Most of the newspaper coverage of the just-released Census Bureau data on health insurance coverage has focused changes in coverage between 2009 and 2010. Since the advent of the Great Recession, the reduction in health insurance coverage has been dominated by the simple fact that as unemployment has risen, since most families with prime-age earners receive health insurance as a fringe benefit of employment, the number of uninsured has risen. The increase was large from 2008 to 2009 when unemployment rose rapidly. From 2009 to 2010, when unemployment stabilized at high levels, the increase was smaller, although still disturbingly large.

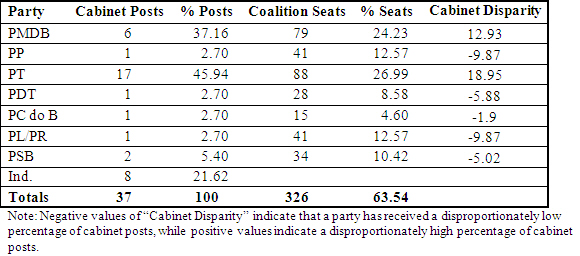

If one looks back a bit farther, however, some noteworthy differences by age group emerge, as shown in the table at the end of this post. Health insurance coverage fell for all age groups but one from 2007 to 2010 and over the longer period starting with the boom year of 1999. That coverage would have fallen in both periods is unsurprising because, as noted, health insurance for most people is linked to employment and unemployment rose over both of those periods.

The age group that stands as the major exception to this record of declining coverage is children through age 18. That coverage for this group rose over both of those periods is striking. Furthermore, although coverage of the elderly fell, the drop was minuscule. What is going on?

The answer is that the safety net is working. The proportion of young people insured privately declined as much as did that of older age groups, but total coverage of this age group not only was sustained but actually increased. The State Child Health Insurance program, enacted in 1997, has dramatically increased coverage for youngsters. Medicaid expansions mostly enacted earlier have helped expand coverage among the young as their parents have lost coverage through work.

In combination, the number of children age 18 or younger with Medicaid coverage rose by 11.3 million since 1999 and by 5.1 million since 2007. Without this expansion (and assuming no other offsets), the number of uninsured Americans would have been not 49.9 million, but more than 60 million.

These developments take on particular salience in light of the current debate about how best to control federal budget deficits. If Congress, in the end, adheres to the principle, embodied in the August 2010 debt-ceiling legislation, that programs protecting the poor should be insulated from budget cuts, the gains in coverage among the young may be sustained, despite the erosion of employment-based coverage that has been going on for more than a decade. If it abandons this principle, the increase in ‘health-insecurity’ would be large and deeply troubling.

The health coverage statistics also bear on the continuing debate about the future of the Affordable Care Act. No one should exaggerate the influence of mere facts on a debate so driven by ideology as that over the Affordable Care Act, but the data on the erosion of employment-based coverage should not be ignored. Trends in employer-sponsored health insurance have long been a contest between two opposing forces: the belief among employers that group health insurance offered as a fringe benefit is a powerful incentive for attracting workers, especially when labor markets are tight, and the concern of employers that the need to boost premiums and cost sharing repeatedly drains management time and saps employee morale.

During the 1990s, the first of these forces was in the ascendant. In the face of drum tight labor markets, increasing numbers of workers were offered health insurance as a fringe benefit and took up the offer. Since 2000, two recessions have tipped the balance the other way. The 2010 survey data—and comparisons with past years shown in the table—suggest that, without the return of tight labor markets (and, perhaps even with them), employment-based health insurance is likely to continue to erode. Given the anemic character of the current economic recovery and the regrettable possibility of yet another downturn (particularly if Congress does not at least extend the current payroll tax holiday), overall health insurance coverage is likely to continue to narrow.

The only hope for extending health insurance currently on the horizon is implementation in 2014 of the requirement in the Affordable Care Act that individuals carry affordable insurance, the associated subsidies to make coverage affordable, and the expansion of Medicaid. Without those measures, it is hard to avoid the conclusion that the absolute number of people and the proportion of the total population without health insurance is headed upward.

Without an economic recovery far more rapid than forecasters now anticipate, the Census Bureau reports on health insurance coverage are likely to be rather dismal over the next three years. The 2011, 2012, and 2013 surveys—each reported in the succeeding year—are almost certain to show an increasing number of people and proportion of the total population without health insurance. Nor is there any reason now on the horizon why the growth of health care spending is likely to slow.

For all its flaws, the Affordable Care Act is currently the only instrument around that holds any realistic prospect for dealing simultaneously with the twin problems of ‘cost’ and ‘access.’ It will take the 2012 elections to resolve the current dispute over whether the ACA is to remain law. If the ACA remains law, one hopes that the 2012 election will also result in sufficient collaboration to fix its shortcomings and to implement it effectively.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Op-edCensus Numbers Indicate the Safety Net is Working

September 15, 2011