At a recent rally in Montana, President Trump claimed that “Republicans passed the biggest tax cuts in American history, the biggest in American history. Everybody in this room is better for them. Everybody is better for them.”

Unfortunately, this isn’t true. Everybody is not better off from the recent tax cuts, which have only served to increase the federal budget deficit—now $779 billion for FY 2018 according to new data released by the Treasury Department. To be sure, the middle class gets help temporarily, but over the longer run, the middle class will be worse off.

The middle class is seeing slower income growth than both the rich and the poor

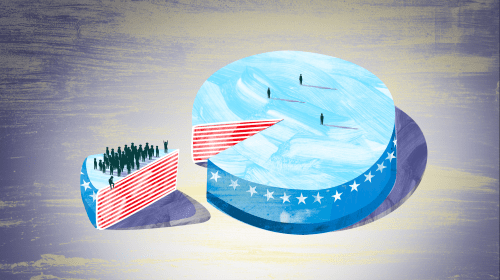

This fact is made all the more egregious in light of evidence that the middle class isn’t doing well and needs help. Stagnating incomes, opportunity gaps, and fragile families are all reasons to worry about the middle class. Public policy has done little to ameliorate these concerns. After accounting for taxes and transfers, growth in average middle-class household incomes has lagged significantly behind the lowest and, especially, the highest income quintiles. Incomes of the top 20 percent rose by 97 percent from 1979-2014—over twice as much as middle-class incomes. Even the lowest quintile has seen faster income growth, 69 percent, or two thirds higher than income growth for the middle class. In short, both public policy and the economy are leaving the middle class behind.

The 2017 tax law doesn’t help the middle class

The new tax law—known as the Tax Cuts and Jobs Act (TCJA)—will exacerbate this trend. The benefits of the law tilt toward the well-off both now and in the future, according to the distributional analysis of the Tax Policy Center. By 2027, benefits of the tax law flow entirely to the rich. (The Joint Committee on Taxation finds similar results using a different measure.)

To be fair, Republicans hope to extend the tax law beyond 2027, but that’s highly unlikely. There is also an argument that increased investment will lead to higher wages in the long run. The theory is that the lower corporate rate and temporarily expanded business expensing will spur investment in the United States, leading to more capital, and more productive workers. As worker productivity rises, firms will boost wages. All of this would happen gradually over the long term.

However, the evidence for this story about long-term growth is weak at best. According to two leading economists, one liberal and one conservative, annual GDP growth might rise by 0.02 percentage points over the next decade. So far, corporations are using their added profits primarily to buy back shares and boost dividends, not to invest. In addition, rising productivity in recent decades has not been fully shared with workers, suggesting a less competitive economy than many assume. Finally, deficit-financing means that middle-class households will likely be hit with big tax increases or spending cuts later and interest rates will rise in the interim as government borrowing explodes. While revenue-neutral, pro-growth tax reform (rather than costly tax cuts) is possible and desirable, the TCJA falls far short of this standard.

The tax code should be reformed to help the middle class

Well-designed tax policy can be an effective tool for helping the middle class. In a new book, The Forgotten Americans, one of us (Isabel Sawhill) has proposed tax credits for workers that directly boost wages for the bottom third of earners, and tax incentives for employers who invest in and share profits with employees. A training tax credit for employers would encourage companies to invest in their own employees with more predictable effects on productivity and wages than corporate rate cuts. Another tax credit to encourage profit-sharing would ensure that excess profits, whether due to tax cuts or rising industry concentration, are more broadly shared.

Government policy in recent decades has lifted many out of poverty and provided large tax cuts to the rich. The middle class has lost out. Tax cuts dressed up as help for the middle class should be labelled for what they are: welfare for the wealthy. The best course of action is not to double-down on deficit-financed tax cuts. Instead, the TCJA should be repealed and replaced with smart tax policy that directly raises wages and encourages investment in human capital.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

The middle class needs a tax cut: Trump didn’t give it to them

October 16, 2018