfolio and intentionally support the type of physical environments that encourage the formal and informal interactions that facilitate technology development and maturation.

Conclusion

Today, most city leaders understand that collaboration is a leading indicator of technology-based economic success. In fact, without external sources of innovation the number of new products developed in the United States over the last decade would be 33 to 45 percent lower.[39] Instead of carbon copying highly cited model, cities can be linchpins of collaborative innovation but need to better understand how their firms innovate, whether via classic, unconventional, or mixed pathways. Each suggests the relevance of different actors, institutions, and channels. Cities will have a better chance to thrive economically if they stop mimicking each other and instead align economic strategies with the particular ways their industries innovate.

acknowledgments

The Brookings Institution is a nonprofit organization devoted to independent research and policy solutions. Its mission is to conduct high-quality, independent research and, based on that research, to provide innovative, practical recommendations for policymakers and the public. The conclusions and recommendations of any Brookings publication are solely those of its author(s), and do not reflect the views of the Institution, its management, or its other scholars.

Support for this publication was generously provided by Anne T. and Robert M. Bass.

Brookings is committed to quality, independence, and impact in all of its work. Activities supported by its donors reflect this commitment and the anlysis and recommendations are solely determined by the scholar.

Endnotes

[1] As Gerald Carlino and William Carr put it in their extensive literature review (“Agglomeration and Innovation,” Cambridge, Mass.: National Bureau of Economic Research, August, 2014), “Innovation looks different everywhere except economic studies.”

[2] Vannevar Bush, Science, the Endless Frontier: Report to the President on a Program for Postwar Scientific Research (Washington: Office of Scientific Research, 1945).

[3] Bill Bonvillian and Charles Weiss, Technology Innovation in Legacy Sectors (New York, NY: Oxford University Press, 2015).

[4] However, much of the innovation in these sectors stems from industries that are covered within this paper. For example, in health care the preponderance of innovation is in health information technology, medical devices, and pharmaceuticals.

[5] Boston Consulting Group, “Rethinking Automotive Purchasing: From Price Pressure to Partnership” (2003).

[6] Eric Von Hippel, “Lead Users: A Source of Novel Product Concepts,” Management Science 32, no. 7 (1986).

[7] Ashish Arora, Wesley M. Cohen, and John P. Walsh, “The Acquisition and Commercialization of Invention in American Manufacturing: Incident and Impact” (Cambridge, Mass.: National Bureau of Economic Research, June 2014).

[8] This figure is lower than that found in other research which, for example, shows that roughly a quarter of firms that utilize external sources for innovation use university research but only 8 percent use prototypes from universities. Firms draw more heavily from research insights than from commercial applications. See Cohen et al., “Links and Impact: The Influence of Public Research on Industrial R&D,” Management Science 48, no. 1 (2002).

[9] Arora, Cohen, and Walsh 2014.

[10] The reason why a greater number of firms use service contracts as compared to solely market mechanisms, despite service contracts being a form or market mechanism, is because many companies employ both services contracts and other non-market forms of technology transfer.

[11] Knowledge@Wharton, “The Innovation-Through-Acquisition Strategy: Why the Pay-Off Isn’t Always There,” Wharton School of the University of Pennsylvania, November 16, 2005, http://knowledge.wharton.upenn.edu/article/the-innovation-through-acquisition-strategy-why-the-pay-off-isnt-always-there-2/.

[12] See Gary Pisano and Willy Shih, “Producing Prosperity: Why America Needs a Manufacturing Renaissance, Harvard Business Review (2012), and Greg Tassey, “Rationales and Mechanisms for Revitalizing US Manufacturing R&D Strategies,” Journal of Technology Transfer, January, (2010).

[13] Fred Block and Matthew Keller, “Where Do Innovations Come From? Transformations in the U.S. National Innovation System, 1970-2006” (Washington: Information Technology and Innovation Foundation, 2008).

[14] Because the Arora, Cohen, and Walsh study surveyed only manufacturing industries, the service sector is not part of this typology. The exception is the software industry. The assessment of where software belongs in the typology is based on survey research in Stuart Graham et al., “High Technology Entrepreneurs and the Patent System: Results of the 2008 Berkeley Patent Survey,” Berkeley Technology Law Journal 24, no. 4 (2009).

[15] The literature used to create this typology did not ask about national laboratories or military research facilities. However, other research suggests that these institutions face many of the same constraints as universities.

[16] Informal partnerships include a host of activities that do not include a market transaction, such as attending conferences, joining industry associations, developing industry standards with suppliers, surveying customers, reverse engineering competitor products, and other activities. The only form of informal partnership that does not follow into this category is the joint research venture, which is identified individually.

[17] Because actors and channels are not mutually exclusive, industries are plotted based on the actors and channels most used. For example, plastics uses more traditional and nontraditional channels than the average industry (because plastics uses more external sources for innovation), but its use of traditional actors is higher, and therefore the industry is plotted in the traditional quadrant.

[18] Gary Pisano, Science Business: The Promise, the Reality, and the Future of Biotechnology (Cambridge, Mass.: Harvard Business School Publishing, 2006).

[19] Arora, Cohen, and Walsh 2014.

[20] Gregory Tassey, “Globalization of Technology-Based Growth: The Policy Imperative,” Journal of Technology Transfer 33 (2008).

[21] Prasanna Tamba and Lorin Hitt, “Job Hopping, Information Technology Spillovers, and Productivity Growth,” Management Science, Forthcoming, 2013.

[22] Knowledge@Wharton, “Collaborative Innovation Holds Key to Semiconductor Industry Growth,” Wharton School of the University of Pennsylvania, November 6, 2013, http://knowledge.wharton.upenn.edu/article/collaborative-innovation-holds-key-semiconductor-industry-growth/.

[23] Ibid.

[24] Hospitals and other clinical care firms do provide a number of jobs, but these are mostly locally traded and don’t foster innovation. The innovative side of health care remains a small portion of the overall sector.

[25] The most effective way to improve the relevance of research institutions would be to incentivize economic outcomes beyond licensing agreements and research. With over a $100 billion in research grants to universities and national laboratories annually, in theory the federal government could use its power of the purse to radically alter the way most research institutions operate. However, funding agencies have largely rejected such efforts for decades.

[26] Scott Andes and Mark Muro, “Going Local: Connecting the National Labs to Their Regions” (Washington: Brookings Institution, 2014).

[27] “Atdc Georgia Tech,” www.atdc.org, January 2016.

[28] “LCCC Breaks Ground on New Richard Desich SMART Commercialization Center for Microsystems,” Interactive Intelligence, September 10, 2011.

[29] Daniel Fehder and Yael Hochberg, “Accelerators and the Regional Supply of Venture Capital Investments” (Cambridge, Mass.: National Bureau of Economic Research, 2014).

[30] Ibid.

[31] Ibid.

[32] MassChallenge is probably the largest and most well-known accelerator in the world, providing over $1.5 million in no-equity grants in 2015. See www.masschallenge.org for more information.

[33] See “An Overview of Our Program: Why AlphaLLab,” http://alphalab.org/program/.

[34] See “The RevUp Difference,” www.betaspring.com, January, 2016.

[35] Carlino and Carr 2014.

[36] Rosenthal and Strange, “The Attenuation of Human Capital Spillovers,” Journal of Urban Economics, 64 (2) (2008).

[37] Carlino and Carr 2014.

[38] Scott Andes and Bruce Katz, “Why Today’s Corporate Research Centers Need to Be in Cities,” Harvard Business Review, March 1, 2016.

[39] Arora, Cohen, and Walsh 2014.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).