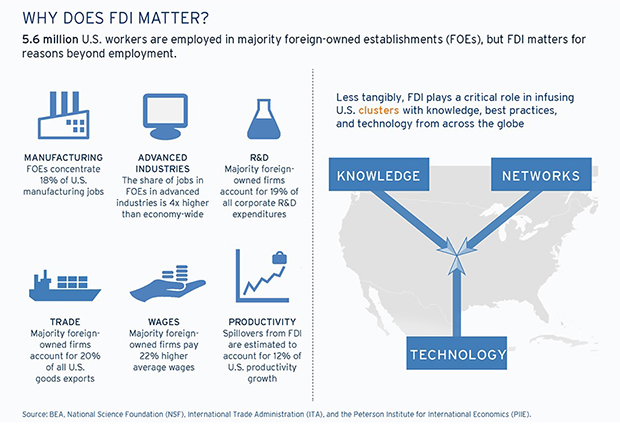

We recently released a new paper on foreign direct investment (FDI) in U.S. metro areas that reported that foreign-owned companies employ 5.6 million workers across the United States. We wouldn’t fault even our most worldly followers for asking “So what?” though. What makes this subset of companies active in the U.S. market special?

The answer is that these companies make inordinate contributions to national and regional economic development. In today’s rapidly globalizing economy, their importance is poised to increase.

At the most basic level, FDI represents a direct infusion of capital into the U.S. economy from abroad. At a time when U.S.-based companies remain reluctant to invest in productive capacity at home, foreign firms have filled some of the gap. In 2011 they accounted for an outsized 15.2 percent of annual investment into the country’s capital stock, compared to their 6.2 percent share of total value added. Important qualitative characteristics lie just below these top-line numbers too:

Manufacturing. In 2012 alone over $80 billion dollars’ worth of FDI—48 percent of the total for that year—flowed into the manufacturing sector, shoring up the country’s eroding production base. Over 18 percent of all U.S. manufacturing workers—that’s nearly one in five—now work for a foreign company, up from 12.5 percent in the 1990s.

R&D. Foreign-owned companies contribute 18.9 percent of all corporate dollars spent on R&D in the United States—over three times their share of value added. This $45 billion dollars annually adds fuel to the entire country’s innovation enterprise.

Exports. In 2011 foreign firms exported nearly $304 billion worth of goods from the United States, accounting for one-fifth of all U.S. goods exports. What is more, FDI indirectly boosts exports by influencing the export decisions of local firms, suppliers, and competitors.

Productivity spillovers. When foreign companies enter a market, they bring with them new production technologies, knowledge, and management practices. These generate what economists call spillovers as they spread through supply chains, labor markets, product markets, and to competitors. Economists estimate that such spillovers from FDI alone accounted for 12 percent of U.S. productivity growth between 1987 and 2007.

FDI via mergers and acquisitions offers a distinct set of micro-level benefits too. Such transactions can provide needed capital for expansion and technology development. Productivity, job quality, and management practices all improve. Exports often increase with access to the parent company’s international distribution network, and local outlooks become global.

Finally, FDI matters for important but less tangible reasons of global engagement. In a world where competition is increasingly global and innovation can happen anywhere regions need to engage actively and directly with the global economy not only to get ahead, but also to prevent falling behind. FDI plays no small part in integrating U.S. regions into global networks. And with 85 percent of global growth through 2019 projected to occur outside the United States, global engagement means big opportunity.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

FDI Matters…For Reasons beyond Capital and Jobs

July 7, 2014