The Vitals

The United States is the only advanced country without a

federal paid leave policy. A majority of Americans support paid leave, and

there are a number of proposals in Congress that address paid leave access, but

the probability of passing any federal legislation is unclear. Several

challenges to adopting a federal paid family leave program remain, including:

the coverage for the type of leave, the duration of the leave, how much an

employee should be paid while on leave, job protection, and how to pay for the program.

-

The United States is the only advanced country without a federal paid leave policy despite an overwhelming majority of Americans supporting paid family and medical leave.

-

Although the U.S. has no federal paid leave policy, states have developed their own paid leave programs and there are now proposals with support from Republicans and Democrats in Congress.

-

An inclusive family leave policy would include three types of leave: parental leave, paid family care leave, and medical leave.

A Closer Look

The United States is the only advanced country without a federal paid family leave policy. Most of the Democratic presidential candidates are in favor of a federal paid leave policy, and there are a number of proposals under consideration in Congress.

What is paid family leave and why might workers need it?

Paid family leave allows employees to take time off from

work to address personal needs without a substantial loss of income or

employment. Without a statutory right to paid family leave, millions of working

Americans find it difficult

to manage paid work and care responsibilities at home. The burden of

caregiving may lead some to stay

out of the labor force.

Workers may need some time away from work for various

reasons: personal illness, to care for a sick family member, or a new child.

Thus, an inclusive paid family leave policy would include three types of leave:

parental leave to allow workers to bond with a new biological or adopted child;

paid family care leave to enable workers to care for a sick family member; and

medical leave to allow workers to recover from a personal illness such as

cancer or a serious injury that is not covered by short-term sick leave. Paid short-term

sick leave is accessible to 76%

of workers, but is by no means universal in the U.S., especially for

low-wage workers. Lack of sick leave is not only burdensome for such employees

but often causes them to come to work while sick, spreading illness to other

employees and customers.

Current policy situation in the United States

The Family and Medical Leave Act (FMLA), enacted in 1993,

provides up to 12 weeks of unpaid leave

for personal illness, caring for a sick relative, or caring for a new child. But

FMLA only covers large employers and their full-time employees—less

than 60% of the labor force. Further, some workers

who are eligible for FMLA are unable take leave because they cannot afford the

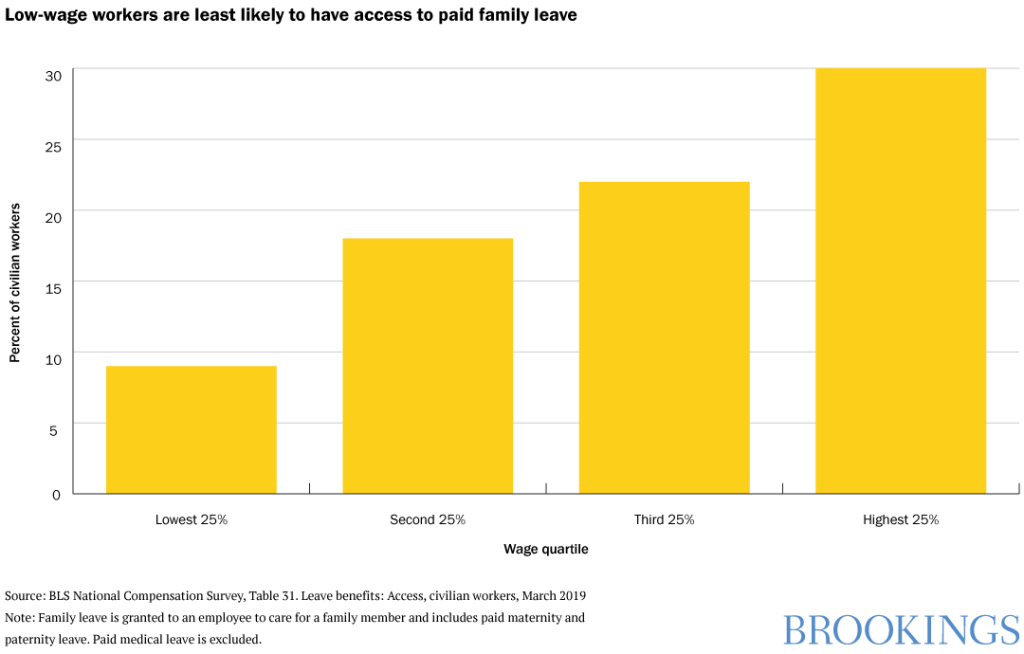

loss of income during the leave period. Many employers offer their own formal

paid leave policies, but access is limited, especially for low-wage workers:

The Tax Cuts

and Jobs Act of 2017 includes a two-year pilot program that provides employers

with a tax credit of up to 25% of wages paid to a qualifying employee who takes

family and medical leave for up to 12 weeks. Employers must provide at

least two weeks of annual paid family and medical leave for each qualifying

full-time employee at a minimum of 50% of their regular earnings. Employees

must have worked for at least one year with an annual income of less than

$72,000, which allows the tax provision to target low- and middle-income

workers. The legislation extends to part-time workers and those employed by

small businesses.

Some states have passed paid family leave laws

In the

absence of a permanent federal paid leave program, several states have

developed their own policies. California became the first state to provide paid

family and medical leave in 2004. Since then, several states have followed

suit, including Washington, Oregon, Hawaii, New York, Vermont, Rhode Island, Connecticut,

New Jersey, Massachusetts, and the District of Columbia. Other states such as

Utah, Indiana, and New Hampshire have recently proposed paid family leave legislation.

(This map summarizes

the details of state policies).

What are the issues in adopting a federal paid family leave program?

One issue is

the coverage of the leave. A federal paid leave policy could guarantee time off

only for new parents, or it could cover family care and medical leave too. Currently,

there is more support for parental leave than for family care or medical leave.

A second

issue is duration of the leave, which may also be capped or limited to a fixed

period such as 12 weeks.

A third

issue is what proportion of an employee’s wages should be paid while they are

on leave. Many policies provide less than 100 percent replacement as one way to

reduce costs and give the employee an incentive to return to work. The dollar amount

of paid leave is also often capped to focus most of the benefits on low- and

middle-wage workers. As an example, a typical policy might provide 70% of wages

up to a maximum of $600 per week.

A fourth

issue is job protection, that is, whether an employee should be guaranteed a

return to their old job or to a comparable job after the leave.

And the final

issue is how to pay for the leave program. The most common financing mechanism

at the state level is a payroll tax, imposed either on employees or on both

employees and employers. This issue of how to pay for any leave is especially

contentious: advocates argue that it is

an essential benefit and worth paying for with new taxes, while critics argue

that it is, in effect, a new social program that the nation can ill afford and

that may have adverse consequences on employers, especially small businesses.

Other key issues

include: administrative structure, gender neutrality, and interaction of a new

paid leave policy with existing state and private sector policies. For example,

large employers are concerned about the proliferation of multiple state

policies, each with different rules and coverage that complicate administration

for multi-state employers. (The AEI-Brookings

Report on paid family leave provides more details about key design

elements and relevant implications).

Policymakers are paying more attention to paid family leave

The topic of

paid family and medical leave is getting more attention from both Democrats and

Republicans. There are now a number of proposals in Congress that seek to

expand paid leave access. One proposal by Senator Marco Rubio (R-Fla.) and

Representative Ann Wagner (R-Mo.) would allow families to claim Social

Security benefits to cover parental leave, paid for by delayed

receipt of retirement benefits. Another proposal by Senator Kirsten Gillibrand

(D-N.Y.) and Representative Rosa DeLauro (D-Conn.) would provide workers with 12

weeks of paid parental leave, family care and medical leave. The

paid leave benefits would be financed through joint payroll contributions,

split evenly between employers and employees.

A new bipartisan

paid parental leave proposal—the

first one in Congress—would allow households to pull forward up to $5,000 from the

Child Tax Credit (CTC) upon the birth or adoption of a child. Families would

need to pay back this “interest-free” loan from the government by receiving a

smaller CTC ($1,500 instead of the full $2,000) over the next 10 years. Low-income

families that are not eligible for the full CTC would be able pull forward the

equivalent of 12 weeks wage replacement, and receive an adjusted CTC in

subsequent years. The proposal provides more income to a family at the time of

a child’s birth but less income during the child’s early years.

President

Trump proposed to use unemployment insurance to finance a paid leave policy and

pledged $20

billion for that purpose over the next decade in his fiscal year

2020 budget. His proposal has not gained much traction in Congress.

Polls

show that Americans are overwhelmingly

in favor of paid family and medical leave and states

have been very active in addressing their concerns. Whether the federal

government will get involved in an era of polarized politics and disagreements about

the benefits of paid leave and how to pay for it remains to be seen.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

What are the challenges to adopting a federal paid family leave program?

October 15, 2019