Criticism that the Federal Reserve’s very low interest rates and large-scale asset purchases (LSAPs), commonly known as quantitative easing, increased inequality by driving up the price of stocks and other assets is misplaced, argues Josh Bivens of the Economic Policy Institute. To the extent that the Fed pushed the economy closer to full employment, it reduced inequality, Bivens argues. Critics of the Fed ignore the crucial “compared to what” question. So Bivens compares the distributional consequences of Fed policy to two counterfactuals: (1) a fiscal stimulus with roughly the same boost to output as low interest rates and LSAPs produced and (2) no macroeconomic stimulus at all.

Monetary stimulus versus equivalent fiscal stimulus

A 2010 fiscal deal—which included a two-year payroll tax cut, an extension of the emergency unemployment compensation, and accelerated depreciation— produced roughly the same positive effect on output and employment as all the Fed’s LSAPs. Comparing the distributional effects of these similar-sized policies, Bivens finds that the relative impact on inequality of monetary policy seems quite small; it’s not even clear if it’s is slightly progressive or slightly regressive.

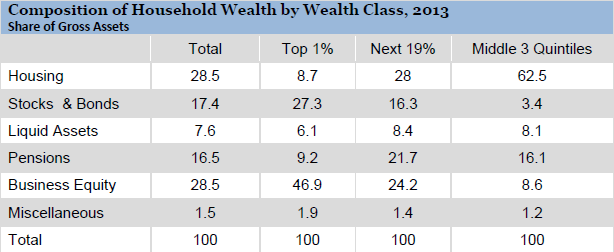

The reason: Housing is a much larger share of assets for the middle-class than it is for wealthier households, as the accompanying table shows. Wealthier households hold a disproportionate share of stocks and bonds. Houses, stocks and bonds all benefitted from the Fed’s LSAPs. Stock price increases disproportionately benefit the top 1%; house price increases, the bottom 90%. Drawing from other research, Bivens estimates home prices were boosted by 7 % due to LSAPs, stock prices by 5% and bond prices between 9% and 14%. Boosting house prices reduces inequality because home equity represents such a large share of middle-class wealth; boosting stock prices increases inequality. These effects are largely offsetting. Moreover, the effects of LSAPs on asset prices are likely to dissipate over time when credit is tightened.

Monetary stimulus versus no stimulus

But Fed officials in 2007 had little influence over fiscal stimulus; they had to decide what monetary policy to pursue given what Bivens considers to be inadequate fiscal stimulus. As bad as wage growth was, it would have been even worse had the Fed not pursued its easy money policies. In short, compared to a counterfactual of no change in fiscal policy in response to a recession, monetary stimulus reduces inequality significantly. If the Fed were to tighten credit before the economy reaches full employment, Bivens argues, this would hurt low- and moderate-wage workers and increase inequality. In addition, the unconventional monetary policies of recent years, including LSAPs, don’t have a substantially different effect on inequality than changes in short-term interest rates.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).